“Don’t look for the needle in the haystack, just buy the haystack” – John C Bogle

Many great investors like Buffett, Bogle, Lynch have been consistent in their advice that a low cost index fund is a very good investing option for a vast majority of the investors. This advice was at the top of my mind when I began my search for an equity mutual fund to start a long term systematic investment plan.

A study from BofA-ML had found that only 3 % of the 1,600 equity funds actually managed to outperform the Nifty in first six months of 2018. A 6 % of them managed to outperform Nifty on a relative basis in the last one year and only 16 % outperformed the benchmark in the last three years.

This set me thinking as to what this really meant for ordinary investors like you and me. Are there any equity funds which have been consistently outperforming the benchmark indices over for a very long time horizon? Or should we just heed to the advice of the investing legends and join the index fund investing bandwagon?

My search for funds to invest duly began by looking for the past performance data. I quickly found that the data for recent periods seem to be readily available but the information became progressively scarce as I looked farther in the past. The maximum tenure for which I could find the performance data was for a 10 year period.

10 years is definitely a long time frame but I believed that even the 10 years time horizon missed two crucial financial events: the tech bubble of the year 2000 and the financial crisis of early 2008. I reasoned that any fund which has outperformed over 15 to 20 years would have had to pass either one or both of these two very difficult tests. And those that have come out in flying colors surely have proved their mettle and stood the test of time. Hence they may have a better chance of having success even going forward.

But what about the data for more than 10 years? Thanks to Larissa and Himanshu at Morningstar, I could get the performance data for 15 years and 20 years. I spent many hours studying the data to find my answers. Hopefully my search for answers will also provide you with some food for thought.

Fund Criteria

Just as there are horses for courses, different categories of funds like Debt funds / Liquid funds / balanced funds are each suitable for different financial objectives. To meet my long term goal of creating a retirement corpus via the SIP route, I came up with the following fund criteria:

A. Category

Over a long period the general wisdom is that equity as an asset class tends to do better. Hence the focus was restricted to pure equity funds and even within equity funds the scope was further narrowed down to the relatively less volatile large cap funds.

Pure Mid-cap, Small-cap, thematic funds were kept out of the scope. The goal was to build a corpus and hence only growth funds were considered.

So the final scope considered and the fund criteria came down to:

- Equity – Large Cap (G)

- Equity – Multi Cap (G)

B. AUM

To focus on funds with a reasonable size, the minimum AUM requirement was pegged at 500 crores.

C. Reference Date

All data for ranking the performance of funds over 15 years and 20 years was taken as of 31st Aug, 2018

Rules for the Road

Before we get into fund performance , a few very important ground rules:

- The funds discussed here are not any recommendations to buy or sell. Please contact a registered Investment adviser before taking your buy / sell decisions. My findings are posted here for educational and informational purposes only.

- There is no reason to believe that the underlying data is not accurate. However, no guarantee is possible towards that end.

- The search is a endeavor to find a suitable fund to invest based on my set of criteria which may or may not be applicable for you nor be the best criteria to decide. E.g. Pure thematic funds or pure sector specific funds were not considered since they were considered to be inherently more risky.

- I am fully cognizant of the fact that past performance is NO guarantee that the future returns may also follow the same pattern. But I strongly believe that funds who have done well for 15 or 20 years have a greater chance of doing well in the future too.

- There are other factors too which are pertinent like the fund expense ratio, fund manager’s style , Fund house etc. which has not been explicitly considered in this exercise.

All set, let us dive straight into the findings.

Equity funds: Large cap

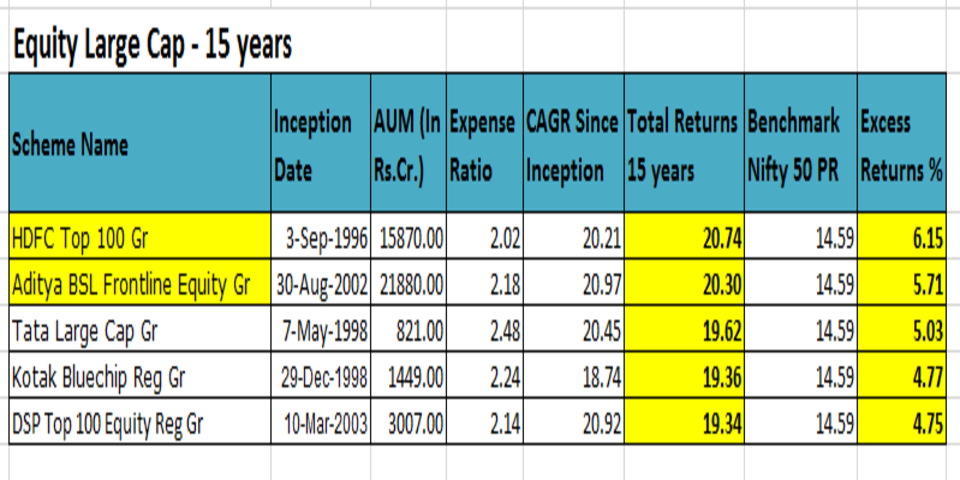

A. Performance over 15 years

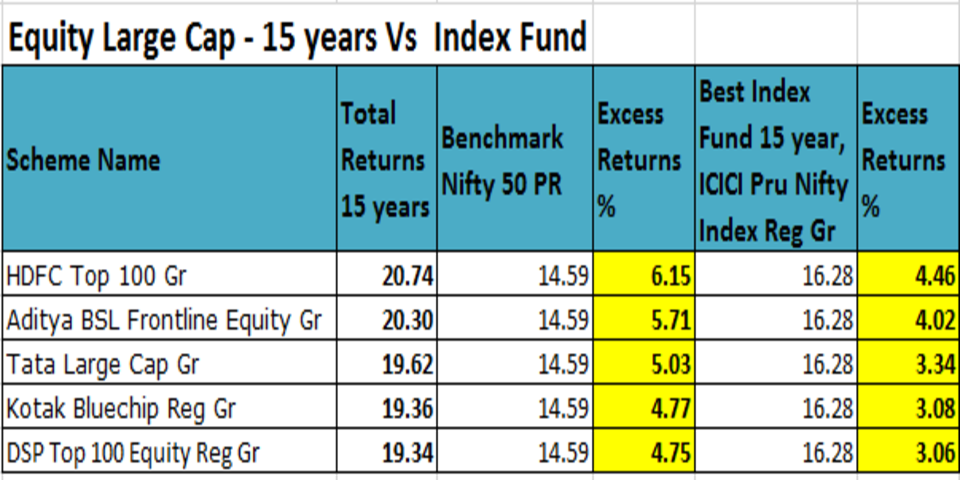

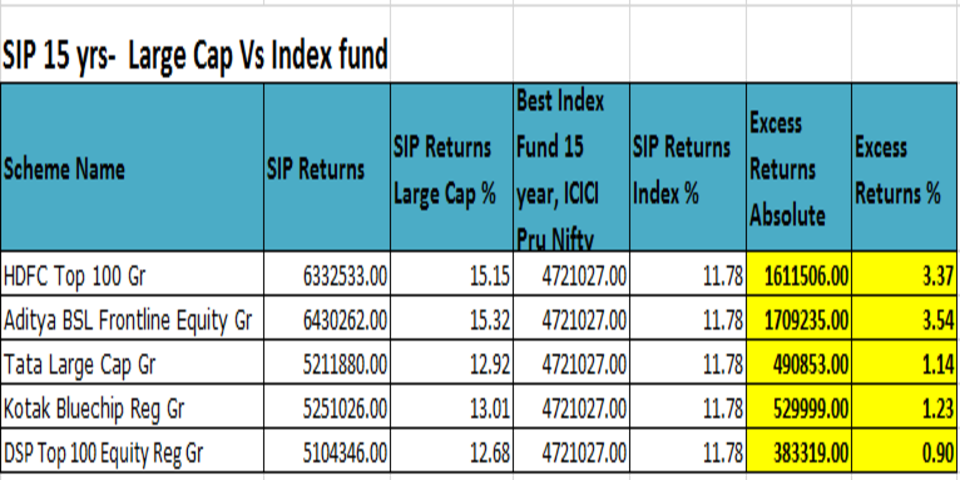

This table gives you the top 5 Equity large cap funds over a 15 year period as of 31st Aug, 2018 and the relative out-performance against the benchmark index (Nifty 50)

- HDFC Top 100 and Aditya Birla SL Frontline equity fund are the big daddies out there- both in AUM and in performance. A 6% approx. out-performance is massive.

B. Performance over 20 years

This table gives you the top 5 Equity large cap funds over a 20 year period as of 31st Aug, 2018 and the relative out-performance against the benchmark index (Nifty 50)

- HDFC Top 100 and Tata large cap funds absolutely rock over a 20 year period with an out-performance of 8% approximately

- Tata’s don’t market their cars well and that seems to be the same theme here with their funds too. Their AUM is only 5% of the second ranked HDFC Top 100 fund’s AUM.

- Beyond the top 3, the fund out-performance tapers off and in fact the 5th performing fund has not beaten the benchmark. Interesting

Equity funds: Multi-cap

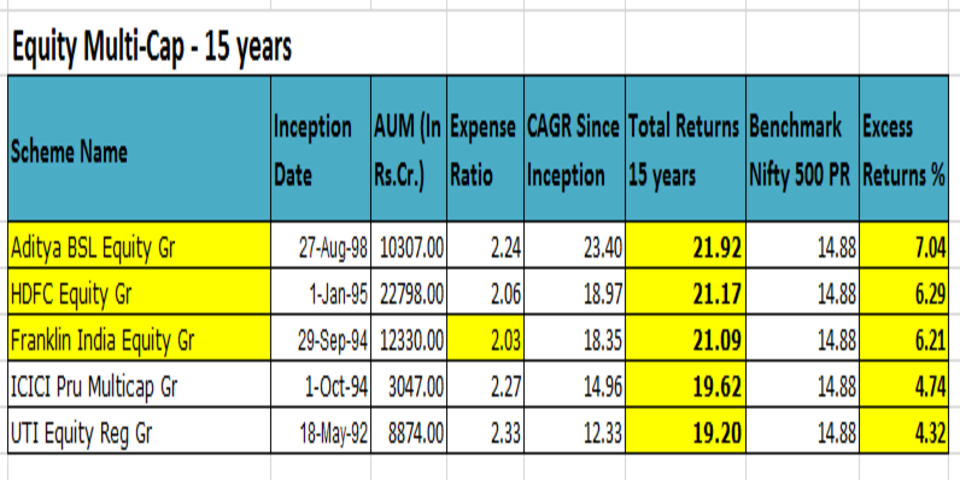

A. Performance 15 years

This table gives you the top 5 Equity Multi-cap funds over a 15 year period as of 31st Aug, 2018 and the relative out-performance against the benchmark index (Nifty 500)

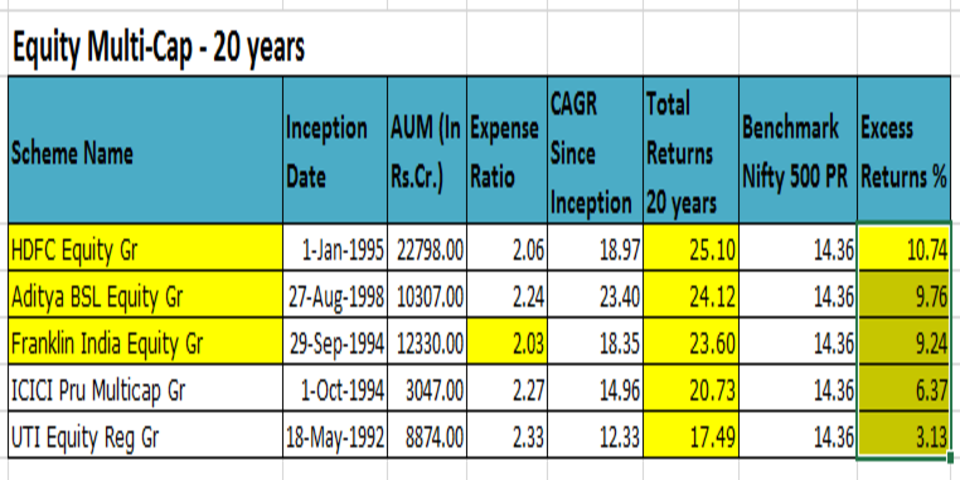

B. Performance 20 years

This table gives you the top 5 Equity Multi-cap funds over a 20 year period as of 31st Aug, 2018 and the relative out-performance against the benchmark index (Nifty 500)

- The Top 3 funds have outperformed the broader index significantly

- The same set of 5 funds make up the top 5 over both 15 years and 20 years

Equity – Index funds

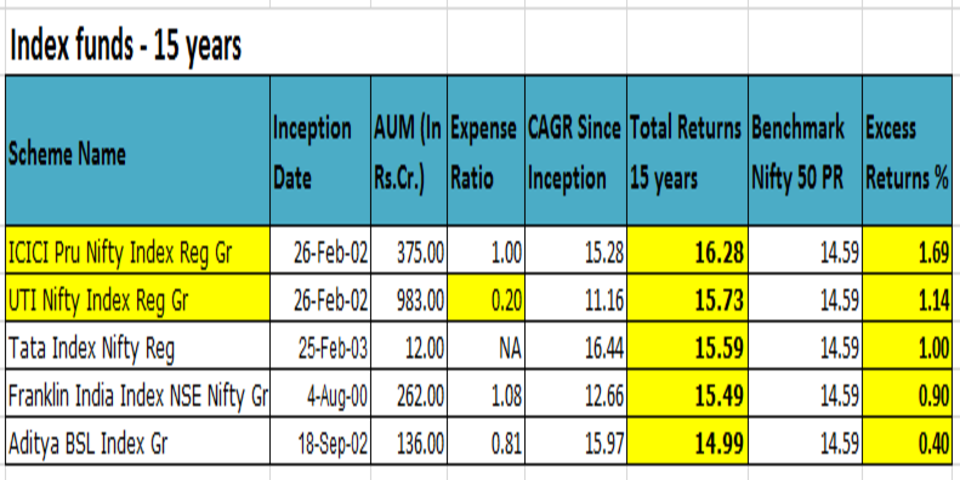

The next crucial question was how the index funds performed. I looked at the 15 years data as on 31st Aug, 2018 to come up with the top 5.

Key Insights

Having looked at the data for 15 years and 20 years, these are some of my observations:

-

Top 3 Equity Large Cap funds

Let us get to the heart of the whole exercise. Based on 15 years and 20 years data, the top 3 funds in NO particular order:

A. HDFC Top 100 (G)

B. Aditya Birla SL Frontline Equity (G)

C. Tata Large Cap (G)

A quick look at 10 year performance validates the above choices.

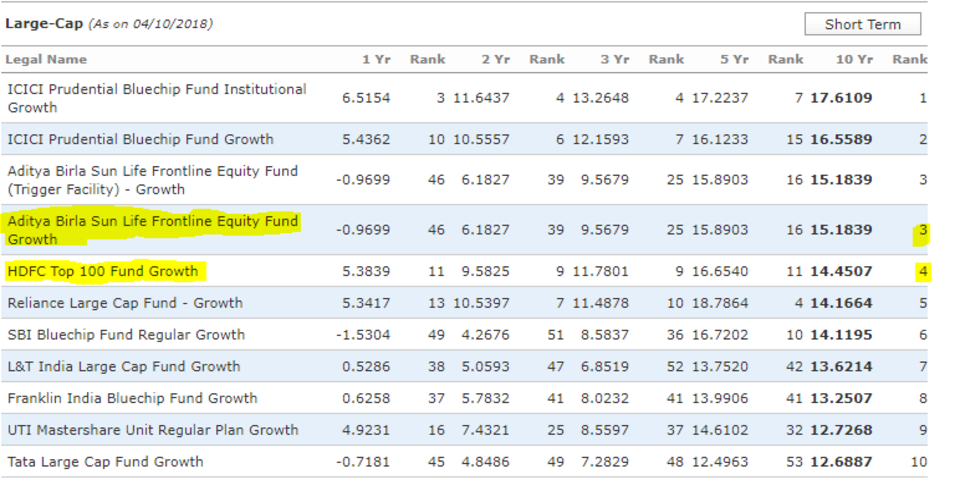

Performance over 10 years

This table gives you the top 10 Equity large cap funds over a 10 year period as of 4th October

(Source: Morningstar)

- HDFC Top 100 performed consistently well over a 5year, 3 year and 2 year time period too

- The top 3 funds namely HDFC Top 100, Aditya Birla SL Frontline and Tata Large cap fund continue their out-performance even for a 10 year time horizon to be in Top 10.

-

Top 3 Equity funds – Multi Cap

Based on 15 years and 20 years data, the top 3 funds in NO particular order:

A. HDFC Equity fund (G)

B. Aditya Birla SL Equity Fund (G)

C. Franklin India Equity (G)

A quick look at 10 year performance validates the above choices.

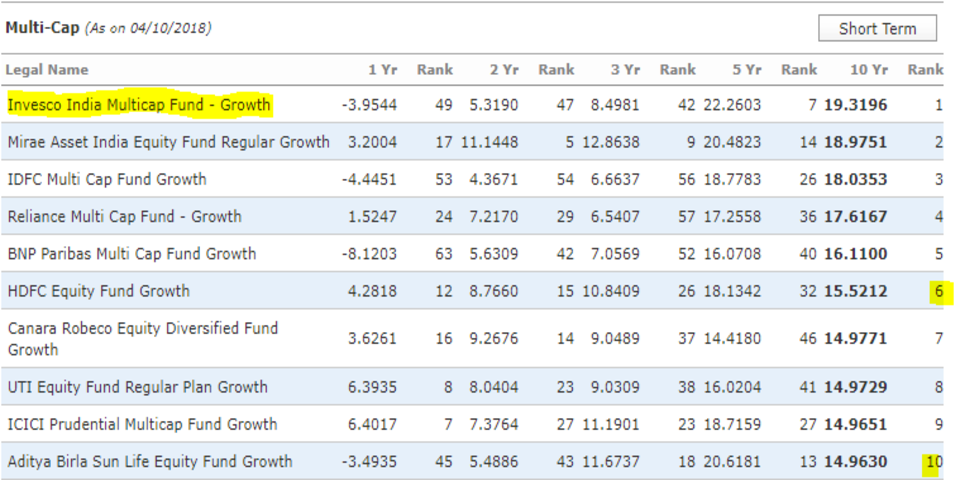

Performance 10 years

This table gives you the top 10 Equity Multi cap funds over a 10 year period as of 4th October

(Source: Morningstar)

-

Top 2 Index funds

Based on 15 years data, the top 2 index funds in NO particular order

ICICI Pru Nifty Index fund (G)

UTI Nifty Index Fund (G)

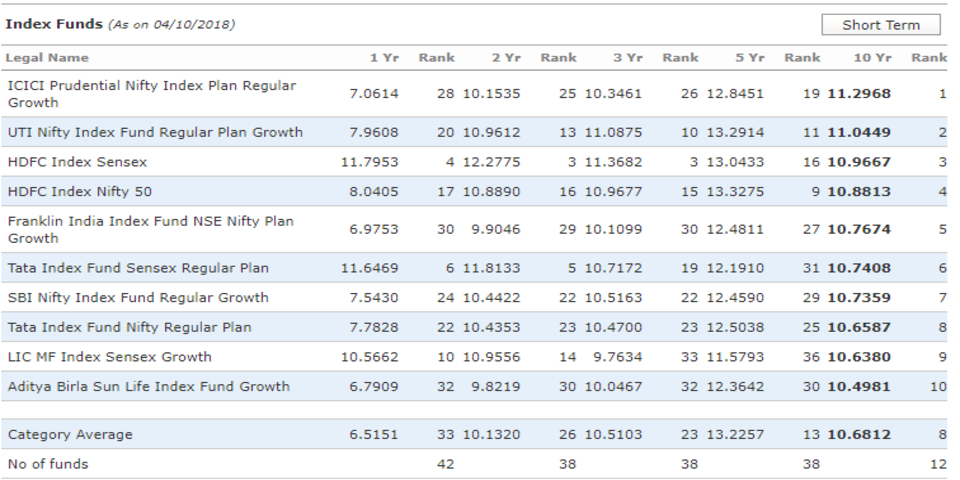

A quick look at 10 years performance validates the above choices.

Performance 10 years

This table gives you the top 10 Equity Index funds over a 10 year period as of 4th October

(Source: Morningstar)

- Actively managed funds have significantly outperformed the benchmark Indices

The question which was in the top of my mind was answered emphatically. In the debate of active vs passive investing, at least in the Indian context, I do not have any more doubt. The top performing funds have beaten the benchmark hands down and with a significant margin.

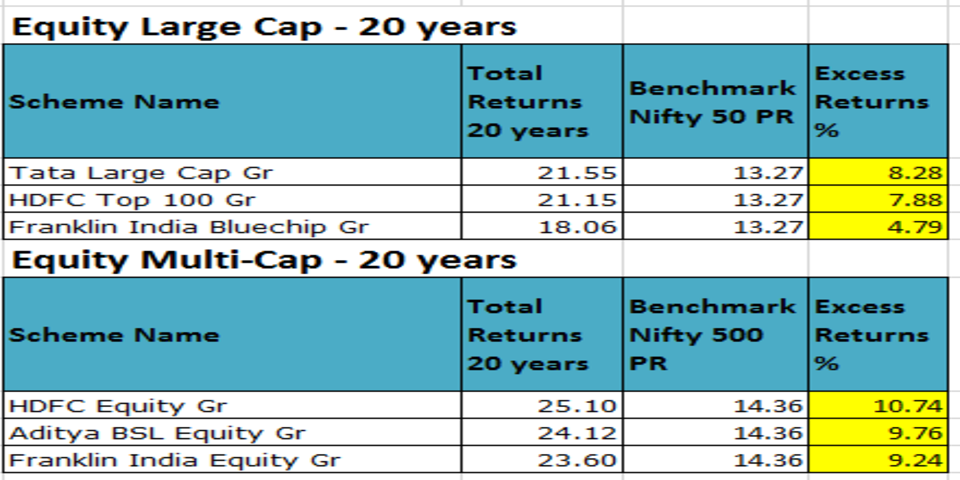

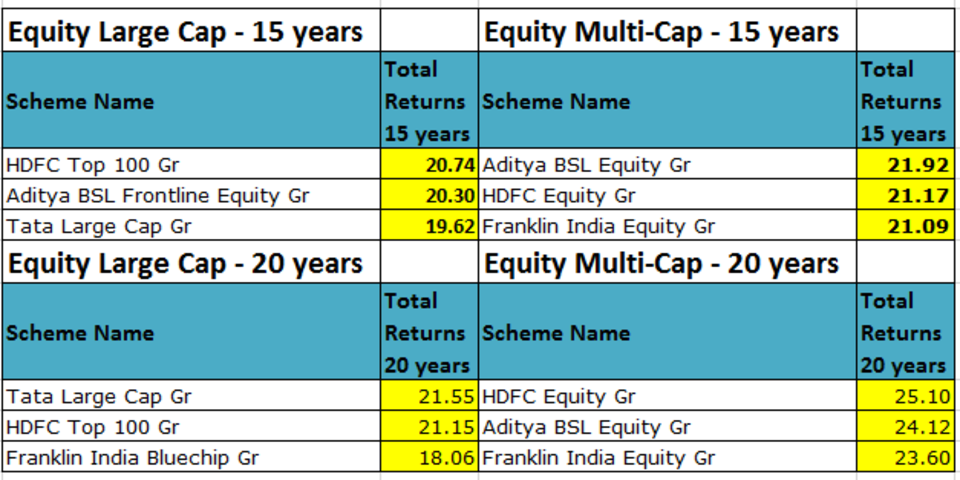

As seen in the table below, the top fund in the equity multi cap fund category, HDFC Equity (G) has outperformed the benchmark by a whopping 10.74% over a 20 year period.

- Actively managed funds have beaten the best index fund too by a wide margin

The actively managed funds have outperformed not just the benchmark indices but even the best performing index fund by a wide margin.

The below table compares the returns of large cap funds Vs the best performing index fund for 15 years, ICICI Pru Nifty Index Reg Gr fund:

Now let us say you had taken the systematic investment route and started an SIP

The below table shows the returns if you had started a monthly SIP of 10,000 for 15 years on 1st September 2003 in any of the top 5 large cap funds against the returns you would have received if the SIP was done in the best performing index fund:

The result is as clear as night and day. The absolute returns in the top 2 large cap equity funds is in excess of 16 lacs (1.6 million) over the best performing index fund over a 15 year period.

It is also pertinent to note that the out-performance tapers off as we go down the list and for the 5th best fund the excess returns is actually less than 1%. This implies that you have to be get the fund selection absolutely right.

- Multi-cap funds have performed better over pure large cap funds

Multi-cap funds by design may invest in mid cap or small cap stocks and that seems to give them an edge over pure large cap only funds. For Long term investors, multi cap funds may also be a good investing option.

The below table shows the total returns of top 3 funds in both Multi-cap and Large cap categories:

As can be seen above, over a 20 year period, the best performing Multi-cap fund (HDFC Equity Gr) has a 3.55 % out-performance over the best performing large cap only fund (25.10 % Vs 21.55%).

Final Thoughts

It is very clear to me now that at least in the Indian context, there are actively managed funds which have consistently beaten the benchmark indices and there is no need to jump into the indexing bandwagon. The best performing actively managed funds have not just outperformed the top index funds by a sizable margin and but also have done that over a very long time horizon of 15 to 20 years.

However, as seen from the data, the excess returns generated seems to be tapering off as we go down the performance list. The key thing then is to get the fund selection decision absolutely spot on. Hitching your financial bandwagon to the right fund is seen to be crucial as to where you will end up in your investing journey. To that end, approaching a trusted financial adviser to help you choose the best fund may just be the fine beginning you can make.

Happy Investing!!!

Liked the Post? Share it with friends.

Do follow me on Twitter (@stocknladdr) where I share more interesting things I read.

(Photo Image: pexels)

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr