Issue 024, 08 Aug 2021

Section A – illumin8

Investing Dinosaurs

“In order to succeed, you must first survive”

These golden words cannot be more truer for an investor. The first step in any race nor mission will be to complete it. Only then we could think of how quickly or by how many points we can finish the race.

Similar in the investing race, the first step is to have a plan to protect your capital. If you had invested 50 lacs in the market then the primary responsibility is to ensure that you don’t lose your capital.

It is inevitable that you will face these in your investing career:

Bad / Dumb luck

Bad Investing decisions

Bear markets

All the the three are inevitable. I hardly know of anyone who has not been unlucky. Talking of dumb luck, let me give you an example as late as Jan 2021

I was tracking a food company for many years. Firstly, i read about that company in a a reputed website and i loved what i read. I did a Peter Lynch and took my family for purchase of grocery. On cue , I found the a packet being picked up and put in the shopping tray.

Remembering Phil Fisher, I used a variation of scuttle-butt. I asked if we could buy another brand, I even highlighted that a competitor product was 5% lower in price. All the while praying and hoping that the brand i was tracking will not be removed from the shopping trolley.

As expected, not only was the lower priced competitor firmly rejected , I even got a face made at me for even suggesting that. While it was not a very pleasant shopping experience, the investor in me got thrilled.

I had studied the finances, business and now my scuttle-but also gave me a positive result that I immediately went and bought 1000 shares at 239 per share.

Now what is bad dumb luck. The very next day, one of the promoters was arrested by authorities on the back of complaints that a part of the companies products was exported to the Middle-east in the promoter’s own personal brand undercutting the brands of the listed company and a price which was far lower than the market price-

in effect the shareholders money was used for market development, marketing, licenses, winning the order but he fulfillment was done in the promoters personal brand.

I asked myself: If only he would have been arrested two days before i would have been saved the pain. Having tracked for 2 years , i was was 2 days early. I felt as if the investing gods were just waiting for my order to be punched. Promptly, the share price tumbled 20% in two sessions and i was looking at 80K losses.

The second and third situations: bad investing decisions and bear markets are self explanatory.

Over the many years, i have realized the wisdom in Charles Darwin’s words:

It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change – Charles Darwin

Our ancestors roamed around in the wilderness of the jungles and made a living hunting for food; some investors now are roaming in the wilderness of the world’s stock markets and are trying to make a living hunting for mis-priced stocks. But the need to be responsive to change is as relevant today as it was for our cave dwelling ancestors.

“We are living in an ever changing world” is both a cliché as well as an understatement. Regulations are changing, new technologies are emerging, unique business models are evolving and more importantly, disruptive innovations have now become a common feature across all walks of life.

In such a dynamic scenario, one of the key skills required today to survive in the stock market and more importantly to be successful, is of “Flexible thinking”.

In psychology, flexible thinking (flexibilitas in Latin means elasticity) is also referred to as “cognitive flexibility”.

Psychologists consider cognitive flexibility as one of the key thinking skills required to succeed along with other thinking skills like creative thinking, critical thinking and problem solving.

Broadly, flexible thinking refers to the ability to consider with an open mind the various alternatives upon encountering new facts or situations; and then be adaptive to change one’s view from the previously held thoughts or beliefs.

Relevance For Investors

As an investor, you have to brace yourself daily to face a deluge of new information, facts and figures. It could be a new political event, a new regulation, new information on a specific business, a new emerging technology, a newly evolving macro trend, new set of economic data….the list is endless.

Faced with such situations, an investor should be able to consider with an open mind the new information, consider the information from multiple angles and then be able to change their existing views.

There are many scenarios in investing where an investor should display this key skill of flexibility in thinking.

Tactical Decisions (Short Term)

“They must often change, who would be constant in happiness or wisdom” – Confucius

Drukenmiller is considered one of the greatest investors not without any reason. In the book, Inside the house of money, there is a fine description of Druckenmiller “Stan may be the greatest money making machine in history. He has Jim Roger’s analytical ability, George Soros’s trading ability, and the stomach of a riverboat gambler when it comes to placing his bets.”

On the fateful Black Monday of October 19, 1987 when the markets started crashing, Druckenmiller exhibited great flexibility in thinking to reverse his initial trading position and that too with speed, to turn in a profit from a losing position.

Here is an excellent description of Drukenmiller’s flexible thinking from Ben Carlson:

In his book, The New Market Wizards, Jack Schwager tells the story about how Druckenmiller pulled a 180 the day before the 1987 Black Monday market crash, only to pull another 180 when it looked like he was initially wrong:

Druckenmiller made the incredible error of shifting from short to 130 percent long on the very day before the massive October 19, 1987 crash, yet he finished the month with a net gain. How? When he realized he was dead wrong, he liquidated his entire long position during the first hour of trading on October 19 and actually went short. Had he been less open-minded, defending his original position when confronted with contrary evidence, or had he procrastinated to see if the market would recover, he would have suffered a tremendous loss. Instead, he actually made a small profit. The ability to accept unpleasant truths (i.e., market action or events counter to one’s position) and respond decisively and without hesitation is the mark of a great trader.“

Strategic decisions (Long term)

Buffett and Tesco

In 2012, Buffett increased his holdings in the U.K food retailer to over 5% by picking up additional shares of Tesco. A year later he started selling a part of his holdings and by 2014, the entire position was liquidated. Buffett explained the Tesco investment in his 2014 Shareholder letter:

At the end of 2012 we owned 415 million shares of Tesco, then and now the leading food retailer in the U.K. and an important grocer in other countries as well. Our cost for this investment was $2.3 billion, and the market value was a similar amount.

17 In 2013, I soured somewhat on the company’s then-management and sold 114 million shares, realizing a profit of $43 million. My leisurely pace in making sales would prove expensive. Charlie calls this sort of behavior “thumb-sucking.” (Considering what my delay cost us, he is being kind.)

During 2014, Tesco’s problems worsened by the month. The company’s market share fell, its margins contracted and accounting problems surfaced. In the world of business, bad news often surfaces serially: You see a cockroach in your kitchen; as the days go by, you meet his relatives.

We sold Tesco shares throughout the year and are now out of the position. (The company, we should mention, has hired new management, and we wish them well.) Our after-tax loss from this investment was $444 million, about 1/5 of 1% of Berkshire’s net worth.

Buffett once said “If you are not willing to own a stock for 10 years, do not even think about owning it for 10 minutes.” But as you can see, he has shown great flexibility in thinking to change his mind and to also make the difficult decision of accepting a loss on his Tesco investment when the facts changed.

Final Thoughts

Edward de Bono famously quipped “If you never change your mind, why have one?”

As an investor we are processing lots of new information continuously. The flexibility in thinking to assess the new materially important facts with an open mind and to change one’s mind when the facts change is a key skill required for surviving in the stock markets.

At the very least, it should help investors in increasing their odds for investing survival.

PS: While I cursed my luck in January, you should realize that a bull market , like a rising tide will raise everything on its path including trash cans. The food stock is up 20% today , a gain of 40% from the lows.

I didn’t wait this long and the moment I made FD returns I cashed out. But I have no regrets on selling early. I know for sure that only when the tide goes out you will know who was swimming naked.

Section B – acceler8

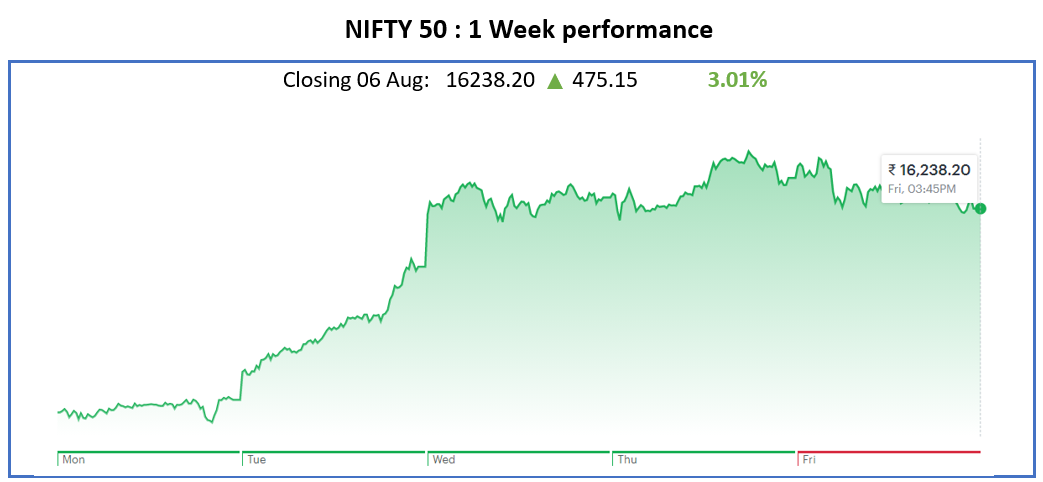

Nifty50 Last Week

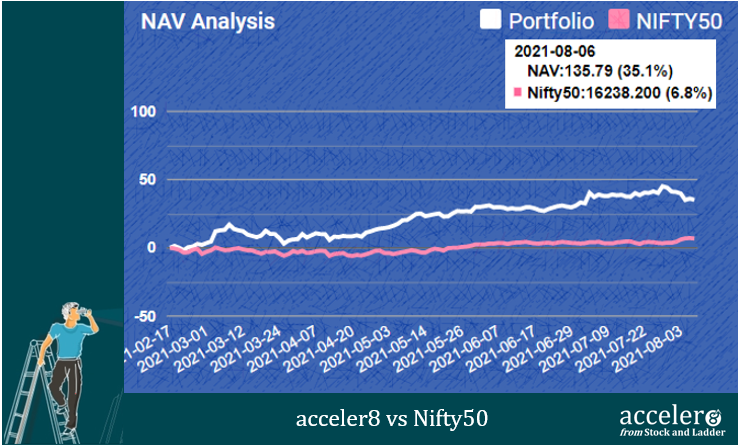

acceler8 Portfolio NAV

#acceler8 continues its strong performance and the portfolio has +28 % outperformance against NIFTY 50.

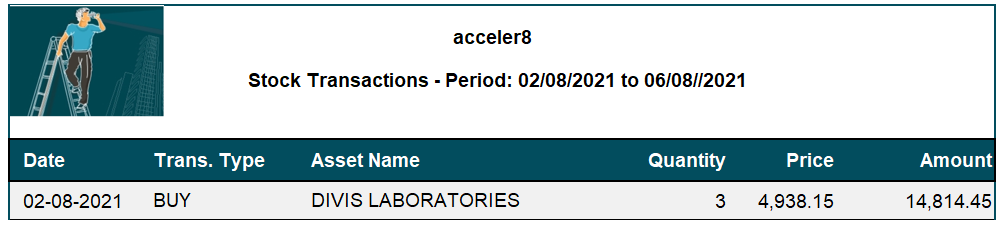

Trades done for the week

Divis Laboratories : A momentum bet on largest API manufacturer in India with strong fundamentals.

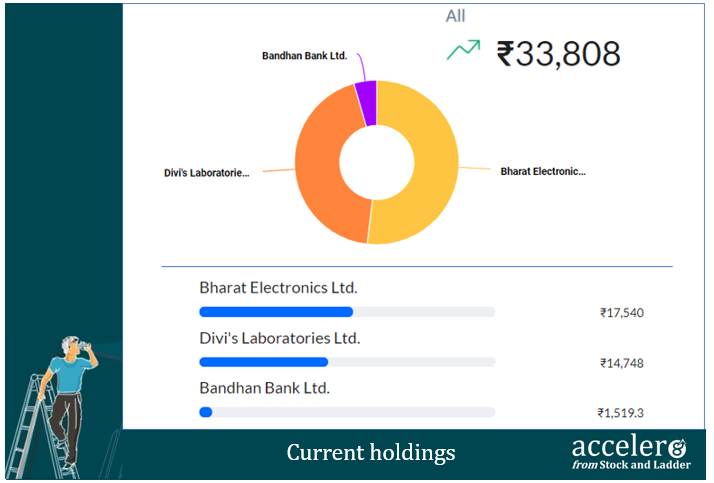

Current position

We are at 65% cash reflecting the high valuations.

We will look around for opportunities and will only bite the bullet when a clear opportunity arises. No trades for trade sake.

Happy investing !

Until next week, take care and stay safe.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr