Issue 013, 23 May 2021

“Buy values, not fancy names”

Phil Carret

A great investor who experienced 31 bull markets, 30 bear markets, 20 recessions, two major crashes, started the “Pioneer Fund” in 1928, and the list of accolades goes on. And the icing on the cake is to be considered by one of the world’s greatest investors, Warren Buffet as his role model.

Yes, you guessed it right. We are talking about Philip Carret who had a illustrious investing career till the age of 101.

Born in 1896 to a lawyer and a social worker, Phil Carret graduated from Harvard College in 1917 and thereafter attended the Harvard Business School. Philip Carret was the first to write on value investing way back in 1927 which went on to form the basis of his seminal book “Art of Speculation”.

Carret’s 12 Principles of Investing

Carret in his 1930 seminal book The Art of Speculation outlines his 12 investing principles:

Never hold fewer than 10 different securities covering five different fields of business;

At least once every six months, reappraise every security held;

Keep at least half the total fund in income producing securities;

Consider (dividend) yield the least important factor in analyzing any stock;

Be quick to take losses and reluctant to take profits;

Never put more than 25% of a given fund into securities about which detailed information is not readily and regularly available;

Avoid inside information as you would the plague;

Seek facts diligently, advice never;

Ignore mechanical formulas for value in securities;

When stocks are high, money rates rising and business prosperous, at least half a given fund should be placed in short-term bonds;

Borrow money sparingly and only when stocks are low, money rates low and falling and business depressed;

Set aside a moderate proportion of available funds for the purchase of long-term options on stocks in promising companies whenever available.

Studying Phil Carret, we get lot of insightful learnings.

Few Key Lessons:

Keep your antennas up

I am a big fan of Peter Lynch and one of the earliest books I read was “One upon Wall Street”. The beauty about this book is that it inspires normal investors like you and me to pick up “multi bagger” stocks.

One famous take away was that Peter Lynch used to take regular trip with his family to shopping malls, buying stuffs and eating burgers, but always on the lookout for opportunities.

a) Philip Carret used this strategy effectively 40 years back to pick up his stocks. He once stayed at Bostonian Hotel on his visit to Boston. He simply loved the brand of the soap “Neutrogena” which was kept at the Hotel and the first thing he did on going back was to check about the company “Neutrogena”.

He liked what he read and immediately bought some shares. He made a company visit and he liked the company even more. His cost adjusted for stock splits was about one dollar a share. The company was bought by Johnson and Johnson at $35 a share.

b) On his drive to office he started noticing lots of North American Van Line trucks on the motorway. He researched the company and picked up a stake when he liked what he researched. Shortly afterwards the truck company was in the radar of PepsiCo too and was promptly snapped up for a premium giving Carret a decent profit.

c) On another occasion he observed the bottle on the water cooler in his office and found it interesting. Carret researched the manufacturer, Liqui-box and bought shares at 10.50$. He eventually sold the stock at around 120$ per share.

The Key Lesson

Keep your investing antenna up always. We may go across cities looking for ideas but Multi-baggers may be just around us, hidden in our daily life.

Reading the footnotes

The master investor Jim Rogers when asked about the best advice he ever got said this “The best advice I ever got was on an airplane. It was in my early days on Wall Street. I was flying to Chicago, and I sat next to an older guy. Anyway, I remember him as being an old guy, which means he may have been 40. He told me to read everything”.

If you get interested in a company and you read the annual report, he said, you will have done more than 98% of the people on Wall Street. And if you read the footnotes in the annual report you will have done more than 100% of the people on Wall Street.”

Philip Carret practiced this long back. Frank Betz, who was Carret’s personal assistant in the Eighties, recalled that he read voraciously – not just corporate reports and newspapers but also books on philosophy, history, economics and biographies. Carret claimed to glean the most useful information from the detailed footnotes appended to corporate annual reports.

The Key Lesson

Please read the annual report before you invest. Even better, read the footnotes too.

As they say God (or Devil, take your pick) is in the detail. If there is to be one take away from this post, then let it be this – Read the footnotes.

Buy and sit on them

When the phrase QSQT is heard, for normal folks it would mean “Qayamat se Qayamat tak”, but for those folks with a target like professional money managers it would only mean “Quarter se Quarter tak”.

When Peter Lynch was asked what edge an individual investor can have, he said:

You could be an interventional cardiologist and you put in a heart pump. You say, wow, this really is an incredible breakthrough, preventing shock, providing hemodynamic support. You’re actually in the operating room, seeing this breakthrough way ahead of most people. That’s an edge. You need an edge on something.

Before picking stocks, every investor should ask “What is the edge I have” ? One edge what an individual has against professional money managers is TIME. Phil Carret took it to the extreme. He held positions in multiples of decades.

In 1946, Carret bought Greif Bros. Cooperage Co. The stock was a steady grower with a steady management and Carret bought it at a reasonable price. Over the years Carret stayed invested and the same person who was managing Grief Bros years back continued to manage it even after 40 years. Over this period, each share that Carret bought at around $15 equaled to 40 shares of Greif Bros. Co.

A typical day at office for Philip Carret will be starting his work at 9 am, breaking for lunch at 12.15 pm and then leaving for the day at 4:30 pm. If you thought this was lazy investing, think again, Carret invested for decades. His investment in Greif Bros was for a period of 48 years.

The Key Lesson

You don’t have to pick up Multi-baggers for having long term success. Carret believed that companies with above average financials, low debt and with manager’s having a skin in the game will give returns if you hold on for long enough.

Final Thoughts

Phil Carret is one of the most famous yet under the radar investor. His investing life has many lessons for the thoughtful long term investor. Personally at Stock and Ladder we follow what I call a Double Barrel Investing.

The Core portfolio (around 80%) is for strategic long term investing and around 20% is for Tactical short term investing.

The Tactical part is what acceler8 portfolio is all about. The larger part where we invest for the long term on fundamentally sound companies with economic moat and a long runway for growth which we refer to as “accumul8” is in the final stages of release. You will hear from us shortly.

Just as Philip Carret was a role model for Warren Buffett, every long term investor should take time out to study his illustrious career spanning 7 decades.

Section B – acceler8

Portfolio Updates

This week was interesting from acceler8 portfolio perspective. There were couple of times when I wanted to pull the trigger on CDSL, (which has gone up by 8.5% in 20 days). I resisted from doing so, only for one reason – lack of other clear cut reinvestment opportunities.

As we analyze the trades done, one trade which could have been better is of Kaveri Seeds. Let me be candid to admit that while we made decent profits in a quick time, the momentum was still there for this stock. Last month we sold it around Rs 603.

PS : Today it is hovering around Rs 760. While the key reason can be any new development, this is one lesson (which market keeps giving) has been that as an investor you should take care of both sides of the trade – Buy and Sell, and selling is indeed an art.

We will address the topic of Art of Selling in a separate post.

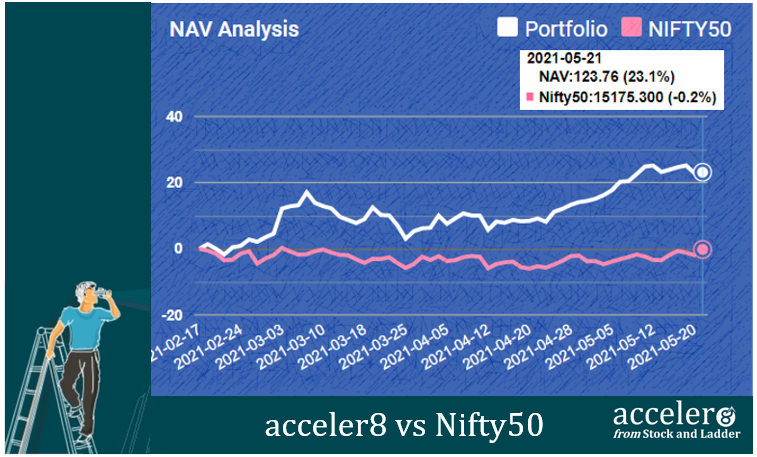

NIFTY50 last week

acceler8 portfolio NAV

As on 21 May 2021, the NAV of acceler8 portfolio is 123.76(+23.1%) and has outperformed the benchmark Nifty50 by a significant margin (+23.3%).

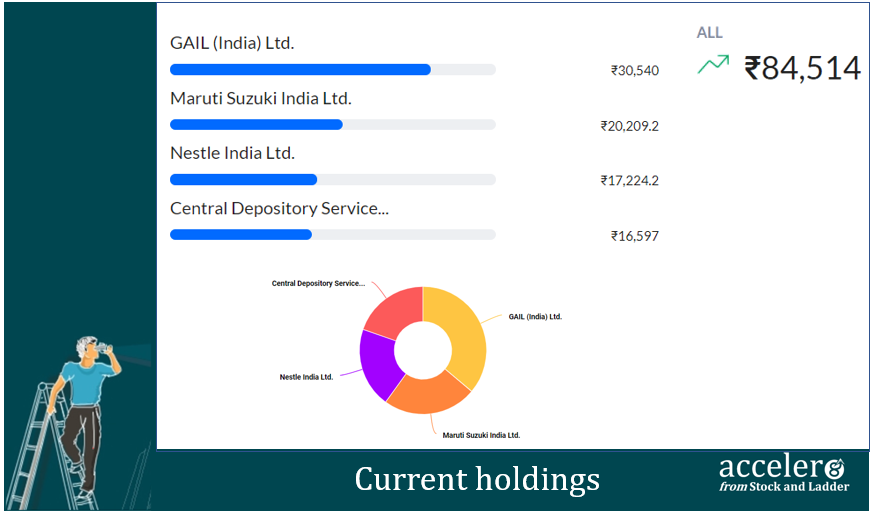

Current Position

As on 21 May, the consolidated value of current holdings is at ₹84,514 with around 20% in cash.

Hope most of you picked by Nestle this week. It has smartly moved up.

Section C – Stock Screeners

Momentum 20-20 Screener

We started the week with three stocks in our Momentum 20-20 portfolio.

1. Grindwell Norton

2. Tata Elxsi

3. Oracle Financial

Rebalancing for this Week

Entry : Nil

Exit : Oracle Financial Services

Momentum 20-20 portfolio has two stocks :

1. Grindwell Norton

2. Tata Elxsi

Until next week, Stay Safe. Happy Investing.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr