Issue 003, 07 Mar 2021

Dear Reader,

With March 8 being celebrated worldwide as “International Women’s Day”, in this issue we celebrate the success of one of the most successful woman Superinvestor of our modern times.

In this post we take a look at her investing philosophy, her stock selection criterion and finally the list of stocks that qualify based on her criteria; in the Indian stock market.

Happy Women’s Day once again to all our women readers.

Hope you enjoy reading this issue; let’s dig in.

Section A – Insights

Dividends Don’t Lie

If I say “Hips don’t lie”, I can safely bet that 8 out of 10 amongst you will get it right about the person I am referring to. Now what if I say “Dividends don’t lie”. Well, I am not too sure how many of you will get that right.

But what I am sure about is that by end of this post you will not only know about who said “Dividends don’t lie” but much more about the woman Superinvestor going by multiple monikers – “Grand Dame of Dividends”, “Duchess of Dividend”, “Dividend Detective”, “Dividend Diva” – GERALDINE WEISS.

Born Geraldine Shmulowitz in the year 1926 in California in a normal unassuming middle class family, she went to become the early torch bearer for women in the field of investing.

Her core belief that “Dividends don’t lie” was the basis for key basis for the success of her investing newsletter “Investment Quality Trends”.

All of us admire and appreciate Buffet’s wonderful long-term record. Another who deserves similar recognition is Geraldine Weiss. Started in 1966 her newsletter is one of the oldest and longest surviving investing newsletters.

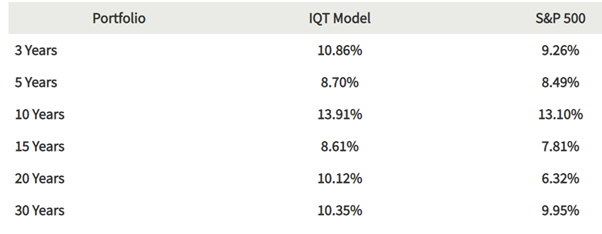

According to The Hulbert Financial Digest, an independent entity which tracks the performance of newsletters, “The Lucky 13 portfolio“ of Geraldine Weiss has routinely outperformed the benchmarks over long periods of time while assuming relatively lesser amount of risk.

Performance data as on 31 July ,2020

If you are curious to know the reason for the outperformance then Geraldine Weiss herself has eloquently explained her dividend yield investing strategy in her interviews, newsletter and in her two books.

Philosophy

She believed that the best barometer of the overall health of a company is Dividends and followed a simple dividend value approach that one should purchase the top divided paying stocks when the dividend yield is historically high, sell when the dividend yield declines to historical lows and completely avoid stocks which pay no dividend at all.

Her strategy focused on using dividend yield as a measure of stock valuation. She restricted her investing universe to 350 of America’s top Bluechip “quality” companies having a long track record of uninterrupted dividend payments of 25 years or more.

Weiss on her investing strategy

“When the price of a stock declines far enough to produce a high dividend yield, value-minded investors who seek income begin to buy. The further the price falls, the higher the yield becomes and the more investors are drawn to the stock.

Eventually the stock becomes irresistibly undervalued, buyers outnumber sellers, the decline is reversed and the stock begins to rise. The higher the price rises, the lower the dividend yield becomes and fewer investors are attracted to the stock.

Meanwhile, investors who purchased the stock at lower levels are inclined to sell and take their profits. Eventually the price becomes so high and the dividend yield is so low, sellers outnumber buyers and the price of the stock begins to decline.

A declining trend generally continues until a high dividend yield is reached that again attracts investors who step in and reverse the trend. At undervalue, the price/yield cycle re-establishes itself and the journey from undervalue to overvalue starts all over again.”

Weiss On Why Dividends Don’t Lie

The importance of dividend in her own words :

“Dividends are the most reliable measures of value in the stock market. Earnings are figures on a balance sheet that can be manipulated for income tax purposes. Earnings can be the product of a clever account’s imagination. Who knows what secrets lie in the footnotes of an earnings report?

Dividends, however, are real money. Once a dividend is paid, it is gone forever from the company. There can be no subterfuge about a cash dividend. It is either paid or it is not paid. When a dividend is declared, you know that the company is in the black. And when a company

increases its dividend, you don’t have to read a balance sheet to know that the company has made profitable progress.

In short, dividends don’t lie.”

(Source: Dividends Still Don’t Lie, Wiley)

Geraldine Weiss Stock screener

For those whose investing appetite has been whetted and are curious to learn more about how to pick stocks like Geraldine Weiss; here is the list of criterion / filters a stock must pass to qualify:

1. Must be undervalued as measured by its dividend yield on a historical basis.

2. Must be a growth stock that has raised dividends at a compound annual rate of at least 10% over the past 12 years.

3. Is selling for two times book value or less.

4. Has a P/E ratio of 20-to-1 or below.

5. Has a dividend payout ratio in the 50% area (or less) to ensure dividend safety with room for growth.

6. Debt is 50% or less of total capitalization.

7. Meets all six of our Blue Chip Criteria:

dividend raised five times in the last 12 years,

carries an A rating from S&P,

has at least 5 million shares outstanding,

at least 80 institutional investors hold the stock,

25 uninterrupted years of dividends and earnings improvements in seven of the last 12 years.

As you can see there is an emphasis on quality, long term track record of consistent divided earning, earnings growth while adopting a value investing approach of not paying too much for growth.

The underlying philosophy is that companies that perform across multiple business cycles have demonstrated the resilience and the ability to survive. Consistent dividend payments is the proof of their superiority and survivability.

Geraldine Weiss Stocks

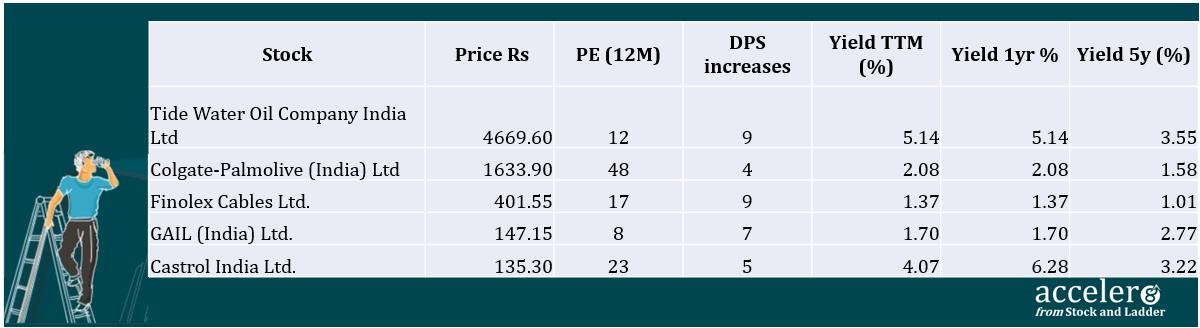

On the basic Geraldine Weiss criteria, I have applied certain other proprietary screening conditions like promoter pledge, net profit margin, return on capital employed (ROCE) and more to arrive at what I call as modified Geraldine Weiss screener.

Nine stocks pass the initial screening and after applying the above additional filters, these five stocks passed the criteria.

Additional details on these five stocks :

(The securities mentioned are for information purpose only and should not be construed as investment advice or solicitation. Please do additional research or contact your finance advisor.)

“J D Rockefeller famously said on the subject of dividends “Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.”

Dividend historically have been a significant contributor of the total returns produced by equities. There are lot of empirical evidence that suggest that portfolios consisting of higher dividend yielding securities can produce returns that are attractive related to lower yielding portfolios.

Every investor should consider the total returns from equity (capital gains + dividend income) for their investment strategy. In the future posts, we will touch upon more of dividend investing.

Additional reading

Section B – acceler8

Portfolio Updates

The acceler8 portfolio continues to enjoy good momentum and we had yet another fine week.

With markets hovering above 50000, as mentioned earlier, the emphasis currently is to protect the downside risk while looking for quick short term profitable opportunities.

This is reflected in only 47% approx. allocation (rest held in cash). Also care has been taken on the nature of securities with a focus on utilities.

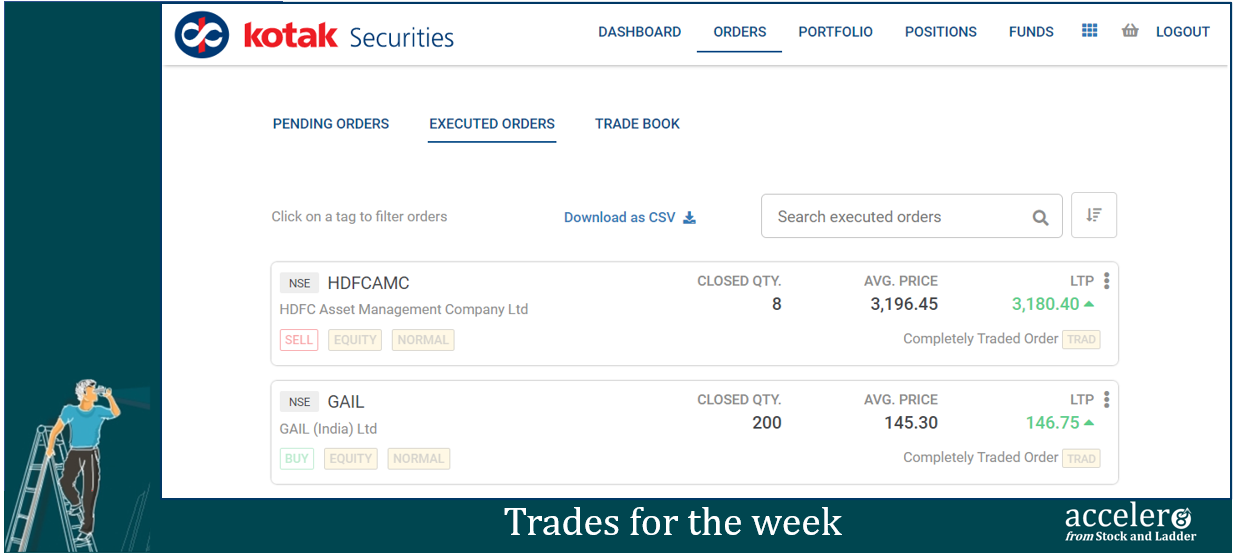

Trades done for the week

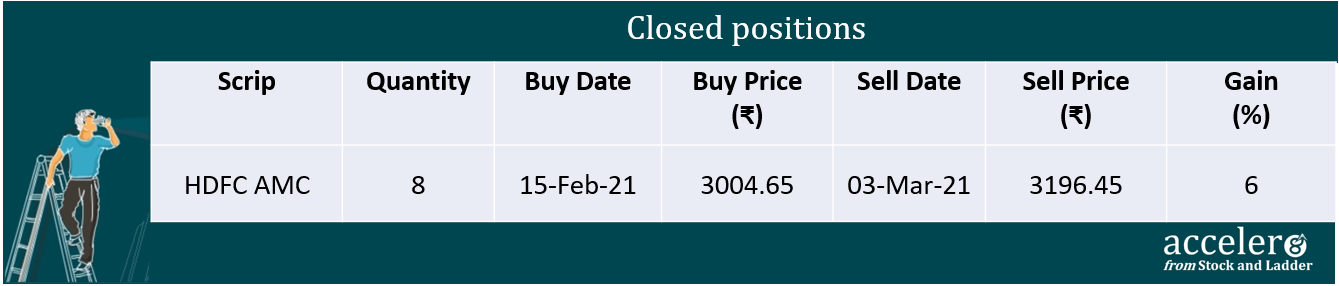

Sold HDFC AMC at ₹ 3196.45

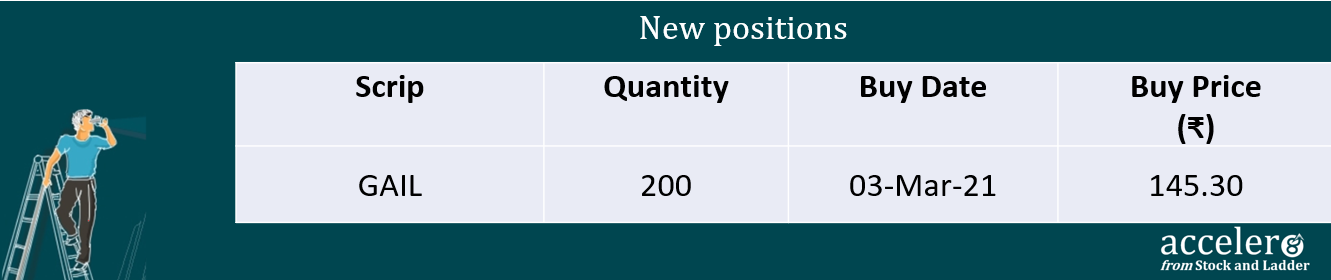

Bought GAIL at ₹ 145.30 *

(The details were shared over email during trading hours itself.)

Closed positions

Closed positions for the week :

HDFC AMC soared 8% in a single day. A combination of quality and momentum with a pinch of luck. The closed position gave us a profit of ₹1534 ( 6.38% ) in 20 days.

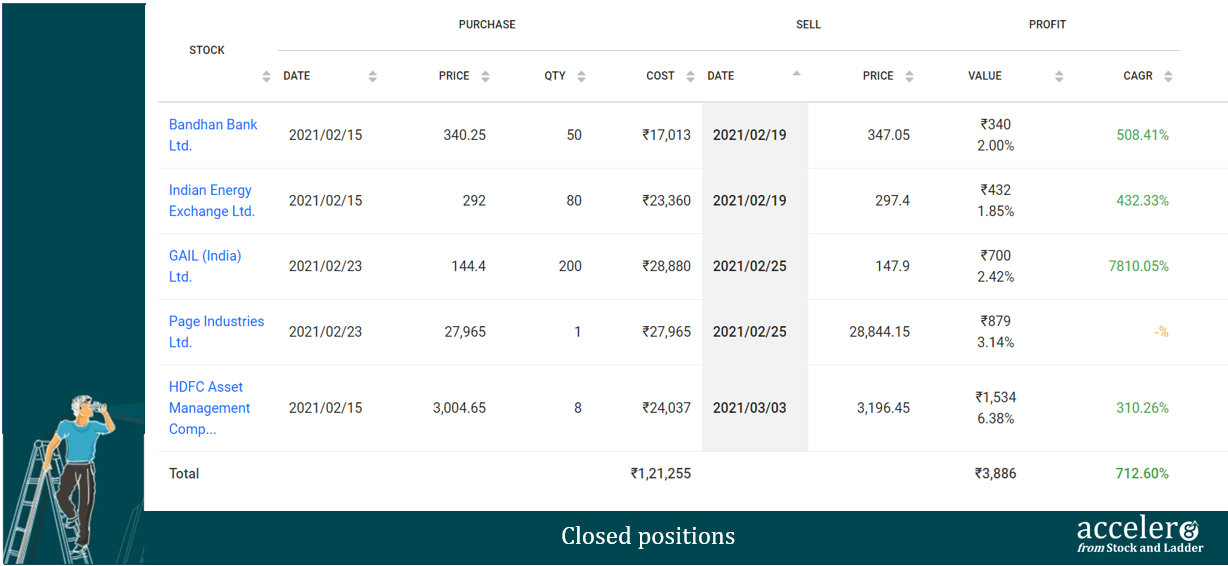

Closed positions – ALL

With this we have closed 5 trades and made an overall gain of ₹3886 (3.2%).

New positions

Entered GAIL – another quality stock with momentum.

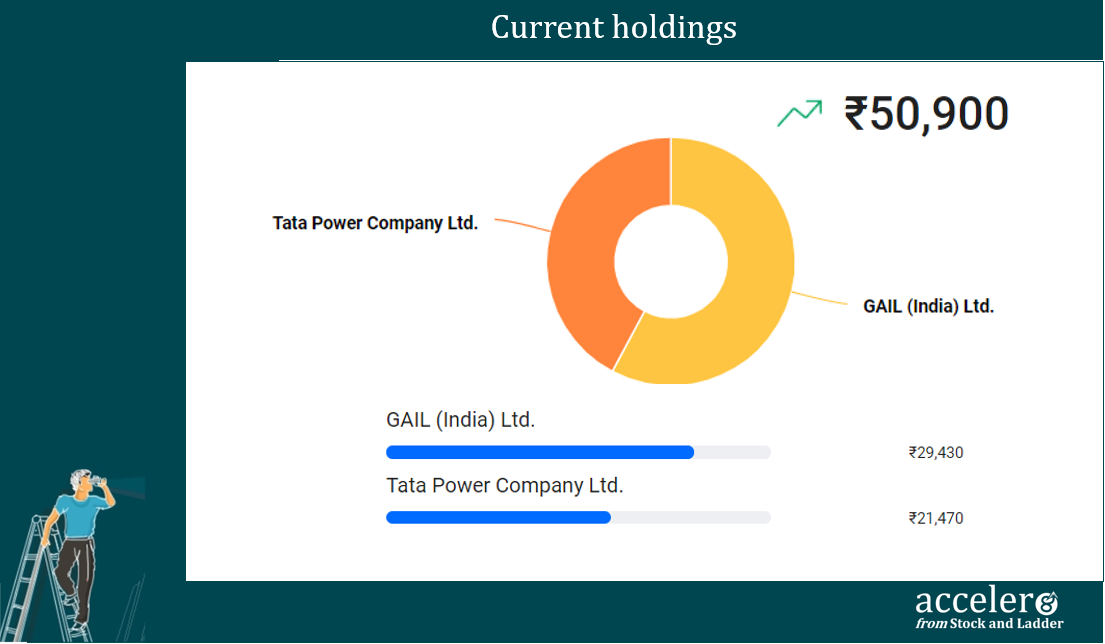

Current holdings

As on 05 Mar, the consolidated value of current holdings is at ₹50,900/-.

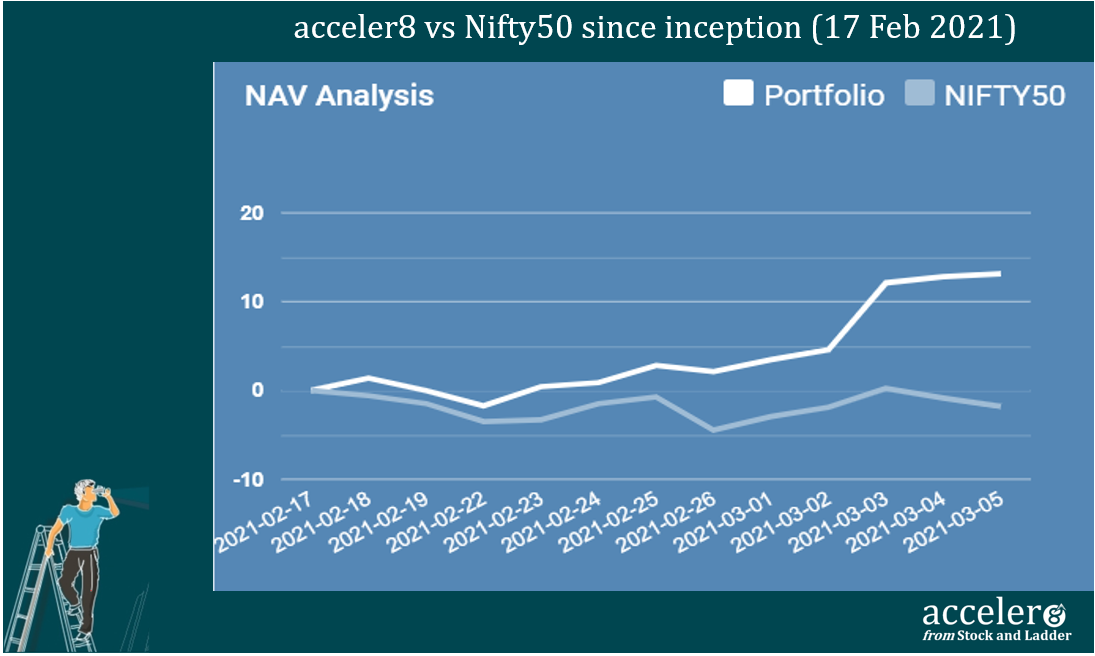

acceler8 NAV vs Nifty 50

As on 05 Mar 2021, the NAV of acceler8 portfolio is 113.75 (+13.2%) and has outperformed the benchmark Nifty50.

With the portfolio being only three weeks old, I am not mentioning the XIRR and other parameters.

May the good times continue.

Section C – Cura8

Handpicked #goodreads

Why so many data science project fail to deliver

Good and bad are two sides of the same coin. The same is with Data too. While good data provides actionable insights and powers business value, bad data can lead to mis-interpretation and business losses. (MIT Sloan)

Building and scaling one of the world’s fastest-growing mobile banks

Growth happens when a right product launched at the right time and backed by a loyal customer base who will spread a positive word of mouth. The mantra to growth is a satisfied customer. (McKinsey)

Why transformation is a buzzword at Piramal

Billionaire industrialist Ajay Piramal is in makeover mode. He wants to remold his conglomerate into a well-diversified NBFC and a pharma firm, which would both be giants in their respective spaces. (Fortune)

Hope you found this post useful and enjoyed reading it.

Compound your learnings, Accelerate your earnings

Happy investing !!!

PS : If you liked this issue, please spread the good word. It will mean a world to me. If you have any feedback or suggestions, do reach out at superinvestorclub@gmail.com.

PPS : acceler8 is now on Facebook. Do like the page and share with your friends.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr