Issue 009, 25 Apr 2021

Section A – Illumin8

Contrarian Investing

The conventional view serves to protect us from the painful job of thinking.

—John Kenneth Galbraith

In the savannahs of Africa, we observe a common sight: In a herd of deer, when one member of the herd starts running then usually you can find the rest of the pack to also start running. Replace “Deer” with “investor” and the “savannahs” with “stock markets” and the sentence will still make sense.

Doing what everyone is doing in the market and expecting to perform exceedingly better than your fellow investors is certainly wishful thinking. Invert this. Now if we are to do exactly opposite to what everyone is doing in the market then would it guarantee you success?

In simple words: Does betting against the crowd guarantee you profits and success in the market?

Ponder.

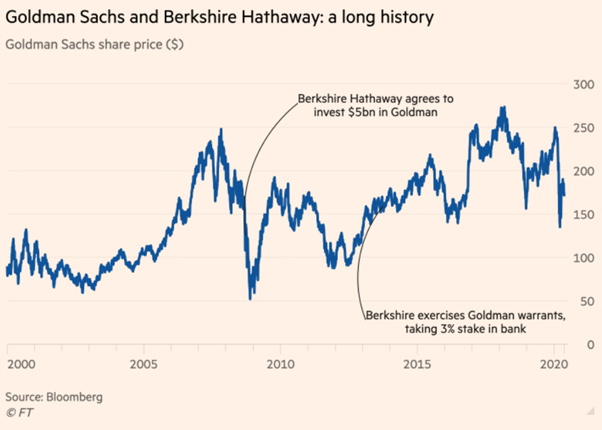

The answer is complex. Big money is made when you take a position which is against popular opinion. There are numerous examples but one which is easily quotable is the billions Warren Buffet made by investing in Goldman Sachs during the peak of financial crisis in 2008.

Buffett invested 5 billion USD earned him a tidy profit and cost Goldman Sachs 500 million USD in dividends only till 2013 when the two sides agreed to a new deal.

Basically, by taking a contrarian* position, Buffett made a killing in the stock market.

What is Contrarian Investing ?

The oxford dictionary defines contrarian as “a person who opposes or rejects popular opinion, especially in financial markets”.

My favorite analogy for describing contrarian investing is that of a “knife”. A surgeon uses the knife to cut open the body to save human lives where as the same knife in the hands of a common man / criminal may take away lives.

For those of you who were active in the market in early 2000 till 2008 will remember that the real estate stocks were absolutely flying. Stocks like DLF, Unitech were soaring and then the financial crisis happened and all stocks including the realty index crashed.

Around that period, I vividly remember that I read numerous stories from various research analysts that owning a home is every middle-class man’s dream and hence it was a matter of time before “normalcy” returned to the realty sector. Its more than 12 years now and the wait continues…

Superinvestors on Contrarian Investing

While lot of successful investors have spoken about contrarian investing, here are a few handpicked ones:

David Dreman

The success of contrarian strategies requires you at times to go against gut reactions, the prevailing beliefs in the marketplace, and the experts you respect

It’s very hard to go against the crowd. Even if you’ve done it most of your life, it still jolts you

Favored stocks under perform the market, while out-of-favor companies outperform the market, but the reappraisal often happens slowly, even glacially

John Neff

It’s not always easy to do what’s not popular, but that’s where you make your money. Buy stocks that look bad to less careful investors and hang on until their real value is recognized

I’ve never bought a stock unless, in my view, it was on sale

Buy on the cannons and sell on the trumpets

Michael Steinhardt

The hardest thing over the years has been having the courage to go against the dominant wisdom of the time, to have a view that is at variance with the present consensus and bet that view. Courage and the ability to withstand pain are required.

Time and again, in every market cycle I have witnessed, the extremes of emotion always appear, even among experienced investors. When the world wants to buy only [bonds], you can almost close your eyes and [buy] stocks.

In order to win as a contrarian, you need the right timing and you have to put on a position in the appropriate size. If you do it too small, it’s not meaningful. If you do it too big, you can get wiped out if your timing is slightly off. The process requires courage, commitment and an understanding of your own psychology.

There are many ways contrarian investing strategy can be implemented. Here is an interesting one:

Loser portfolio

Let us say you are a long-term investor with an investing horizon of 5 years, and I gave you a choice to buy 25 stocks that have gone up the most in the previous year OR buy 25 stocks that have gone down the most in the previous year.

Which would you prefer? Make up your mind and the rationale. Now let us say your friend was with you when I made this offer, and he is an investor with a horizon of 1 year. Your friend is saying he will also go with your choice. What would you do ?

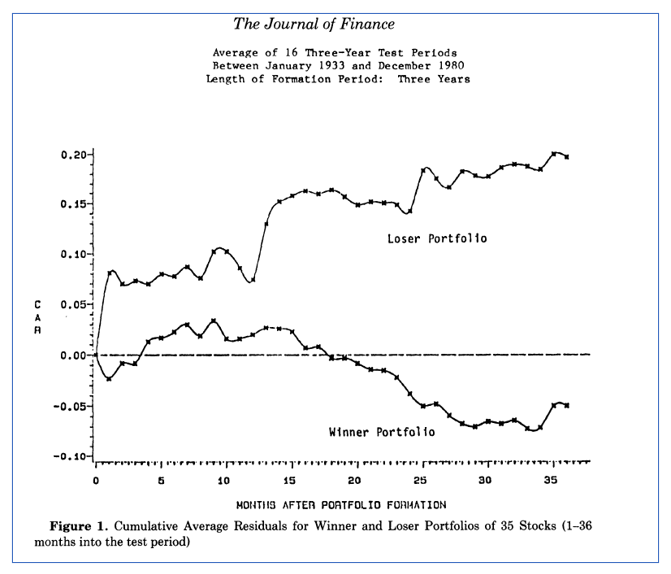

Well in 1985, DeBont and Thaler published a paper in the Journal of Finance “Does the Stock market overreact” which had a startling conclusion.

They constructed a winner portfolio, composed of the 35 stocks which had gone up the most over the prior year, and a loser portfolio that included the 35 stocks which had gone down the most over the prior year, each year from 1933 to 1978.

They examined returns on these portfolios for the sixty months following the creation of the portfolio and the results are summarized in the figure below:

Findings

An investor who bought the 35 biggest losers over the previous year and held for five years would have generated a cumulative abnormal return of approximately 30% over the market and about 40% relative to an investor who bought the winner portfolio.

The authors concluded that

“Consistent with the predictions of the overreaction hypothesis, portfolios of prior “losers” are found to outperform prior “winners”. Thirty six months after the portfolio formation, the losing stocks have earned about 25% more than the winners, even though the latter are significantly more risky”

There was a subsequent study done by Jegadeesh and Titman compared the winner and loser portfolio’s by the investing horizon or the number of months the portfolio was held. Another interesting set of results came out

Winner portfolio outperforms the loser portfolio in the first 12 months.

After 12 months, the loser portfolio starts gaining ground on winning stocks.

Final thoughts

Just like herd mentality and the animal instincts of the deer helps it run away from danger and survive in the jungles of Africa, the same instincts help the investor to survive in the financial jungle.

Running away from real estate stocks that were alarmingly high on debt, poor on corporate governance, low on transparency and bleeding financially was absolutely necessary for the common investor to survive.

There is one side to the stock market; and it is not the bull side or the bear side, but the right side.

-Edwin Lefevre in Reminiscence of a Stock Operator

While large profits are a possibility, one should go contrarian only when we are sure that the market has overreacted and are basing our decisions based on facts and not emotions. Else it is akin to us simply refusing to wear a mask while stepping out of our homes during these COVID-19 times just to be a contrarian. And you know how that will end.

Additional reading :

Does the Stock Market overreact? (The Journal of Finance, 1985)

Section B – acceler8

Portfolio Updates

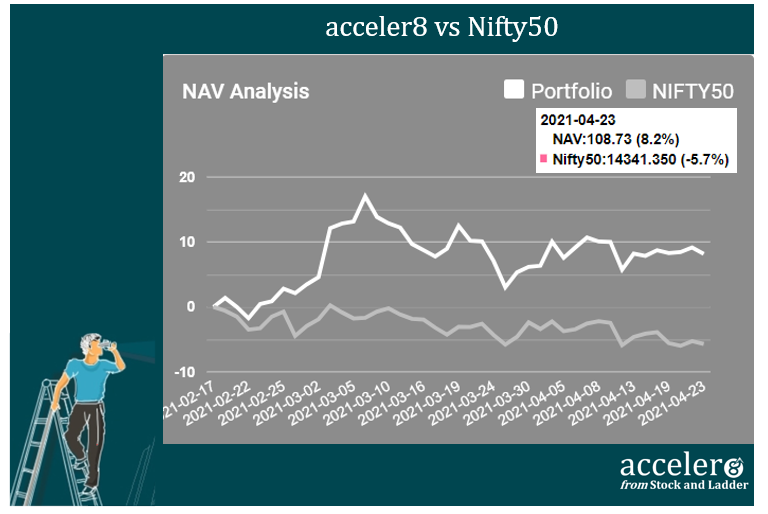

1) acceler8 portfolio NAV

As on 23 Apr 2021, the NAV of acceler8 portfolio is 108.73 (+8.2%) and has outperformed the benchmark Nifty50 by a significant margin (+13.9%).

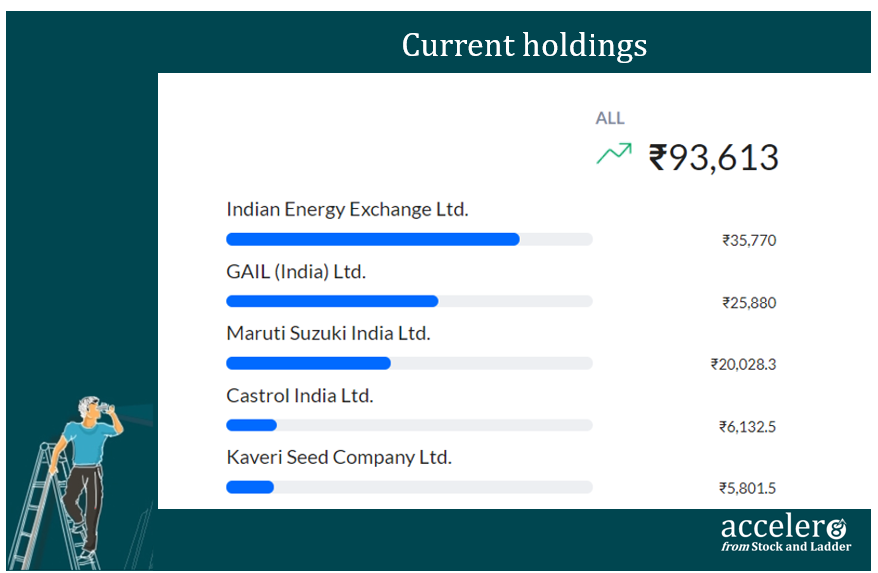

2) Current Position

As on 23 Apr, the consolidated value of current holdings is at ₹93 ,613 with 9% approximately in cash.

3) Market Musings

The past week was a sideways market in a backdrop of rising COVID cases. This created a sense of wait and watch. The situation is not going to change anytime soon.

NIFTY last week

There were couple of instances where I wanted to pull the trigger on Kaveri Seeds but held back as the stock is fundamentally strong with rising momentum. Another important point to consider is that the company had done a buyback at ₹ 700 per share last year.

Kaveri Seeds

Castrol – Few thoughts

Firstly all subscribers who had bought Castrol and still holding will receive a dividend of ₹ 3 per share. Apr 22 was the record date for dividend.

A quick word on Castrol India Ltd, a company I love.

The company has declared 43 dividends since 2000 and is a dividend investors dream. In the past 12 months, Castrol India Ltd. has declared an equity dividend amounting to ₹ 8.50 per share.

At the current share price of ₹ 122.65, this results in a dividend yield of 6.93%

I would urge you all to read the latest annual report. There are quite a few interesting developments with respect to the company.

a) It became the first company in the industry to have BS VI compliant products across all categories of automotive lubricant.

b) It has entered into a strategic collaboration with 3M India Limited for a range of quality vehicle care products for the automotive after-market.

c) Digital initiatives : The company has launched numerous digital initiatives. Castrol Fast Scan – a unique digital incentive platform for mechanics and retailer Castrol Fast Lane – an online portal for retailers

d) Advance mobility solutions: The Company is working on Advanced mobility solutions including improved lubricants for ICE technology, hybridization and biofuels.

Globally, Castrol has developed e-fluids, transmission coolants and greases for electric vehicles as the space continues to evolve. In India, the Company already has supply agreements for e-fluids with two of the leading electric vehicle OEMs.

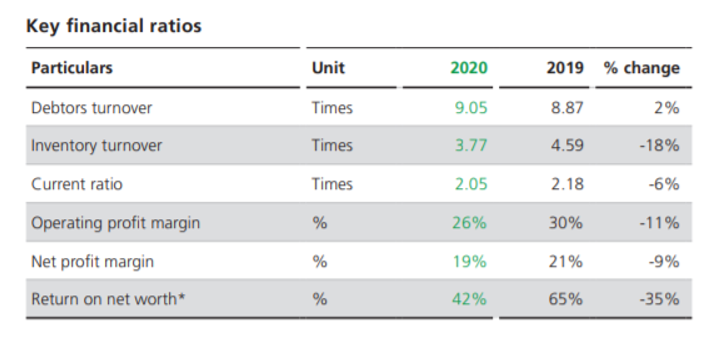

e) Financials : Please find below a quick snapshot of key financial ratios at an operating margin of 26%, NPM of 19% and a RONW of 42% – the company boasts of a rock solid balance sheet.

In case the readers are interested, I will do a detailed analysis on a later date.

Section C

Last week I had given an interview with FinMedium where I spoken about my investment journey, investing lessons learned during COVID period, Black Swan event proof portfolio.

The interview starts at 1.20 mts.

Be Safe, Take Care.

Keep learning, Keep rising.

PS : Based on some of your feedback, have penned few thoughts under “Market Musing”. Please let me know if you find it useful.

PPS : Please do recommend acceler8 to your friends and family as we need your support in these initial days.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr