Part 2 – Portfolio as on 16 Jul 2021

Further to the earlier post on the Launch of Momentum Buddha Portfolio, where we explained the concept of this strategy and the backtested results, in this post we will cover:

How will Momentum Buddha Portfolio help?

Portfolio ground rules

Actual portfolio as of 16th July 2021.

Recap

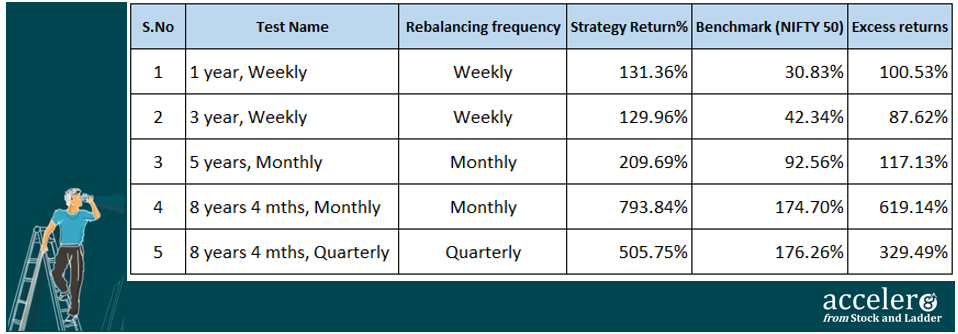

We back tested the strategy for different scenarios. Here is the quick summary of the backtested results:

Momentum Buddha Portfolio

I have over the years come up with many variations of my underlying strategy. While the #acceler8 portfolio is completely managed by me based on the underlying strategy, Momentum Buddha (aka Momentum 20-20) is a DIFFERENT VARIATION of this strategy with slightly different parameters and with a key difference- very minimal intervention from my side.

Please note that the role of equity analyst should be played by YOU:

– Whether to invest

– How much to invest

– Fundamental analysis

– Composition of the portfolio

& Much more.

Then why track Momentum Buddha?

How will Momentum Buddha Portfolio help?

With 5000+ companies listed on the BSE and 1600+ companies listed on the NSE, the task of narrowing down your investing universe is very essential.

This portfolio strategy is backed by sound investing principles and has been back tested for the Indian stock markets which should give you sufficient confidence on the underlying investing strategy.

Key benefits

Helps you create a high quality watchlist of 8 momentum stocks which can become the starting point of further research

Provides you with new stock ideas for strategic trading and momentum investing

Track the portfolio performance with weekly updates

A word of caution though. No strategy is perfect and produces winners only.

Do not expect 10 on 10

“In this business, if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.

– Peter Lynch

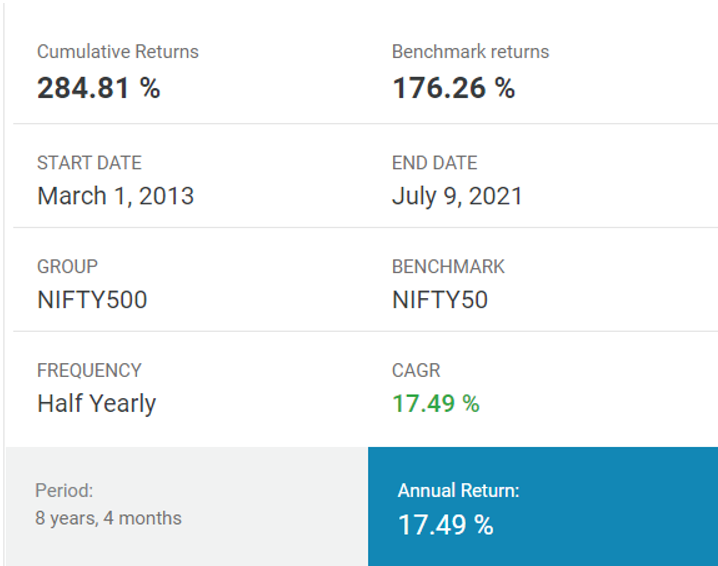

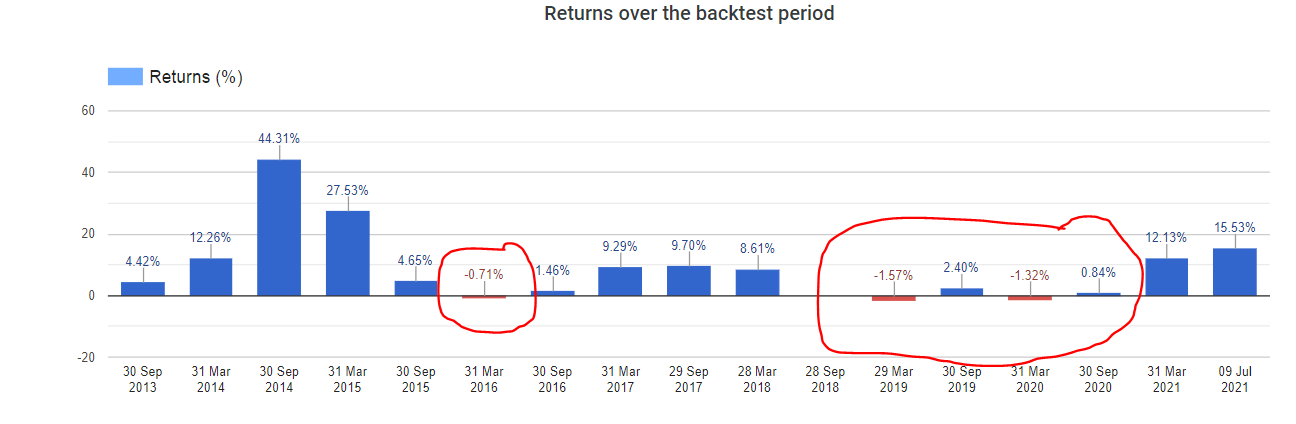

Here is a back-test done for 100 months for “half-yearly” rebalancing.

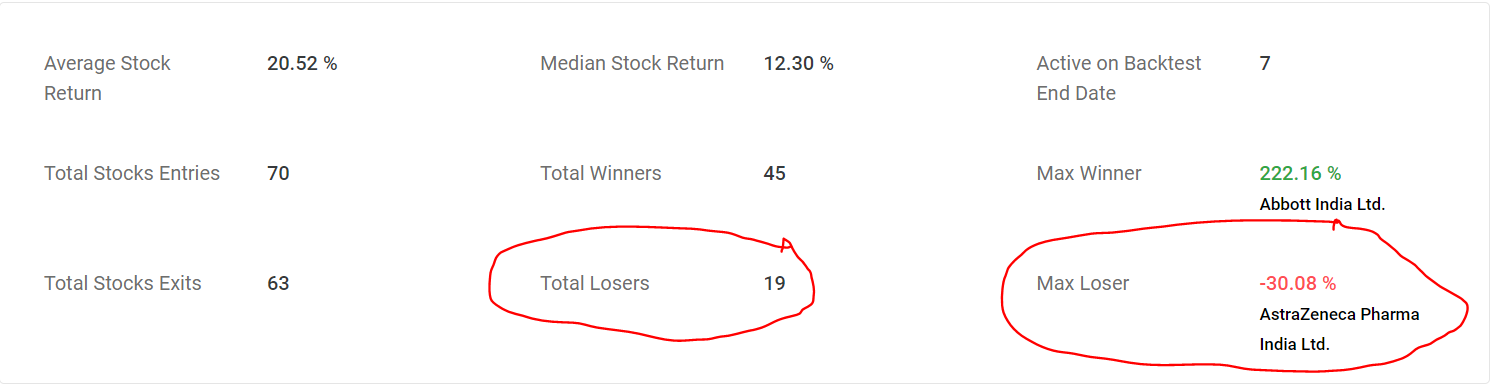

While prima-facie the back-test results were satisfactory. If you dig deeper there are few other data points:

There were 19 losers with Astra Zenca the biggest loser.

The below chart clearly shows that there were periods where the strategy has delivered negative returns.

Portfolio Ground Rules

A virtual portfolio with a corpus of ₹ 100000 will be created to track the performance of this strategy. Please note that no actual money is invested, and the allocations are done for performance tracking purposes only.

Key points

– The portfolio will be rebalanced every weekend based on Friday closing price

– In case, Friday is a Holiday then the closing price of the next working day is considered

– There will be a maximum of 8 stocks in the portfolio with approximately 8500 to 12500 invested per scrip.

– Brokerage, taxes, and any other charges are not considered while calculating the returns

– There have been instances where a stock enters and exits within the same week, or the inclusion / exclusion is border line. These will not be considered

– There will be no rationale given for Buy / Sell.

– Cash is not expected to deliver returns, however in real life you can put it in Liquid Bees or any other ultra-short-term instruments and generate some nominal returns.

– This is in no way a recommendation to buy / sell. You are advised to do your own homework or take professional help.

Current Portfolio (16 Jul 2021)

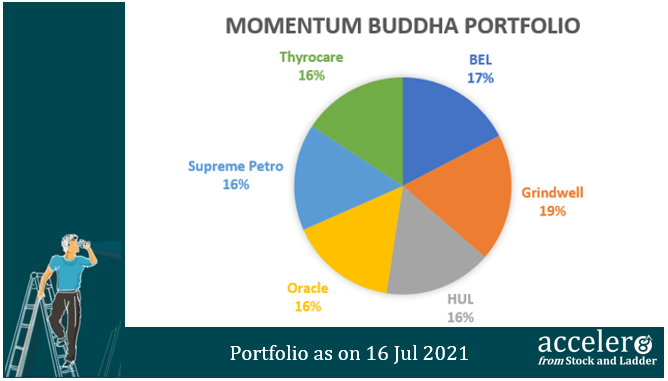

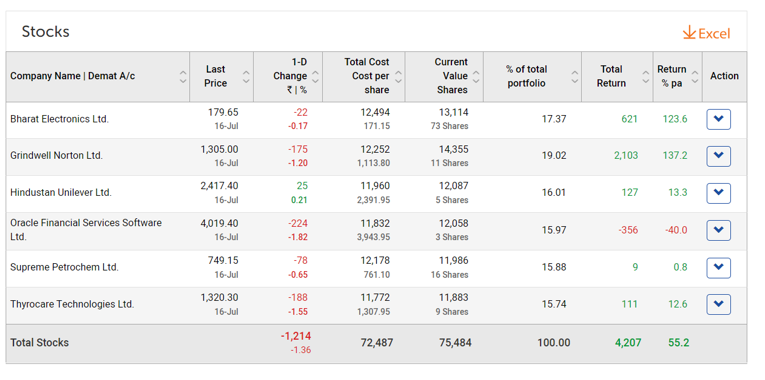

The portfolio was started on 9th May 2021 and you after all the entries / exits based on the strategy , please find the latest portfolio as on 16th July, 2021.

Portfolio details

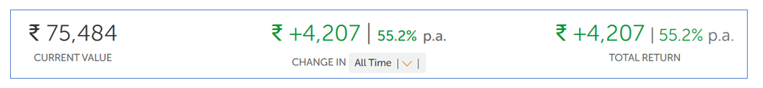

The portfolio was started on May 9, 2021 and two months later, here is the portfolio performance.

Going forward, you can track the performance and updates on this strategy- Momentum Buddha on our telegram channel.

For just 800 per year, you can track and follow this portfolio in the Stock and Ladder Telegram channel. A performing momentum smallcase will cost you upwards of 10k in today’s market. Here you get to follow the same for just 800 per month.

Additionally, along with the Momentum Buddha portfolio, you will get the following:

#llumin8- one piece of Investing infographic daily

#Quotes – 1 Quote or piece of wisdom daily

#Cura8- 8 handpicked investing content weekly (weekend)

Explainer Videos

Stock ideas, trivia’s and interesting facts from the Indian stock market

We will add more value as we go along. In case you wish to see sample content click here:

Subscribe

Telegram App

Alternatively, you can subscribe to the channel directly from your Telegram App. Please search for user : @stockandladder_bot.

Steps to follow

1) Launch the bot

2) Click “1 year Subscription, Rs 800/ 1 year”

3) Click Razor Pay Payment Gateway (make the payment through UPI / Internet Banking / Card etc.).

Looking forward to having you onboard,

Keep Learning, Keep Rising.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr