Issue 017, 20 Jun 2021

Section A – Illumin8

Zulu Investing Principles

“I fear not the man who has practiced 10000 kick once , but I fear the man who has practiced one kick 10000 times”

– Bruce lee

What is common among Benjamin Graham, Warren Buffett, Peter Lynch, John Neff, John Templeton, Jack Bogle, Martin Zweig ………….? Think again from a geographical perspective. Yes, you have guessed it right: they are all investors who made a mark in the Americas. And if you read the literature on investments, you are most likely to be reading on an American Superinvestor.

When I first heard the phrase “Zulu Principles” in Investing, I was extremely curious. Zulus are the largest ethnic community in South Africa and are known to be fearless warriors and was very eager to know what we could learn from the famous Zulu King Shaka and his tribe.

As it correctly turned out these principles were NON- American but neither was it from Africa.

Overview

The Zulu principles is the brainchild of Jim Slater, a British Fund manager. His early foray into investing was writing a column “The capitalist” in London’s Sunday Telegraph. A chartered accountant by profession he honed and fine-tuned his stock picking strategy during his stint as financial journalist which he later called as “The Zulu principles”.

Why Zulu Principles

If you wondered why he called it the “The Zulu Principles” then you have company. I too was wondering and I found the answer in his book .

In his own words:

the name of my first book on investment, taken from an idea I had after observing my wife as she read a four-page article in Reader’s Digest about Zulus. As a result, within a few minutes she knew more than I did about Zulus and it occurred to me that, if she had then borrowed all the available books on Zulus from the local library, she would have become the leading expert in Surrey.

If she had subsequently been invited to stay on a Zulu kraal (by an unsuspecting chief) and read about the history of Zulus at Johannesburg University for another six months, she would have become one of the leading experts in the world. The key point is that my wife would have applied a disproportionate effort to becoming relatively expert in a very narrow subject. She would have used a laser beam rather than a scattergun and her intellectual and other resources would, in that narrow context, have been used to maximum advantage.

So, it is with investment – concentrate on an approach, such as buying growth shares or asset situations, or concentrate on a particular sector. That way, you will become relatively expert in your chosen area. It is only necessary to be six inches taller than the other people in a room to see above everyone’s heads. Applying the Zulu Principle helps you grow those extra six inches.

Focus is indeed one of the key principles of #acceler8 and one I really believe in.

Elephants don’t Gallop

Slater goes on to say how “growth investing” is what individual investors should focus on. Growth at Reasonable Price (GARP) was his preferred strategy and his hunting ground was in the small stocks space which are outside the focus of large institutional investors as they considered them to be too insignificant to make a difference to their portfolio. He believed that small cap stocks had more room to grow than large blue chip stocks and he put it eloquently as “Elephants don’t gallop”.

He quotes Warren Buffett to say that some companies are too small to move the needle for their fund performance that Big players ignore

Warren Buffett, probably the world’s most successful investor, sums up of the institutions’ problems well: ‘A fat wallet is the enemy of superior investment results. Though there are as many good businesses as ever, it is useless for us to make purchases that are inconsequential in relation to [our] capital. We now consider a security for purchase only if we believe we can deploy at least $100m in it. Given that minimum [our] investment universe has shrunk dramatically.’

In other words, there are some companies that are too small for the institutions to bother about investing even if they believe that the shares will outperform the market by a wide margin.

Also, the institutional investors have additional restrictions like the maximum amount they can invest in a security. Obviously your fifth best idea is going to be better than your 15th or 50th . An individual can stop at his best ideas.

Zulu Principles

Jim Slater outlined his principles in his book “The Zulu Principle- Making Extraordinary Profits from Ordinary Shares” and further fine-tuned his principles in the revised edition “ Beyond the Zulu Principles- Extraordinary Profits from Growth Shares”

(Note : For a collection of excellent books on investing :

check out the recommended books)

Slater divides his 11 Zulu Principles into categories based on their relative importance:

A ) Mandatory

1. A PEG with a relatively low cut-off such as 0.75.

2. A prospective PER of not more than 20. The preferred range for PERs is 10-20 with forecast growth rates of 15-30%.

3. Strong cash flow per share more than EPS, both for the last reported year and for the five-year average.

4. Positive cash or gearing of below 50%, other than in exceptional circumstances (such as massive cash flow per share or impending sales of major assets).

5. High relative strength for the previous twelve months.

6. A competitive advantage, which will usually be evidenced by a high ROCE

and good operating margins.

7. No selling of shares by a cluster of directors.

B) Highly desirable

1. Accelerating EPS, especially if it is a result of activities being cloned.

2. A cluster of directors buying shares.

3. A small market capitalization in the £30m-250m range.

4. A dividend yield.

C) Bonus

1. A low PSR.

2. Something new- New product , New CEO or some trigger / catalyst

Back testing Zulu screen

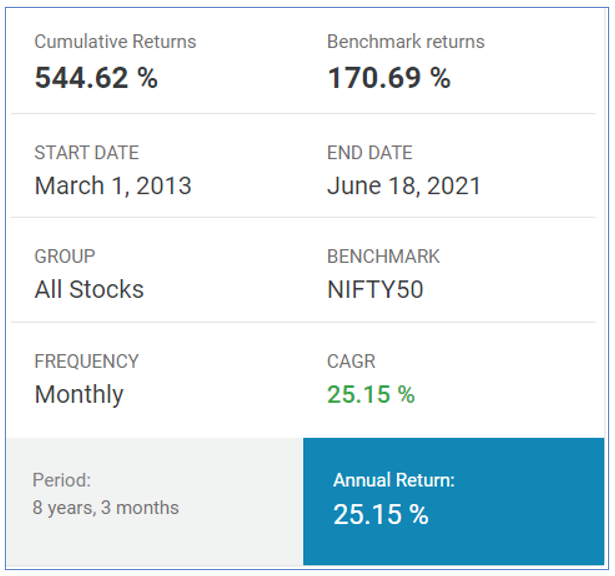

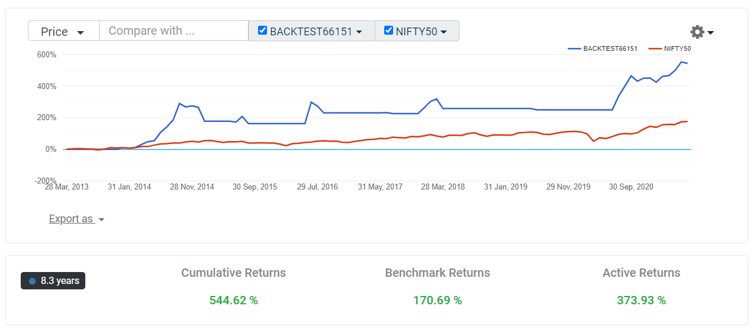

As with every strategy, Jim Slater’s Zulu principles were used to create a stock screen. The screen was modified with Stock and ladder proprietary rules / criteria and back tested for the Indian markets.

Backtesting results

Stocks Active as of 18 Jun:

a) Kanchi Karpooram Ltd

b) Saksoft ltd

Final Thoughts

Any strategy which gives 25% CAGR over 12 years is worth digging deeper. Jim Slater’s Zulu principles are both common sense and focused investing combined with the wisdom drawn from various investors.

Just as Bruce Lee feared a person practicing a single kick 10000 times, a focused approach harnessing your circle of competence practiced over a long period of time should produce encouraging results.

For that as Aristotle said “Knowing yourself is the beginning of wisdom” and Confucius put it even better “To know what you know and know what you do not know, is true knowledge”

Section B – acceler8

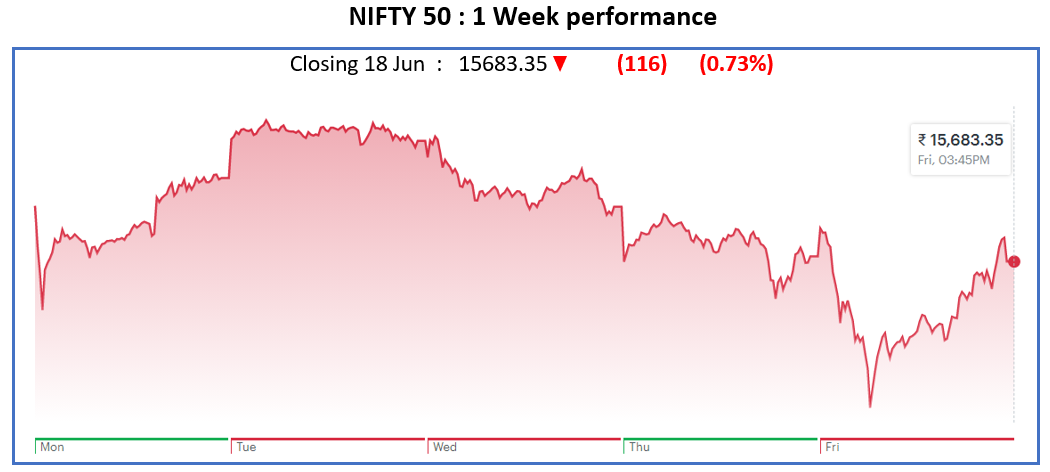

NIFTY50 Last Week

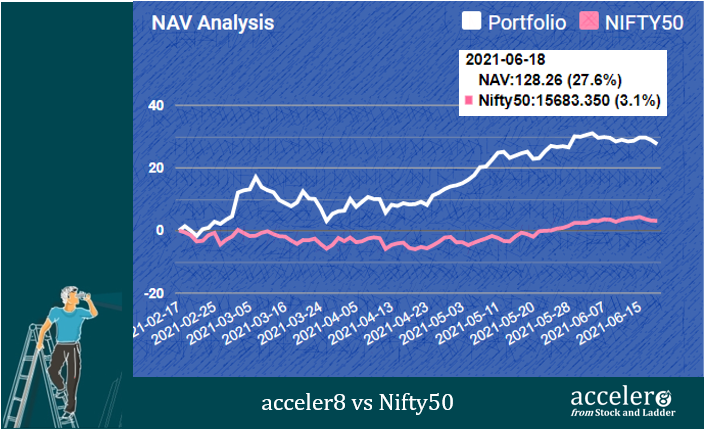

acceler8 Portfolio NAV

As on 18 Jun 2021, the NAV of acceler8 portfolio is 128.26 (+27.6%) and has outperformed the benchmark Nifty50 by a significant margin since inception (+24.5%).

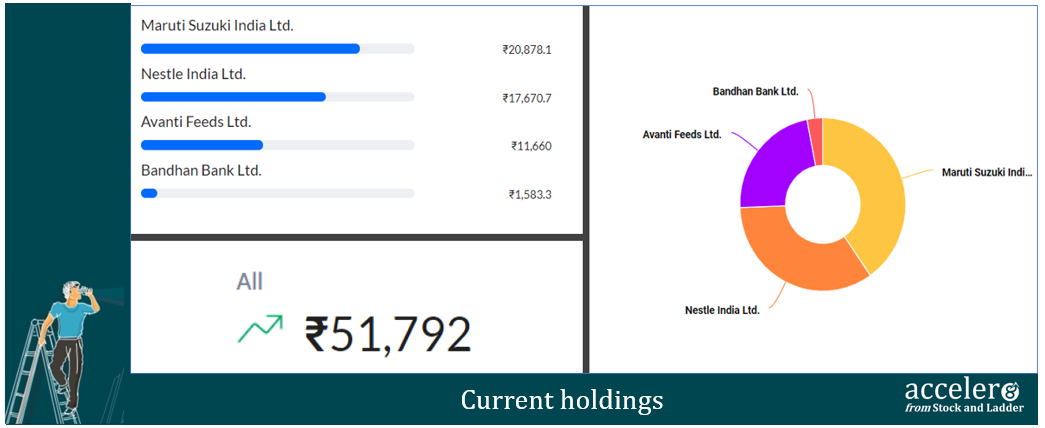

Current Position

As on 18 Jun, the consolidated value of current holdings is at ₹51,792 with around 52% in cash.

Market Musings

This week saw the return of IPO’s : Sona Comstar, Shyam Metalics & Energy , KIMS. Also the gradual unlocking post COVID phase 2 is slowly revving up the growth engines. The economy which was also in ICU unlike the stock market is also slowly revving up.

Further restrictions are bound to ease up and unless something drastic happens, the economy will slowly limp pack to normalcy.

Just like the hostile conditions the Indian cricket team is facing in England in the World Test cricket Championship with rains, cold weather, extreme swing bowling an Indian investor too is facing a tricky condition with overheated markets, falling oil prices, slow economic recovery.

To be the best you need to beat the best. Virat Kohli & Co cannot pick their battles if they want to be the Inaugural Test Cricket Champions but we as individual investor can wait and choose our own battle. This battle is not to beat anyone else but just reach your investing goals.

Let us see what Mr. Market throws up next week. One thing, we will be ready to act if the pitch is in our zone. We will wait for the fat pitch and not swing at anything.

Section C – Stock Screeners

Momentum 20-20 Screener

Momentum 20-20 portfolio had 4 stocks :

1. Grindwell Norton

2. Tata Elxsi

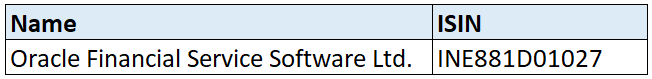

3. Oracle Financial Service Software Ltd.

4. Supreme Petrochem Ltd.

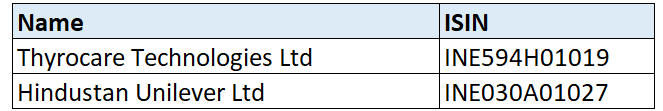

Rebalancing for this week

2 Entries and 1 Exit

Entries

Exit

Revised Portfolio

1. Grindwell Norton

2. Tata Elxsi

3. Supreme Petrochem Ltd

4. Thyrocare Technologies Ltd

5. Hindustan Unilever Ltd

Until next week, stay safe and take care.

Happy Investing!

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr