Issue 023, 01 Aug 2021

Section A – illumin8

Lessons from Buffett’s 1995 Shareholder Letter

“A great business at a fair price is superior to a fair business at a great price.”

-Charlie Munger

Is Mona lisa smiling or she is serious? It depends. According to research Professor Margaret Livingstone of Harvard University said that Mona Lisa’s smile disappears when observed with direct vision, known as foveal. Because of the way the human eye processes visual information, it is less suited to pick up shadows directly; however, peripheral vision can pick up shadows well.

I read somewhere that some works of art and literature are classics for a reason. Every reader based on his or her knowledge and experiences find something unique / great / something to learn from these classics.

Like many in the investing world, I am a big fan of Buffett’s annual shareholder letters. For me they are nothing short of masterpieces to be studied, analyzed much like Leonardo Da Vinci’s Mona Lisa. I believe there is so much investing packed in these annual letters that reading each letter will actually help you become a better investor than reading 10 good investing books

I wrote about the 2020 letter here and the 2018 letter here.

This edition we will take a close look at the 1995 Shareholder letter. Here are a few key learnings from 1995 Annual letter.

Lesson 1 – Follow a Double-Barrelled approach in investing

Our favorite acquisition is the negotiated transaction that allows us to purchase 100% of such a business at a fair price. But we are almost as happy when the stock market offers us the chance to buy a modest percentage of an outstanding business at a pro-rata price well below what it would take to buy 100%.

This double-barrelled approach purchases of entire businesses through negotiation or purchases of part-interests through the stock market gives us an important advantage over capital-allocatowho stick to a single course.

Woody Allen once explained why eclecticism works: “The real advantage of being bisexual is that it doubles your chances for a date on Saturday night.”

The Woody Allen thinking can be applied in our investing. One should not be a one-trick pony.

I will go to the extent that this letter was the one of the key inspirations of our investing strategy. Acceler8 + Accumul8 = Double barrel investing

Read more about our strategy here.

Lesson 2 – Look out for businesses with moats and run by outstanding managers

Charlie Munger, Berkshire’s Vice Chairman and my partner, and I want to build a collection of companies both wholly-and partly-owned that have excellent economic characteristics and that are run by outstanding managers.

In 1995 Moat and Management were still relatively hot topics for investors. Today you find Moat, Honest management being parroted by every long-term investor that many times I now tend to avoid talking about this.

While moat and management do play a crucial role in helping a business shape its destiny, I prefer to leave this topic for another day.

Meanwhile here is Warren Buffet on business moat

Lesson 3 – Do not trust financial projections of sellers

I never give them a glance, but instead keep in mind the story of the man with an ailing horse. Visiting the vet, he said: “Can you help me?

Sometimes my horse walks just fine and sometimes he limps.” The vet’s reply was pointed: “No problem when he’s walking fine, sell him.”

I am sure many of you would have read sometime in the papers when the market is bearish (March 2020- Covid outbreak) a few headlines like—IPO postponed, Government postpones stake sale. Ever thought why?

You guessed right Sellers in general and IPO issuers / Issuers of securities like to get maximum price for their issue. Merchant bankers specifically assure promoters they will help raise maximum money in the upper band of the IPO price range.

So as investors we need to take these financial projections and marketing talk with a large doze of salt.

As Buffett states in his annual letter:

“Too often things are seldom what they seem, skim milk masquerades as cream.”

In a similar note, an investor should not be lured by fancy figures on balance sheets or future projections of companies performance. One should always do enough research and analysis and evaluate a business holistically rather than any singular aspect that is seemingly promising.

Why Buffet and Munger don’t trust financial projections.

Lesson 4 – Passionate managers are essential to create profitable businesses

Many of our managers don’t have to work for a living, but simply go out and perform every day for the same reason that wealthy golfers stay on the tour: They love both doing what they do and doing it well.

No business can succeed with unhappy employees. Also, the reverse is equally true. Companies that tend to treat their employees will generally treat their customers well. This kind of rub on effect makes them treat their shareholders well.

This is a kind of virtuous circle which will be profitable for investors. I generally look out for lists like Top 10 companies to work for, Top 10 innovative companies etc. They are a fertile ground for good stock ideas.

Lesson 5 – What is a Good business

While the context was different in Buffett’s letter, the contents pretty much gives us a blueprint of what type of companies Buffett loves and would be profitable for investors.

• Demonstrated consistent earning power (future projections are of no interest to us, nor are “turnaround” situations),

• Businesses earning good returns on equity while employing little or no debt,

• Management in place (read as – competent management team),

• Simple businesses (if there’s lots of technology, we won’t understand it)

What do you do when a company fits the bill – go buy some shares of the company. And that is what he wants us to do- Buy companies which have demonstrated consistent earning power with good return on equity with a competent management with very little debt.

Like Leanardo Da Vinci’s Monalisa which offers a different perspective depending on the person viewing the drawing, Buffett annual letters provides different perspectives and learnings depending on the investor reading the same.

Also for the same investor who reads the same letter after a certain period, may end up forming a different perspective from an initial one.

These are my perspectives. What about yours ?

Section B – acceler8

Nifty50 Last Week

acceler8 Portfolio NAV

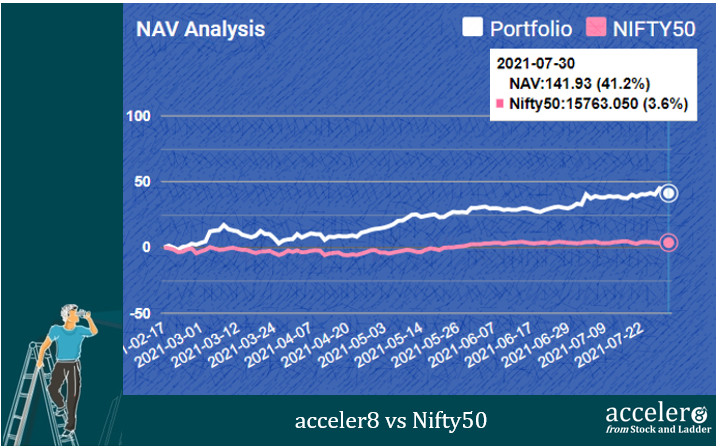

#acceler8 continues its strong performance and the portfolio has +37% outperformance against NIFTY 50.

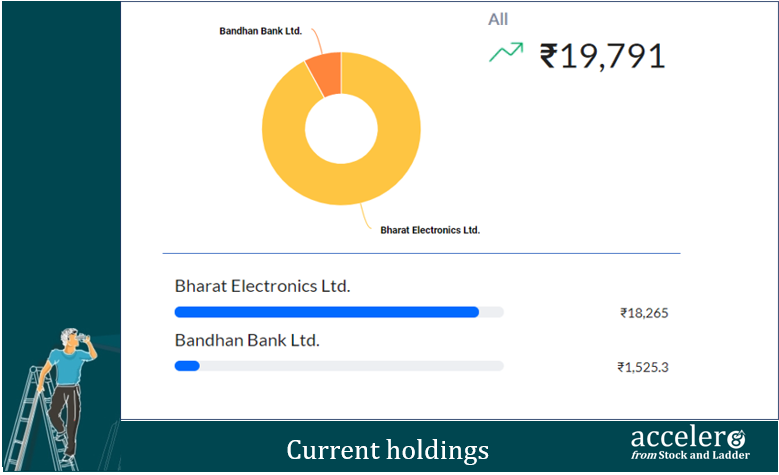

Current position

We are at 80% cash reflecting the high valuations.

Swing you bum

The stock market is a non-called strike game. You don’t have to swing at everything – you can wait for your pitch. The problem when you’re a money manager is that your fans keep yelling, “Swing you bum!”

-Warren Buffett

With Indian markets being one of the most expensive markets in the world, while I can understand there is a twitch to swing the bat, we will be responsible and wait for a good pitch.

Happy investing !

Until next week, take care and stay safe.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr