Long-Term Follow My Portfolio Service

If you don’t find a way to make money while you sleep, you will work until you die

–Warren Buffet

You work hard, endure lot of hardships to make money but have you paused to reflect on whether money works for you?

While there are myriad ways to invest money, numerous studies have confirmed that equities are the best possible option across centuries both globally and in India.

However, the irony is that not every investor is able to fully harness from equities due to various reasons ranging from lack of time, skill, capital among others.

At Stock and Ladder, we are passionate about the power of equities and we aspire to inspire as many as possible to create long-term wealth from equities through sensible common-sense investing.

To this end, we had launched acceler8 “Follow my Portfolio” service a while back, and I am really thankful to our wonderful subscribers for their support and encouragement. Incidentally, #acceler8 has had a great start, much more than what we could ever have dreamt off.

acceler8 has outperformed the benchmark NIFTY 50 by a wide margin, and the numbers speak for themselves.

While acceler8 caters to short term investing strategy with a horizon of less than a year (portfolio allocation of 15% to 25%), the core of your portfolio should be for long-term investing with a horizon greater than 1 yr., (ideal portfolio allocation 75% to 85%). This is where accumul8 Portfolio comes into picture.

accumul8 Follow My Portfolio Service

What is accumul8 Portfolio Strategy?

accumul8 is a “Follow my Portfolio” service focused on Long Term Investing with a horizon of at least 3-5 years.

accumul8 Portfolio aims to invest in Bluechips at Reasonable Price (BARP) and own a collection of outstanding companies a.k.a – “Build your Berkshire”, inspired by Punchcard Investing.

#accumul8 Portfolio = (A) Blue-chips At Reasonable Price + (B) Build Your Berkshire + (C) Punch card Investing

Let us look at each of these components

A. Blue-chips At Reasonable Price

“Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business whose earnings are virtually certain to be materially higher five, ten and twenty years from now”

– Warren Buffett 1996 Shareholder letter

The bedrock of the strategy aims to buy Bluechip stocks at a “rational” price and not aim for absolute bargains. There will be no Christmas card shopping in January.

Happy to pay a reasonable price and if the market gives an opportunity to add to existing positions at a lower prices the “More of the same can only be wonderful”.

B. Build Your Berkshire

Charlie Munger, Berkshire’s Vice Chairman and my partner, and I want to build a collection of companies both wholly-and partly-owned that have excellent economic characteristics and that are run by outstanding managers. Our favorite acquisition is the negotiated transaction that allows us to purchase 100% of such a business at a fair price. But we are almost as happy when the stock market offers us the chance to buy a modest percentage of an outstanding business at a pro-rata price well below what it would take to buy 100%.

– Warren Buffett, Shareholder letter 1995

At accumul8, our goal is to own a collection of outstanding companies in our Portfolio.

C. Investing Punch-card

“I always tell students in business school they’d be better off when they got out of business school to have a punch card with 20 punches on it. And every time they made an investment decision, they used up one of their punches, because they aren’t going to get 20 great ideas in their lifetime. They’re going to get five or three or seven, and you can get rich off five or three or seven. But what you can’t get rich doing is trying to get one every day.”

– Warren Buffett

Punchcard Investing is a philosophy that ensures that we think through each “Investing Punches” very carefully before we pull the trigger.

While there will surely be more than 20 punches in the accumul8 Portfolio wherever the lifetime punch is being used up, we will highlight the same for our subscribers.

Read more about accumul8 philosophy here.

accumul8 FAQ

Going forward we will have one issue every month and paying members who subscribe will get the following benefits.

Subscriber Benefits

– Access to accumul8 Portfolio

– Same day trade alert with actual screen shot

– A Detailed Profiling of 1 stock to help you create a quality watchlist

– Quarterly review with rebalancing if any

– Highlighting Punch-Card Stocks

– Access to Historical trades

You can read everything about the accumul8 portfolio : investing horizon, portfolio allocation, number of trades expected and much more in our detailed FAQ.

accumul8 – First Issue

The first trade has been done and the inaugural issue of the premium monthly newsletter is out. You can access the first issue here (the actual trade and the reasons I love the scrip).

Subscribe to accumul8 Now

The annual plan is priced at ₹ 9900 per year and for a limited time we are happy to offer a 20% discount on the annual plan at ₹ 7920.

We also have 3 year plan offered at almost 40% discount @ ₹ 18000. Do write to us at superinvestorclub@gmail.com in case you are interested in availing the same.

Please DO NOT choose monthly option as we believe this strategy to take effect needs to be practiced in years and not months.

Looking forward to having you onboard accumul8.

Happy Investing.

PS : About Me

I am an Ex-banker, blogger and Investor who is keenly following, studying and investing in the Indian markets for the last 23 years ever since I passed out of MBA in 1998.

Incidentally my blog was named as the top 150 investing blogs on the planet by the famous publication “The Acquirers Multiple” and also have been called out as one of the top Twitter handle to follow in the Indian investing space. My works have been regularly published on Morningstar, FinMedium and other investing publications.

Top 150 Investing Blog

Top FinTWIT India Investing

PPS : acceler8 Portfolio

acceler8 Performance Since Inception

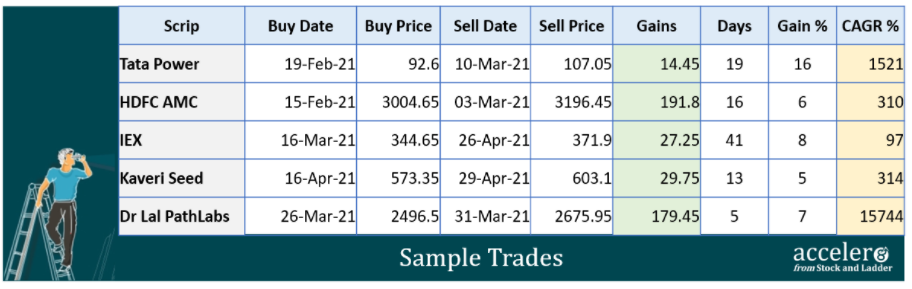

acceler8 Sample Trades

Subscribe to acceler8 Portfolio here

In case you wish to subscribe to acceler8, click here.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr