Issue 015, 06 Jun 2021

Section A – Illumin8

Indian Investor and Index investing

When virtually all the luminaries of a particular industry recommend a particular product or service, it is but obvious that anybody connected with the Industry sits up and takes notice.

In the case of investing, one thing all the brightest minds have agreed on as a fine / must have product / investment every common man or individual investor should make is – Index funds.

Superinvestors on Index Funds

A minuscule 4 percent of funds produce market-beating after-tax results with a scant 0.6 percent (annual) margin of gain. The 96 percent of funds that fail to meet or beat the Vanguard 500 Index Fund lose by a wealth-destroying margin of 4.8 percent per annum.

David F. Swensen

Index funds eliminate the risks of individual stocks, market sectors, and manager selection. Only stock market risk remains.

John C. Bogle

To build a well-diversified portfolio, you might stash 70 percent of your stock portfolio into a Wilshire 5000-index fund and the remaining 30 percent in an international-index fund.

Paul Samuelson

Buffett on Index Investing

1) Advise for Individual Investors

Buffett always believed that for majority of the shareholders, the index fund is the best way to go.

“If you invested in a very low-cost index fund – where you don’t put the money in at one time, but average in over 10 years -you’ll do better than 90% of people who start investing at the same time.”

– Warren Buffett

2) Advice to Trustees on how to invest the money left for his wife.

“Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers”.

– Buffett 2013 shareholder letter

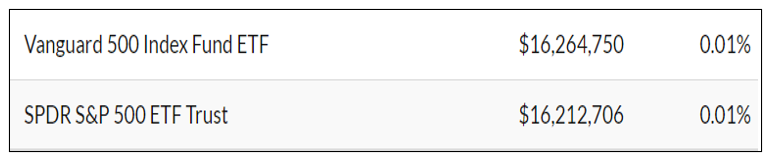

3) Latest Buffett holding Apr 2021

The records say that Buffett does have a small portion invested in Index funds

David Swensen, Paul Samuelson, Peter lynch, Jack Bogle and the father of all great investors—Warren Buffett says that Index investing is the way to go. It should be that way right. Yes and No.

Yes. At the crux, we are very emotional people and that reflects in our investing. Just as the deer starts running at the first sound of a predator, the individual investors as a group too display classic herd mentality. To add insult to injury they also exhibit a plethora of behavioral and emotional biases.

Herd mentality + emotions in Investing + behavioral biases creates a heady cocktail of wealth destructing behavior. And how does Index fund help? – it eliminates sector risk, stock selection risk , fund manager risk and behavioral risk; what is left is only market risk

Active Funds and Alpha

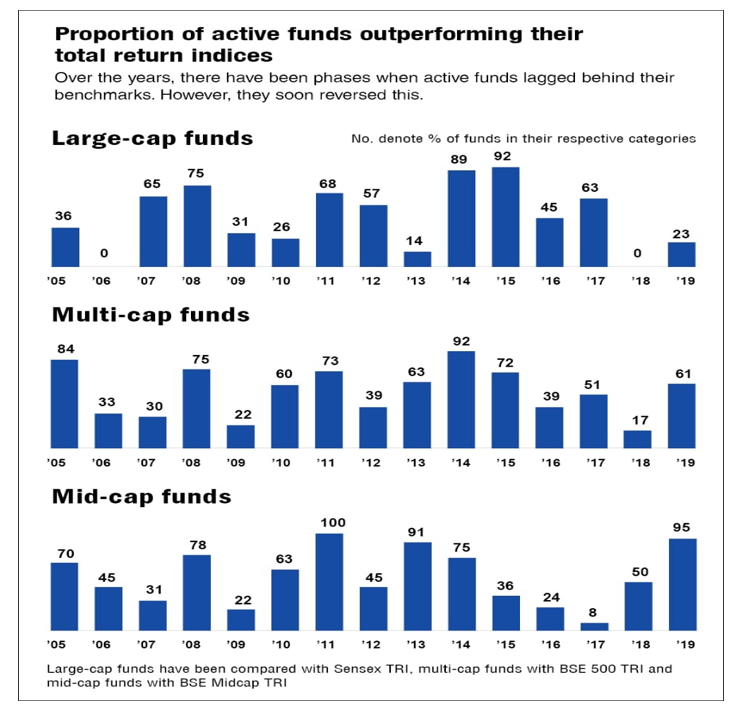

Value research published an interesting study some time back on how much percentage of fund managers / active funds actually beat their category benchmark across Large Cap, Mid-cap and Small cap funds.

The results were startling but not surprising at all.

Source: Value research Online

In Large cap space, there were 2, one-year periods where no active fund beat the benchmark. Also in 7 out of 15 years, less than 40% of the funds beat the Index. Please go back, re-read this paragraph again.

Did you ask yourself why professional money managers, whose only job is to pick stocks, fail to even beat the benchmark let alone outperform it.

If that is the fate of highly paid and incentivized full time professionals then what chance do time-poor individual investors who juggle between their time between their regular day job and their investing passion / hobby / part-time gig have to succeed?

While the answer is a Qualified “YES”, the reasons vary from long term orientation to brilliant stock picking (subscription to excellent stock advisory services also counts😊), but that is a topic we will revisit some other time.

However, my premise is slightly different- Yes, Index investing is a must for Indian individual investors too but for entirely different reasons than what the luminaries opined for the US market

Views on Index Investing

While the advice is very sound for an individual investor, my take is that the underlying reasons for which the suggestion was made ( with U.S. markets in mind) is quite different across markets (especially India).

1. Consistent outperformance by select active fund managers

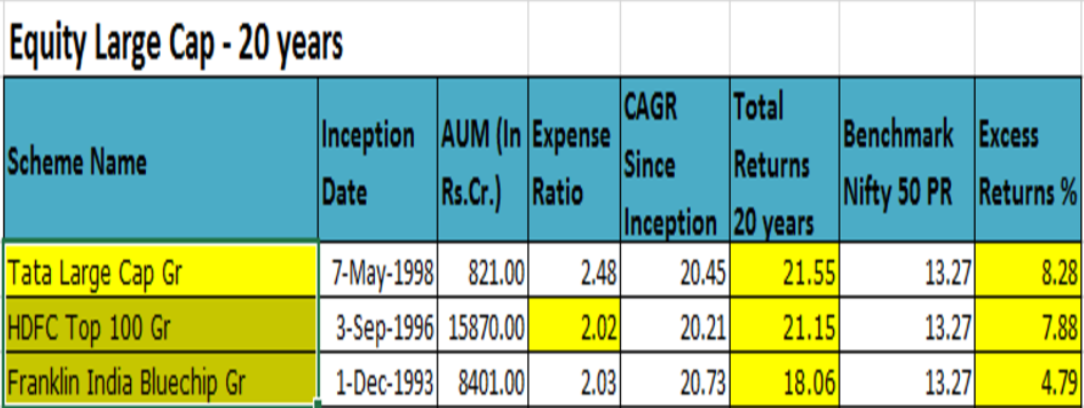

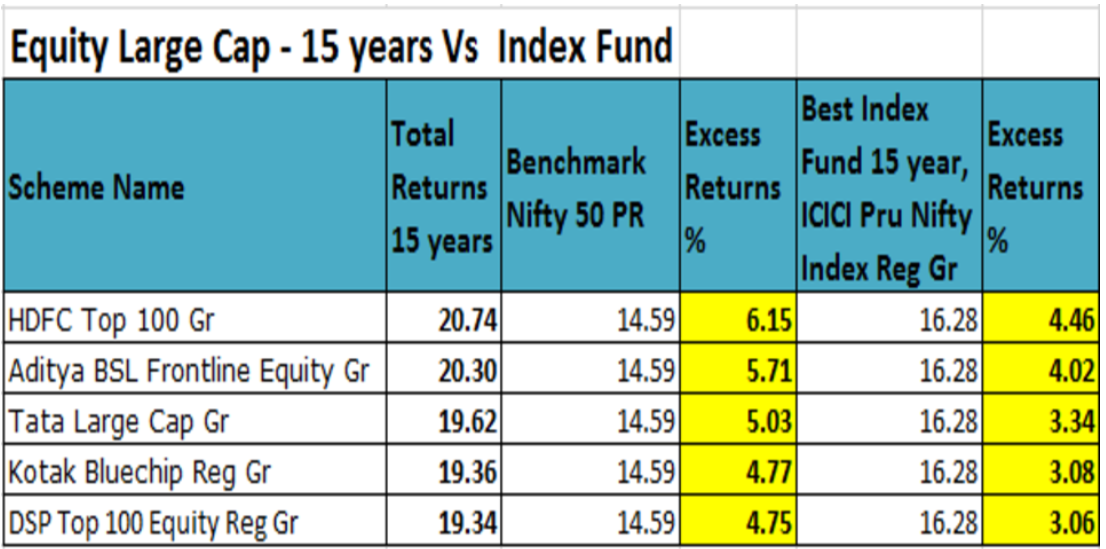

In India, it has been observed that few actively managed funds consistently outperform the benchmark. If not by the bucket loads, there are a few select funds which are beating the index consistently over 10-year, 15 year and 20-year periods.

I wrote about this a few years ago based on data from my friends at Morningstar.

“The best performing actively managed funds have not just outperformed the top index funds by a sizable margin and but also have done that over a very long time horizon of 15 to 20 years”

As you can see from the table above, the actively managed funds have beaten passive funds by a wide margin.

While the above study was done as of Dec 2018, I went back to Morningstar for data till Dec 2020 (When doing 20 year analysis we should not allow recency bias to creep in).

Around 44 funds have a track record more than 20 years.

2. Taxation rules are different.

In the US, the buying and selling by the fund manager attracts capital gains for the fund holders. A fund that is actively managed and has a high turnover ratio will be subject to capital gains during its holding period.

In India, this is not relevant as capital gains are applicable only when the unit holder actually redeems / switches out.

This is big because the whole impact of being passive is not reflected in taxes and cost.

3. Proportion of Fees

In US, the equities provide an average of 7 to 8 % returns and an index fund offers 1% savings in cost of funds which adds upto 14% of the fund returns.

In the case of Indian scenario, the equities tend to give 12-13% over a period of 10 years and a 1% on this translates to 7% and hence the effect of fees is not directly felt by the fund manager.

Final thoughts

As explained above, the Index Fund is definitely a must have in every investors portfolio. However, the rationale for investing is slightly different in the Indian context. In case you are looking for a good Index fund to invest, ICICI Pru Nifty Index fund (G) and UTI Nifty Index Fund (G) are good options. It is preferable to invest in SIP route.

Dalbar INC which publishes the popular study QAIB (Quantitative Analysis of Investor Behavior) opined in their latest edition of their report that there seems to be a perceivable change of investor behavior during the COVID-19 crisis. Surprisingly, only 11% of the individual investors moved out of equity. This is indeed heartening to see this behavior.

Section B – acceler8

Portfolio updates

The past week was pretty interesting with the country’s GDP contraction turning out to be better compared to that forecasted amid the pandemic impact. The hospitality sector got a boost this week with RBI’s decision to allocate Rs 15000 crores.

The defence related stocks also had a jump in the expectation of a major order from Navy.

NIFTY50 Last Week

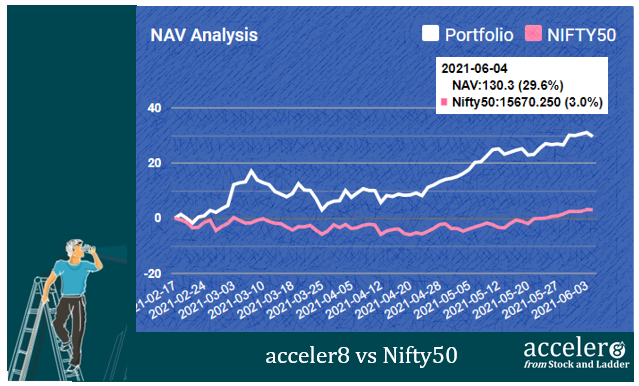

acceler8 portfolio NAV

As on 04 Jun 2021, the NAV of acceler8 portfolio is 130.30 (+29.6%) and has outperformed the benchmark Nifty50 by a significant margin (+26.6%).

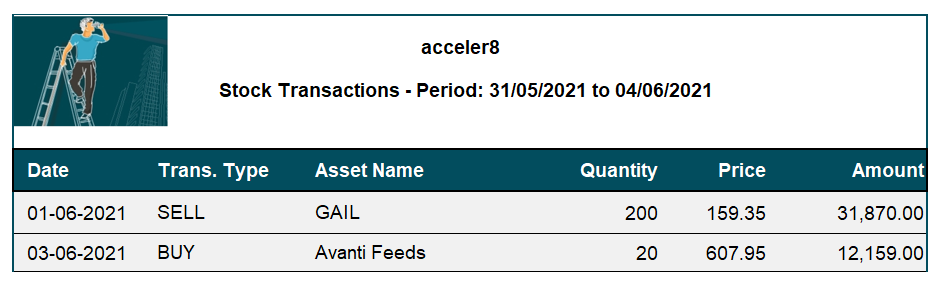

Trades done for the week

The following trades were done this week.

As GAIL reached a 3 month time horizon from the date of purchase and has given decent returns, we pulled the trigger on GAIL.

Why we like Avanti ?

There are multiple aspects I like about Avanti Seeds.

1) India’s position in global shrimp exports

2) Technical know how from Thai Union Group

3) Strong balance sheet, zero debt with higher returns

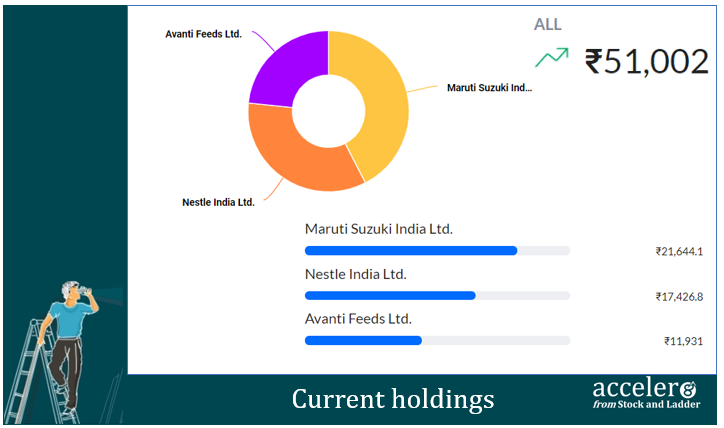

Current Position

As on 04 Jun, the consolidated value of current holdings is at ₹51,002 with around 52% in cash.

Section C – Stock Screeners

Momentum 20-20 Screener

Momentum 20-20 portfolio had two stocks :

1. Grindwell Norton

2. Tata Elxsi

Rebalancing for this Week

Entry : Colgate Palmolive India

Revised Portfolio

1. Grindwell Norton

2. Tata Elxsi

3. Colgate Palmolive India

Dear Subscriber,

Thank you for your support and response for accumul8. We will be releasing the next accumul8 stock profiling shortly. We would love to have all our acceler8 customers also subscribe to accumul8.

Below are a comprehensive list of plans. We request you to consider subscribing and enrich your journey of long term wealth creation with “accumul8 – Follow my Portfolio” information service.

accumul8 – 1 year subscription

accumul8 – 3 year subscription

accumul8 + acceler8 – 1 year subscription

accumul8 + acceler8 – 3 year subscription

Looking forward to having you onboard accumul8.

Happy Investing !!!

Stay Safe and Take Care.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr