My version of momentum investing

The premier market anomaly is momentum. Stocks with low returns over the past year tend to have low returns for the next few months, and stocks with high past returns tend to have high future returns

Eugene Fama & Kenneth French

When the fathers of modern portfolio theory and efficient market hypothesis call “momentum” as a market anomaly, you sit up and notice. You are curious and as you read more , you realize that this anomaly is actually a game changer.

Momentum as a phenomenon existed since the beginning of mankind, only that we discovered its influence in every sphere gradually.

Isaac Newton and his laws of motion introduced us to this concept:

An object in motion tends to stay in motion. What is at rest will remain at rest.

1) About Bluechip Momentum

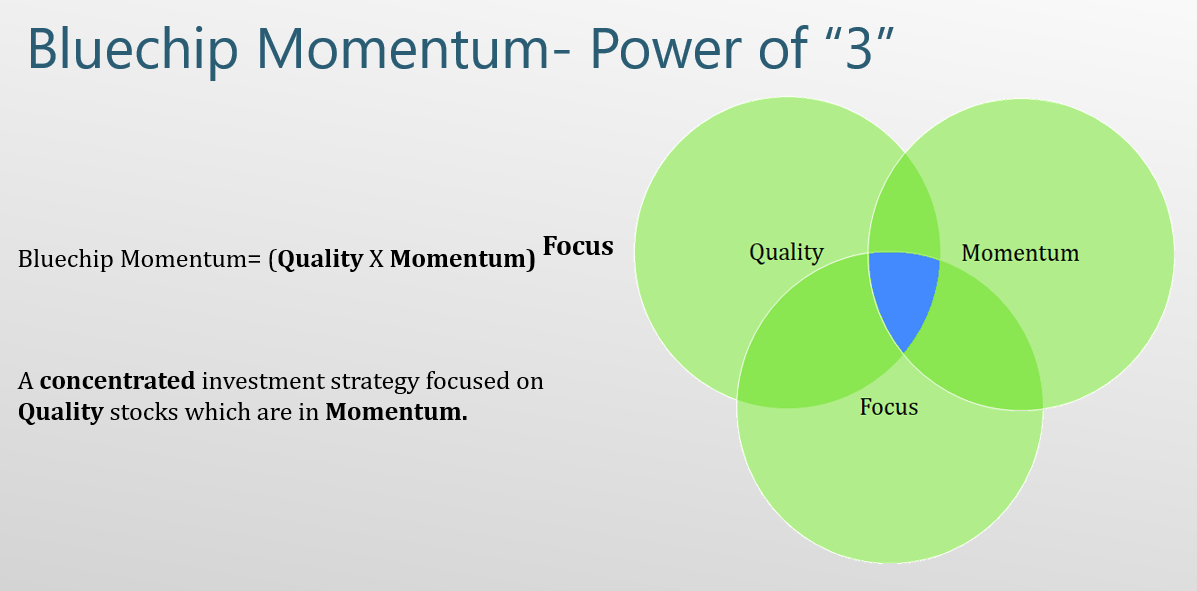

Bluechip Momentum Investing is a proprietary trading strategy based on momentum investing which I employ on a part of my portfolio.

What is Bluechip momentum investing?

A single strategy harnessing the combined power of three distinct investing strategies to generate investing ideas for short to medium term horizon.

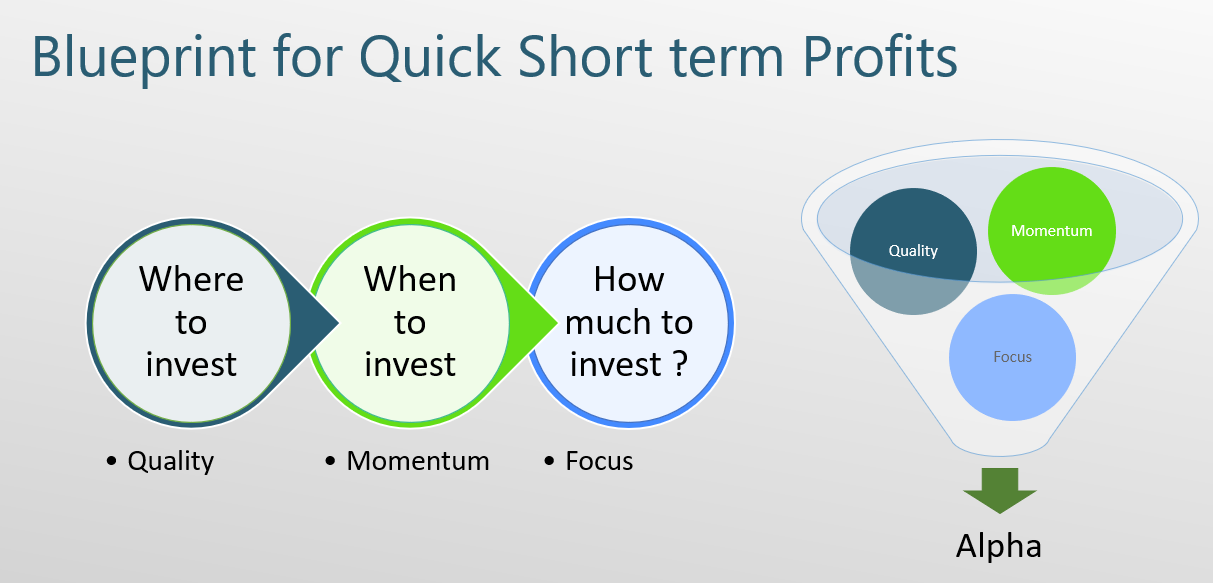

A blueprint for your short term investing – Answers to key questions: Where to invest in ? When to invest ? and How much to invest?

2) Why Quality investing?

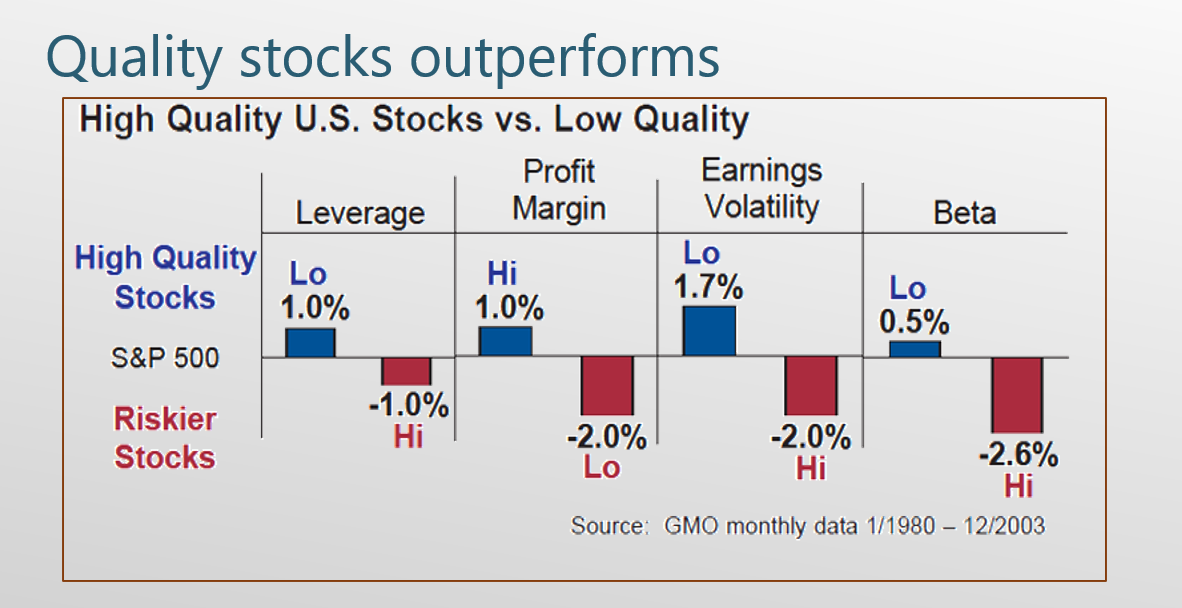

The momentum factor is applied on a basket of high quality stocks based on proprietary criteria to ensure the building blocks of the portfolio are inherently designed to deliver outperformance.

Multiple studies validate this.

GMO Study: Quality outperforms Junk

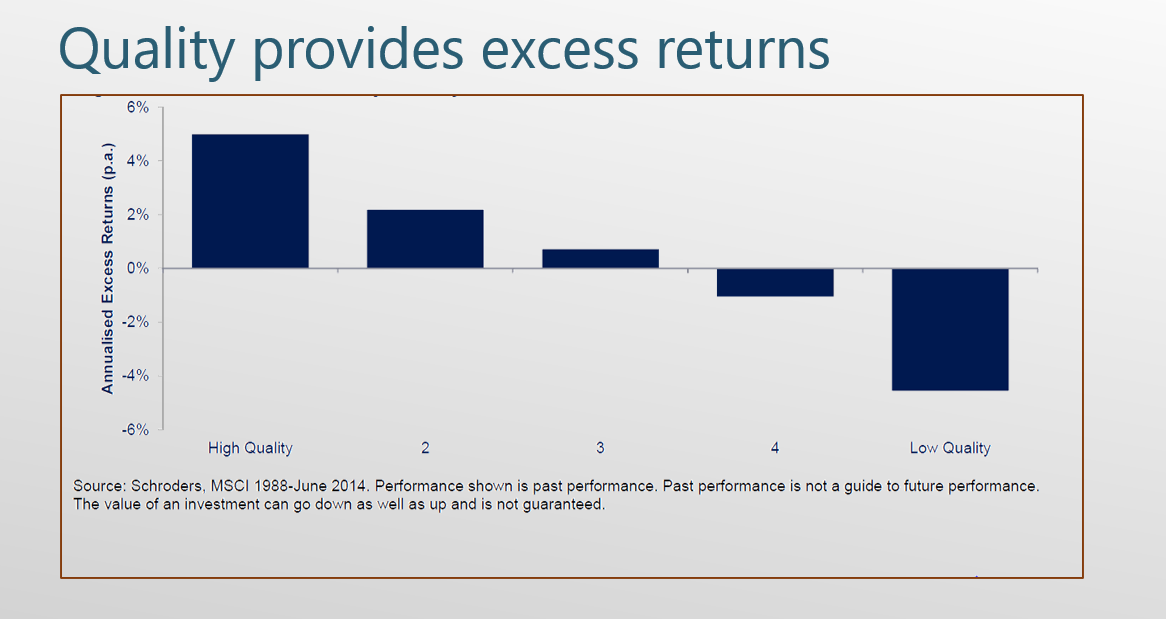

Schroders study : Quality delivers + 4% annualized excess return

Double Bonanza : Lower Risk & Higher Return

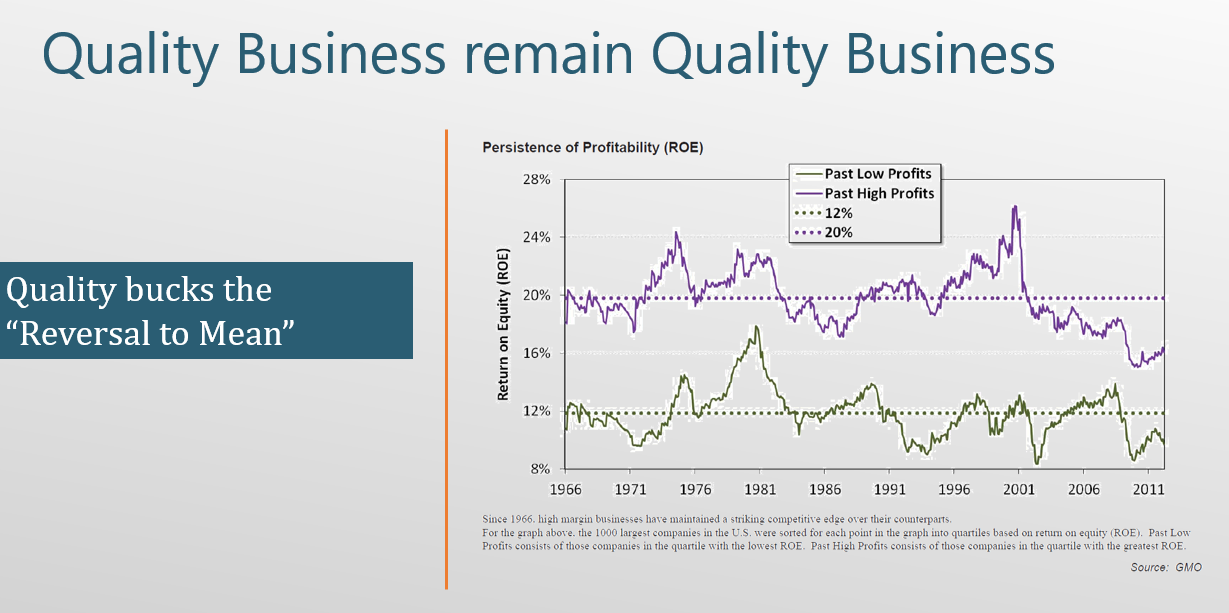

Persistence of Quality: Quality business likely to remain quality

Quality – Predictable & Stable Earnings

3) Why Momentum investing?

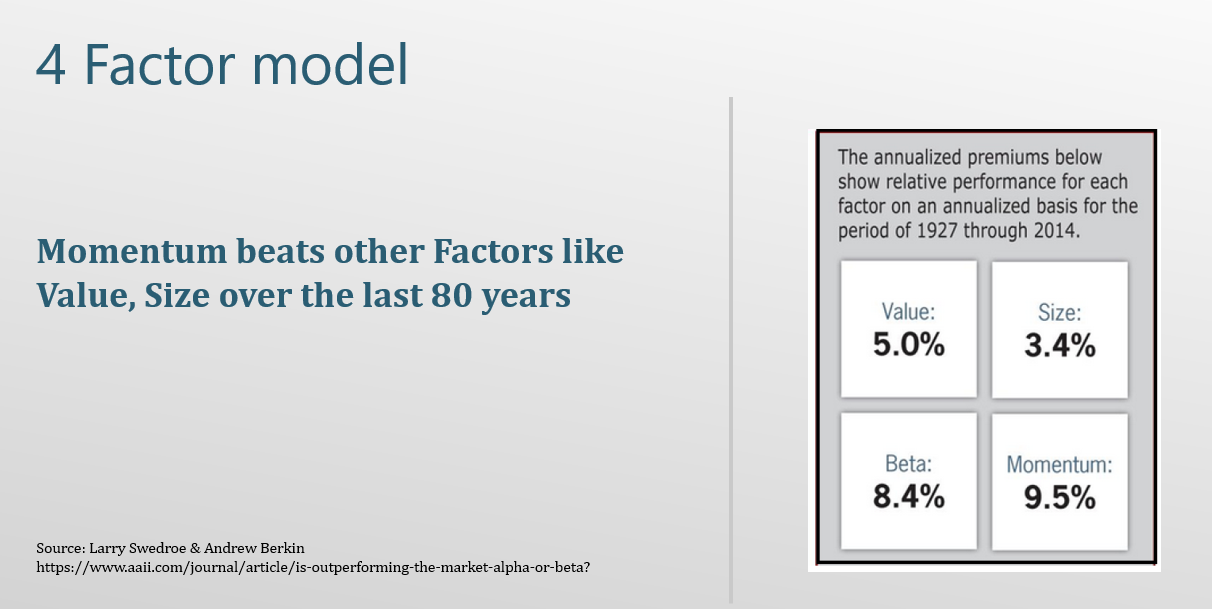

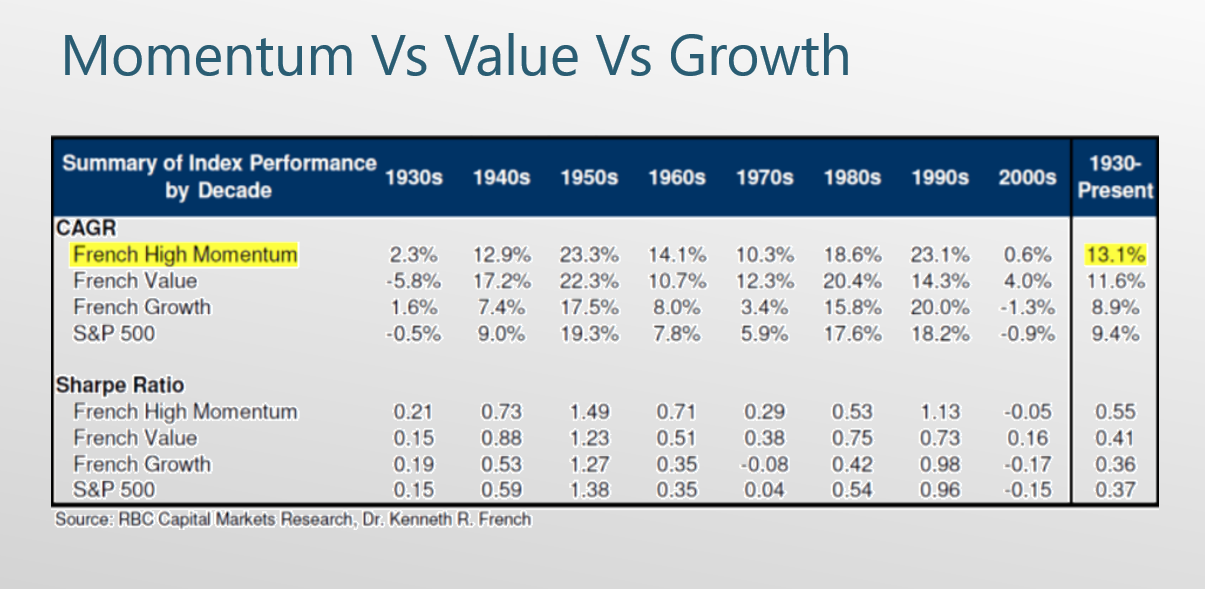

Numerous Studies have shown momentum investing outperforms

Another study, similar result: Outperformance of momentum strategy

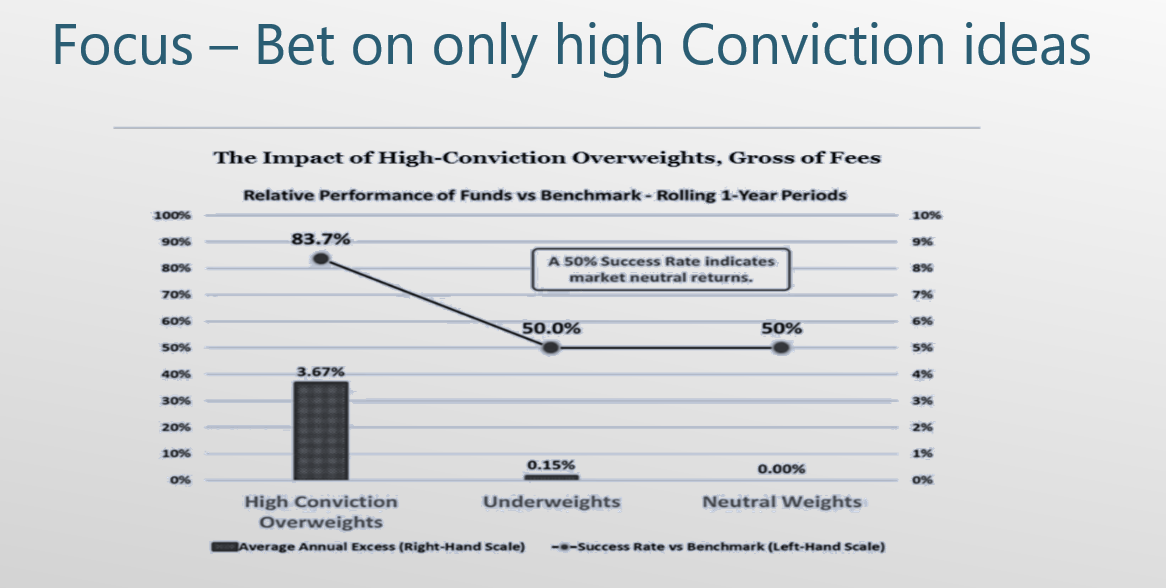

4) Why Focus investing ?

Concentrated positions on high conviction ideas builds wealth and diversification is meaningless beyond a point.

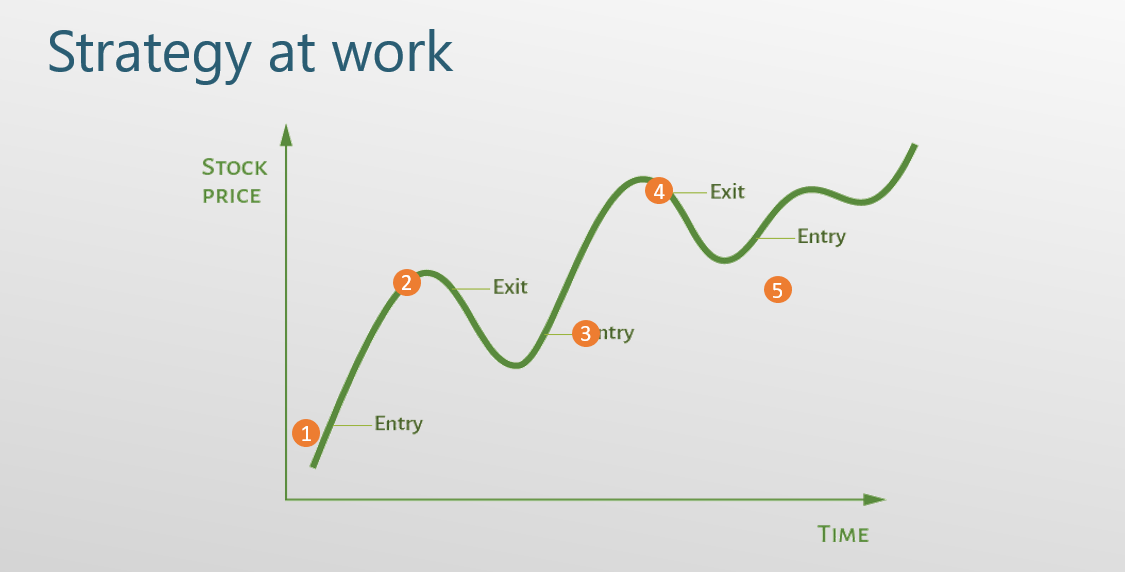

5) Implementing Bluechip Momentum

Multiple small wins

Rule based entry and exit

High Risk Strategy

Possibility of higher returns comes with Higher risk & higher trading costs

Final Words

In short, Bluechip momentum strategy tries to harness the power of three distinctly powerful strategies to generate ideas for accelerated profits.

Additional reading : Into the world of momentum investing

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr