Issue 018, 27 Jun 2021

Editors Note

Stock and Ladders Turned 5. Scroll down to the end of this post for details.

Section A – Illumin8

Customer is the King

The purpose of a business is to create and keep a customer

Peter Drucker

We regularly hear statements like “Customer is the King” or “Customer comes first!” emphasizing the significance of a satisfied customer for a business. On the face of it, the emphasis on customer satisfaction makes a lot of economic sense as the customer is the prime source and reason for the revenue, cash flow and profits of the business.

However, can an intangible parameter like “customer satisfaction” also be a viable indicator of a company’s future financial performance? Do businesses that deliver superior customer satisfaction also do relatively better in the stock market? Is an investing strategy of “creating a portfolio of stocks based on customer satisfaction” a profitable approach in the stock market ?

The answer to all the above questions seems to be a resounding YES! Academic research by Prof. Claes Fornell and others have found convincing empirical evidence that stock returns on customer satisfaction do beat the market, that too by taking on a lower risk.

Underlying theory

The basic premise is that

Customer satisfaction leads to increased customer loyalty resulting in higher spending per customer which then adds up to a long term stock appreciation.

There are plenty of academic studies that reaffirm this theory that customer satisfaction has immense economic effects. Some of the benefits include more repeat business, greater Cross-selling opportunities, fewer customer complaints and lower warranty / service costs among others.

Customer Satisfaction Index

For studying the effects of customer satisfaction on stock returns, researchers did an analysis of publicly available data in the United States. Customer satisfaction was measured based on data from American Customer Satisfaction Index (ACSI).

ACSI is cross-industry measure of customer satisfaction based on annual survey of more than 180,000 US consumers. The survey data acts as an input to an econometric model that benchmarks customer satisfaction among more than 300 companies across various sector.

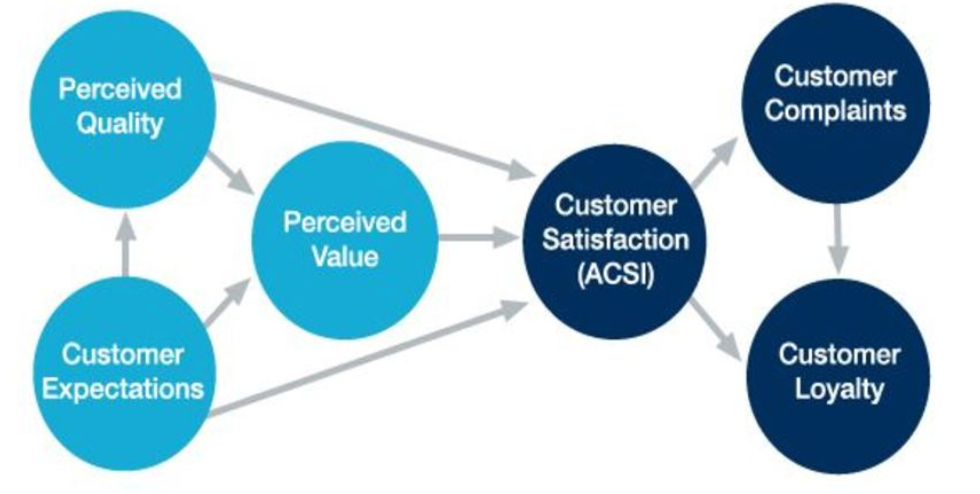

ACSI Model

The underlying basis for the index is ACSI econometric model.

This cause and effect model was developed at the University of Michigan’s Ross school of business. The model was proposed by Prof. Claes Fornell & others in a 1996 paper published in the Journal of Marketing.

ACSI Portfolio Vs S&P 500

Coming to the crux of the post, let us see if customer satisfaction has an effect on stock returns and stock market performance.

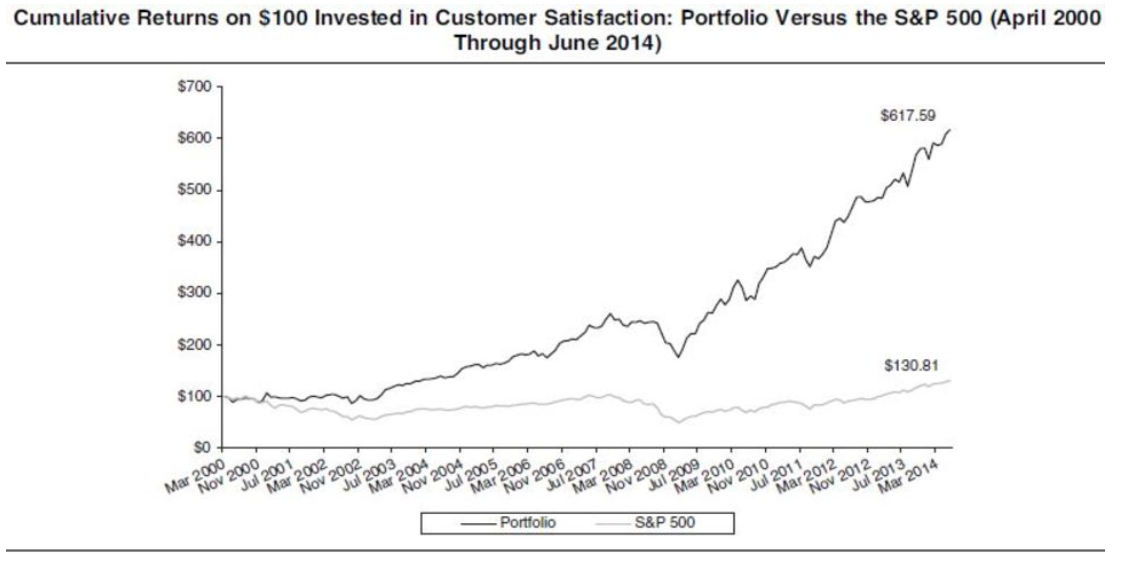

In 2016, Prof. Claes Fornell & others published a paper comparing the cumulative returns on the customer satisfaction portfolio based on ACSI data with S&P 500 data for a 15 year period. The results were nothing short of remarkable:

The cumulative, model-free returns, expressed as the value of $100 invested from April 2000 through June 2014 grew to $618 (+518%) compared to 31% growth in S&P 500

The other key finding was how consistently the customer satisfaction portfolio beat the S&P returns on an annual basis. In 14 out the 15 years of the study, the customer satisfaction portfolio did better than the broader index except in the year 2013.

ACSI Portfolio In UK Market

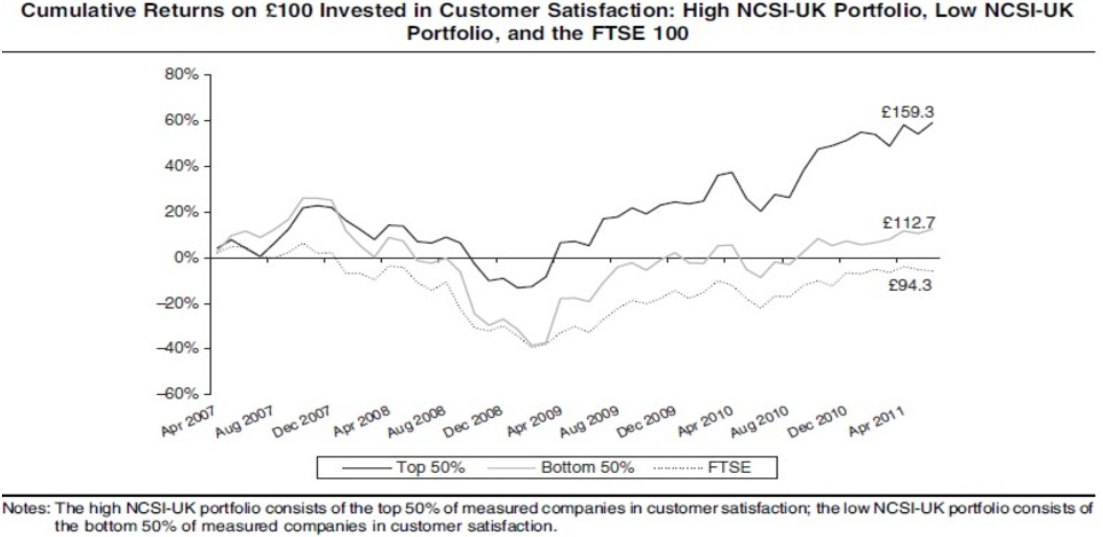

To see whether the effects of customer satisfaction to generate out-sized stock returns can be replicated across markets, the researchers checked the data for United Kingdom ( They have a similar customer satisfaction Index called NCSI-UK).

The findings were similar to the US market which further validated the thesis that an investing strategy based on customer satisfaction does indeed produce excess returns and can be a profitable stock picking strategy.

Final thoughts

As a savvy investor one should be on the lookout for customer service published in newspapers, magazines and trade publications (e.g. JD Power Customer Satisfaction Survey for Auto companies). These will give us stocks which can be shortlisted for our watchlist.

Section B – acceler8

NIFTY 50 Last Week

acceler8 Portfolio NAV

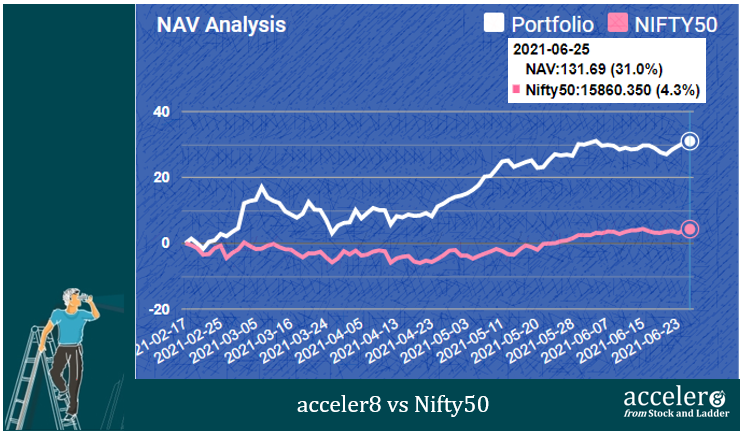

As on 27 Jun 2021, the NAV of acceler8 portfolio is 131.69 (+31.0%) and has outperformed the benchmark Nifty50 by a significant margin since inception (+26.7%).

Current Position

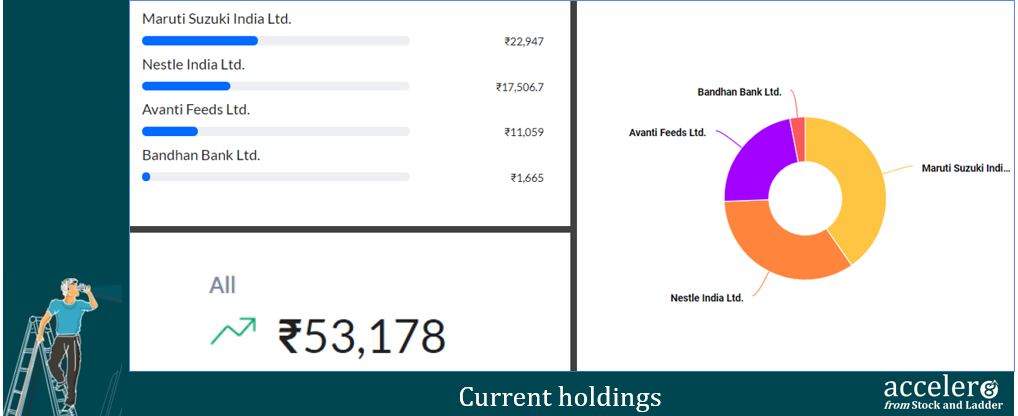

As on 27 Jun, the consolidated value of current holdings is at ₹53,178 with around 50% in cash.

Section C – Stock Screeners

Momentum 20-20 Screener

Momentum 20-20 portfolio had 5 stocks :

1. Grindwell Norton

2. Tata Elxsi

3. Supreme Petrochem Ltd

4. Thyrocare Technologies Ltd

5. Hindustan Unilever Ltd

Rebalancing for this week

1 Entry and No Exits

Revised Portfolio

1. Grindwell Norton

2. Tata Elxsi

3. Supreme Petrochem Ltd

4. Thyrocare Technologies Ltd

5. Hindustan Unilever Ltd

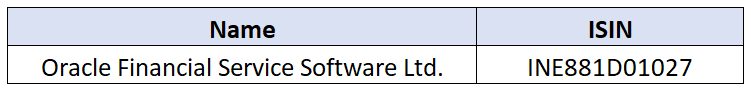

6. Oracle Financial Service Software Ltd.

How to use the screener?

Momentum 20-20 is a model portfolio that will have a maximum of 20 stocks. The stocks in the portfolio are screened based on the proprietary Blue Chip Momentum Investing Strategy.

The strategy tries to marry three investing strategies: Quality investing, Focus investing and Momentum investing to pick up winning stocks for short term profits. Read more.

This screener should be used as a watchlist creation tool to create a high quality momentum watchlist.

These are not recommendations to buy or sell

Readers are requested to conducted further research before investing in these scrips.

Stock and Ladder turned 5

Stock and Ladder turned 5 this week.

Looking back, the journey from a standing start as a standalone blog to what we are today has been momentous.

From writing blog posts, tweeting on investing, conducting investing chats, doing investor presentations to starting “Follow My Portfolio” service, the journey has been one big enjoyable learning experience.

Over the years, through blog, social media and now through Follow My Portfolio Service, I have got acquainted with a wonderful set of new friends, well-wishers and customers – whose support and encouragement I am ever grateful for.

5 years is infancy and I know there is a long way to go. Looking forward with excitement and quiet confidence for the next 5 years with optimism. Remembering the golden words of Robert Frost –

The woods are lovely, dark and deep.

But I have promises to keep,

And miles to go before I sleep,

And miles to go before I sleep.

Looking forward to your continued support and wonderful company in our investing journey together.

Birthday Offer

We are receiving multiple requests for long term subscription to acceler8. On this occasion we are happy to announce a birthday offer to you all for subscription to acceler8 for 3 years @ 13800/- only.

We will add three years to your current acceler8 subscription end date. This is a one time offer only for existing acceler8 subscribers. Offer valid till 01 Jul 2021.

Until next week, stay safe and take care.

Happy Investing!

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr