Part 1 – 8 High Quality momentum stocks

“Mind is like water. When it is turbulent it is difficult to see, when it is calm everything becomes clear”.

– Buddha

Gautam Buddha was born as Prince Siddhartha in the kingdom of Sakyas in the sixth century B.C. The story of prince Siddhartha becoming Gautama Buddha and getting enlightenment under a pipal tree is a fascinating read.

On a Buddha Purnima day, few years back, I got an enlightenment of a different sort.

My “enlightenment”

Portfolio returns were particularly good but not spectacular. But I seemed to be spending my time secretly wishing for the markets to collapse.

Every bad news was silently cheered on hoping that the small fall will precipitate into a large correction and I can binge invest on my favorite scrips. But to my dismay, investing gods did not seem to hear my (silent) prayers instead was giving me the silent treatment.

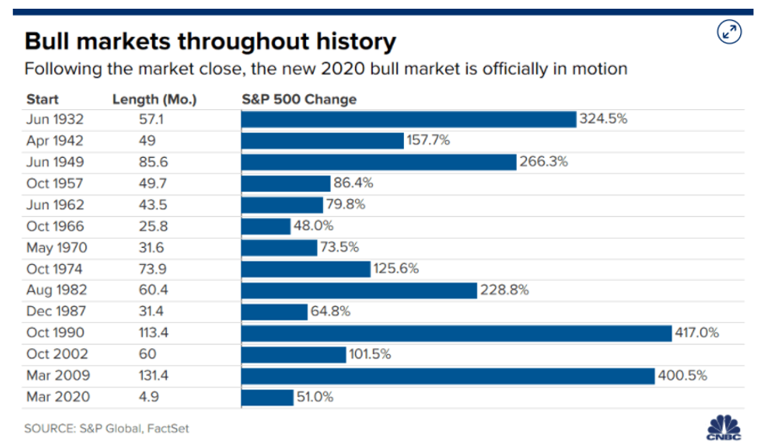

The below table will help you visualize my anguish:

The last bull market was the longest in our financial history, lasting a cool 132 months or 11 years from Mar 2009 to Mar 2020.

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

— Peter Lynch

It clearly dawned on me that something was amiss with my strategy. The more I thought about it , it became very obvious that I seem to be a one-trick pony. The importance of having a variety of tools in your arsenal cannot be over emphasized.

Let me give you a cricketing analogy. Anil Kumble was a very successful cricketer – beside all other reason- one key reason was- variety.

Let us here about the Anil Kumble from the legendry Steve Waugh himself:

It was on one such morning, on a Buddha Purnima day that I chanced upon a book – Gary Antonacci’s Dual Momentum Strategy.

In a gist, Momentum investing is all about betting on winners and avoiding the losers. I felt a flick of the switch had happened inside my brain and I immediately seem to warm up to the idea of momentum investing like a duck to water.

“I’ve said in investing, in the past, there’s more than one way to get to heaven”.

Warren Buffett

Remembered this Buffett quote and took this as his approval and I started reading everything I could lay my hands on the topic of momentum investing.

Slowly but surely things started making sense and many months & hundreds of hours later, I came up with my own version of momentum investing- Bluechip Momentum investing.

Back Testing

Before starting any new investing strategy, the same should also be thoughtfully back tested for different (almost) real life like scenarios.

I backtested the strategy for:

multiple time horizons (1 year, 3 yr, 5 yrs, 8 yrs, 10 yrs)

for multiple rebalancing frequencies (weekly, monthly, quarterly, half yearly and yearly) for re-balancing

different portfolio sizes (8 / 10/ 15 / 20 stocks).

Along with the key criteria of Momentum score, I experimented with different variables like ROIC , EPS, Revenue, NPM, Cash EPS etc. to arrive at my “magic portion” (Asterix fans will relate to this)

Back Testing Results

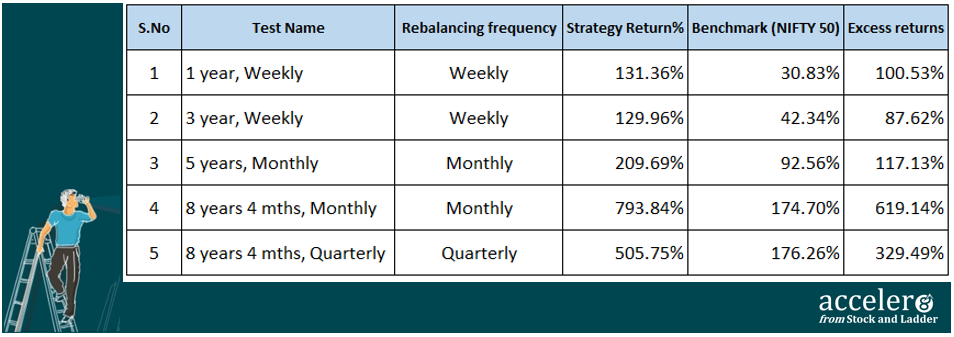

While it is not possible to share the entire back-testing results, I have few key ones:

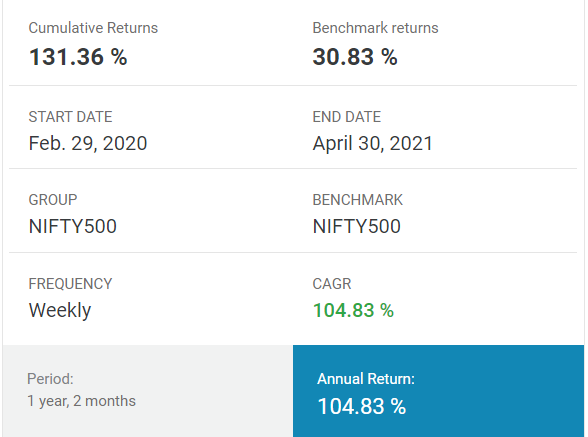

1) One-year back testing with Weekly rebalancing

The CAGR came in at an eye-popping 104.83% but much was due to the rebound from Covid-19 lows. Still enough to whet my appetite.

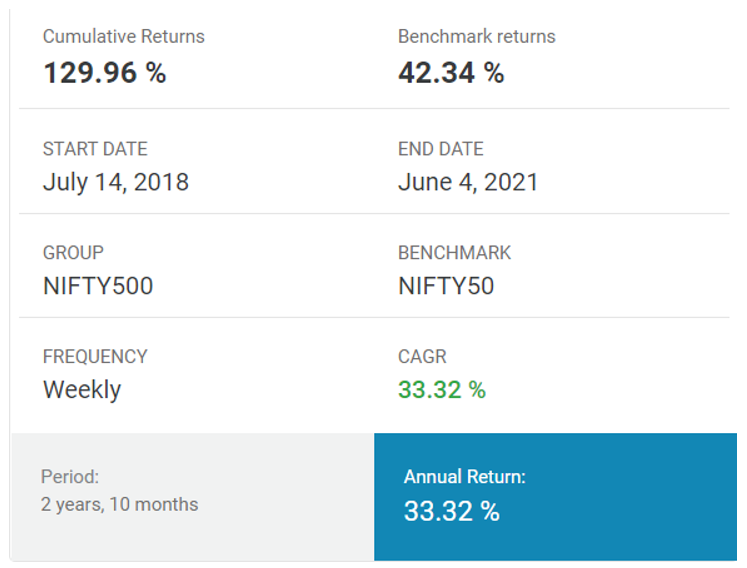

2. Three Year Back testing with Weekly rebalancing

Now the same rules were tested for 3 years and the returns came at a CAGR of 33.2%

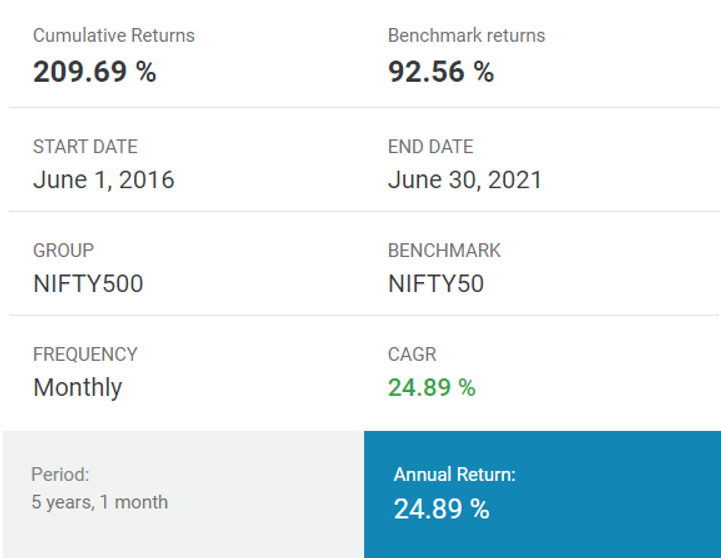

3. Five years back testing with Monthly rebalancing

Now my interest got sufficiently whetted and I checked for 5 years while tweaking the rebalancing to “Monthly”. The results came in at an equally impressive 24.89% over 5 years.

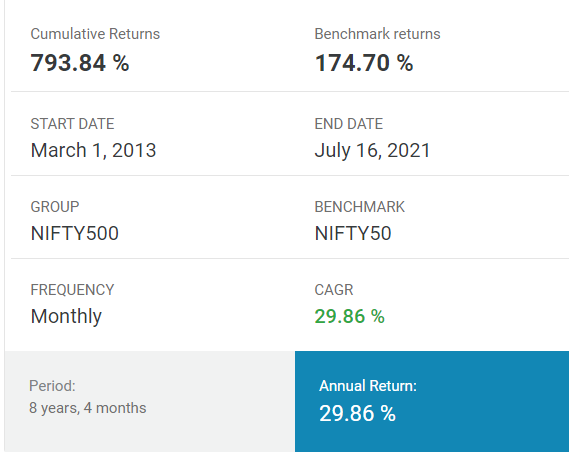

4. 100 months (8 years & 4 months) back testing with Monthly rebalancing

From 60 months, I extended the test to 100 months (the period covered Demonetization & Covid-19). The results came in at 29.86% CAGR over 8+ years and I felt I as onto something.

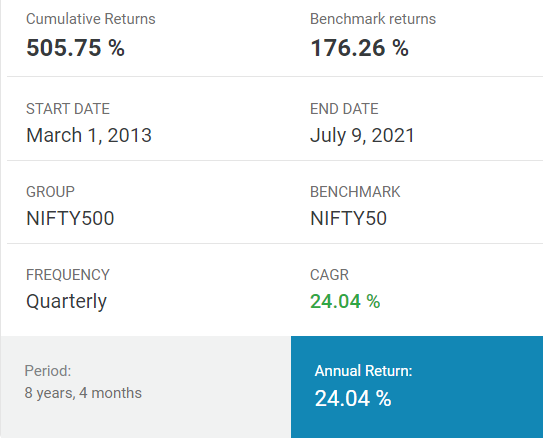

5. 100 months back test Quarterly rebalancing

The next series of tests were done to find if the strategy worked only for Weekly or Quarterly.

Please find below the summary of all tests.

Final thoughts

As you can see, this strategy has given fantastic returns in the past. Personally, my chance reading of Gary Antonacci’s Dual momentum strategy and my “enlightenment” about the philosophy of momentum investing was indeed a big turning point in my investing journey.

Now, I am neither very happy that bull markets are going up or very sad that they are going down. I have become a double-barrel investor.

Read Part 2 – Momentum Buddha Portfolio for the actual portfolio details as on 16th Jul 2021.

Going forward, you can track the performance and updates on this strategy- Momentum Buddha on our telegram channel.

Telegram App

Alternatively, you can subscribe to the channel directly from your Telegram App. Please search for user : @stockandladder_bot.

Steps to follow

1) Launch the bot

2) Click “1 year Subscription, Rs 800/ 1 year”

3) Click Razor Pay Payment Gateway (make the payment through UPI / Internet Banking / Card etc.).

Looking forward to having you onboard,

Keep Learning, Keep Rising.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr