A detailed stock analysis

Dear reader,

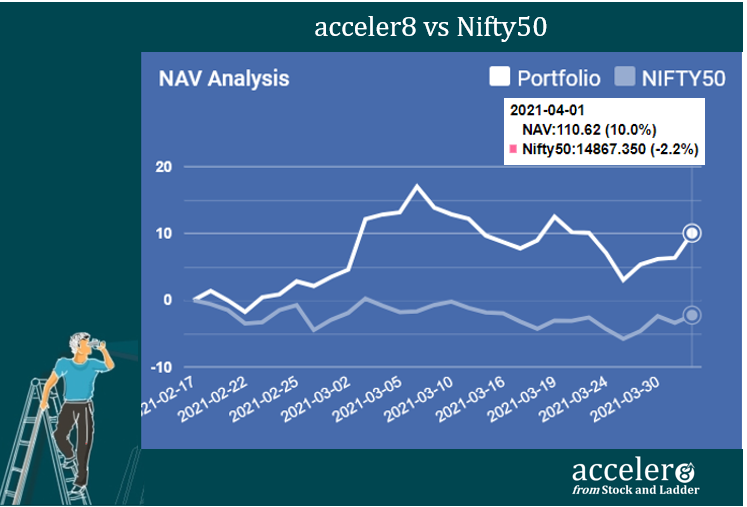

We launched acceler8 portfolio based on momentum investing few months ago.

Based on your feedback, acceler8 just got better.

Starting this month, we will also focus on long term investing as part of our investment newsletter.

Here is the first step in that direction. A detailed stock analysis of a company whose long term prospects we simply love – Indian Energy Exchange (IEX).

Trust you will find this useful. Do share your thoughts and feedback.

Keep Reading, Keep Rising.

Team #acceler8

Stock analysis – IEX

Source : NASA, India shining bright from Space

“In business, I look for economic castles protected by unbreachable moats”

– Warren Buffett 1995 shareholder letter

Facebook, Amazon, BookmyShow, Uber, Swiggy, Zomato, Twitter….. what do they have in common? Network Effect. Network effect states that as the company scales and adds more users their value to existing customers increase.

There are two types of network effect- Direct and Indirect. Direct network effect is straight forward that as the number of users increase the network itself grows. E.g. Facebook, Twitter

There is another type called Indirect network effect, the one in which the platform depends on two or more user groups: producers and consumers / buyers and sellers /user and developers. As more people from one group joins the platform the other group get more value. E.g Amazon / OLA.

In today’s business and start-up world, network effect plays a major role in the life of a website / platform and there is a mad scramble among businesses to increase the market share and the same is referred to as “Winner-takes-all” market.

Section A – IEX Overview

One such shining company enjoying network effect is Indian Energy Exchange (IEX), a company I like very much. IEX is the first and largest energy exchange in India providing a nationwide, automated trading platform for physical delivery of electricity, Renewable Energy Certificates and Energy Saving Certificates.

Think of it this way , if you want to purchase / sell stocks then NSE & BSE are the exchanges / platforms which will facilitate your equity trades. Similarly, if you want to purchase / sell electricity ( State electricity board / power company / captive power plants) then IEX is the platform that will facilitate your electricity trades.

IEX platform enables efficient price discovery and increases the accessibility and transparency of the power market in India while also enhancing the speed and efficiency of trade execution. Today, more than 6600 participants are registered on the exchange from 29 States, 5 Union Territories (UTs).

Electricity value chain

The company has impact across the electricity value chain right from Generation of power to the final consumption.

We will now take a little deeper look at the various product offerings of the company.

Products and Market segments

A brief synopsis of the various products and market segments in which IEX operates:

Day-Ahead Market (DAM)

In this segment, participants transact electricity on 15-minutes block basis, a day prior to the delivery of electricity. Both buyers and sellers submit their anonymous bids electronically during the market bid session and matching of bids is done on double sided auction mechanism with uniform market clearing price.

Term-Ahead Market (TAM)

This segment covers a range for buying/selling electricity for duration up to 11 days. It enables participants to purchase electricity for the same day through intra-day contracts, for the next day through day-ahead contingency, on daily basis for rolling seven days through daily contracts, and on weekly basis through weekly contracts to manage their electricity portfolio for different durations.

Renewable Energy Certificates (REC)

Launched in February 2011, Renewable Energy Certificate market facilitates transaction in environmental attributes. The Renewable Energy (RE) generator can opt to get RECs against green attributes of their generation. These generators can sell RECs through the exchange.

On the other hand, the obligated entities-distribution companies, captive plants and open access consumers may opt to purchase RECs to fulfill their Renewable Purchase Obligation (RPO).

Energy Saving Certificates (ESCerts)

ESCerts are the tradable certificates under the Perform, Achieve, Trade (PAT) Scheme of Bureau of Energy Efficiency (BEE), a market-based mechanism to incentivise energy efficiency in large energy-intensive industries.

IEX became the first and only Power Exchange to commence trading in ESCerts on 26 September 2017.

Section B – The Numbers

In this section, we take a brief look at the key numbers from P&L, Balance Sheet, key ratios and growth figures. Each of these numbers are hand picked and has a relevance for our analysis.

Most of these numbers are self explanatory.

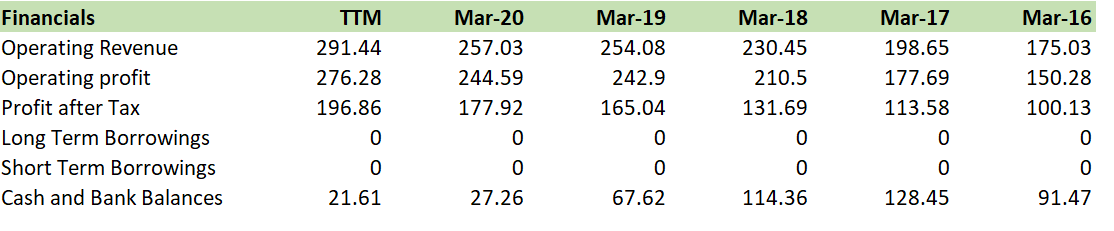

Financials

Growing the topline and the bottom line at a good clip without taking on leverage.

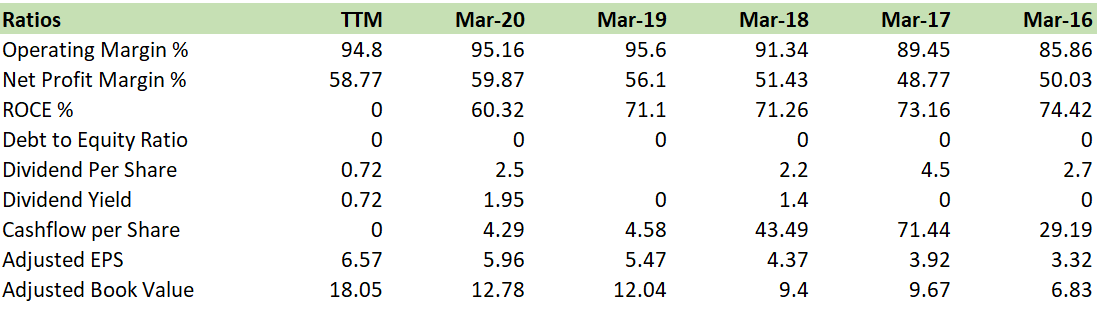

Ratios

Zero debt with absolutely insane Net profit margin % and Return on Capital employed (ROCE) around 60%.

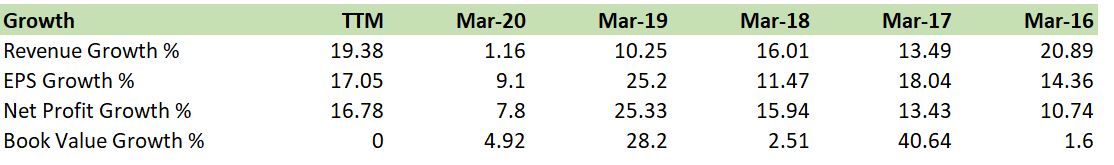

Growth

Healthy all round growth of Net profits , EPS , Revenue and Book Value

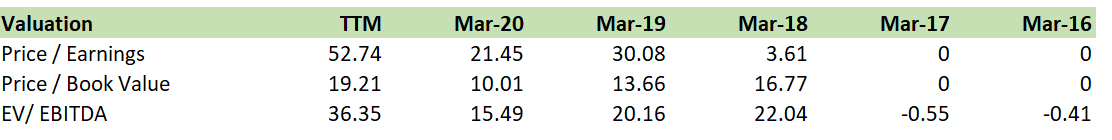

Valuation

This is where the things become tricky. With PE north of 50 , the company is not apparently cheap .

But as you go through the “reasons to invest” section, it will become clear that with a long runway for growth and with strong tailwinds propelling the company forward, the “earnings” part of the PE multiple is likely to grow bigger in the days ahead.

As is apparent, IEX boasts of some fantastic set of numbers.

Section C – Reasons to invest

This is the heart of this post where we look closely at some of the key reasons for the investor to consider investing in the business.

Solving real customer problems

The most successful businesses are those created with a business model around solving a real customer problem. By solving customer problems and needs, the business is able to demonstrate tangible value proposition to the customer.

“We’ve been doing this for 6-7 months at APTransco, and we managed to save ₹500 crore in FY20. We were well placed to maximise this benefit when spot prices fell on the exchange during the lockdown in March and April. We saved ₹56 crore and ₹132 crore in those two months. We were able to buy power for as low as ₹1.8 a unit at one point.”

–Mr Babu, Joint MD , Transmission Corporation of Andhra Pradesh

A top bureaucrat (customer) publicly acknowledging the savings and value IEX delivers to a state power transmission is a clear testimony of company’s clear value proposition and usefulness to its customers.

The COVID 19 pandemic only but helped to accentuate the adoption by various parties due to sudden demand and supply mismatches brought about by the lockdown. The need to re-look at the Power Purchase Agreements (PPA’s) model for securing electricity became apparent to the the distribution companies.

Also the possibility of buying electricity in the spot market at short notice incase of emergency has only ensured that all key players in the electricity value chain are onboarded into the platform.

Economic Moat:

While investing in companies , I prefer those which enjoy some sort of economic moat rather than a run of the mill company with no tangible competitive advantages.

Pat Dorsey published a beautiful study on economic moats where four types of moats were identified:

a) Intangible Assets

b) Switching Costs

c) Cost Advantages

d) Network effect

IEX as explained in the beginning of this post enjoys one of the most financially rewarding type of moat: The network effect.

As more Discoms , power generators, transmission companies, electricity boards and other key players in the electricity value chain gets onboard on to the exchange the greater will be the “ value” of the platform for the other participants.

Market Share

Simply put IEX is not just a market leader but IEX is the market. With a market share of 95%, the company is a Monopoly and virtually rules the market. Month after month we get to read press releases that they have had the best month ever.

Great Set of Numbers

Everything is interconnected. The company has a strong economic moat with a virtual monopoly and this is reflecting in the numbers. Net profit margins and ROCE hovering around 60% with Zero debt and a growing business, the company boasts of some great numbers.

Cash generating Machine

Corollary to the above point, with very low Capex requirements, a healthy profit margin and Zero debt , IEX is a cash generating machine. Period.

Long runway for Growth

A key factor to consider while selecting an investment is to have a view on the long term prospects of both the company and the industry in which it operates. A leader in a sunset industry is not an ideal long term investment candidate.

However, if you invert the logic- a growing company in an industry with favourable growth prospects augurs well for the investor. IEX is at the right place at the right time.

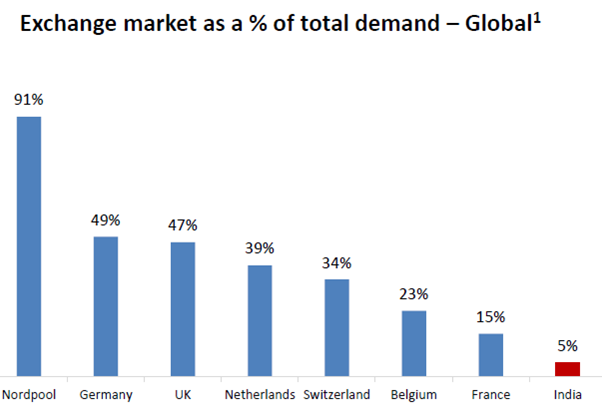

Share of Exchanges

The share of exchange markets in the overall power market in the developed countries are manifold higher. At just 5%. Indian has only taken baby steps in the power exchange market.

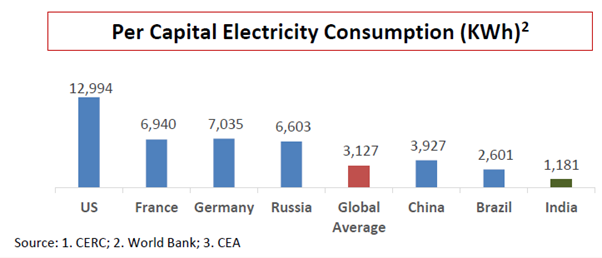

Per Capita consumption

The per capita consumption of electricity in India is a third of the global average as depicted in the table below:

As the Indian economy engine starts revving up again post COVID slowdown and the sustained thrust for Atmanirbhar Bharat continues, the demand for electricity is bound to go up manifold.

Rapid urbanization also drives up the demand and expands the electricity market. Just to put it in perspective, 17 of the 20 among the fastest growing cities in the world are in India.

All these augurs well for IEX.

Government Initiatives

After decades of neglect , the current Government has launched various schemes and undertaken various policy initiatives to light up the nation and give a boost to the power sector.

The Ministry of Power, in fiscal year 2020, continued its thrust on flagship schemes such as Integrated Power Development Scheme (IPDS), Ujjwal DISCOM Assurance Yojana (UDAY), Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY), Saubhagya, UJALA, Urban Jyoti Abhiyan (URJA)

All these policy measures are a big positive for IEX.

Strong technological competency

To be successful in this digital era, every company needs to be technologically savvy. When I read some parts of the management commentary I began to to wonder whether If I was reading about a technology company or a power utility exchange.

I found mentions of IOT, Smart contracts, Blockchain, Robotic Process Automation and many more of the latest technological trends which we normally associate with technology leaders.

The management seems to have got their priorities right by investing in the latest technologies as well as by close collaborations with the academia and research.

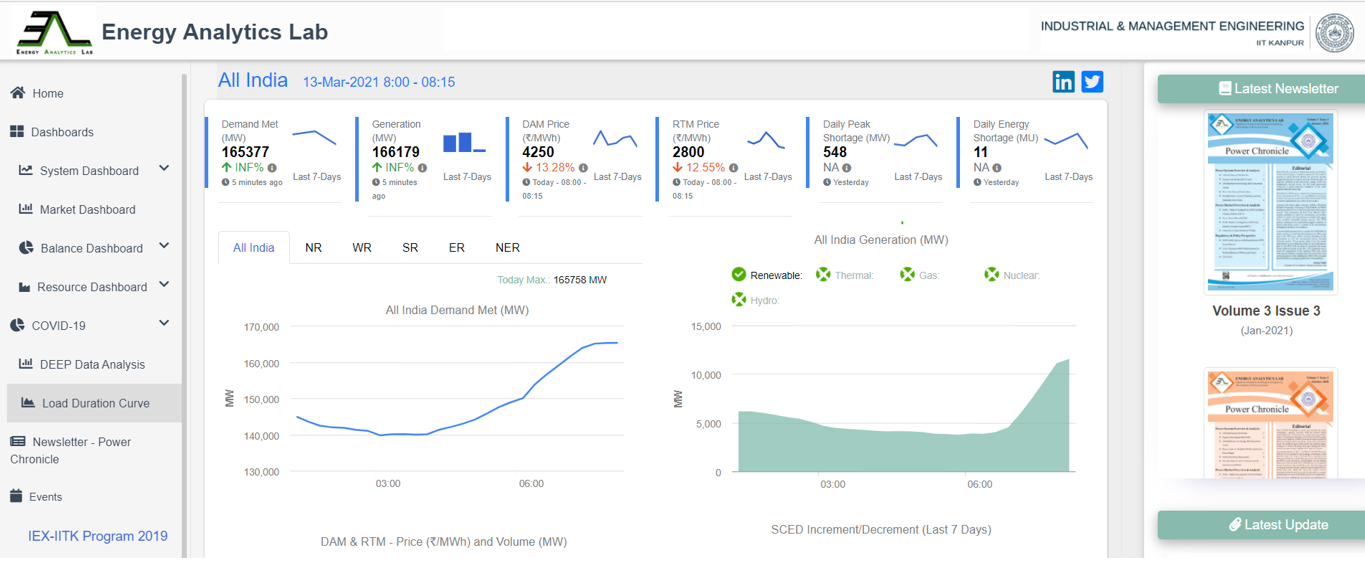

Energy Analytics Lab (with IIT Kanpur)

Mega Trends with favorable tailwinds

IEX is propelled forward by some strong mega trends and tailwinds namely: Decarbonization, Decentralization, Digitization & Democratization.

Each of these trends are self explanatory. Decarbonization is the global thrust for moving away from fossil energy sources and a focus on sustainable “green” renewable energy sources. Additionally with India being a signatory of Paris Climate agreement, there is a deadline for cutting down on fossil energy sources.

India Gas Exchange (IGX)

The company has set up the first gas exchange – Indian Gas Exchange in 2020. The company launched on 15th June 2020, is India’s first automated national-level trading platform for physical delivery of natural gas. GAIL, NSDL have all picked up stake in this.

With Natural Gas set to play a pivotal role in the future energy mix of the nation, IGX is well positioned to reap the rewards. So will be the investors of IEX.

I could go on and it must be very apparent to the reader that there are multiple reasons why I simply love this company. However, just as every rose has a thorn, it is prudent to be cognizant of some of the “thorns” which may come back later to hurt the investors.

In the next section, we look at a few reasons to not invest in IEX.

Section D – Reasons to not invest

1. Regulation risk

Power is a highly regulated sector and the company faces few key strategic risks and operational risks.

The company has to ensure compliance of various regulations and operative guidelines imposed by Central Electricity Regulation Commission (CERC), Ministry of Power (MoP) and State Electricity Regulation Commissions (SREC) among others.

Also, any change in regulation like the proposed new entity by the regulators for price discovery will lead to IEX just involved in the exchange transactions and the role of IEX in price discovery will go away.

2. High Valuation

The returns of the investor are directly related to the price paid for acquisition. As they say “Bhav Bhagwan Che”. However wonderful the business is, an excessively high price paid will diminish the long term returns of an investor.

IEX with PE multiple of 60 is not cheap by extent of imagination.

3. Competition imminent

Just like when BSE was ruling the roost there came along competition in the form of NSE to take away the market share. With a market share of 95% IEX virtually owns the market. It is very unlikely that the situation will remain the same for a long time. It is question of When and not If.

Final thoughts

With a renewed thrust for Atmanirbhar Bharat and cranking up the levers for economic recovery and growth, the electricity sector is in a sweet spot and is poised for sustainable growth. With a Government at the helm which is actually working for India Shining, IEX has a long runway for growth aided by powerful tailwinds.

Investors hitch hiking to ride on IEX is set for a rewarding financial experience.

Trust you found this analysis useful. At acceler8 we are on a mission to inspire common man accelerate wealth accumulation through equities. As part of the acceler8 portfolio learning services, you can follow a momentum portfolio with same day trade updates. The portfolio has outperformed the benchmark Nifty 50 by over 10%. To know more check out this FAQ.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr