“Those who don’t remember the past are doomed to repeat it “– George Santayana

The last six months has been very painful to say the least for the investors of Yes Bank. The scrip which was hovering around the 280 levels even as late as April 2019 has been battered, bruised and mauled by the bears to around 40 levels in just 6 months.

Yes Bank, in my opinion, has all the ingredients to become a classic case study material for academia and the students of the market in just 15 years of its existence.

Watching this fall from the sidelines has reinforced many of the investing lessons learnt from my own experiences as well as from my observation, reflection and readings of the wisdom shared by super investors like Buffett, Graham, Lynch, and Munger among others.

In this post I have put down a few key takeaways for the investor from the Yes Bank Saga. This is not intended to be an analysis in hindsight but an exercise in remembering and reinforcing the lessons Mr. Market teaches us.

1. Promoter fights spell trouble for investors

“Make no mistake about it: a management’s acumen, foresight, integrity, and motivation all make a huge difference in shareholder returns.” Seth Klarman

The management plays a pivotal role in investor’s wealth creation. Corporate history is replete with examples of feuding promoter families’ involved in boardroom battles , public spats and an “open war” to wrest the management control .

All this leads to a bad press and the diversion of precious management attention in firefighting when they should be actually overseeing the strategic directions of the company. Eventually this may all lead to destruction of shareholder wealth.

Something similar happened in Yes Bank’s case too. The differences among promoter families (Kapur Vs Kapoor) started as early as 2009 when the Co-Promoter Ashok Kapur met with an untimely death. His wife Madhu Kapur has since been fighting the Kapoor’s in the court and you can read a detailed account of the feud among the Yes Bank promoters here.

The Lesson:

Any incident of promoter infighting is a red flag for investors. The investor should immediately do a careful analysis with the available information before deciding the next steps.

2. Corporate Governance Matters

“Managers that always promise to ‘make the numbers’ will at some point be tempted to make up the numbers.” Warren Buffett

Minority “outsider” shareholders are mostly at the mercy of the “insider” management when it comes to shareholder wealth creation. Managements perceived to be honest with a history of actions supporting their integrity are usually rewarded with a premium by the market. The opposite is also mostly true.

Does the mention of Satyam, Kingfisher airlines, Fortis, Ricoh India ring a bell? Yes, all these had issues of corporate governance to outright fraud which lead to a massive destruction of shareholder wealth.

A quick look at the short history of YES Bank (incorporated 2004) show that there has been some warnings of questionable corporate governance before. One of them is the massive under reporting of NPA’s found out by RBI during its audit to the tune of 6355 crores for the year 2016-17. The difference was three times the originally disclosed figures.

The second instance is a conveniently structured financial deal done to raise money on the strength of Yes Bank shares to tune of 1700 crores by Rana Kapoor’s family investment vehicles. The actual modus operandi of sophisticatedly structuring the deal is in itself worth reading to know on how influential promoters can game the system.

The management then chose to keep the shareholders in the dark on this transaction. Recently this very transaction caused further misery for shareholders due to the invocation of the pledge by the lenders.

Lesson

Corporate governance is a serious matter and any short comings in this area is severely punished by the market. Your investing antenna should be up the moment you first come to know of any corporate governance issues in the companies you are invested in.

A thorough assessment of the situation needs to be done and if you are not sure it’s better to err in the side of caution and exit your positions

3. A Buy and forget strategy is akin to financial hara-kiri

“When the facts change, I change my mind” John Maynard Keynes

Considering yourself as a long term investor and then turning a blind eye to key market developments is akin to committing a financial suicide or hara- kiri. It is like trying to cross the roads here in Bangalore with your eyes closed.

Expecting to navigate around the stock markets with your eyes and mind closed to the new developments can be financially disastrous as it has been proved in Yes Bank’s case. Some take the advice of not following your stocks continuously to the other extreme by practicing to completely shut themselves off in a “Buy & Forget” mode.

The stock has been absolutely pummeled by the market and in 6 months about 85% of the value is gone. And this is not without reason.

The trouble started with the regulator taking the step of not giving the incumbent CEO an extension and insisting that a new CEO be appointed. Then the proverbial skeletons started tumbling out of the cupboard one by one and the counter was hit with a flurry of bad news. The latest being the invocation of pledged shares at a fraction of the original price.

There are a few misconceptions which are so popular among investors yet are so very detrimental to their financial health. One such popular misconception is to buy a stock and then not monitor it because they have are a “long term” investor with a 5 year / 10 year horizon

Hope is not a sensible strategy. Warren Buffett who is idolized by many long term investors for staying invested for decades in Coca Cola or American Express also has shown that when facts change he has the flexibility in thinking to quickly change his mind.

Buffett’s U turn on Airline stocks or his liquidation of his entire position in Tesco just a year after hiking his stakes are classics on how you need to regularly validate your investing premise regularly. Buffett explained the Tesco investment in his 2014 Shareholder letter:

At the end of 2012 we owned 415 million shares of Tesco, then and now the leading food retailer in the U.K. and an important grocer in other countries as well. Our cost for this investment was $2.3 billion, and the market value was a similar amount.

17 In 2013, I soured somewhat on the company’s then-management and sold 114 million shares, realizing a profit of $43 million. My leisurely pace in making sales would prove expensive. Charlie calls this sort of behavior “thumb-sucking.” (Considering what my delay cost us, he is being kind.)

During 2014, Tesco’s problems worsened by the month. The company’s market share fell, its margins contracted and accounting problems surfaced. In the world of business, bad news often surfaces serially: You see a cockroach in your kitchen; as the days go by, you meet his relatives.

We sold Tesco shares throughout the year and are now out of the position. (The company, we should mention, has hired new management, and we wish them well.) Our after-tax loss from this investment was $444 million, about 1/5 of 1% of Berkshire’s net worth.

Lessons:

When facts change you should re-validate your investing decisions too

Learn to cut your losses and not let your losers run.

In the markets, Do not try to catch a “falling knife”

Risk is not a number but a permanent loss of capital

Buying more of the same blindly (on the basis of hope) for averaging down your purchase price is not a sound strategy

4. Don’t Take Market Predictions by Pundits too seriously

“If stock market experts were so expert, they will be buying stock and not selling advice”- Norman Augustine

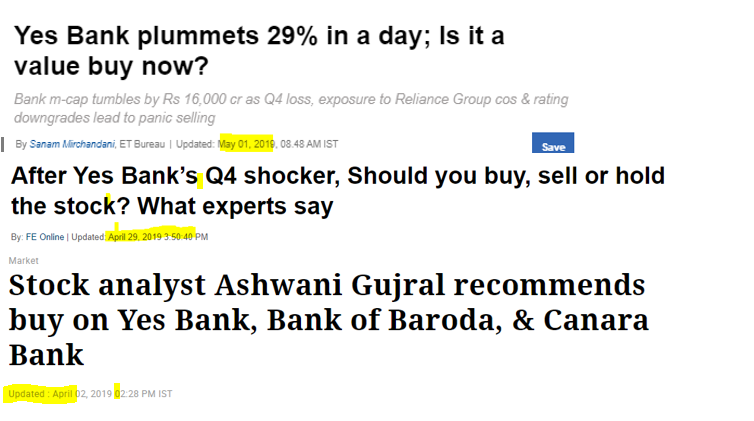

A quick Google search of analyst recommendations around April 2019 threw up interesting results:

What I saw was an entire spectrum of possible analyst recommendations right from an outright buy to an outright sell with everything in between like “Outperform”. “Hold”, “Underperform” and “Sell”. Obviously some had got it very wrong and absolutely no one had a target less than 100 leave alone the 40’s level where the scrip is currently hovering around.

Bold predictions made by sticking your neck out can make you famous and if it turns out the other way you stand to look foolish. Unless you are having the powers of a Nostradamus or you are related to Paul the Octopus , the chances of your predictions being consistently right is to put it vey mildly: “ slim”.

Paraphrasing what J K Galbraith said “The only function of stock market forecasting is to make astrology look respectable”

The CXO Advisory group published a fascinating study on forecast accuracy of equity market experts. They collected 6582 forecasts given publicly for the US market from 1998 to 2012. The average forecast accuracy % for a market expert came around only 47%.

Still I find it extremely strange and slightly unnerving to think that a section of the investors still look up these pundits and analysts for tips and insights to make their investing decisions. Seek information but think for yourself.

Lessons:

Seek information but never seek tips and advice.

Remember to take all the analyst recommendations and Market predictions with a pinch of salt

Mark Twain once said “History does not repeat itself, but rhymes”. Neither is “Yes Bank” the first stock to experience this kind of massive fall in share price nor will it be the last one. I can confidentially say that there will be many more Yes Bank like scenario’s that will happen in the future too.

It will never be the exact scenario but a variation of this play out in the market. Those that invest time to reflect on these market lessons will profit. Brian Herbert famously said “The capacity to learn is a Gift, the ability to learn is a skill, the willingness to learn is a choice”. Mr. Market is ready to teach us every day but the key question being: Are we ready to learn?

What are your lessons from this Yes Bank Saga? Do share in the comments section.

Liked what you have read? Subscribe to get the latest posts delivered for FREE directly into your inbox.

Do you love Reading? Check out the best books to read at the Superinvestors Bookshelf

Let’s stay connected, Follow me on Twitter @Stocknladdr

Terms of Use: Read Disclaimer

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr