Issue 007, 04 Apr 2021

“Well begun is half done” – Aristotle

Its that time of the year when we must look up to the planetary movement of the Sun and Stars as we have just completed the end of a Financial Year. Its time to take stock of your portfolio and reflect on the year gone by. It’s necessary to pause, reflect and look back so that the view looking forward is even better.

Dear Acceler8ors, firstly a big thank you for the leap of faith and trust placed on us and subscribing to the acceler8 portfolio service. Indeed, it is a very humbling experience and you are the founding members and subscribers of this service and you will all remain special forever.

Before we reflect, I am excited to inform that we are planning to have a virtual meeting (Zoom call) next Sunday, 11 Apr. It would be an occasion to interact with all of you and am really looking forward for the same.

Consider this as a virtual AGM 😊. There is an event registration form at the end of this post. Kindly fill up the same to help us share the call details with all the registered participants.

Reflections

Suffice to say, acceler8 portfolio has had a dream start. Like a child in a candy store, I am grinning end to end as I am sharing these performance figures with you all. However, I have been in the market for long enough now (two decades) to know that one has to be humble enough with feet on the ground. Also one needs to constantly learn and strive to get better if we have any chance of matching the benchmark, let alone beating it.

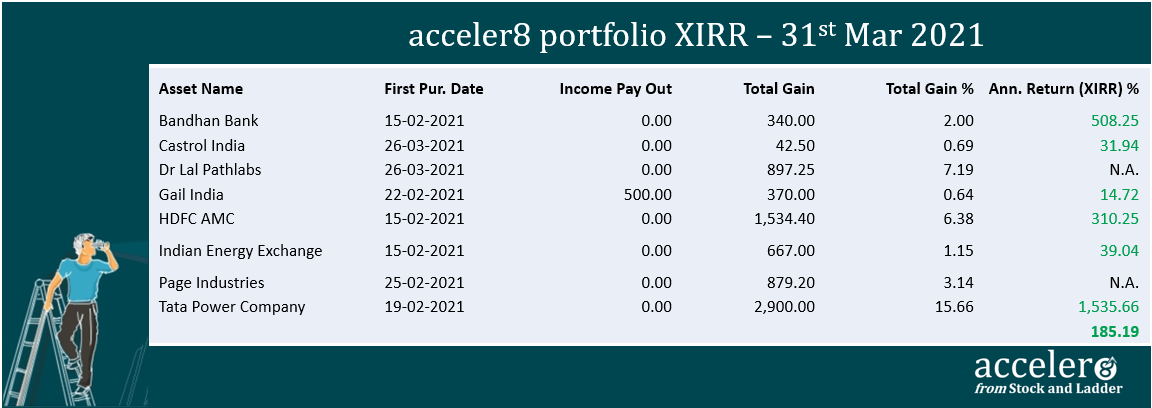

Let us first look at the numbers.

Portfolio performance

Your portfolio delivered an XIRR of 185%.

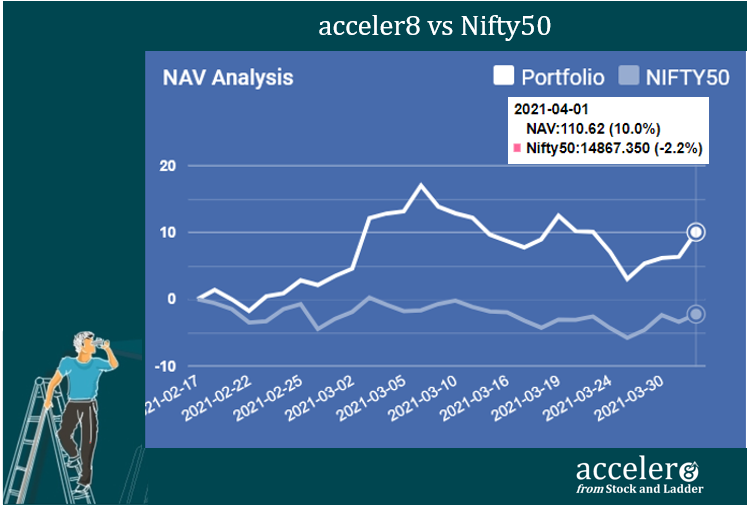

Portfolio Vs Benchmark

A fine way to compare the performance of the portfolio viz-a-viz the benchmark is to calculate the NAV of your portfolio. The NAV (Net Asset Value) for your portfolio is the market value of your portfolio for a given period, after adjusting for your losses, as well as dividends.

Buy Decision Analysis

It is very important that every trade needs to be well thought of and needs to be analyzed.

For doing a buy decision analysis, we have classified the purchases into three buckets: Annualized returns greater than 15%*, Returns 0 to 15% and Negative Returns.

83.33% of our buys have delivered returns greater than 15% with no negative returns

* I believe 15% is the benchmark returns the index will give over a very long term (above 7 years) in India

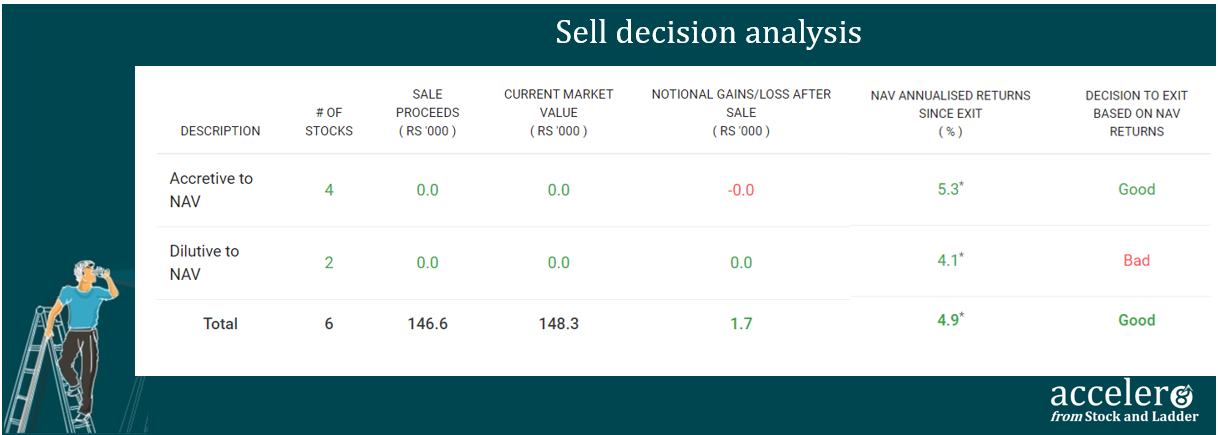

Sell Decision Analysis

Selling is extremely important function of investing. Sell too late and your profits will diminish and conversely if you sell too early you are forgoing an opportunity to make more money. While it is virtually impossible to sell at the peak, every investor must focus on sharpening this part of the trade.

From this table we can deduce that 4 out of 6 trades the decision to sell was good and the portfolio delivered a return of 4.9% versus the 1.2% returns the sold stocks would have given if I had held on to it.

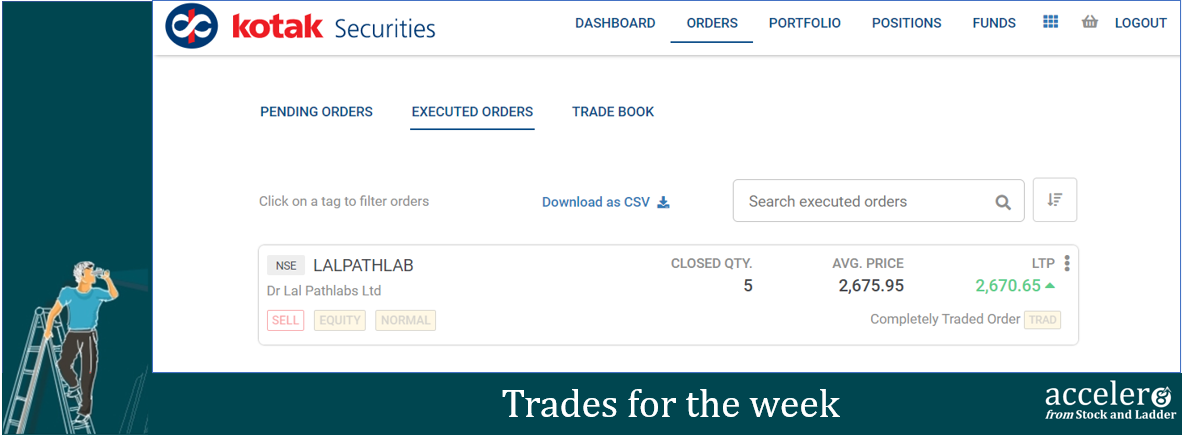

Trades of the week

We closed Dr PathLab in less than a week with 7% gain. The stock is fundamentally sound but in the momentum strategy we will follow rule based entry and exit.

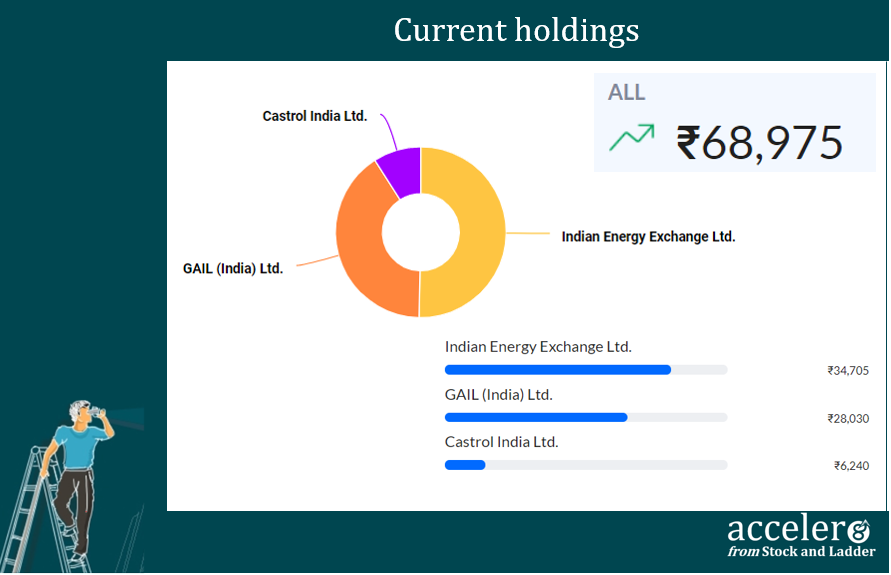

Current position

Having looked back at the numbers, it is time to look forward at the investing landscape.

Looking forward

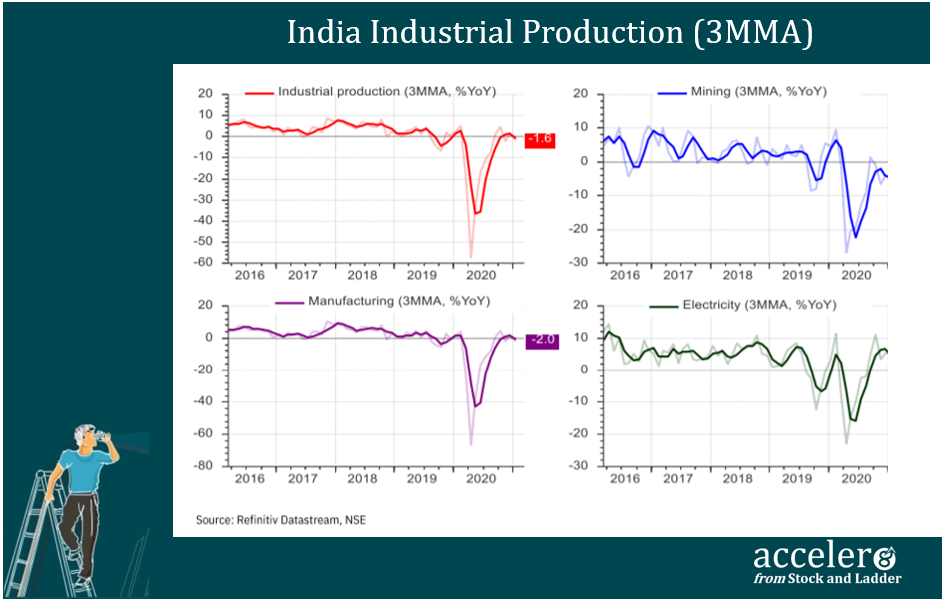

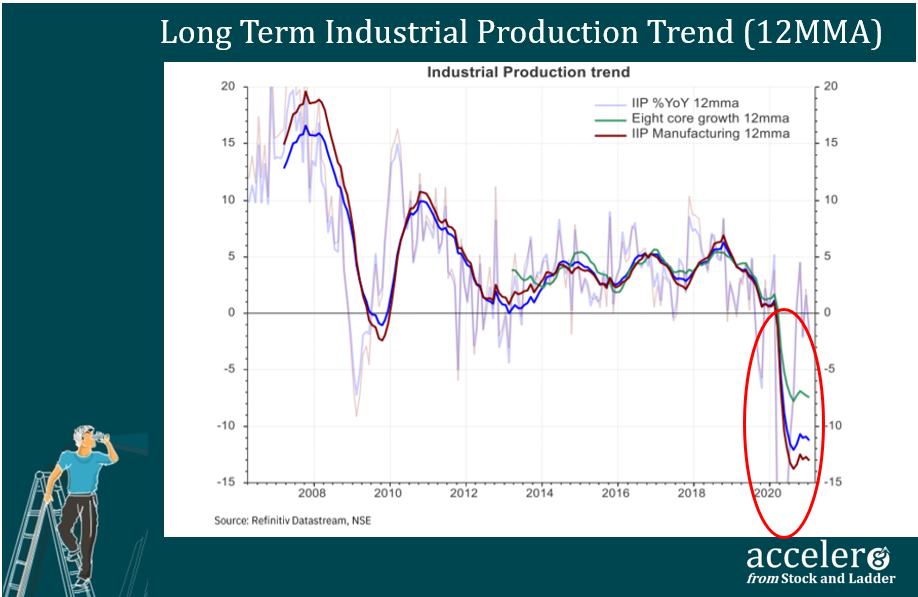

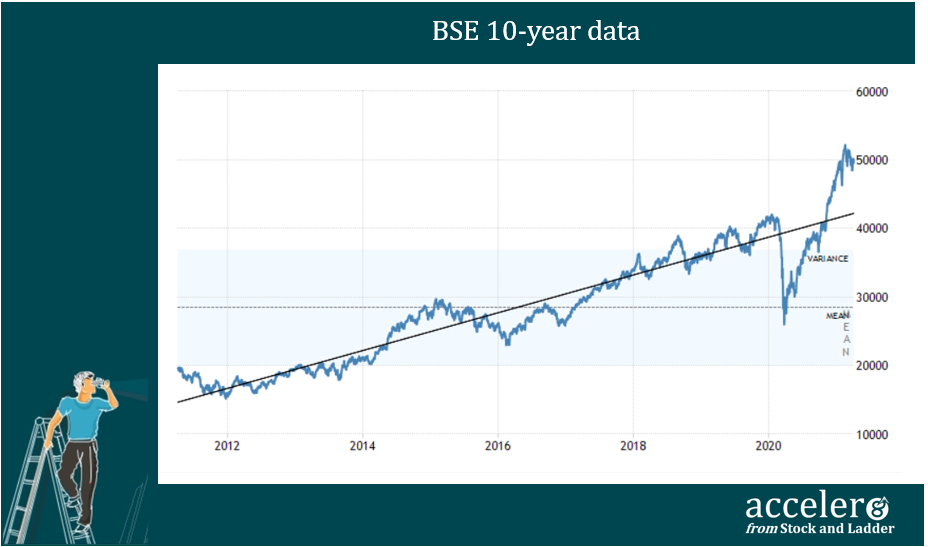

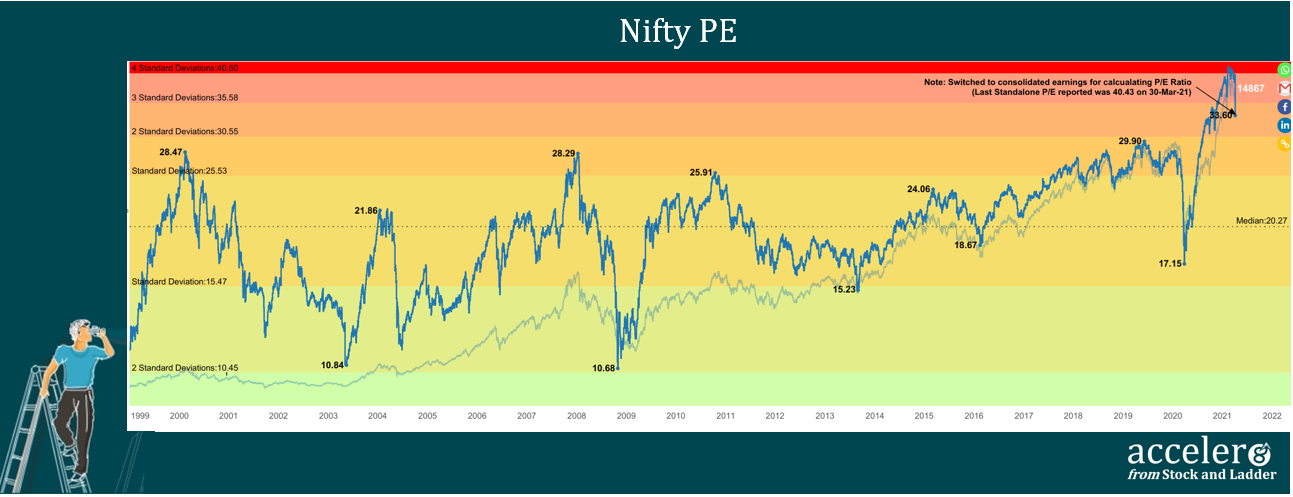

Pictures speak a thousand words. I have included two charts each on the state of the economy and stock market. The stark difference is clear as chalk and cheese.

State of economy

State of stock market

BSE 10-year data

It is pertinent to remember these wise words.

“Markets can remain irrational longer than you can remain solvent”.

– John Maynard Keynes

And with such dichotomy, all one can do, is to BE PREPARED.

Being ‘Storm’ ready

“Only when the tide goes out do you discover who’s been swimming naked”- Warren Buffett

With extremely high valuations, a faltering economic recovery and an increasing number of COVID cases – we have all the ingredients of a perfect storm.

What does one do in real life when we expect a storm ? We prepare. We create an evacuation plan, secure and fortify your exteriors, ready a storm shelter and generally be alert for warning signs.

Its no different while preparing for financial storms in the stock markets. And at #acceler8 , we strive to be storm ready.

Few key things :

a) Portfolio construct

In order to protect your portfolio from large drawdowns its absolutely vital to take care of the construct of the portfolio. Factors like market cap (large cap vs Midcap vs small cap) of the stock; nature / sector of the stocks (Utilities , IT , FMCG are considered defensive), and current valuations are (some of the few factors) to be kept in mind while constructing the portfolio

At #acceler8 great care is taken on these parameters. You will be surprised to know that at the portfolio level the PE is only 14.8 vs 33.6.

b) Quality stocks

Quality investing is an all-weather strategy. In times of falling markets, quality stocks provide you with downside protection and quick recovery while junk will be decimated. In an earlier issue we extensively covered the importance of quality stocks

C) Be mentally ready

Unless you can watch your stock holding decline by 50% without becoming panic-stricken, you should not be in the stock market.” – Warren Buffett

In the end , stock market survival depends less on intelligence quotient (IQ) and more on emotional quotient (EQ)

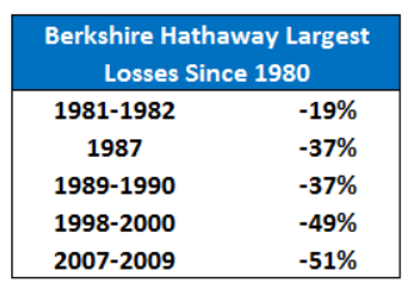

While every care will be taken to protect against fall in portfolio value , one must be mentally ready to take notional losses. Even the best of the best cannot escape the volatility, not even Warren Buffet.

Financial storms and volatility are part and parcel of life in the markets. Off the many mistakes possible in the market, not investing because you expect volatility is the biggest mistake of all and one that we will not be doing at acceler8.

Final thoughts

The journey of #acceler8 has just begun and we have only taken baby steps and there is a long way to go.

As Robert Frost beautifully put it in his 1923 poem

The woods are lovely dark and deep.

But I have promises to keep,

And miles to go before I sleep,

And miles to go before I sleep.

Stopping by Woods on a Snowy Evening (1923)

As we clock up the miles and e look forward to another financial year, I am delighted to inform that a slew of things have been lined up for acceler8 premium subscribers from webinars to a brand new home (website) for acceler8 in the coming days.

The first one in that will be the first virtual get together planned for next week at 4 pm to 6 pm. Do fill up the registration form and looking forward to virtually meeting you all.

And one last thing, acceler8 needs your help and support to grow. Please spread the word socially and among friends / family.

Happy investing and wishing you all a great FY 21-22.

Cheers

Please fill up the registration form for next week’s virtual meet. We will be having a lucky draw for the registered participants.

We are soliciting your feedback and suggestions to improve our newsletter and the same can be provided in the registration form. A small token of appreciation awaits the best suggestion received.

Looking forward to meeting you all.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr