Issue 027, 05 Sep 2021

Section A – illumin8

Richard Driehaus- Father of Momentum Investing

As a practitioner of momentum investing, it is surprising that I took us week 27 to talk about Richard Driehaus, who many consider to be the father of Momentum investing.

Jegadeesh and Titman in their seminal paper “Returns to Buying winners and selling Losers: Implications to stock market efficiency” first published about momentum and found in their analysis :

“Strategies which buy stocks that have performed well in the past and sell stocks that have performed poorly in the past generate significant positive returns over 3- to 12-month holding periods. We find that the profitability of these strategies are not due to their systematic risk or to delayed stock price reactions to common factors.”

However, it would be surprising to know that great minds like Richard Driehaus was practicing a variation of the momentum investing as we know now from the 70’s itself.

While Richard Driehaus has not written any investing book nor has, he clearly spelled out his investment strategy, there are enough material from the interviews and talks he had provided during his lifetime.

Richard Driehaus passed away earlier this year aged 78 but not before leaving a rich legacy in the field of investing.

Here are few interesting observations from my notes from various interviews especially these two books-

Few Investing Lessons from Richard Driehaus

A. Start Young, Read Voraciously

I have studied many great investors and I have found this common thread. All had started young. The story of Buffett starting at 6 years is legendary. Buffett going to a public library and reading A to Z of Moody’s is also quite famous. You can see the same pattern here too.

Driehaus in his own words of how he got interested in stocks:

“I started as a coin collector aged 13. When I had enough money, I invested in the market. Initially, I bought two stocks – a conservative stock and an aggressive stock. The aggressive stock, Sperry Rand, went down and the conservative stock, Union Tank Car Company, was very dull and boring. When those stocks didn’t perform, I went to the library and began reading all the magazines, newspaper articles and investment advisory letters that I could. During that time, I sub- scribed to various investment advisory services

Also he was smart to exhibit second order thinking and as Buffett would often quote Wayne Gretzki “Skate where the puck is going to be”, young Richard exhibited great acumen as he started out even younger as a coin collector“.

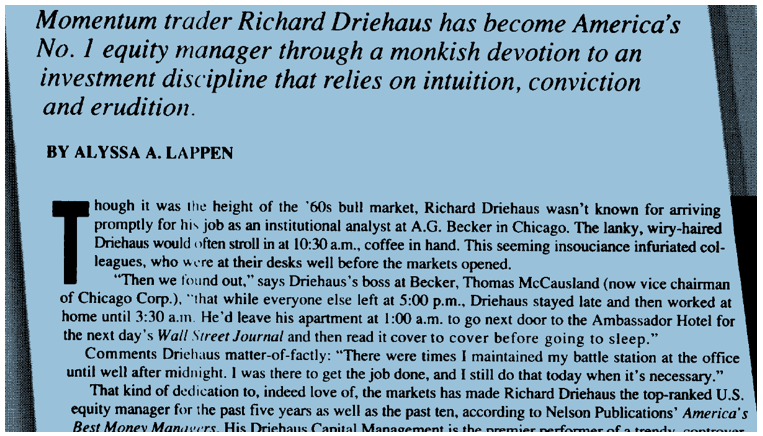

B. Love for the market

Every Superinvestor I know had tremendous love for their job and a work ethic to match. There is a popular saying “you cannot have millionaire dreams and a blue-collar work ethic. Making money and success was a by-product of their passion, dedication and work ethic.

An interesting anecdote from a 1993 article in Institutional investor is reproduced below.

C. Not a fan of Long-term

What’s the long term? A generation? Longer? The 1800s are a good vantage point because the industrial revolution started then. If we went back to the 5th Century, the decline of Rome, to the 12th century, or the beginning of the Renaissance, that was probably the right time for value type investments. If you were born on a farm, you stayed on the farm and you married the girl next door. There was little circulation of ideas.

D. Cut your losses short

“I use a war analogy. If you were engaged in a military campaign, first you try to win philosophically – not mano a mano. Then, if you can’t win philosophically, you try to win strategically like the British did when they sur-prised Napoleon.

For example, if I were building tanks, I’d make them with bright back-up lights so if I needed to reverse, I could do it quickly – a strategic retreat. The idea is not to lose men or equipment.

This is not a game of muscle, it is a game of survival. Live to fight another day. Long term, battles are won philosophically. Sun-tzu, the famous Chinese military tactician, was always quick to reverse and win in a more intelligent way

On a tactical basis, we are a real bottom-up player. If each stock were like a tank, we’d be quick to reverse and change course if it was not working.

E. Flexibility

While stock picking is a skill, seasoned investors will realize that the magnitude of returns is directly related to the ability to sell. When to sell? When one should be greedy and let winners ride but when one should quickly exit even if it involves a small loss is a key skill.

I have found that taking a loss is a very painful activity and many investors hold on to a losing position even when the facts change.

Great investors have this key skill of flexibility in thinking and thinking on the feet. When their original hypothesis goes awry, based on facts superinvestors.

F. Earnings and Momentum

In plain simple words:

We are looking for earnings growth, earnings acceleration. After all, momentum investing is an acknowledgment that things in motion tend to stay in motion. We say that the most successful.

companies are those which have been able to demonstrate strong, sustained earnings growth. We look for many different variations of earnings growth.

We look for accelerating sales and earnings. We look for positive earnings surprises. We look for sharp upward earnings revisions. And, finally, we look for a company that is showing very strong, consistent, sustained earnings growth – like a Starbucks which looks very enduring.

But we don’t just look at earnings We have to see how that earnings growth relates to the stock, its group within the market – its sector, and how it relates to other ideas that are out there.

It’s not an absolute criterion. It’s this question: how will this earnings growth, and positive change, impact the stock, especially relative to the market expectations out there? The company could show very strong earnings.

Backtesting in Indian Market

The criteria mentioned by Richard Driehaus were applied in the Indian market and backtested.

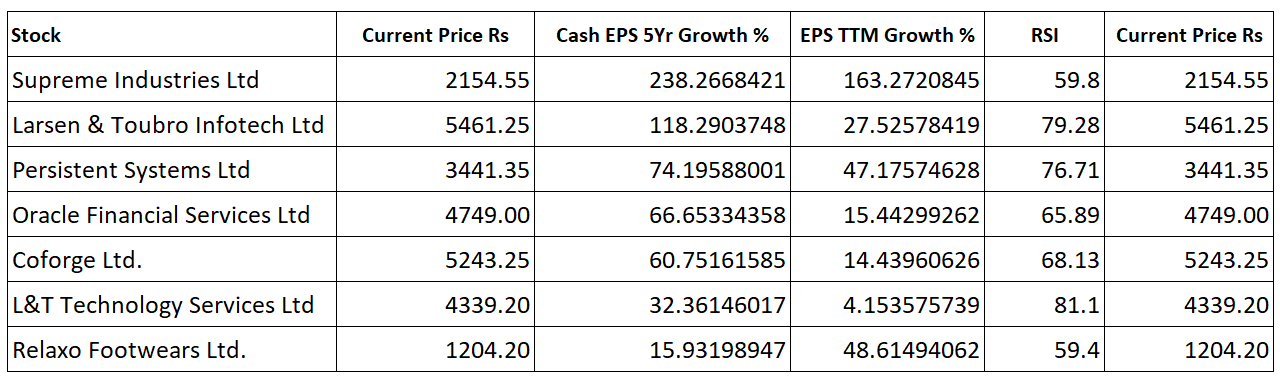

The factors applied were :

1) Cash EPS Growth

2) EPS Yearly Growth

3) RSI >50

4) Market Cap

5) Other proprietary criteria

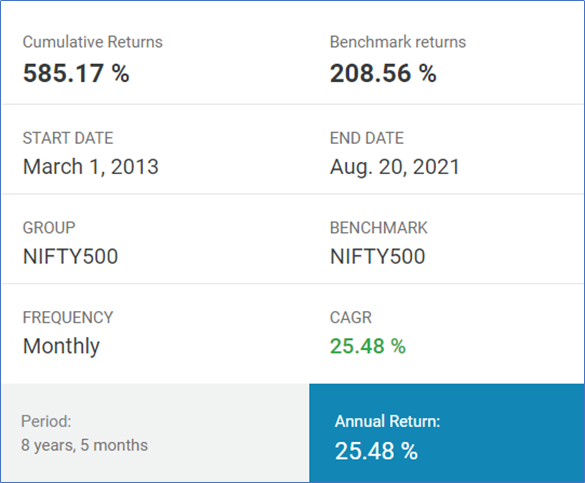

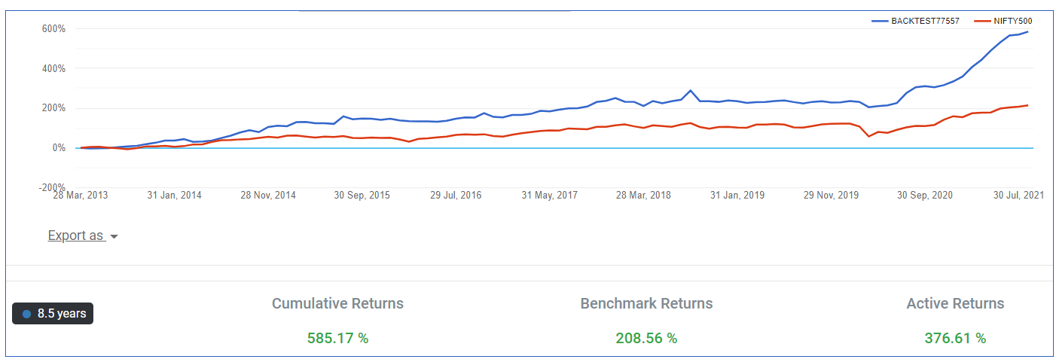

The screen was run for 8 years with a monthly balancing. Here are the results:

a) Excellent returns of 25.48% CAGR

b) Comfortably outperformed the benchmark (NIFTY 500)

c) Stocks which pass the screen

These seven stocks pass the Richard Driehaus screen as on 03rd Sep 2021.

Final Thoughts

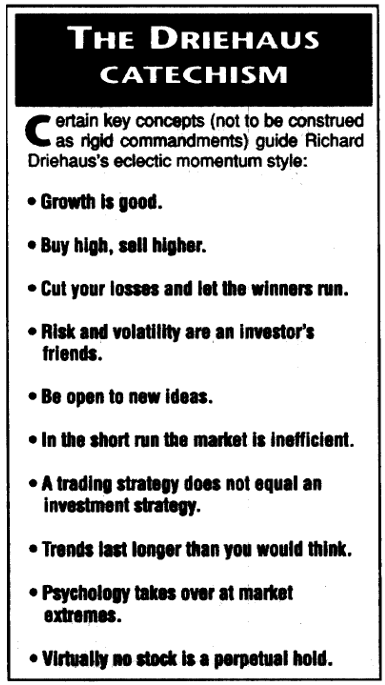

Richard Driehaus was indeed a pioneer to apply the concept of price and earning momentum as an investment strategy. His concept of buy high and sell higher with a focus on strong growth at any cost is indeed an interesting read.

Section B – acceler8

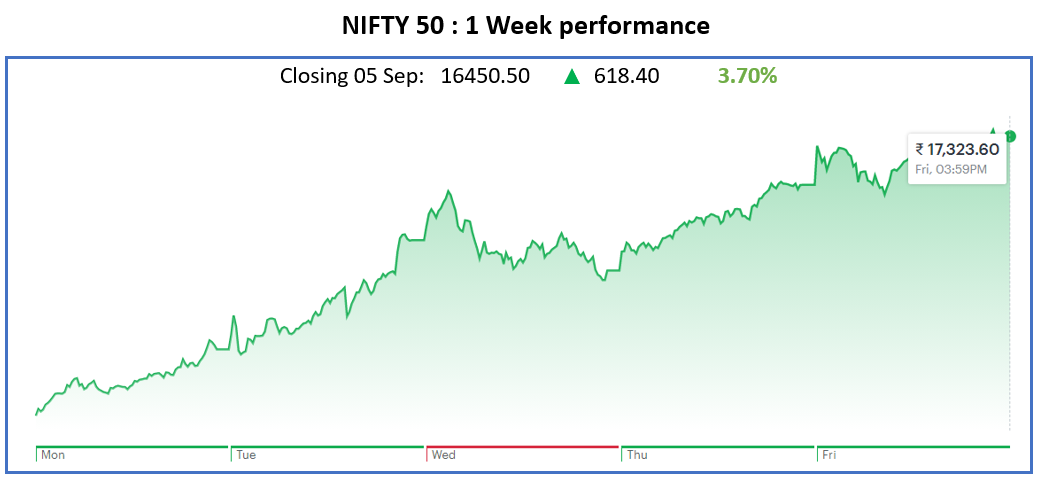

Nifty50 Last Week

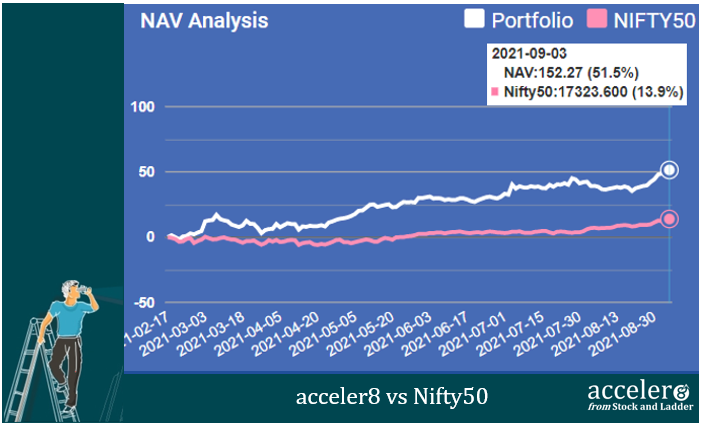

acceler8 Portfolio NAV

#acceler8 continues its strong performance and the portfolio has 37.6 % outperformance against NIFTY 50.

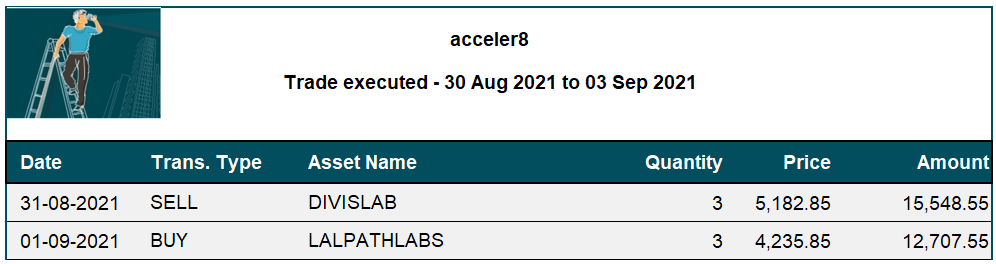

Trades this week

We did two trades this week. We had a 16th consecutive +25% CAGR trade.

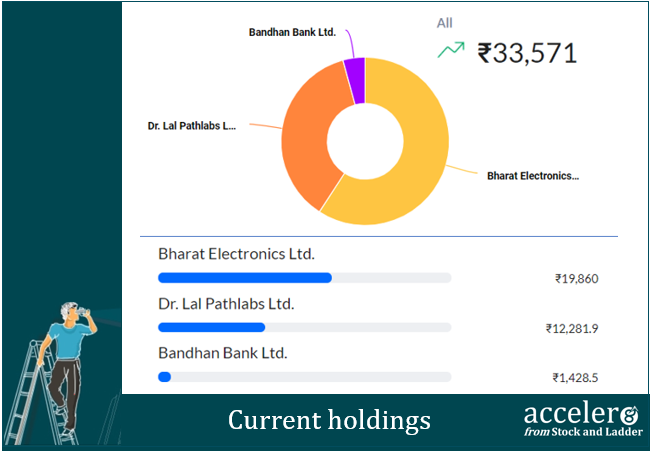

Current position

We are at 68% cash reflecting the high valuations.

We will look around for opportunities and will only bite the bullet when a clear opportunity arises. No trades for trade sake.

Happy investing !

Until next week, take care and stay safe.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr