Issue 021, 18 Jul 2021

Section A – Illumin8

Momentum Buddha

“Mind is like water. When it is turbulent it is difficult to see, when it is calm everything becomes clear”

– Buddha

On a Buddha Purnima day few years back, I hit upon the idea of Momentum investing. As a devout value investing practitioner until then the returns on my portfolio were decent but not spectacular. I saw the markets on a secular bull run which went on and on with not end in sight.

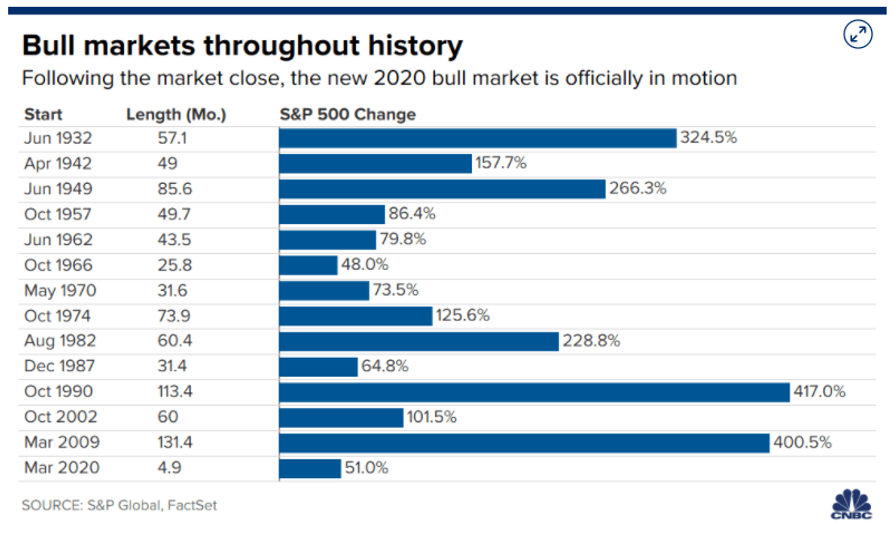

The last Bull market lasted the longest in the Financial History- 131 months or close to 11 years. Pure play value investors had a tough time finding under-valued investments.

I was waiting / praying for corrections to happen so that I could purchase my favourite stocks at low prices. Unfortunately, corrections and drawdowns do not follow a time-table and I remembered what Peter Lynch said

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

— Peter Lynch

Slowly it dawned on me that being a one trick pony does not help. Just like its horses for courses it became pretty obvious that what was needed was an all-weather strategy which can perform during both bull and bear phases.

I chanced upon Gary Antonacci’s Dual Momentum Strategy. Immediately like a flick of the switch I got hooked on to the idea and read as much as I can on the topic of momentum investing. I immediately felt this was the missing piece in my investing arsenal.

“I’ve said in investing, in the past, there’s more than one way to get to heaven”.

Warren Buffett

Many hundreds of hours of study later, I devised my own version of the momentum investing which I call as Bluechip Momentum investing which tries to combine 3 uniquely powerful strategies Quality investing, Focus Investing and Momentum investing into one single strategy.

The strategy has multiple criteria including ROIC, DE ratio, Revenue growth, EPS, RSI, Momentum score among others. The strategy was backtested and the results were nothing short of being spectacular.

I back-tested a version of this strategy with data from the Indian market . The goal was to create a 20 stock portfolio with a weekly rebalancing for a year and benchmark it against the Nifty 50.

The result was nothing sort of startling.

Back Testing strategy

I devised the following rules for backtesting my strategy :

Focused 8 stock portfolio.

Sorted by Momentum Score

Investing universe = NIFTY 500

Rebalancing Weekly

Benchmark = NIFTY 50

Rule: Proprietary Momentum strategy which includes criteria like

ROIC

Debt equity ratio

EPS

Annual revenue growth rate

Net Profit Margin

& Few more which are proprietary to Stock and Ladder

Back Testing Results

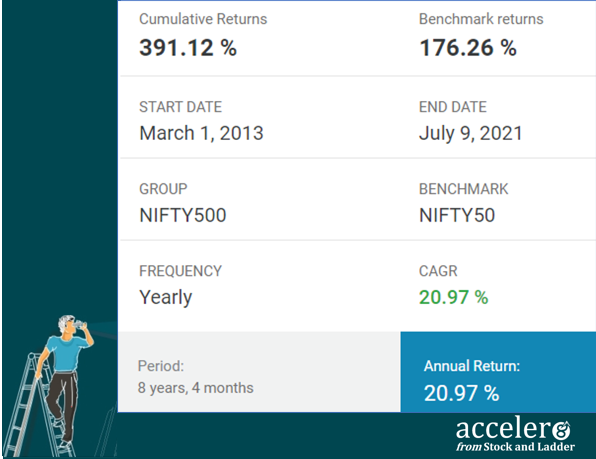

I backtested the portfolio for multiple time horizons (1 yr, 3 yr, 5 yrs, 8 yrs, 10 yrs) and multiple frequencies (weekly, monthly, quarterly, half yearly and yearly) for re-balancing. I also tested for optimum portfolio size (8 / 10/ 15 / 20 stocks).

I am presenting hereby the key data points.

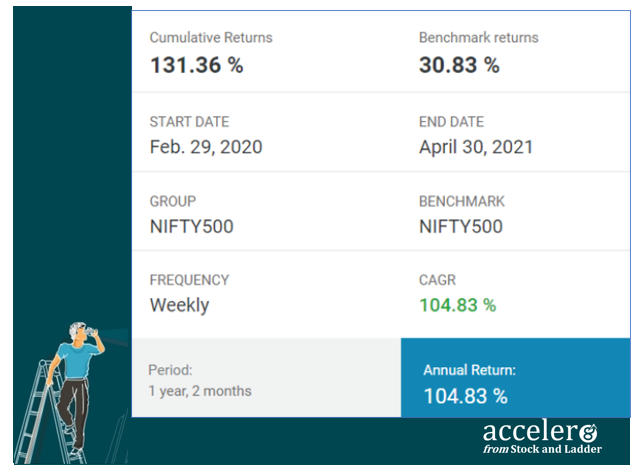

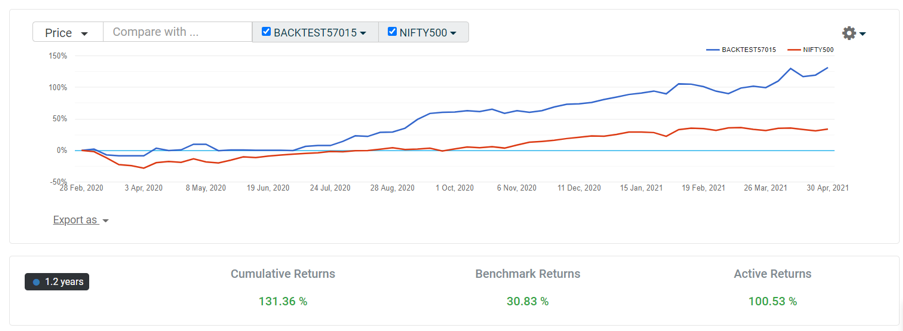

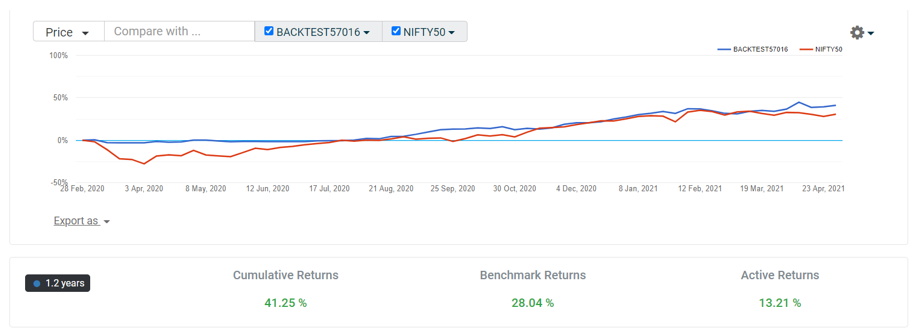

1) One year backtesting with Weekly rebalancing

1.1 Backtest Summary

1.2 Performance Vs NIFTY 50

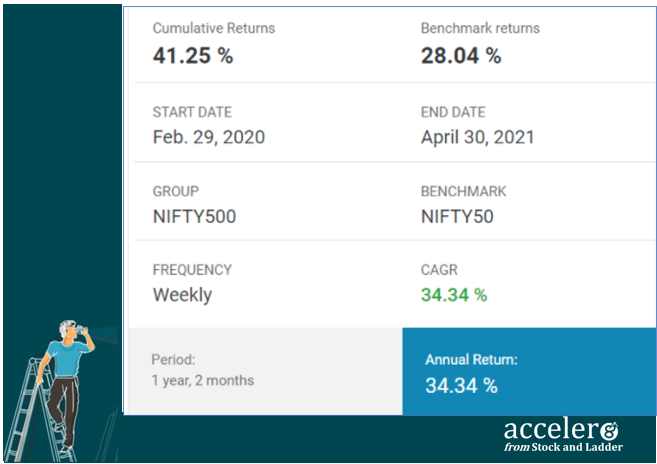

2. Three Year Back testing with Weekly rebalancing

2.1 Backtest Summary

2.2 Performance Vs NIFTY 50

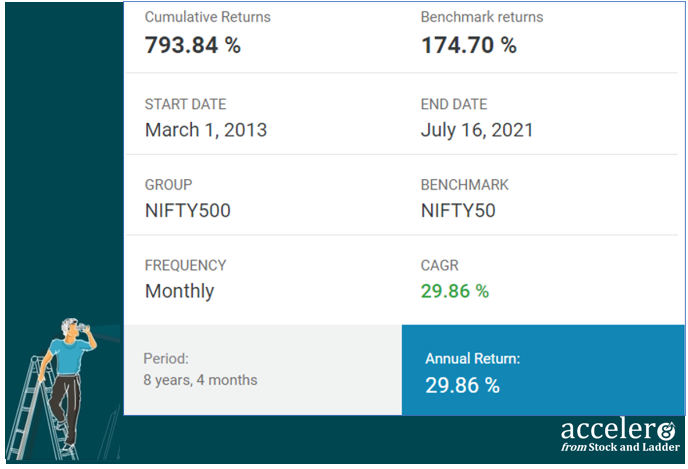

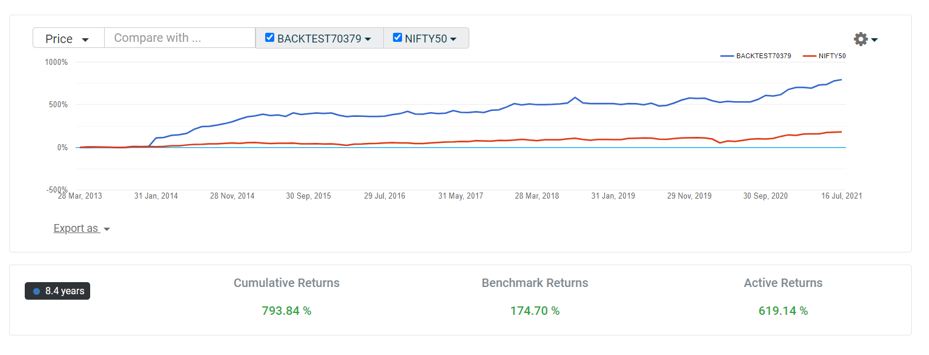

3. Eight years back testing with Monthly rebalancing

3.1 Backtest Summary

3.2 Performance Vs NIFTY 50

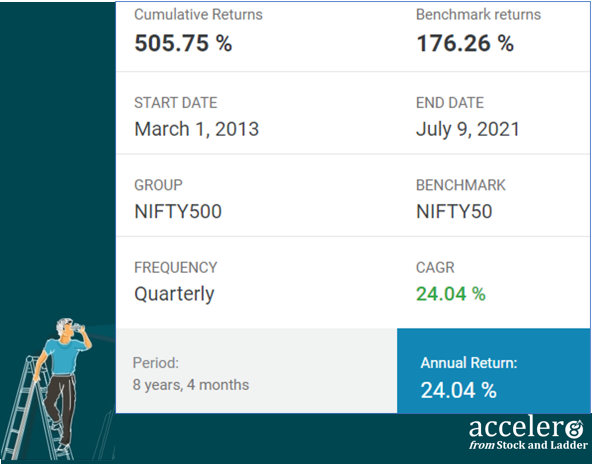

4. Eight years back testing with Quarterly rebalancing

4.1 Backtest Summary

5. Eight years back testing with Yearly rebalancing

5.1 Backtest Summary

As you can see the strategy has given fantastic returns over different time periods.

Momentum Buddha (Momentum 20-20 ) Portfolio

While the #acceler8 portfolio is completely built by me based on the underlying strategy , Momentum Buddha (aka Momentum 20-20) is automated with zero intervention from my side.

Also #acceler8 portfolio has other sources for investing ideas, some of which may never come up on this screener. Hence this portfolio is never going to be a superset or a subset of the acceler8 ‘Follow my Portfolio’ service.

Why track Momentum Buddha?

The key reason to track this portfolio is for getting a high quality watchlist of momentum stocks with strong fundamentals.

There are more than 1500 stocks on NSE itself. If you choose to follow a momentum strategy then this portfolio will help you build a high quality watchlist / screener which can be taken up for further research.

Please note that the role of equity analyst should be played by you – checking the fundamentals, competitive advantage, financial data, fair value and much more.

Also, the user should keep cognizance of the fact that not all stocks which pass the screener are winners.

Example

Let us take the backtesting scenario where we tested for 8 yrs yearly rebalancing.

While the strategy delivered an overall return far exceeding the benchmark, there were 9 losers out of the 23 exits. Which means one in 3 stock gave negative returns. This is not to scare you but to make your aware of the potential loss if you don’t apply your judgement.

If you feel this is not your cup of tea then simply follow my portfolio

Portfolio Rules

The portfolio will be rebalanced every weekend (Sunday) based on Friday EOD prices. In case you are tracking this portfolio you can be ready for Monday morning trade

There will be a maximum of 8 stocks in the portfolio with approximately 8500 to 12500 per scrip

Brokerage and taxes are not considered.

Stocks greater than 10K per scrip will not be considered.

Cash is not expected to deliver returns, however in real life you can put it in Liquid Bees or any other ultra short term instruments and generate some nominal returns

The portfolio is maintained for tracking the performance

There is no way we can be certain that the actual portfolio results will be similar to the backtest results

Please do your homework before you invest in the portfolio. These are no recommendations to buy or sell

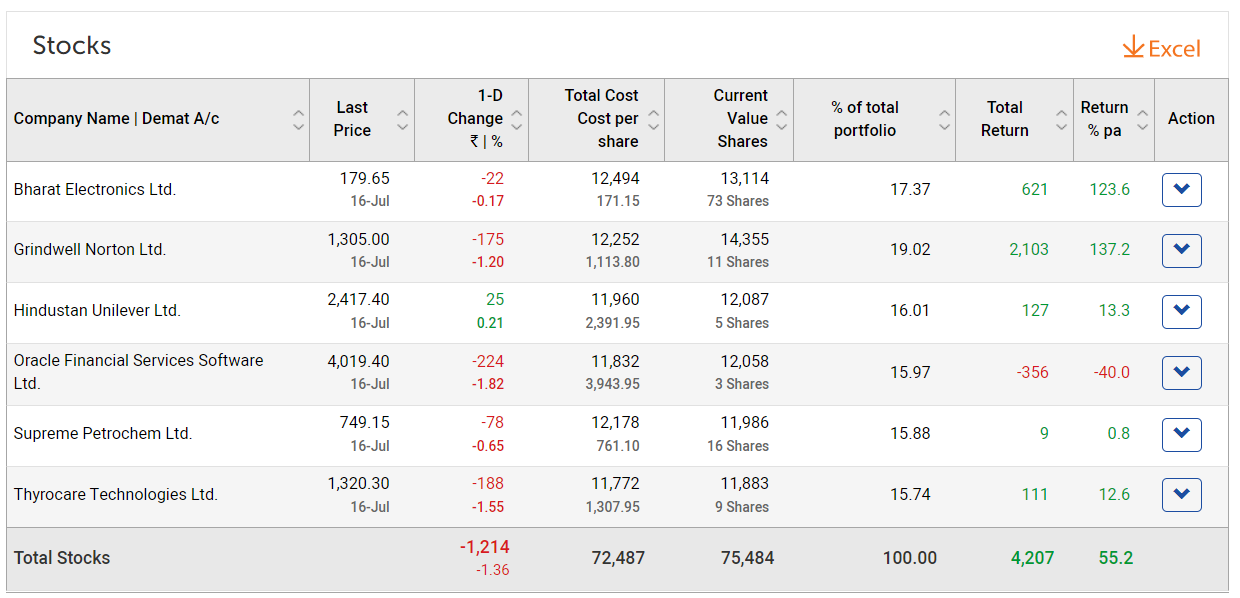

Current Portfolio (16 Jul 2021)

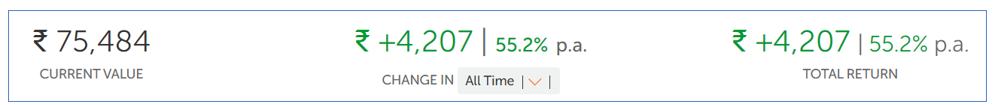

The portfolio was constructed from 9 May 2021 and currently is up 55.2 %.

The future updates of Momentum Buddha Portfolio will be in Stock and Ladder Telegram channel.

Editors Note : We are in the processing of arranging for complementary subscription for Stock and Ladder Telegram Channel. You will be receiving a mail in the next few days.

Section B – acceler8

Nifty50 Last Week

acceler8 Portfolio NAV

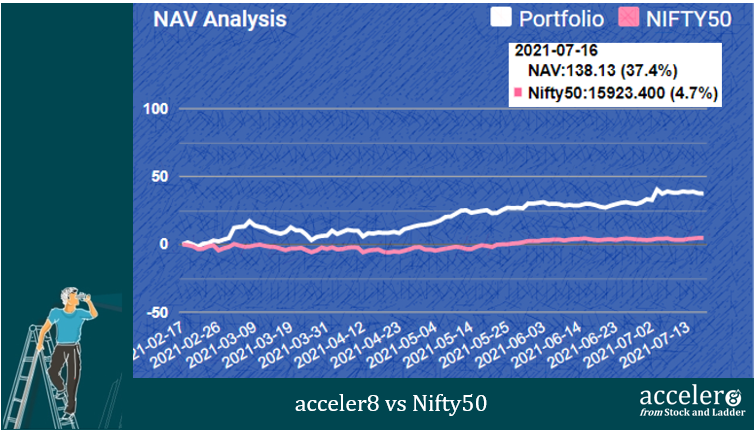

As on 16 Jul 2021, the NAV of acceler8 portfolio is 138.13 (+37.4%) and has outperformed the benchmark Nifty50 by a significant margin since inception (+32.7%).

Current Position

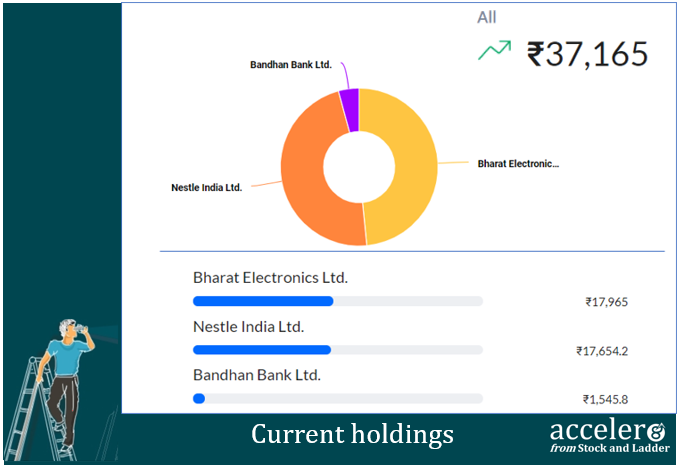

As on 16 Jul, the consolidated value of current holdings is at ₹37,165 with around 65% in cash.

We are at close to 65% cash. In this overheated market, as always, we will be doing only surgical strikes. At such rich valuations let us wait patiently for profitable opportunities to present themselves.

Until next week, stay safe and take care.

Happy investing !!!

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr