Everything you need to know about acceler8

Dear Reader,

We have put forth a set of frequently asked questions about acceler8. We believe it should have answers for most of your questions. In case there are any further questions, please feel free to reach out to us at superinvestorclub@gmail.com.

In case you wish to see a sample newsletter click below

Section 1

acceler8 Portfolio Learning Service

Q1. What is acceler8 portfolio learning service?

acceler8 is a premium paid newsletter released every Sunday broadly covering the following topics currently:

a) Follow my Portfolio

This is a one of the kind information service where the actual trade details (screenshots of trades) are shared with the subscribers on the same day itself.

This section includes current holding, closed positions, and overall portfolio performance details. You will have access to stocks which qualify my investment criteria which can be a starting point for creating your own watchlist or doing further research.

I eat my own cooking and the same strategy is applied for the family portfolio and personal capital. Hence the incentive for outperforming is inbuilt in this service.

b) Investing Lessons

“The harder lessons you can learn vicariously rather than through your own hard experience, the better” – Charlie Munger

This section provides an opportunity for vicarious learning from the investing lessons, experiences and analysis based on actual trades done in the acceler8 portfolio.

c) Curated investing content

“Ancora Imparo (I am still learning)” – Michelangelo at the age of 89

This section provides an opportunity for continuous learning where we will be sharing handpicked investing contents (blog/ article/ research paper/ white paper/ annual letter/ classic articles / interviews) to consume.

Q2. What is the investing objective of this portfolio?

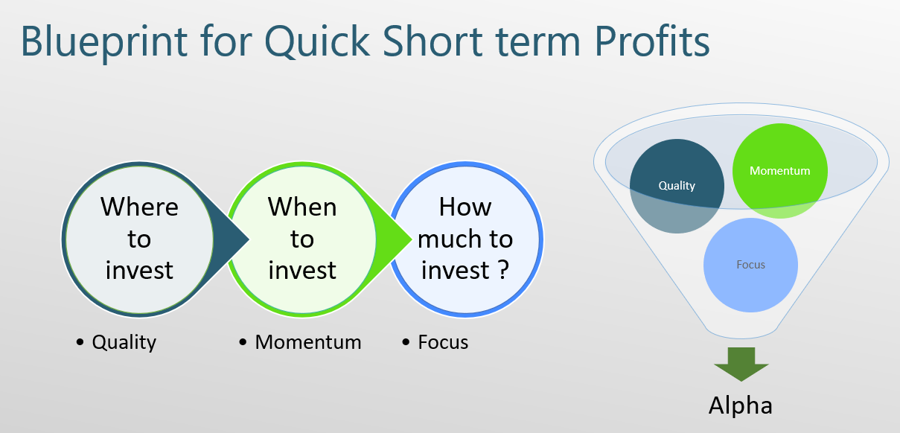

The objective of this portfolio is to generate quick returns over a shorter time frame of one week to one quarter (less than 1 year) by focusing on quality stocks which exhibit upward positive momentum.

The returns are benchmarked against NIFTY 50. The returns are excluding fees and taxes.

Q3. How has the performance of the acceler8 portfolio been till now?

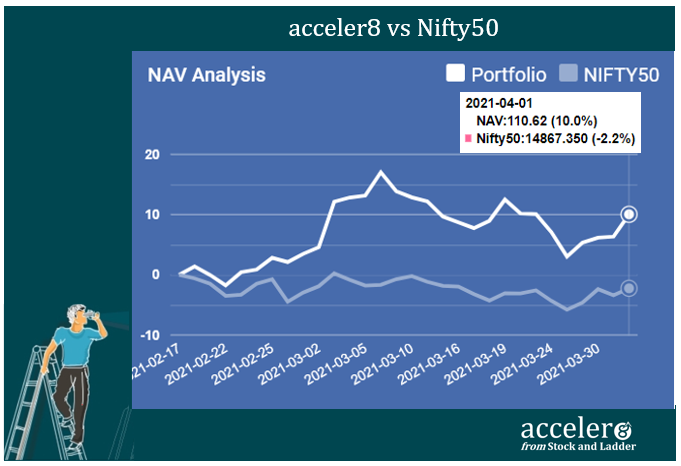

A fine way to compare the performance of the portfolio viz-a-viz the benchmark is to calculate the NAV of your portfolio. The NAV (Net Asset Value) for your portfolio is the market value of your portfolio for a given period, after adjusting for your losses, as well as dividends.

As on 01 Apr 2021, the performance of the NAV of acceler8 portfolio is 110.62 (+10%) and has outperformed the benchmark Nifty50.

Q4. What are the criteria for picking the stocks?

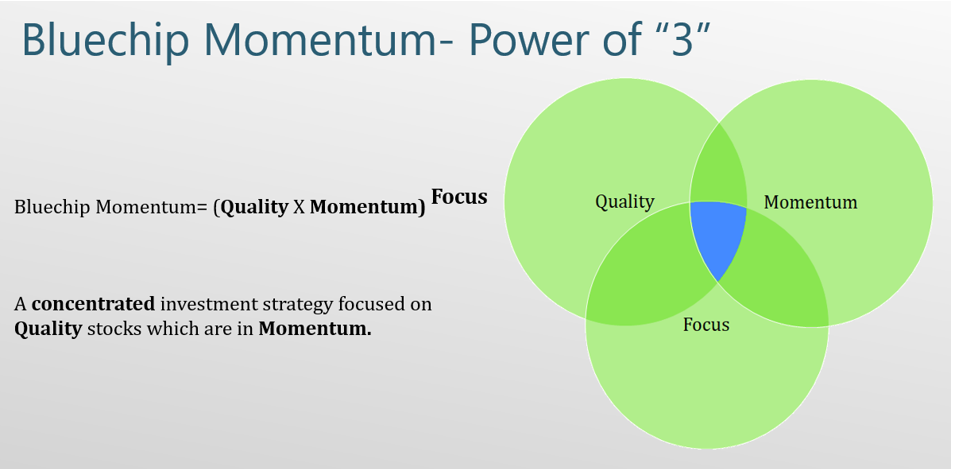

acceler8 follows a proprietary stock selection strategy named “Blue Chip Momentum”.

The strategy tries to harness the power of three uniquely distinct and powerful strategies – quality, focus and momentum. However, when a trade is done there will be no detailed analysis of why a position was taken. Any analysis may be done if any, post-closing of that position (exiting the position).

You can read more about the strategy here.

Q5. Is “Portfolio Learning Service (PLS)” containing an actual portfolio with real money? How can I be sure of the trades done?

Yes, “Follow my Portfolio” is an actual portfolio started with a corpus of 1 lac INR and maintained presently with Kotak Securities.

The screen shots of the actual trades are shown and additionally the trade details are audited annually.

Q6. How will I get to know of the trade details?

The trade details will be shared in a similar format on the same day of the trade by email.

Q7. What will be the frequency of trade in acceler8 portfolio?

While there is no specific frequency, usually based on the past experiences, there will be at least one trade a week. Also, there will not be a trade done just for sake of trading. As in investing, not deciding to invest is also a decision.

Q8. Is PLS a portfolio advisory service or a stock recommendation service to buy / sell?

No. This is not a portfolio advisory/financial planning/stock recommendation service. This is intended to be a portfolio information service where paying subscriber can view the trades done in the acceler8 portfolio.

It is upto the reader to do further analysis and take his or her investing decisions.

Section 2

Subscription to acceler8

Q1. Who will get benefitted from subscription to acceler8 newsletter?

acceler8 will benefit anyone directly or indirectly connected with investing in the stock market either as a full-time investor, part time investor or simply interested to learn more about investing. Apart from the portfolio information updates, the newsletter is a knowledge sharing service which we believe will benefit those seeking to continuously improve their investing acumen.

Q2. What is the validity of #acceler8 paid subscription service?

#acceler8 paid subscriptions are valid for the period of subscription (monthly /yearly). The access to premium features of this service will expire after the subscription period gets over unless a renewal is done.

Q3. What are the various subscription options?

Currently there are three plans.

We strongly recommend you to choose the annual option.

Q4. Can I view a sample newsletter?

Click the below link to view the sample newsletter.

acceler8 Issue 001 dated 23 Feb 2021

Q5. What are the social media credentials for following acceler8?

Like us on social media

Twitter: @super_investing; @stocknladdr (24K followers)

Facebook : superinvestorclub

Q6. Any further questions, our contact details

Please drop a mail at superinvestorclub@gmail.com

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr