acceler8 Update, 21 Feb 2021

The secret to getting ahead is getting started

Mark Twain

As a nation, we are all cricket crazy and the recent victory over England in the second test match gave us a lot to cheer about. One of the keys to that victory was a fine century from our opener Rohit Sharma which helped team India in putting up a decent first innings score.

The good start set the tone for the rest of the match and also laid the foundations on which the team pushed on a fine victory. Just as in the game of cricket, in the world of investing too, the need for a solid start cannot be emphasized more.

With prayers in the lips and ₹ 100,000 in hand, “acceler8” started its innings looking for a good start. Here is a reflection after the first over (week 1).

Trades of the week

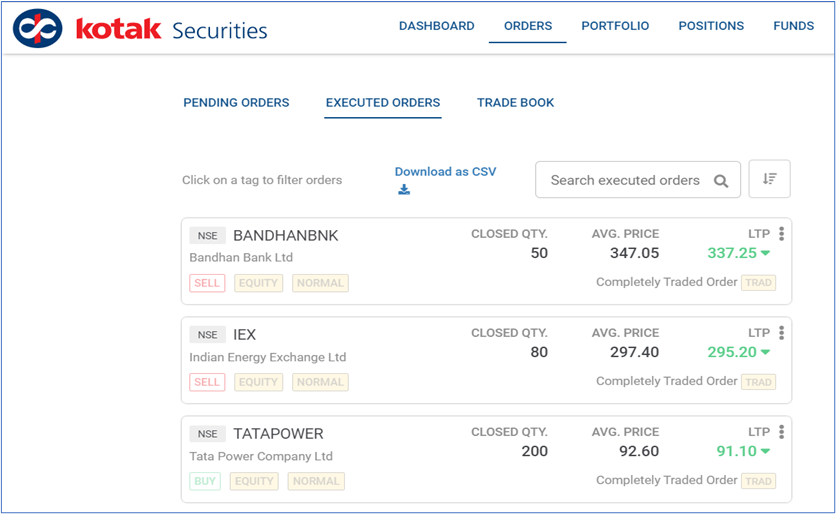

Now to the crucial details, three trades were done this week:

· Exited Bandhan Bank @ 347.05

· Exited IEX @ 297.40

· Entered Tata Power @ 92.60

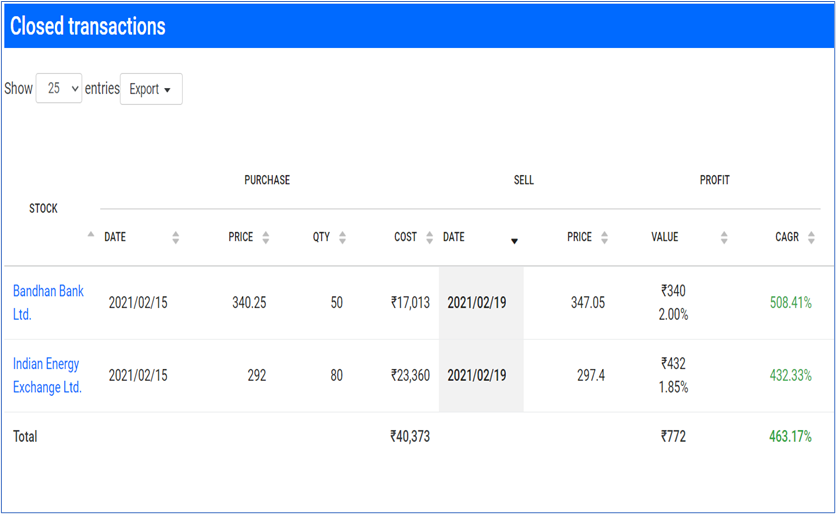

Closed Positions

The closed positions gave us a profit of 1.91% .

New position

Entered Tata Power – A quality stock backed with momentum.

Reflections On Week 1

With the finer details out of the way, its time to reflect on the big picture.

Respect the Environment

In cricket, teams spend a lot of time analyzing the pitch and the weather conditions. Will it be a “dust bowl” helping the spinners or will it be a “green top” helping the quick bowlers. Will it be sunny and pleasant to play or will it be windy with a possibility of rain? The results of this analysis go a long way in shaping the team strategy.

Similarly, investors playing in the stock market should be aware of the prevailing market conditions.

NIFTY 50 – Last week

Professor Sanjay Bakshi wrote this fine piece of advice in late 2008 on expensive markets (refer end of this post for the original article):

“Recent research done by my firm shows just how dangerous it is to remain invested in an expensive market. Since NSE started, every time when Nifty’s Price/Earnings ratio exceeded 22, the average return from Indian equities over the subsequent three years became negative — see accompanying table.

When the next bull market comes, you will find plenty of “experts” who will tell you to buy stocks and to remain invested, and to ignore lessons from history because “this time its different.” You must resolve today that you will ignore such advice. You will avoid investing, and remaining invested in equities when they become historically expensive.

Remember this: History tells us that when markets fall, almost every stock falls too. Sure there are cheap things to buy in a bull market. They are traps. You will avoid them because you know that cheap things will become cheaper after a major market decline.

By ignoring the table and my advice, you will not prove Benjamin Disraeli right when he wrote: “What we learn from history, is that we don’t learn from history.”

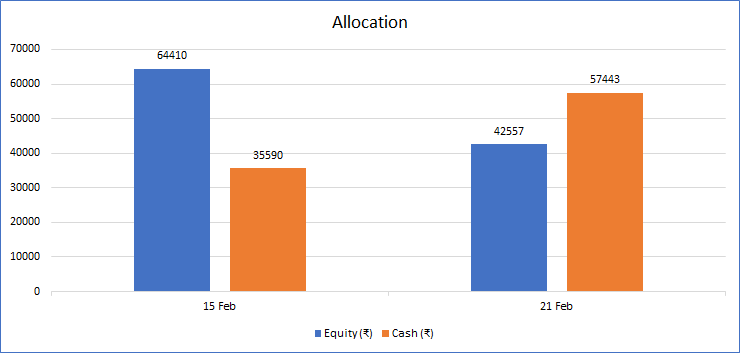

The markets are at peak valuations with Nifty50 at PE of 40.88 and the stretched valuations means that we should be very choosy on the new positions we enter and also on the size of the positions.

Currently we are at almost 60% cash.

Be Ready

Taking the cricket analogy further, good batsmen tend to respect the pitch and when the pitch is difficult to play, they tend to avoid the riskier boundary shots and instead go for the singles and two’s to keep the scoreboard ticking.

Similarly, while investing in these overheated markets, we should not go for risky trades with large payoffs but should try to play it safe with less riskier trades backed with high convictions.

This is what was attempted at acceler8 last week. Two quick exits at decent profits helped to register the first runs on board and the cash flow ticking . With 60% in cash, we have taken only a limited exposure to equities in this overheated market. As and when the opportunity presents itself ,we will be ready to seize the opportunity.

As Benjamin Disraeli said “ Secret of success is to be ready when the opportunity comes”.

Happy investing !

Additional Reading

Prof. Sanjay Bakshi – Keeping yourself out of trouble

Ps: Next issue next Sunday.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr