Issue 022, 25 Jul 2021

Section A – illumin8

Halo effect and Investing

In a time when companies are bending backwards to keep customers happy and trying every trick in the marketing play book to create brand loyalty, mindshare and eventually market share, we have companies on the other end of the spectrum.

Companies where customers brave the weather, lose their sleep and sometimes even get hit by the cops – for what ? To buy the latest product from the company on the first day.

Don’t take my word for it, check out this video.

What are we talking about? Halo Effect.

You felt attracted to a product from a brand and ended up exploring more products from the same brand

You hear a company being called the next HDFC by media and analysts, you immediately develop a sense of respect for the company

You find likeable, tall, and handsome CEOs being able to pull off M & A deals more easily

You hear phrases like expansion, forward integration in the news and you immediately find investors are expecting growth and increase in stock prices.

In all these cases what you experienced is called a “Halo Effect”.

“But there’s plenty of evidence to suggest that height-particularly in men-does trigger a certain set of very positive unconscious associations. I polled about half of the companies on the Fortune 500 list-the list of the largest corporations in the United States-asking each company questions about its CEO.

Overwhelmingly, the heads of big companies are, as I’m sure comes as no surprise to anyone, white men, which undoubtedly reflects some kind of implicit bias. But they are also almost all tall: in my sample, I found that on average, male CEOs were just a shade under six feet tall.”

–Malcolm Gladwell in his book Blink on the general positive bias towards tall men as CEO’s

Our minds often tend to form impression about people based on their personality. We have little knowledge about their background, character, education, interests etc. however, we confidently evaluate the person in all dimensions based on the single trait.

Here is a video that clearly explains how people make wrong judgements based on personality.

Halo effect is a cognitive bias in which a single trait of a person or a thing influences our mind and affects how we see the full picture.

“If people are failing, they look inept. If people are succeeding, they look strong and good and competent. That’s the ‘halo effect.’ Your first impression of a thing sets up your subsequent beliefs. If the company looks inept to you, you may assume everything else they do is inept.”

–Daniel Kahneman

Halo effect does not limit itself to products or brands and extends across all aspects of our day or day lives, be it relationships, work, school, places , products or even celebrities…. the list is endless. Halo Effect can work to bring about positive or negative influences.

Empirical evidence of Halo effect

The empirical evidence of Halo effect was provided by Edward Thorndike, an American psychologist. who wrote about it in his 1920 paper ‘A Constant Error in Psychological Ratings‘.

“In a study made in 1915 of employees of two large industrial corporations, It appeared that the estimates of the same man in a number of different traits such as intelligence, industry, technical skill, reliability, etc., etc., were very highly correlated and very evenly correlated. It consequently appeared probable that those giving the ratings were unable to analyze out these different aspects of the person’s nature and achievement and rate each in independence of the others. Their ratings were apparently affected by a marked tendency to think of the person in general as rather good or rather inferior and to color the judgments of the qualities by this general feeling.”

Halo Effect, Business and Investing

In the corporate world, what could be a better example of Halo effect than Apple Inc.

Apple has been adjudged as world’s most innovative companies (BCG’s list of 50 serial innovators for 2020). Apple’s products (iPod, iPhone, iPad, Mac, Watch) revolutionized the market space.

If you thought only the company had an aura around it, you could not have been farther from the truth.

Its legendary founder Steve Jobs needs little introduction. He is a source of inspiration for technology professionals, designers, business owners and his charisma added to the halo effect of the company. Take a moment to check out how he passionately introduced Mac (incidentally in many corporates and B-Schools, folks are asked to watch this video to understand about good presentation skills).

Steve Jobs introducing MacBook Air

Here is a fine article by Al Ries (incidentally my favorite author on Marketing from my MBA days- His 22 immutable laws of Marketing is a must read). He eloquently talks about how companies like Apple, Fedex successfully create a halo effect around their brand.

Halo Effect and Investor

As an investor, many a times we unknowingly fall a prey to the halo effect. Here are a few points each investor should keep in mind –

Never carry your impression of one aspect of a stock or company to every other area or aspect about that company.

Do not follow the herd mentality and consume easily available pieces of information and use them as a short cut for decision making based on prior experience.

Do not make your judgements about a company based on a single aspect of a business. E.g., financial report, financial ratios, quality of management, nature of product etc.

Do not get carried away by news on recent wins, improved sales, increased profits while making investment decisions. Such judgements prove to be irrational and often lead to wrong decision making.

Evaluate a business holistically considering critical parameters such as credibility of management, feasibility of business model, business moat, company valuation, regulatory implications etc.

Final thoughts

Investing is still done by humans and not robots. Humans being humans tend to have emotions. The emotions of fear and greed are the primary drivers of market inefficiency. These emotions causes pain and losses to the investor.

Add to this a set of behavioral biases. What we then have is a potent mix of forces detrimental to investor returns. Halo Effect is one such behavioral bias that is wired in our brains and influences our opinions and choices in daily lives.

Investors are well served if they remember these lines

“If you select companies on the basis of outcomes—whether success or failure—and then gather data that are biased by those outcomes, you’ll never know what drives performance. You’ll only know how high performers or low performers are described.”

Philip M. Rosenzweig’s The Halo Effect: … and the Eight Other Business Delusions That Deceive Managers”

Section B – acceler8

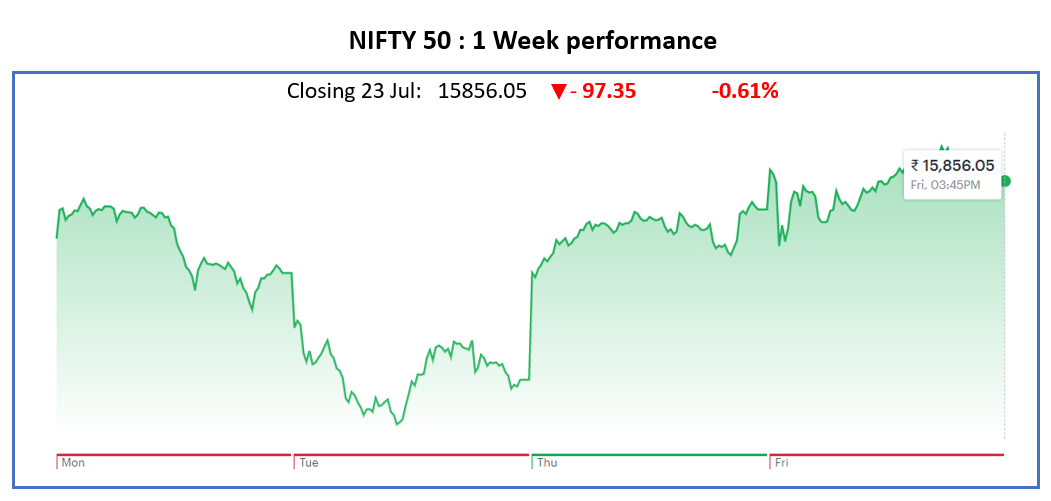

Nifty50 Last Week

acceler8 Portfolio NAV

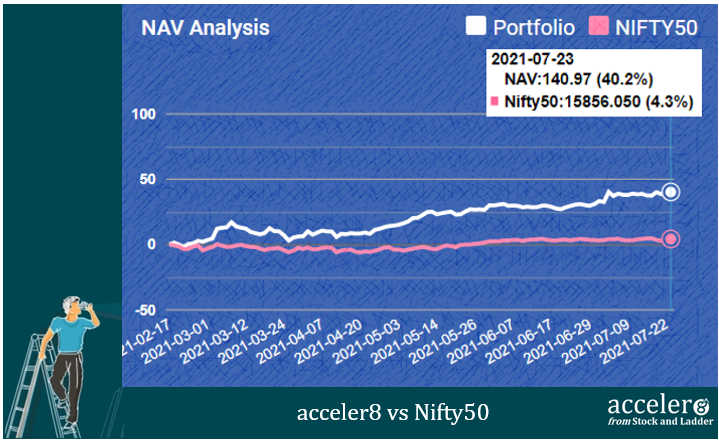

#acceler8 continues its strong performance and the portfolio has +35% outperformance against NIFTY 50.

The portfolio performance since inception has been 120% CAGR with a 3 month return of 29.3% return. The YTD % return has been 31.88% against the NIFTY 50 performance of 7.93.

These are excellent numbers which almost sounds too good to believe.

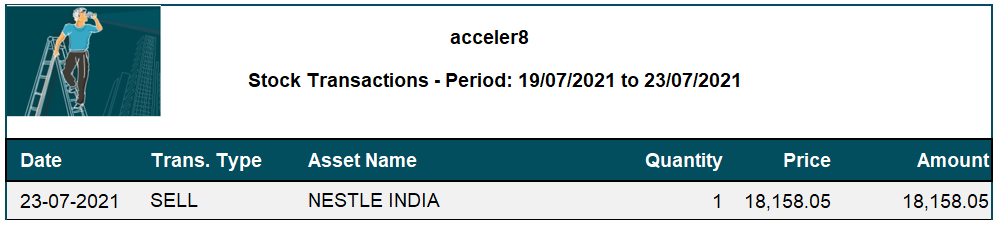

Trades done for the week

This week we exited Nestle, our 15th consecutive +20% return.

Nestle slogan reads Good food, Good life. For us it also meant good profits. We closed at 5+ % absolute returns and 30+ % CAGR.

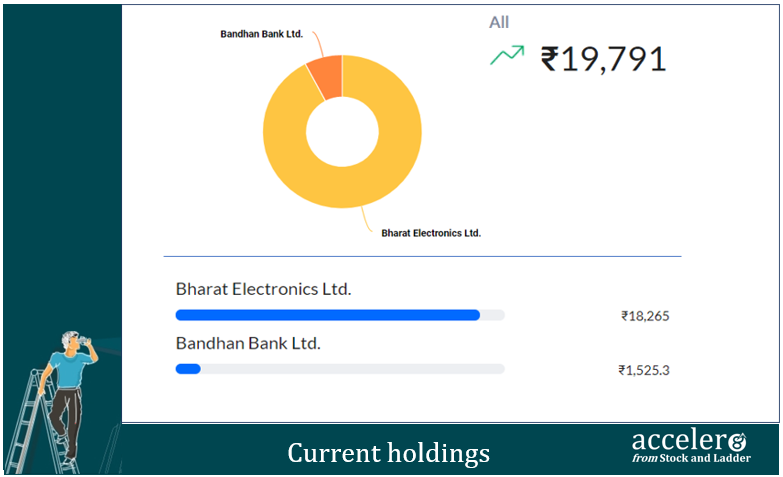

Current position

We are at 80% cash reflecting the high valuations.

We will look around for opportunities and will only bite the bullet when a clear opportunity arises. No trades for trade sake.

Happy investing !

Until next week, take care and stay safe.

PS : Hope you have joined the Stock and Ladder Telegram channel. If not please subscribe using the access code link mailed to you.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr