Learnings from actual trades

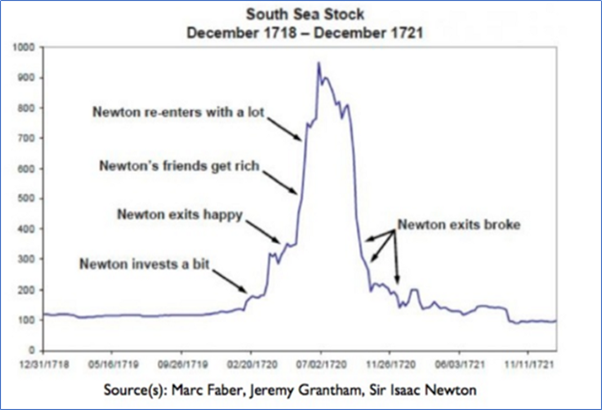

“I can calculate the movement of stars, but not the madness of men”

– Sir Isaac Newton

It turns out that when it came to the world of stock markets, Newton was not so much a genius as he was in the world of science. His (mis) adventures in the market are famous and how he lost a fortune in the South Sea bubble is part of financial folklore.

Then why talk about Newton here?

His discovery of the laws of motion gave us investor one of the biggest gifts– the concept of “Momentum”. Momentum basically tells us that things in motion continues to be in motion and things at rest remains at rest.

Momentum incidentally has been referred to as a premier “market anomaly” by none other than Eugene Fama, the father of modern portfolio theory and study after study has shown that momentum as a factor outperforms Value, Quality or any other factor when it comes to portfolio performance.

Fans of Asterix comics will know how Getafix gives the ordinary Gaulish warriors superhuman strength by brewing his magic portion. Similarly, I believe that momentum is a magic portion which can do wonders and add sparkle to any portfolio.

So much so that I truly believe “Momentum” should be referred to as the ninth wonder of the world. (Incidentally Compounding is often referred to as the 8th wonder of the world by investors)

I gradually became a fan of momentum investing and adopted it for a part of my portfolio. The results were very encouraging to the say the least. Overtime, I have fine-tuned the strategy and I continue to refine it as I incorporate my learnings back to my investing process, refining it as Mr. Market teaches newer lessons.

The current form which I call, Bluechip Momentum Investing tries to harness the power of three distinct but equally powerful investing strategies to generate investing ideas for short to medium term horizon.

The results speak for itself but I was a little surprised about the reaction I got when I spoke about this concept of “Momentum” to my friends. What I found out was that there was lack of sufficient clarity on the concept of momentum strategy.

Origin of the idea

Warren Buffet when quizzed about Peter Lynch’s wide diversification strategy put the point eloquently “I’ve said in investing, in the past, there’s more than one way to get to heaven”.

As I looked around in general, I found few investors to be tightly wedded to their own tag of a “long term investor” or “value investor” that they would not even entertain a meaningful conversation on momentum strategy.

That’s when the idea of acceler8 – Portfolio Learning Service (PLS) was born. With this service, I intend to spread the word on the magic of momentum. I want ordinary investors like you and me to harness the power of momentum in our investing.

As they say proof of the pudding is in the eating. On the same lines, am convinced for an investor too seeing is believing and that’s when the idea hit me to employ the momentum strategy and share the learnings with the readers.

About Portfolio Learning Service (PLS)

This is a “Follow my Portfolio” type of service with a key difference. I will be sharing my ACTUAL portfolio / trade details and not just some MASKED tabular data or excel spreadsheets with data in percentage terms.

PLS = Trade Details + Investing lessons

As part of this service, I will be sharing my trade book and my analysis, lessons and insights from my investing journey.

How will it benefit you?

1. Get Access to Actual trades:

The stocks which are included in the Bluechip momentum portfolio are carefully selected after subjecting them to a proprietary set of qualitative and quantitative criteria. Only those stocks which are exhibiting some form of economic moat / leadership position and which we often loosely call as “quality” are included.

These are the ones which I am happy to hold forever (ok, two to three years) if the markets were to close suddenly.

2. Continuous Learning: Most importantly, this is an information service and I think the biggest benefit will be the lessons from this money experiment.

“Continuous learning is the minimum requirement for success in any field”

– Brian Tracy

“Spend each day trying to be a little wiser than you were when you woke up”

– Charlie Munger

Mr. Market is a willing teacher as long as you are a willing student. Every day and every trade in the stock market has an investing lesson in it.

Some lessons are obvious and some are not so obvious. In some cases the lessons and insights are hiding behind the data, numbers and even emotions of the investor. This requires a conscious and concentrated effort to study the trades and transform information into insight.

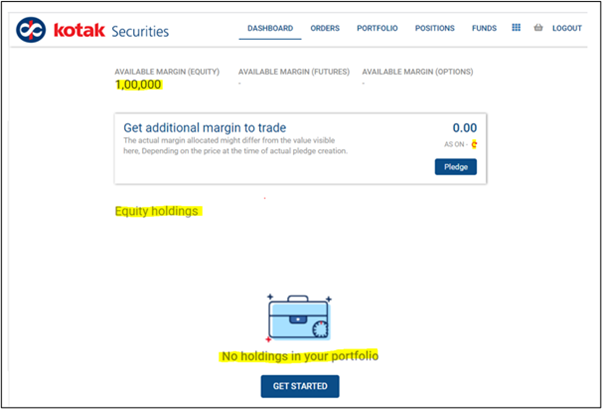

Towards this end, a separate Demat account with a corpus of ₹ 1 Lakh has been opened.

Ground rules for acceler8 PLS

A separate Demat A/c is opened exclusively for tracking this portfolio- acceler8.

A sum of 100,000 (one lakh rupees) will be the initial corpus.

The trade details will be shared after business hours on the same day.

This is not a recommendation or portfolio advisory service to buy / sell any securities but an information and knowledge sharing premium service for subscribing members.

The key objective of the portfolio is to generate returns in excess of the benchmark (Nifty50) net of charges. Performance data will be inclusive of taxes and brokerages.

Every trade is done with a horizon of less than a year.

While there are no restrictions on the number of stocks to be held in the portfolio, as a philosophy, a concentrated investing strategy of holding a maximum of 8 stocks.

The analysis of the trade, if any, will be done post facto after closing the position. While taking a new position only the basic security details may be provided.

First Trades

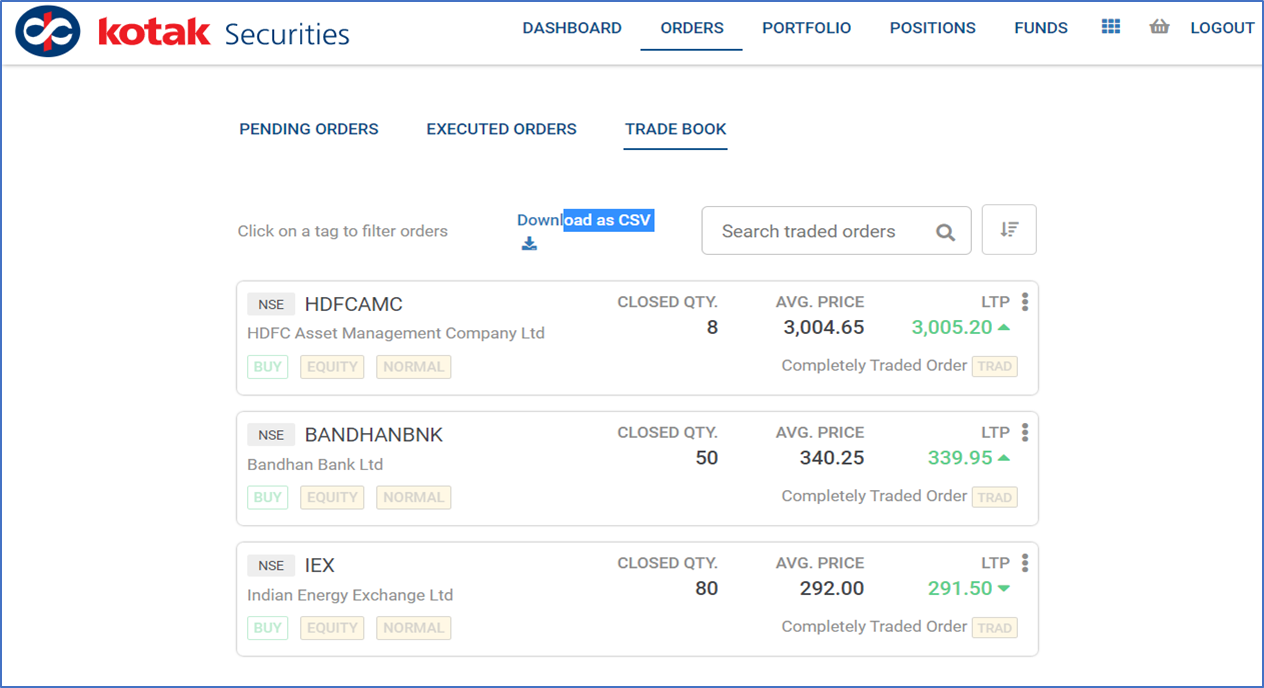

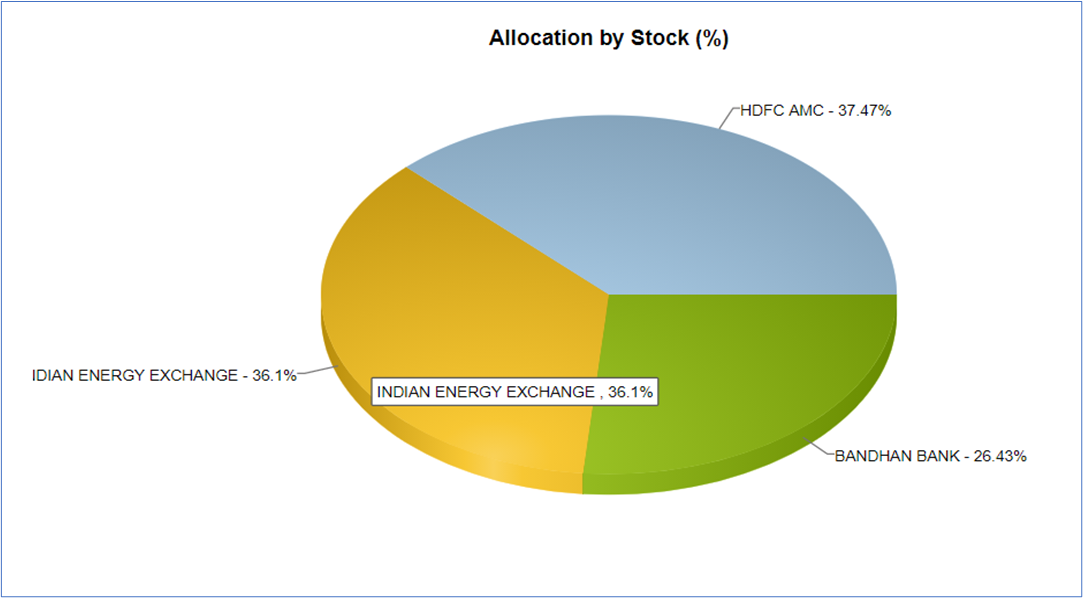

As they say a journey of a thousand miles begins with a single step. Today, Feb 15th , the first steps for the actual accler8 portfolio was taken and a set of three trades were done . A sum of 64,410 was deployed in three stocks and the balance of 35,590 is held in cash account.

Holding As on Date (15 Feb, 2021)

In the coming days we will deploy the rest.

Final thoughts

When there is actual money involved, you have what they call as skin in the game. I am fully aware that sharing the actual trades is a double- edged sword and there is also a huge reputation risk involved.

There will be challenges. There will be mistakes. There will be doubters. But then as in life in general and investing in particular, nothing worth having comes easy.

So please be rest assured, I will be trying my absolute best deliver maximum value to acceler8 subscribers.

Keep learning, Happy investing!

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr