Issue 019, 04 Jul 2021

Section A – Illumin8

Thinking is the hardest work there is, which is probably the reason why so few engage in it.

Henry Ford

In a world drowned in data and information, it is surprisingly hard to find meaningful insights. In the world around us, data and data sources have expanded exponentially but the fountainheads for original thinking and insights seem to run dry.

For an investor, this is even more pertinent as the lack of it confirms the herd mentality (or confirmation bias) and prevents from profit taking on contrarian positions. In investing, one of the key traits I find among successful investors is – (original) THINKING.

Let me try to explain this better with a few examples from Warren Buffett – one of the greatest capitalist / investor / businessman & THINKER.

Warren Buffet and financial derivatives

Buffett in 2002

Buffett spoke about how destructive financial derivates are and compared them to weapons of mass destruction.

Charlie and I believe Berkshire should be a fortress of financial strength – for the sake of our owners, creditors, policyholders and employees.

We try to be alert to any sort of mega catastrophe risk, and that posture may make us unduly apprehensive about the burgeoning quantities of long-term derivatives contracts and the massive amount of uncollateralized receivables that are growing alongside.

In our view, however, derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.

Buffett in 2008

Here Buffett admits to be a part to 251 derivative contracts

Considering the ruin I’ve pictured, you may wonder why Berkshire is a party to 251 derivatives contracts (other than those used for operational purposes at MidAmerican and the few left over at Gen Re).

The answer is simple: I believe each contract we own was mispriced at inception, sometimes dramatically so. I both initiated these positions and monitor them, a set of responsibilities consistent with my belief that the CEO of any large financial organization must be the Chief Risk Officer as well.

If we lose money on our derivatives, it will be my fault.

Our derivatives dealings require our counterparties to make payments to us when contracts are initiated. Berkshire therefore always holds the money, which leaves us assuming no meaningful counterparty risk.

As of year end, the payments made to us less losses we have paid – our derivatives “float,” so to speak – totaled $8.1 billion. This float is similar to insurance float: If we break even on an underlying transaction, we will have enjoyed the use of free money for a long time.

There seems to be an apparent dichotomy between the 2002 and 2008 letter regarding the use of financial derivatives.

Disdain for Technology Stocks

Famous Wrigley’s chewing gum – 1998

Warren Buffet in the late 90’s while addressing Harvard students, spoke of this disdain for companies which are in a changing business landscape :

Take Wrigley’s chewing gum. I don’t think the Internet is going to change how people are going to chew gum.

Bill probably does. I don’t think it’s going to change the fact that Coke will be the drink of preference and will gain in per capita consumption around the world; I don’t think it will change whether people shave or how they shave.

So we are looking for the very predictable, and you won’t find the very predictable in what Bill does. As a member of society, I applaud what he is doing, but as an investor, I keep a wary eye on it.

Purchase of stake in IBM – 2011

Berkshire revealed in 2011 it bought $10.7 billion worth of common stock in IBM, or 64 million shares at an average price of $170 per share and went on to say that he actually should have done it much before.

He gives a lot of credit to former CEO Lou Gerstner, and wishes he’d bought the stock back when Gerstner was running the company. “It was something I should have spotted years earlier.” He decided to start buying this year after reading the company’s 2010 annual report.

Buffett typically shies away from technology stocks because he often doesn’t “understand” what they do, but told us he’d been “hit between the eyes” by how the company finds and keeps clients.

“It’s a company that helps IT departments do their job better. It is a big deal for a big company to change auditors, change law firms,” or change IT support. “There is a lot of continuity to it.”

Fast forward 10 years- Stakes in Apple and Amazon

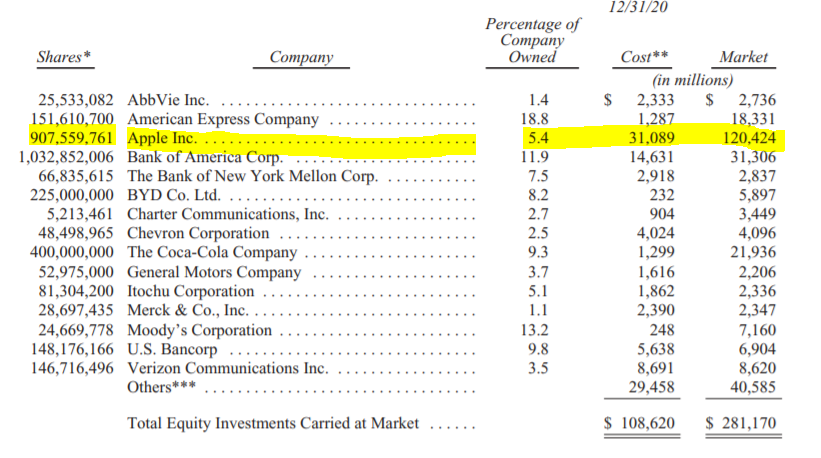

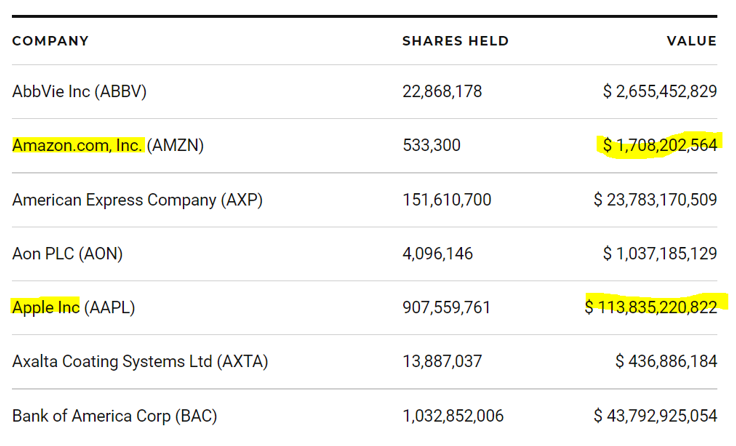

Now fast forward 10 years and Warren Buffett has 42% of his portfolio (USD 120 billion) only in a single technology stock – Apple. Incidentally Berkshire Hathaway also own 1 billion USD worth of Amazon stocks.

Circa 2021, one of the largest holdings of Berkshire Hathway, in terms of Value is Apple – 120 Billion USD or 42% of his overall portfolio

For a good account of his gains on Apple read this : Buffett’s 100 Billion Apple Jackpot

So much so for disdain of technology.

For the latest holdings of Berkshire Hathaway, please check here.

I am sure comparing Apple and Wrigley’s is like comparing chalk and cheese or Day and night. They can’t be any more different. Then what does this mean for common investors like us.

I am sure there are many who have avoided financial derivatives going literally by what Buffett said. Similarly, for many of the old timers who are not that technology savvy they could immediately relate to the Wrigley’s analogy and avoided the technology stocks like plague.

Buffett and Gold

Gold mean, if you own an ounce of gold now and, you know, you caress it for the next hundred years, you’ll have an ounce of gold a hundred years from now.

“[Gold] gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head. ”

Come 2019- & Buffett the famously gold-adverse Warren Buffett’s Berkshire Hathaway had invested in major gold company Barrick Gold (NYSE: GOLD) (TSX: ABX)

Final Thoughts

What does this mean for common investor ?

For want of a better word: don’t be a blind bhakt – in both life and in investing.

Even if great investors like Buffett say something, please ask the hard questions – not for anybody else but for yourself

Do not outsource “thinking”- keep it inhouse with yourself

In God we trust, every one else must bring data

In the end, its your hard-earned money, no one will take care of it as much as yourself

I leave it to the Master to answer in his own words:

In the end, it all goes back to Aesop… a bird in the hand is worth two in the bush…

And when we buy Amazon, we try and figure out… whether there’s three or four or five in the bush and how long it’ll take to get to the bush, how certain he is that he’s going to get to the bush, you know, and then who else is going to come and try and take the bush away…the basic equation is that of Aesop. And your success in investing depends on how well you were able to figure out how certain that bush is, how far away it is, and what the worst case is, instead of two birds being there, and only one being there, and the possibilities of four or five or ten or 20 being there.”

To find out whether there are two, three or more birds in the bush, first you must start THINKING.

Section B – acceler8

NIFTY 50 Last Week

acceler8 Portfolio NAV

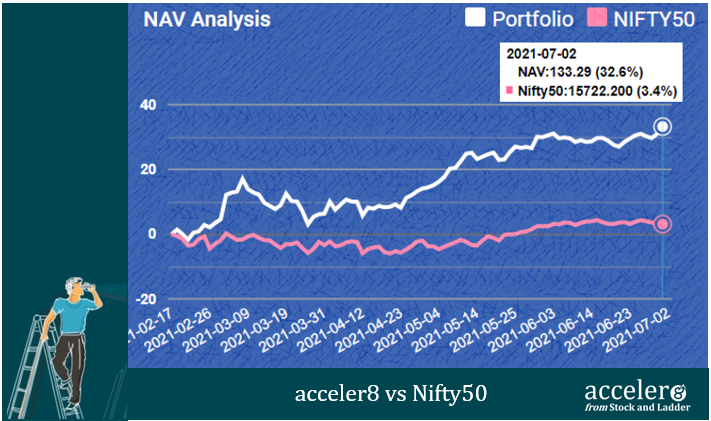

As on 2 Jul 2021, the NAV of acceler8 portfolio is 133.29 (+32.6%) and has outperformed the benchmark Nifty50 by a significant margin since inception (+29.2%).

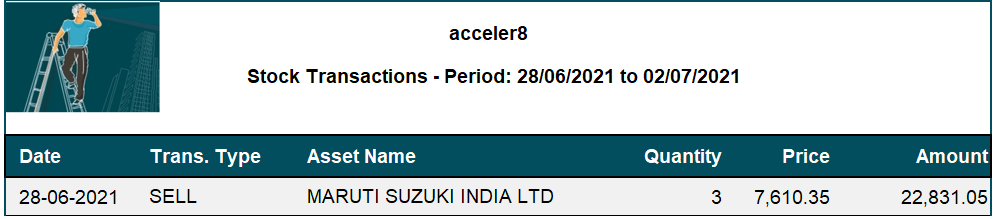

Trades done for the week

The following trades were done this week.

We closed our position in Maruti with a 10.34% absolute gain and a CAGR of 54.95% in close to 3 months. This is the 15th consecutive positive trade in acceler8.

Hoping for more.

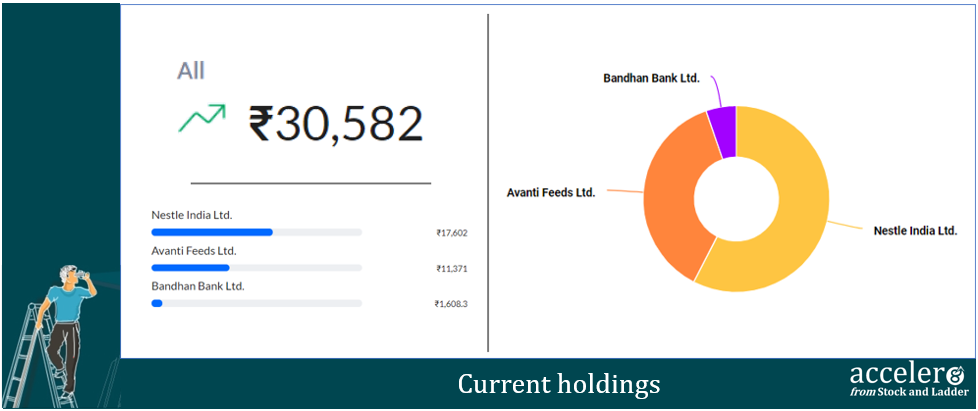

Current Position

As on 02 Jul, the consolidated value of current holdings is at ₹30,582 with around 72% in cash.

Section C – Stock Screeners

Editors Note : We received multiple queries regarding Momentum 20-20. We will be publishing a separate post this week on this.

For now please consider this as a high quality momentum watchlist.

Momentum 20-20 Screener

Momentum 20-20 portfolio had 6 stocks :

1. Grindwell Norton

2. Tata Elxsi

3. Supreme Petrochem Ltd

4. Thyrocare Technologies Ltd

5. Hindustan Unilever Ltd

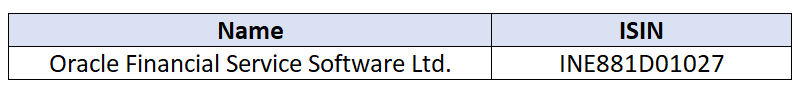

6. Oracle Financial Service Software Ltd.

Rebalancing for this week

1 Entry and 1 Exit

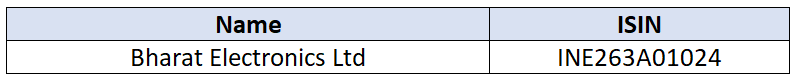

Entry

Exit

Revised Portfolio

1. Grindwell Norton

2. Tata Elxsi

3. Supreme Petrochem Ltd

4. Thyrocare Technologies Ltd

5. Hindustan Unilever Ltd

6. Bharat Electronics Ltd

Best books for investing beginners

Over the last two decades, I have read many books, followed the book recommendations of great investors and gone through the top books list from reputed publications. Based on these, I have applied a G.R.E.A.T formula too to arrive at the best books every budding investor must read. G- Generic, R- Readable, E- Exciting, A- Accessible T- Timeless.

Check out the books here.

Until next week, stay safe and take care.

Happy Investing!

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr