Issue 029, 19 Sep 2021

Editors Note

Dear Subscribers,

We had written about strategies, screeners, superinvestors in the past editions. This week we have attempted something new. We have written a detailed educational post on a key concept every Indian equity investor should know. Please let us know your thoughts on this type of content. Please share your thoughts / feedback to superinvestorclub@gmail.com.

One more quick thing.

Thank you for the good response last week for the extension offer. The offer of buying acceler8 at Rs 5000 per year is available till 30 Sep 2021.

So you can buy 1 / 2 / 3 years of subscription in multiples off 5000 (5k, 10k and 15K). We will extend the subscription end date accordingly. In case you buy three years of subscription, you get additional 3 months free.

Section A – illumin8

Grandfathering – What every Indian equity investor should know

“I’m gonna make him an offer he can’t refuse” – Don Vito Corleone

Just like Don Corleone told this epic sentence, our late Finance Minister Mr Arun Jaitley delivered this epic new provision in the 2018 budget :

“I propose to tax such long-term capital gains exceeding Rs1 lakh at the rate of 10% without allowing the benefit of any indexation. However, all gains up to 31 January 2018 will be grandfathered.”

Since 2018, Grandfathering is a term many of us have heard often. In this post we explain in detail on :

What is Grandfathering ?

Origin of the term

Grandfathering in Investing

What is Grandfathering

Grandfathering is a legal provision that allows people /organizations to operate under an old rule that was approved prior to introduction of a new set of rules or regulations.

The provisions of an old rule will apply in certain situations for a limited period of time whereas the new rule will be applicable with effect from a future date. The people or organization that are entitled to continue with the old set of rules are said to have ‘grandfather rights’.

Take a simple example to understand grandfathering better.

There are often news about builders who have to comply with a new set of rules or standards of construction for newly sanctioned projects. However these regulations are exempt for existing buildings / projects that were completed before application of such rule.

Such projects or buildings that are exempt are said to have ‘grandfather rights’ or ‘been grandfathered in’. However, any future renovation or modification will require compliance with the new laws.

Origin of the term “Grandfathering”

The term “Grandfathering” / “Grandfathered” used for legal clauses originated during the American civil war period.

In the late 19th century, some of the US Southern States passed statutes after the Civil War that kept the African-Americans from voting for a century or more. Any African-American who wished to cast their vote had to clear literacy tests, poll taxes, quizzes which made it almost impossible for them to register to vote.

In order to keep African-American from voting and to protect the whites from voting restrictions, the southern states brought in a ruling where white voters whose grandfathers had voted before the end of the Civil War were exempt from taking the tests and paying the taxes under the legacy clause.

The Supreme Court declared the statute unconstitutional, however the term / legal clause “Grandfathering” stayed.

In fact it expanded beyond the legal sphere and today its used in multiple contexts such as investing, real estate, pricing, manufacturing etc.

The term “Grandfathering” has been adapted to refer to legal provisions that allow people or organization to operate under an old rule in specific situations till a certain period of time, though a new set of rules are approved and made effective from a future date.

Grandfathering Rule in India

We make our investment decisions based on the investment options, prevalent rules and tax laws. Many a time the tax component is a critical factor in our investment decisions. However, the changing tax rules may often upset our financial goals and force us to comply with new rules.

It is here that the grandfathering clause comes handy and allows an investor to apply the provisions of an earlier rule that was the premise for a certain decision.

The Union Budget 2018-19

Till the financial year 2017-18, the tax on Long Term Capital Gains (LTCG)1 on equity shares and equity linked mutual funds on which Securities Transaction Tax was paid was exempted U/S 10(38) of Income Tax Act.

With more than 11000 cases of penny stock trading abuse and misuse of the provisions of nil tax on LTCG , incidents of evading taxes, the government had to look at withdrawing capital gains benefit for stocks held for more than one year.

As a step towards this, in the Union Budget 2018-19, Finance Minister Arun Jaitley removed this exemption u/s 10(38).

The Government introduced Section 112A as per which Long Term Capital Gains (LTCG) in excess of Rs 1 lakh on sale of equity shares or units of equity oriented mutual funds are taxable @ 10% with effect from April 1, 2018 without any benefit on indexation.

In order to protect the interests of investors, the government introduced a grandfathering clause to ensure that such tax is prospective in nature. All gains upto 31 Jan 2018 were grandfathered.

This means that if a taxpayer has acquired equity shares or equity oriented mutual funds prior to Jan 31, 2018, all LTCG made on them upto this date will remain tax free for all future years.

The grandfathering clause allowed investors to cope with the sudden change in the law and enjoy the benefits of the earlier rule for a limited time.

Applicability of Grandfathering rule

Section 112A of Income Tax Act is applicable to the long term capital gains arising from the transfer of long-term capital assets. The assets are

a) Equity shares

b) Units of equity oriented fund

c) Units of a business trust

The provisions of the law is applicable from the FY 2018-19 (AY 2019-20).

Any transaction carried out for an equity or equity oriented mutual fund after 01 Apr 2018, resulting in a long term capital gain of Rs 1 lakh would attract a tax of 10%. The law is applicable for both residents and non-resident Indians.

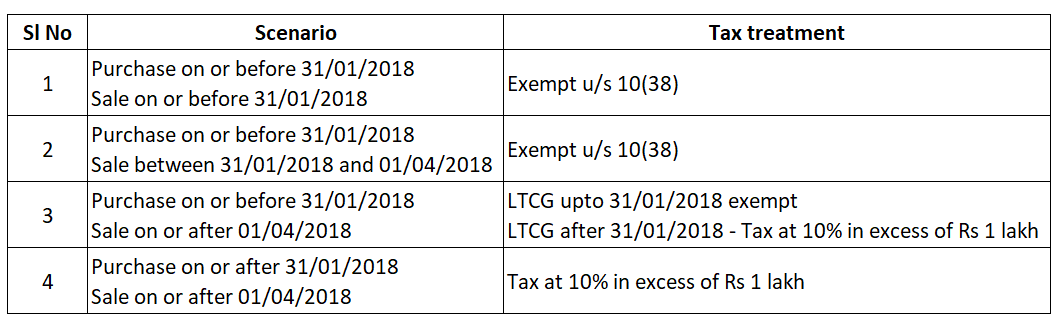

The below table provides the tax implications for Long Term Capital Gains under Sec 112 (A).

An investor holding investments in equity or equity oriented mutual funds as on 31 Jan 2018, is not required to pay tax on entire capital gains. In order to provide the benefit of the earlier rule, the capital gains earned upto 31 Jan 2018 will be grandfathered by applying a formula to arrive at the cost of acquisition.

Arriving at the Cost of acquisition

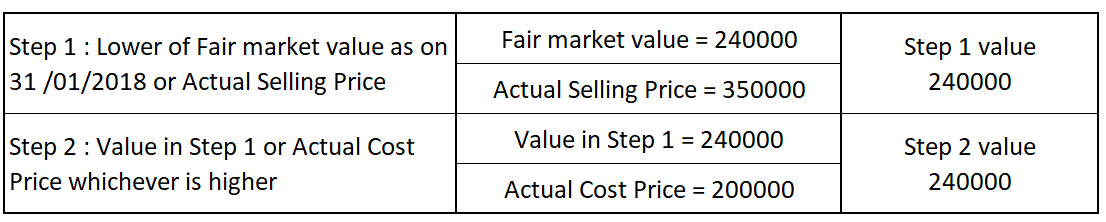

For equity shares and equity oriented mutual funds bought on or before 31 Jan 2018, the cost of acquisition will be calculated as

Step 1) Lower of Fair Market Value (FMV)2 as on 31/01/2018 or the Actual Selling Price

Step 2) The value in Step 1 or Actual Cost Price whichever is higher

How Grandfathering rule works

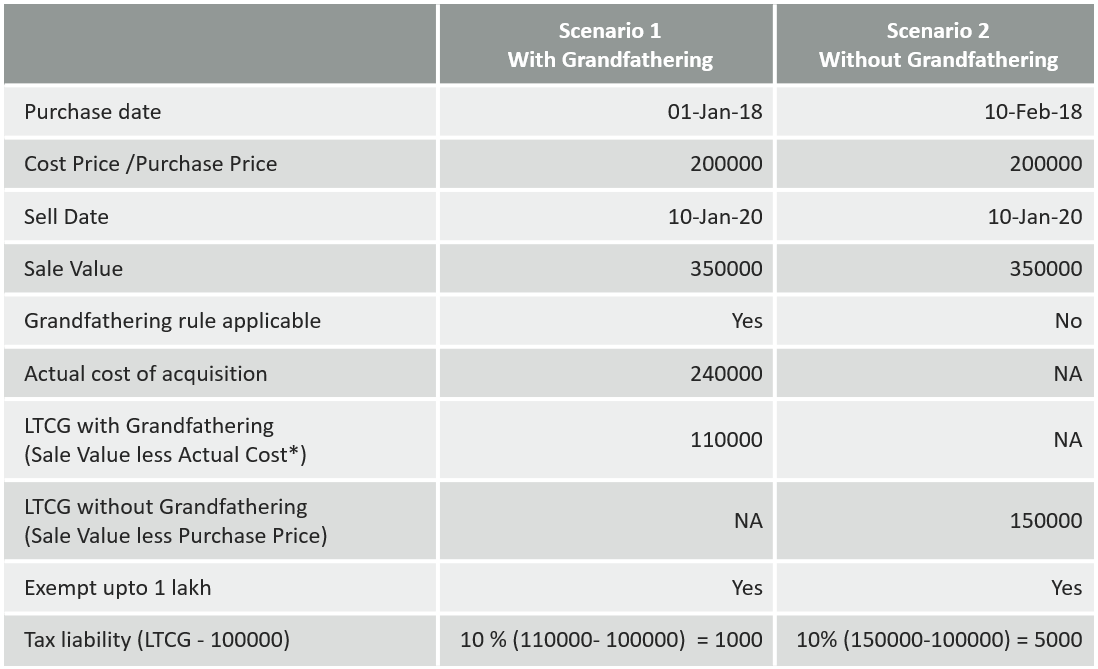

Here is a simple example with two scenarios to help you understand the concept of grandfathering and how it works.

Scenario 1 :

Sunny is an investor in the stock market.

He purchased shares of HDFC Bank for a total consideration of ₹ 200000 on 01-Jan-2018. On the 31st of January 2018, the price of the share is ₹ 240000. He sells the shares at ₹350000 on 10 Jan 2020.

Scenario 2:

Sunny is an investor in the stock market.

He purchased shares of HDFC Bank for a total consideration of ₹ 200000 on 10-Feb-2018. He sells the shares at ₹350000 on 10 Jan 2020.

Scenario 1

Sunny purchased the shares of HDFC Bank on 01-Jan-2018 and has been holding the investment as on 31 Jan 2018. He sold the shares on 10 Jan 2020.

Since the period of holding is more than an year, the investment is subject to long term capital gains or loss.

Since he has been holding the investment as on 31/01/2018, the grandfathering clause as per Sec 112(A) is applicable.

As per grandfathering rule, Sunny need not pay tax on capital gain from purchase date 01-Jan-2018 till 31-Jan-2018. The Capital Gains earned up to 31/01/2018 would be grandfathered.

For this, the cost of acquisition / actual cost is calculated as follows:

The actual cost of acquisition as per the grandfathering clause = Rs 240000

The further calculations to arrive at the tax liability with the grandfathering clause is explained in the table below.

Scenario 2

Sunny purchased the shares of HDFC Bank on 10-Feb-2018. He sold the shares on 10 Jan 2020.

Since the period of holding is more than an year, the investment is subject to long term capital gains or loss.

Since the date of purchase is after 31/01/2018 and sale is after 01/04/2018, grandfathering clause is not applicable and the transaction is subject to LTCG tax @ 10% as per Sec 112 A.

The further calculations to arrive at the tax liability with the grandfathering clause is explained in the table below.

Long Term Capital Gain Tax applicable in Case 1 and Case 2 :

With the grandfathering clause, Sunny pays and LTCG tax of ₹ 1000 as against an LTCG tax of ₹ 5000 without the grandfathering clause.

Note : In the above example, we have taken the case of equity shares . In case of Mutual Funds, the NAV as on the purchase date / sell date will be applicable for calculating the LTCG and Tax.

Applicability of Grandfathering clause in specific scenarios

1) Issue of bonus / rights shares

The provisions for grandfathering will be applicable for bonus /rights shares as long as these are acquired prior to 31 Jan 2018.

2) Long term capital loss

The long term capital loss that may arise from sale of shares upto 31 Mar 2018 are not allowed to be set off against taxable LTCG for the same year. Also this loss cannot be carried forward to next year.

However, the long term capital losses for transfers with effect from 01 Apr 2018 can be set off against long term capital gain and in case of net loss, the same can be carried forward to the next year.

Final Words

The grandfathering clause serves to reduce the tax burden on investors who are already loaded with various costs such as brokerage, securities transaction tax, GST, stamp duty, transfer charges etc.

As an equity investor in the Indian stock market it is imperative that we are very clear with the concept of Grandfathering.

Section B – acceler8

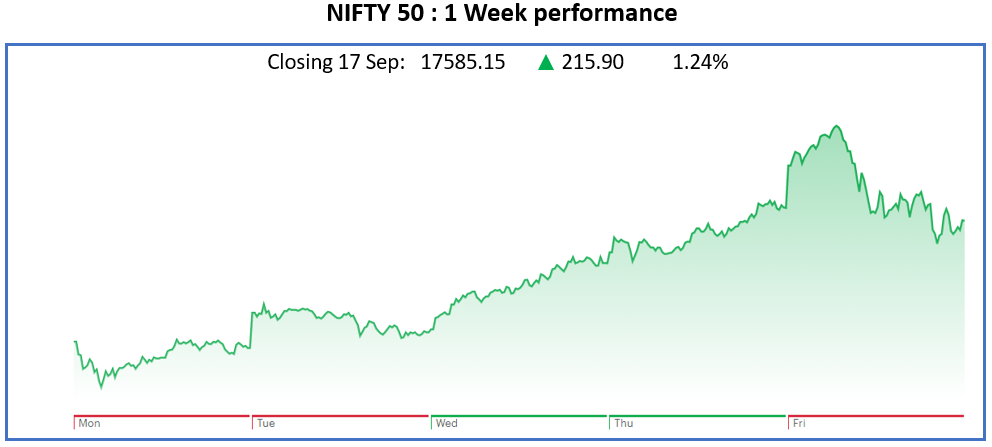

Nifty50 Last Week

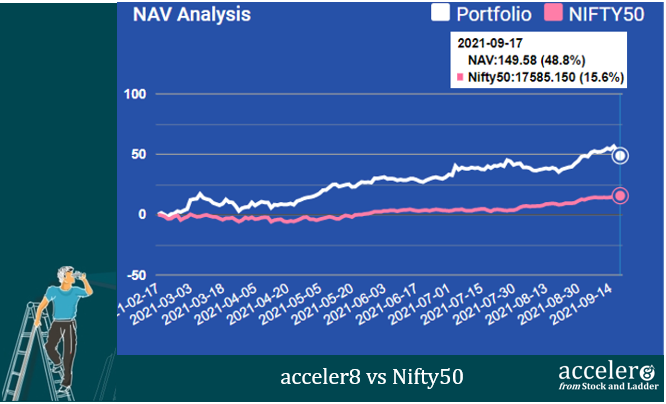

acceler8 Portfolio NAV

#acceler8 continues its strong performance and the portfolio has 33.2 % outperformance against NIFTY 50.

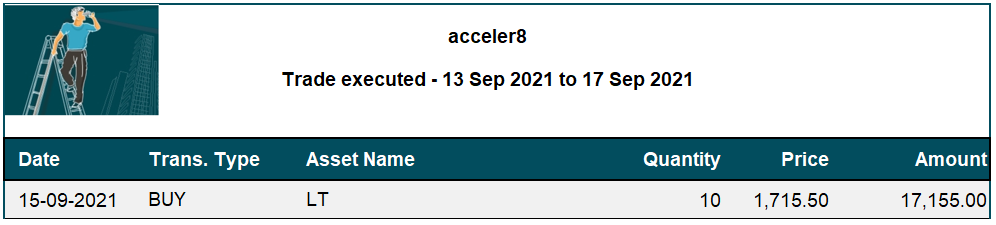

Trades this week

We bought Larsen & Toubro (LT). A company with excellent fundamentals with strong momentum. This is our 20th trade.

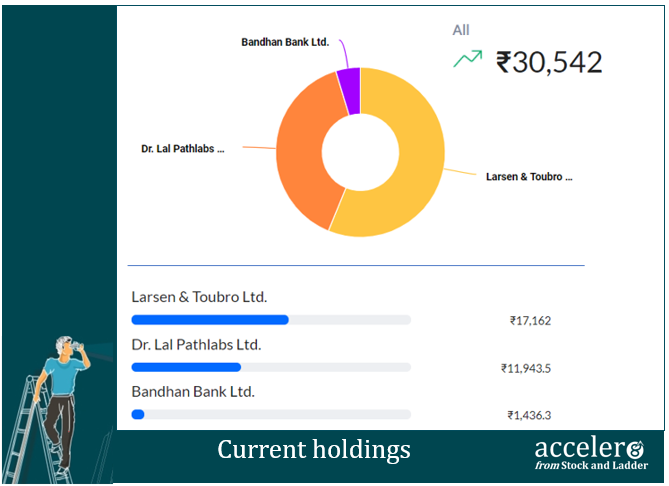

Current position

We are 72% in cash reflecting the high valuations.

Happy investing !

Until next week, take care and stay safe.

Long Term Capital Gain or Loss (shortly referred to as LTCG or LTCL) is the profit or loss on the sale of a capital asset held for a specific period. In equities, a long term capital gain or loss it the profit of loss incurred on sale of the equity after 12 months of purchase. The holding period of each capital asset may vary depending on the nature of the asset.

The Fair Market Value (FMV) of listed securities is the highest price of the security quoted on the stock exchange. In case there was no trading in the security on 31 January 2018, the FMV is the highest price of the security quoted on a date immediately preceding 31 January 2018 when the security had traded on the recognized stock exchange.

In case of units of equity-oriented mutual fund the fair market value is the Net Asset Value of the units on 31 January 2018.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr