Issue 032, 17 Oct 2021

Editors Note :

We are back after a short Dussehra break and rejuvenated for the coming quarter. Hope you all too had a good time.

Now, for those who are wondering what ‘The Eight’ means – It is the collection of eight screeners we had published over the last 32 weeks. Screening is a powerful tool for an investor to get more out of his research.

With more than 5000 stocks listed on the Indian Stock Exchanges, the need to have effective screens to quickly identify and shortlist your stocks based on your criteria cannot be over emphasized.

With acceler8, the icing on the cake has been the backtesting of the screens for the Indian market. In this post, we have listed out all the eight screens we have published till date along with the link to the original post for further reading.

In Part 2 of the post, we will be covering the latest stocks which qualify for each of these eight screens.

PS : This post was conceived as a ready reckoner / summary of the various screens that we had covered in acceler8 till date. In the coming days, we will be covering more screeners.

PPS : Here is the link to all the premium editions of acceler8 newsletter. Do not forget to bookmark this link.

Also look out for the complete list of 19 closed positions in acceler8 portfolio in Section B of this post.

Trust you will find this useful. Happy Investing.

Section A – illumin8

The Eight

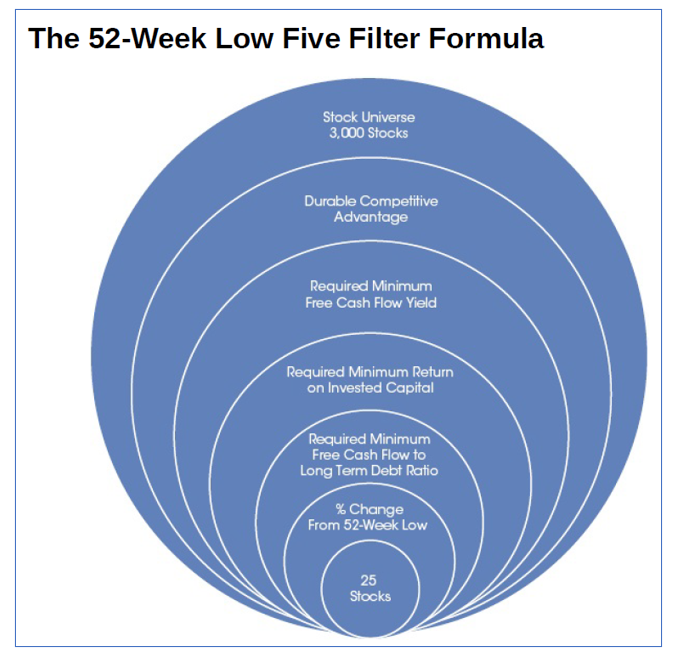

Here is a list of eight screens we have covered till now.

A. Geraldine Weiss Dividend Screen

Original Post : Dividends Don’t Lie

The underlying philosophy is that companies that perform across multiple business cycles have demonstrated the resilience and the ability to survive. Consistent dividend payments is the proof of their superiority and survivability.

Here is the list of criterion / filters a stock must pass to qualify:

1. Must be undervalued as measured by its dividend yield on a historical basis.

2. Must be a growth stock that has raised dividends at a compound annual rate of at least 10% over the past 12 years.

3. Is selling for two times book value or less.

4. Has a P/E ratio of 20-to-1 or below.

5. Has a dividend payout ratio in the 50% area (or less) to ensure dividend safety with room for growth.

6. Debt is 50% or less of total capitalization.

7. Meets all six of our Blue Chip Criteria:

dividend raised five times in the last 12 years,

carries an A rating from S&P,

has at least 5 million shares outstanding,

at least 80 institutional investors hold the stock,

25 uninterrupted years of dividends and earnings improvements in seven of the last 12 years.

As you can see there is an emphasis on quality, long term track record of consistent divided earning, earnings growth while adopting a value investing approach of not paying too much for growth.

B. GMO Quality Screen

Original Post : Quality triumphs Junk

Numerous studies have shown that investing in “quality” companies is highly rewarding to investors.

In one such excellent study by GMO “The Case for Quality- The danger of Junk” the authors compared the performance of high quality stocks versus low quality and found high quality stocks to outperform which is relatively unsurprising.

What is surprising was that investors were regularly willing to overpay for “riskier” stocks while overlooking the less riskier, more profitable, more rewarding and less volatile high quality.

In the study, Quality company meant fulfilling all the three criteria:

Low leverage

High profitability

Low earnings volatility

The authors studied data from 1980 and concluded :

“High quality stocks have always won over longer holding periods. No matter what metric is used to identify quality stocks – leverage, profitability, earnings volatility, or beta – high quality stocks have beaten out low quality stocks”

C. Walter Schloss Value screen

Original Post : Buy them Cheap

Even though Walter Schloss never shared his full portfolio publicly nor did he clearly specify what were his criteria for stock selection. However by analyzing multiple interviews, presentations, lectures and articles we can deduce the key criteria’s:

1. Zero debt

“Never lose money” so “buy cheap” was his cornerstone of his investing philosophy. For this he believed that little or zero debt companies had a better chance of protecting him from incurring losses. In one interview he repeated the phrase “Zero debt” 20 times in one interview. Ponder.

2. Clear Investing universe

He limited his investing universe to his circle of competence.

No Foreign stocks

No Stocks in the finance sector.

Only companies with at least 10 years of business history and financial data

Preferred companies in the manufacturing sector which produced goods.

3. Trading below book value

One valuation metric he used to identify under-valued stocks was the “book value” of the share. He believed that earnings could be volatile but actual physical assets would be difficult to manipulate. He preferred companies trading at a significant discount to its stated book value

4. 52 week low

Another favorite hunting ground was the daily 52 week low list or those hovering close to that. While a 52 week low does not automatically make it a buy , the list he believed was a good starting point.

5. Inside ownership

He preferred companies where the management had significant holdings with a belief that manager owners would keep the shareholders interest in mind in their decisions. He also kept a keen eye on insider transactions of buy and sell.

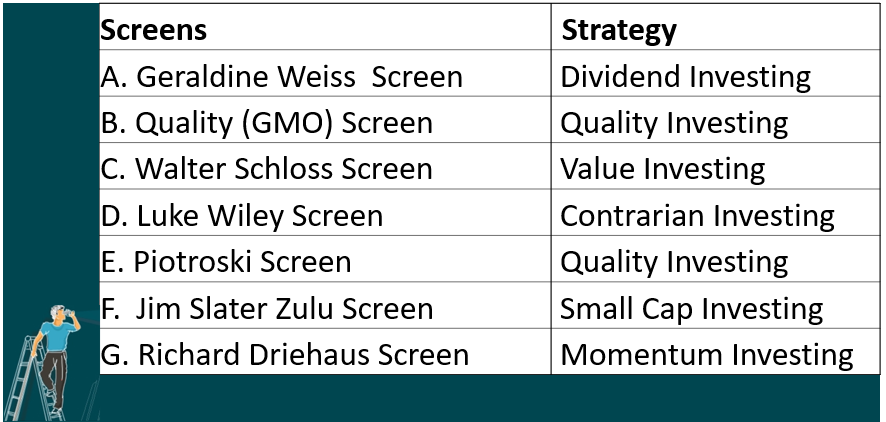

D. Luke Wiley Screen

Original Post : Betting on Comebacks

The below table explains the 5 filters used to screen stocks based on this criteria.

1. Do they have a durable competitive advantage?

In simple words : Does the company has any kind of economic moat ? Is it a company that is hard to compete against either because they operate in a difficult market or because competing with them would require an unreasonably high investment from competition.

2. What is the purchase value of the company?

If someone were to come in and buy everything, would they inherit debt greater than revenue? Would you make more money that you would simply investing in 10-year Treasury bonds?

3. What’s the Return on Invested Capital of the company?

Is it using its money well to create returns or is it taking on bad investments that don’t pay off?

4. Can it pay its debt off quickly?

There are a lot of companies out there that are making a lot of money, but can they, should all revenue activities cease and all debt come due, remain in the black?

5. Finally, is it trading close to its 52-week low?

After the first four filters are applied, this is the most crucial filter which seeks to identify companies trading close their 52-week low which implies they are temporarily fallen outside the investors radar.

E. Piotroski F Screen

Original Post : Piotroski F Score

Piotroski F Score is value obtained between 0 to 9 calculated as part of an accounting-based process of stock selection to identify the financial health of non-finance companies.

Screening criteria inputs :

1. Profitability

1. Net Income – Score 1 if there is positive net income in the current year.

2. Operating Cash Flow – Score 1 if there is positive cashflow from operations in the current year.

3. Return on Assets – Score 1 if the ROA is higher in the current period compared to the previous year.

4. Quality of Earnings – Score 1 if the cash flow from operations exceeds net income before extraordinary items.

2. Leverage, Liquidity and Source of Funds

5. Decrease in leverage – Score 1 if there is a lower ratio of long term debt to in the current period compared value in the previous year .

6. Increase in liquidity – Score 1 if there is a higher current ratio this year compared to the previous year.

7. Absence of Dilution – Score 1 if the Firm did not issue new shares/equity in the preceding year.

3. Operating Efficiency

8. Score 1 if there is a higher gross margin compared to the previous year.

9. Asset Turnover – Score 1 if there is a higher asset turnover ratio year on year (as a measure of productivity).

How to read the score?

A score of 8 or 9 would indicate a strong financial position

0 to 2 would be poor

3 to 7 are the average ones.

F. Jim Slater Zulu Screen

Original Post : Zulu Investing Principles

The Zulu principles is the brainchild of Jim Slater, a British Fund manager. His early foray into investing was writing a column “The capitalist” in London’s Sunday Telegraph. A chartered accountant by profession he honed and fine-tuned his stock picking strategy during his stint as financial journalist which he later called as “The Zulu principles”.

Slater divides his 11 Zulu Principles into categories based on their relative importance:

1) Mandatory

1. A PEG with a relatively low cut-off such as 0.75.

2. A prospective PER of not more than 20. The preferred range for PERs is 10-20 with forecast growth rates of 15-30%.

3. Strong cash flow per share more than EPS, both for the last reported year and for the five-year average.

4. Positive cash or gearing of below 50%, other than in exceptional circumstances (such as massive cash flow per share or impending sales of major assets).

5. High relative strength for the previous twelve months.

6. A competitive advantage, which will usually be evidenced by a high ROCE

and good operating margins.

7. No selling of shares by a cluster of directors.

2) Highly desirable

1. Accelerating EPS, especially if it is a result of activities being cloned.

2. A cluster of directors buying shares.

3. A small market capitalization in the £30m-250m range.

4. A dividend yield.

3) Bonus

1. A low PSR.

2. Something new- New product , New CEO or some trigger / catalyst

G. Richard Driehaus Screen

Original Post : Richard Driehaus

Richard Driehaus is considered to be the father of Momentum investing.

Earnings and Momentum

In plain simple words:

We are looking for earnings growth, earnings acceleration. After all, momentum investing is an acknowledgment that things in motion tend to stay in motion. We say that the most successful companies are those which have been able to demonstrate strong, sustained earnings growth. We look for many different variations of earnings growth.

We look for accelerating sales and earnings. We look for positive earnings surprises. We look for sharp upward earnings revisions. And, finally, we look for a company that is showing very strong, consistent, sustained earnings growth – like a Starbucks which looks very enduring.

But we don’t just look at earnings We have to see how that earnings growth relates to the stock, its group within the market – its sector, and how it relates to other ideas that are out there.

It’s not an absolute criterion. It’s this question: how will this earnings growth, and positive change, impact the stock, especially relative to the market expectations out there? The company could show very strong earnings.

The screening factors :

1) Cash EPS Growth

2) EPS Yearly Growth

3) RSI >50

4) Market Cap

Section B – acceler8

Nifty50 Last Week

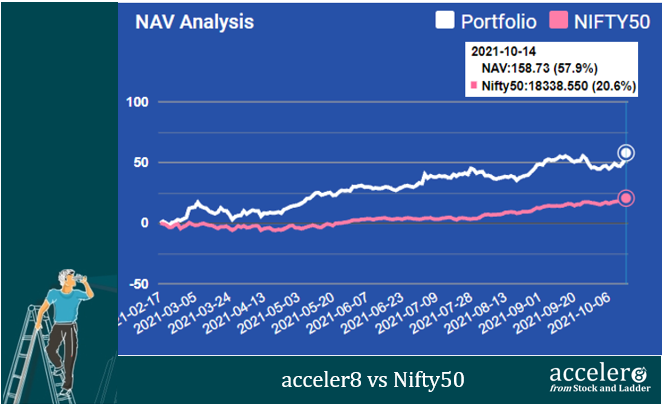

acceler8 Portfolio NAV

#acceler8 continues its strong performance and the portfolio has 37.3 % outperformance against NIFTY 50.

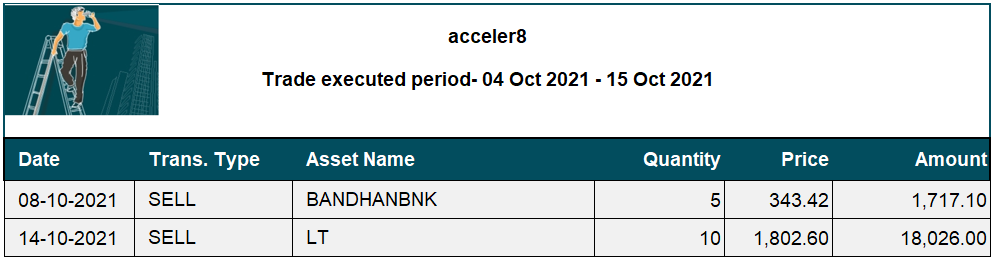

Trades done : 04 Oct – 15 Oct 2021

We have exited from the following stocks :

a) BANDHANBNK @ Rs 343.42.

The fundamentals are intact and the trade has booked at an absolute return of 6.83%. The CAGR is at 22.83%.

b) LT (Larsen & Toubro) @ 1802.60

5.08 % absolute return, 86.51 % CAGR in one month approx.

This marks the 19th consecutive trade with +20% CAGR return.

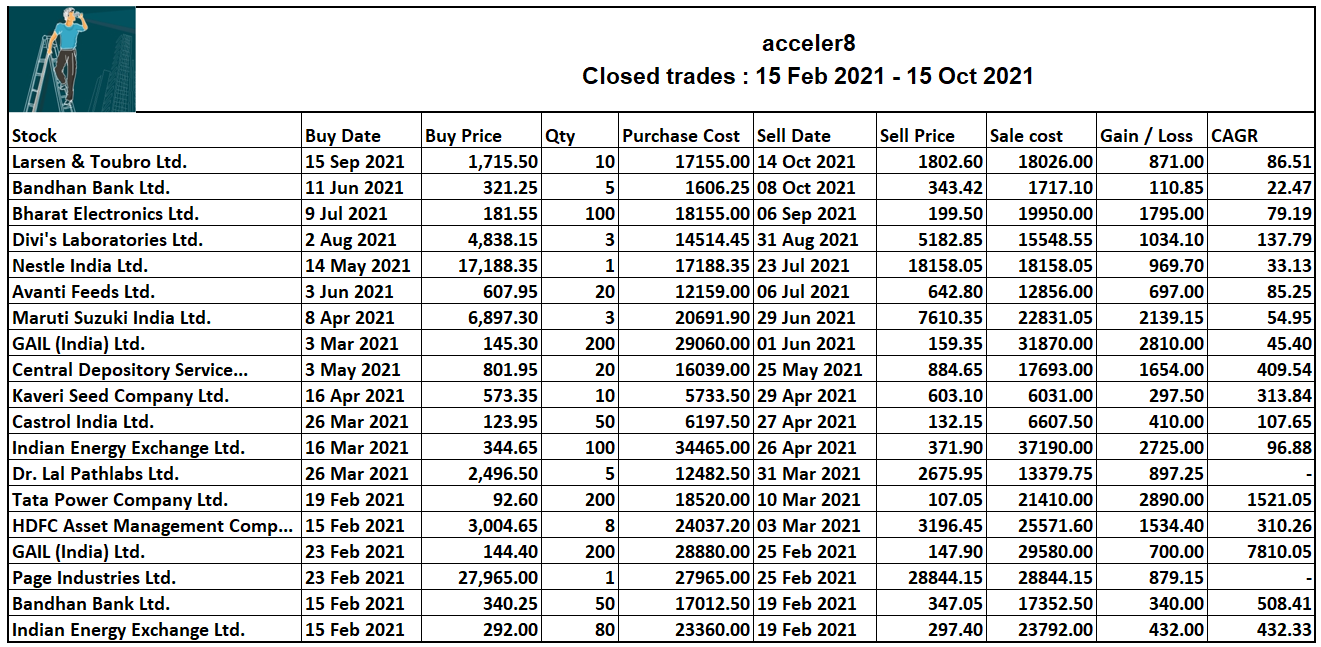

Closed trades till date

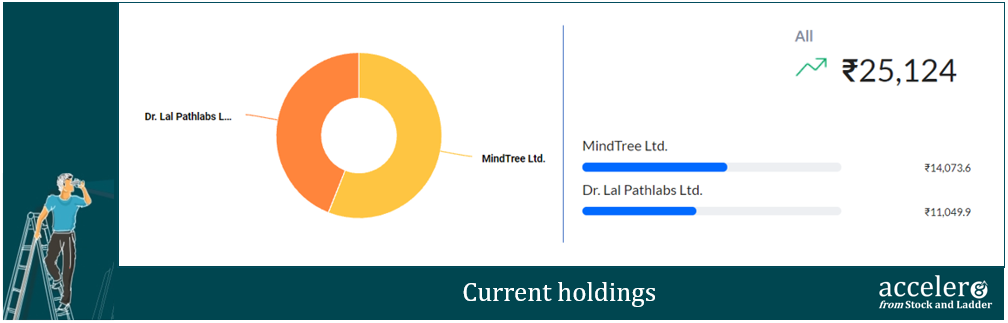

Current position

With market upwards of 60000 we are 77% in cash reflecting the high valuations. Our antennas are up, we will look for any good opportunities and may be take a larger bite of the cherry to use our cash better.

Stay tuned for Part 2 of the post shortly.

Until then, take care and stay safe.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr