Issue 028, 12 Sep 2021

Dear Subscribers

We had published an insightful investing chat with D Muthukrishnan this week. We had published partly in acceler8 and telegram channel.

In this week’s acceler8, we are providing the complete investing chat covering Muthuji’s perspective on achieving investment success and achieving financial independence.

Muthu prefers to call it Financial Independence (FI) rather than Financial Freedom. If only one thing you take away from this chat then let that be the 6 point Step for achieving Financial Independence.

Hope you find it useful in your investing journey. Please also note that with effect from next week, we will be publishing acceler8 issue every Friday. Accordingly the next issue will be published on 17 Sep.

Section A – illumin8

Investing Chat with D Muthukrishnan

“A Single conversation with a wise man is worth a month’s study of books” – Chinese proverb

In 2016, I had published an investing chat with D Muthukrishnan a.k.a. @dmuthuk as the twitter world knows him. A few months back I had re-read the investing chat I had posted on my blog 5 years back.

A lot had happened in the world over the 5 years, the most significant event globally being the COVID 19 pandemic. In India the re-election of our honorable prime minister Narendra Modiji played a significant role in the upward march of Sensex to mount 58K.

With this in my mind a thought flashed across that it would be great if it was possible to revisit this initial interview taken 5 years back and check with Muthuji if anything had changed.

For those of you who know Muthuji, you will agree that Muthuji is intensely private person and very choosy about giving interview. I have been incredibly lucky to have the chance to pick his brains not once but twice. Once in 2016 and the second one now in 2021.

The investing acumen gained over years of study, reading and experience permeated into our conversations.

The conversations touched on many topics ranging from investment strategy followed, why Financial Independence (FI) should be every investor’s key goal, what needs to be done to achieve FI, investing greats who have shaped his investment strategy, Investment book recommendation and much more.

The investing insights from both the chats have been combined and logically grouped to present a holistic picture of a topic.

Part 1 – Investing

A. How I entered the world of Investing and personal finance

When I was studying in college, I was attracted towards the stock market. I hail from a very low-income family and naively thought that the stock market is a quick way to get rich.

I joined a stock broking firm in Madras Stock Exchange (MSE) which gave me an opportunity to read financial newspapers, business magazines and interact with many investors. That kindled my interest to take up a career as a personal financial advisor.

But destiny had a different plan. After the start of National Stock Exchange, many small broking houses had to shut down and I lost my job.

At the same time, in the second half of nineties, the BPO industry in India had started coming up. I got an opening and soon found myself progressing well in my new job.

Because of my innate interest in investing and personal finance, I used to give financial advices to many of my colleagues. They found my inputs very useful and also encouraged me to share more.

This went on for a decade. Though I was getting paid well, various factors including the odd working hours, continuous travel and stringent timelines started to take a toll on my health.

By then I was married and discussed with my wife about pursuing my passion in personal finance and becoming a financial advisor.

Being high savers, by the age 34, we had a house, no loans and also had a corpus worth 10 years of our expenses. Since my wife continued to work (she quit after our son was born 6 years ago), she encouraged me to become a full time advisor.

I took up the CFP (Certified Financial Planner) certification and then started my own practice about 11 years ago.

B. Muthu’s investing strategy

My investment strategy is influenced by Prof. Sanjay Bakshi (his writings on quality), Terry Smith and Nick Train.

Investing Strategy

I define my investment strategy as follows (influenced by Terry Smith):

Buy quality companies

Expect to hold for 10+ years

Try not to overpay

Keep track

Sell rarely

My investment philosophy and strategy which evolved in the beginning of last decade remains unchanged. So, buy good companies, rarely sell them and rest of the time just stay the course remains my investment mantra.

What’s Changed in the last 5 years?

Moving away from Intelligent Fanatics, lending, and leverage business.

Last decade, I was greatly attracted by the concept of intelligent fanatics. Hence had bought two companies, Piramal Enterprises and Thomas Cook, based on the above concept. The concept of intelligent fanatic didn’t come naturally to me.

Subsequently decided to stay the course only with quality investing. Hence sold both these companies. This pandemic has reemphasized the concept that portfolios need to be created to survive bad times.

Since I’ve a focused portfolio, decided to move away from lending businesses and leveraged entities.

C. Traits of Businesses preferred

B2C business

Catering to the wants and needs of the society

Likely to keep doing the same thing for next 10 to 20 years

Subject to less disruption

Capable of evolving through disruption

D. Investing books recommendation

Part 2 – Achieving Investment Success & Financial Independence

Bill Gates said, “If you are born poor it’s not your mistake, but if you die poor, it’s your mistake”.

Financial Independence (same as Financial Freedom) is the Goal every individual must aspire for

A. Why should we aspire for Financial Independence (FI)?

Allows you to do what you like.

Allows you to avoid doing what you hate &

Gives you control over your “TIME” to pursue your interests.

Real financial freedom is not in what we are able to buy. It is in what control we have over our time.

B. What to do for attaining FI?

Save Aggressively.

Live below your means

Combine both: High Savings + Living below your means = Large Investment Surplus.

Put it differently, avoid doing this and you may save yourself a lot of financial troubles and possibly put you firmly in the path of financial Independence:

Taking on huge debt (loans)

Leading a flashy lifestyle

Income is for a limited period. Expenses are forever. Always remember this. You don’t have to take extra ordinary risk to be attain financial freedom. Even an average or above average returns will deliver extraordinary results for your portfolio.

C. Getting rich slowly

Getting rich slowly is the only way to get rich for most of us. If this is clearly seen, we would make less mistakes. We would not be stupid. Surprisingly then you would start getting rich at a faster pace. Slow is fast. Slow is the way.

If the desire of quick money goes away, we would cease to be dumb.

D. Need for right temperament

Along with an investment strategy one should have the right “temperament” or investing behavior.

Right temperament is learnable. Legends like Buffett and Munger has shown ways to become a better investor. But this involves lot of inner work. With focus and practice, right behavior can be cultivated.

E. Achieving Investment Success

Good investment advice is repetitive and boring. There is nothing exciting about it.

My six-point advice for investment success

Save more

Avoid or minimize debts

Be willing to get rich slowly,

Don’t chase performance,

Be a continuous learner and

Lastly, remember that investing is about 10% knowledge and 90% about your behavior.

The COVID 19 situation has also highlighted the fact that investors should build their portfolios to survive shocks and black swan events like COVID-19.

Lastly, I will restate what John Bogle said:

“Stay the course. No matter what happens, stick to your program. I’ve said ‘stay the course’ a thousand times, and I meant it every time. It is the most important single piece of investment wisdom I can give to you.”

Final Words

It’s very tragic that some of them in our known circle have suffered immeasurably in the last few years due to COVID -19. Some have lost loved ones, some have lost money, some have become unemployed.

There is no tailor-made advice for them. We need to understand their unique life situation and handhold them. Helping them both financially and non-financially is the way to go.

Dear Muthuji, as usual it was an absolute pleasure to know your thoughts. I am once again thankful and grateful to you for agreeing to do this investing chat with me. I have learnt a lot over the years in my interactions with you and more so in these two intelligent conversations.

While I don’t know what the next 5 years will be, I hope to again revisit this 5 later in 2026.

Additional :

Section B – acceler8

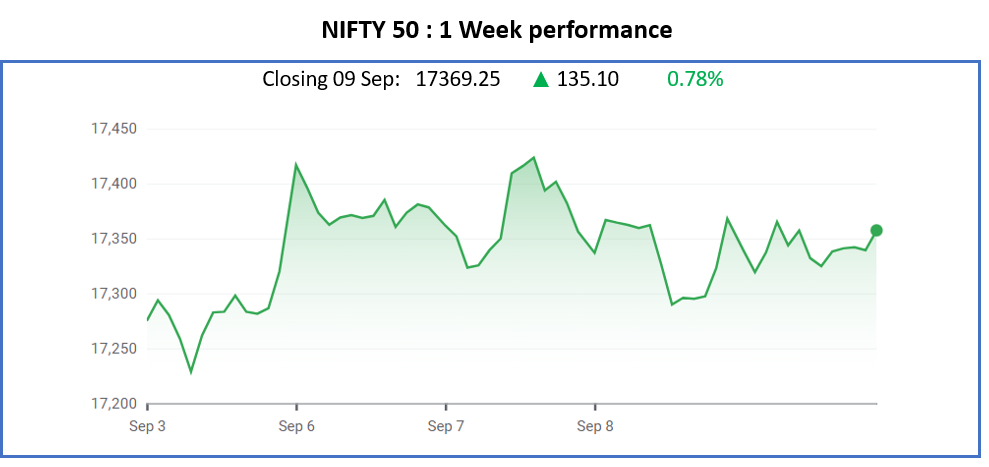

Nifty50 Last Week

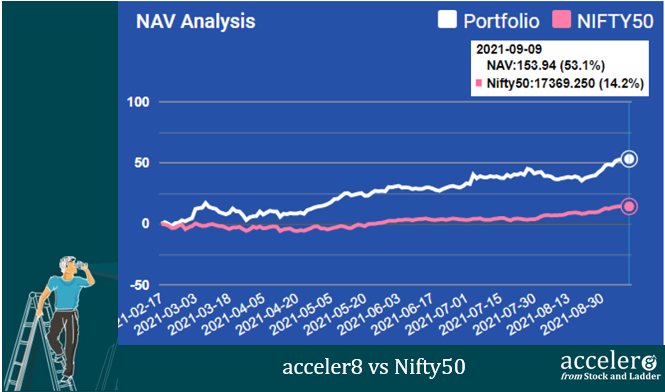

acceler8 Portfolio NAV

#acceler8 continues its strong performance and the portfolio has 38.9 % outperformance against NIFTY 50

Since inception the portfolio has delivered a CAGR of 87%, with a 6 month return of 34.1% and 1m return of 12.05%

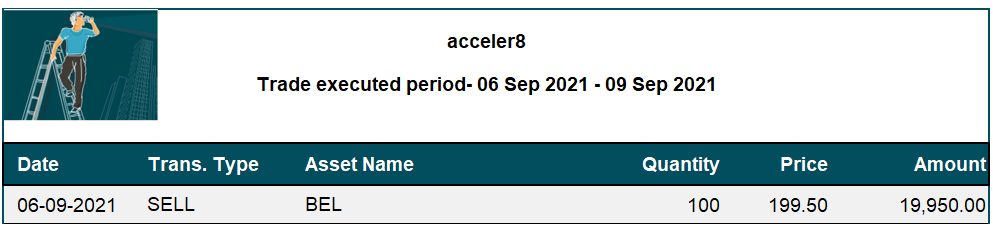

Trades this week

We did the third trade of the month exiting BEL at a decent profit. This was a 4 day week and we had our 17th consecutive +25% trade.

We had entered BEL on July 9th and in 2 months we exited with 10% absolute gain and a CAGR of 79%.

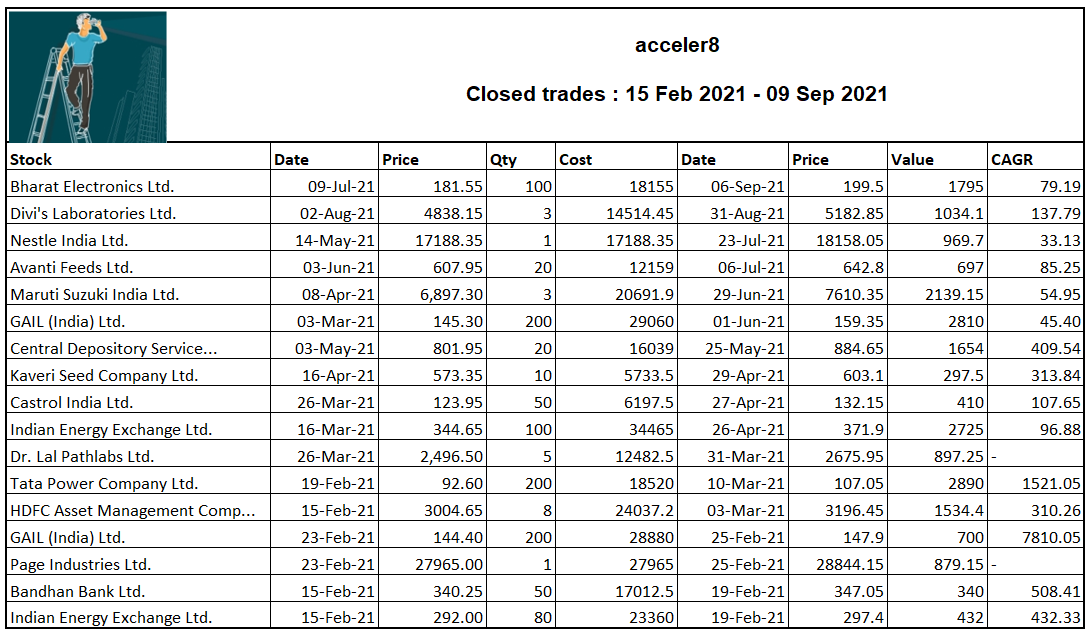

Summary of trades done since inception

We have done 19 trades in acceler8 till now. Two positions are open. For the 17 trades, we have closed at +25% CAGR.

The details are below :

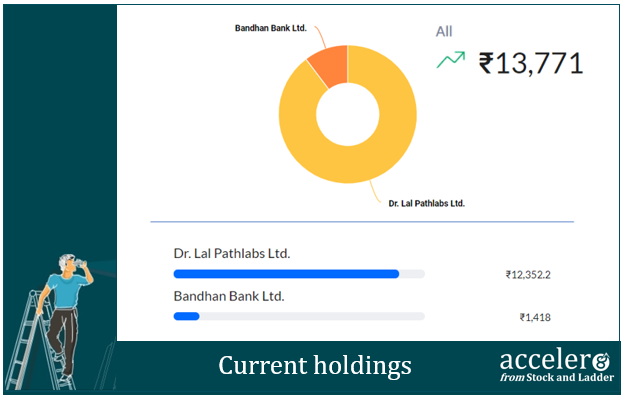

Current position

We are at 85% cash reflecting the high valuations. We have two open positions which are both excellent business with sound financials.

We will look around for opportunities and will only bite the bullet when a clear opportunity arises.

Growing together

Dear Subscribers,

We are happy to have you as a part of acceler8 family and we believe that we have been growing together in our investing journey.

\We wish to have your company in the years to come and as a gesture to thank you for your patronage, we wish to offer you a subscription plan @ Rs 5000/- per year for a good number of years of your choice.

For example, in case you wish to extend your subscription for the next 2 years, you pay Rs 10000/-

The benefit we offer here is a fixed price of Rs 5000/- for any number of years covering you against any future increase in the subscription fee. The subscription will be extended for the equivalent years from the current expiry date.

We look forward to your continued support and hope you will avail this offer to your advantage.

Happy investing !

Until next week, take care and stay safe.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr