Issue 030, 26 Sep 2021

Section A – illumin8

Darwinism and Investing

It is not the most intellectual of the species that survives; it is not the strongest that survives; but the species that survives is the one that is able best to adapt and adjust to the changing environment in which it finds itself.

-Charles Darwin

All of us must have studied Charles Darwin in our school days and I am sure you would remember the above lines from his theory on Origin of Species.

In the theory he beautifully explains the universal quality or trait needed to survive – “Adaptability”.

You don’t have to think too hard to know that this theory is equally applicable for investing too. If you closely observe and study all great investors, almost every single one of them will possess this trait of adaptability.

Stanley Druckenmiller & Black Monday (Oct 1987)

Druckenmiller is considered one of the greatest investors not without any reason. In the book, Inside the house of money, there is a fine description of Druckenmiller

“Stan may be the greatest money making machine in history. He has Jim Roger’s analytical ability, George Soros’s trading ability, and the stomach of a riverboat gambler when it comes to placing his bets.”

On the fateful Black Monday of October 19, 1987 when the markets started crashing, Druckenmiller exhibited great flexibility in thinking to reverse his initial trading position and that too with speed, to turn in a profit from a losing position.

Here is an excellent description of Druckenmiller’s flexible thinking from Ben Carlson:

In his book, The New Market Wizards, Jack Schwager tells the story about how Druckenmiller pulled a 180 the day before the 1987 Black Monday market crash, only to pull another 180 when it looked like he was initially wrong:

Druckenmiller made the incredible error of shifting from short to 130 percent long on the very day before the massive October 19, 1987 crash, yet he finished the month with a net gain. How? When he realized he was dead wrong, he liquidated his entire long position during the first hour of trading on October 19 and actually went short. Had he been less open-minded, defending his original position when confronted with contrary evidence, or had he procrastinated to see if the market would recover, he would have suffered a tremendous loss. Instead, he actually made a small profit. The ability to accept unpleasant truths (i.e., market action or events counter to one’s position) and respond decisively and without hesitation is the mark of a great trader.

A successful investor must display extreme agility and adaptability when confronted with important new facts. The ability to be flexible in thinking and quickly adapt to the evolving situation is what separates the wheat from the chaff.

Warren Buffett & Airline Industry

Warren Buffett, one of the greatest investors of modern times exhibited this trait of adaptability regularly.

Below is what he spoke of airline industry at different points of time : 2002, 2016 and 2020.

Warren Buffett in 2002

Telegraph: Do you still regard US Air as your worst investment?

Warren Buffett: I made the comment that if a capitalist had been present at Kittyhawk back in the early 1900s, he should have shot Orville Wright. He would have saved his progeny money.

But seriously, the airline business has been extraordinary. It has eaten up capital over the past century like almost no other business because people seem to keep coming back to it and putting fresh money in.

You’ve got huge fixed costs, you’ve got strong labour unions and you’ve got commodity pricing. That is not a great recipe for success.

I have an 800 [freephone] number now that I call if I get the urge to buy an airline stock. I call at two in the morning and I say: “My name is Warren and I’m an aeroholic.” And then they talk me down.

Warren Buffett in 2016

14 years later in 2016, Berkshire Hathaway revealed holdings in not one but FOUR airline stocks: American Airlines; Delta Airlines; Southwest Airlines; United Continental Holdings. Buffett explained that he had strong reasons for jumping into airline stocks.

Berkshire owned 42.5 million (10% stake) American shares, 58.9 million (9.2% stake) Delta shares, 51.3 million (10.1% stake) Southwest shares and 21.9 million (7.6% stake) United shares.

Warren Buffett in 2020

In May 2020, we woke up to the news that Berkshire Hathaway has sold the entire position in the airline industry worth around 4 billion USD.

“The world has changed for the airlines. And I don’t know how it’s changed and I hope it corrects itself in a reasonably prompt way,” he said during Berkshire’s annual shareholder meeting Saturday, which was virtual this year. “I don’t know if Americans have now changed their habits or will change their habits because of the extended period.”

I think there are certain industries, and unfortunately, I think that the airline industry, among others, that are really hurt by a forced shutdown by events that are far beyond our control.

As you can see Buffett’s views on airline industry changed overtime and he was adaptable and flexible in his thinking to enter / exit as he deemed appropriate.

What does this all mean for ordinary investors like us ?

1) When facts change be adaptable in your thinking and be willing to embrace change.

2) They say in investing, to succeed you must first survive.

As Darwin explained in his theory of evolution that inferior species get eliminated over a time through a process called natural selection, if we don’t exhibit this trait of adaptability we will find ourselves eliminated.

There are many instances in our investing career where we take a position only to realize that it did not pan out as we planned.

How many of us are willing to accept that it did not go as per plan and are ready to cut our losses early? I for one, surely did not exhibit this around 2006-2007.

I had invested and taken a large position in Suzlon. Within a short time I started reading about blades cracking, debts mounting and promoters pledging shares. I was no Stanley Druckenmiller and I did very little in the initial days to cut my losses.

Final Thoughts

When the facts change I change my mind.

– John Maynard Keynes

The small but nimble cockroach survived, but the big but immobile dinosaur became extinct. There is a lesson in this for investors like us.

We all live in a world where change is the only constant. Hence its vital that we are flexible in our thinking and adaptable when the facts change. Else instead of being in the investing hall of fame we will find ourselves on the walls of the investing museum.

Section B – acceler8

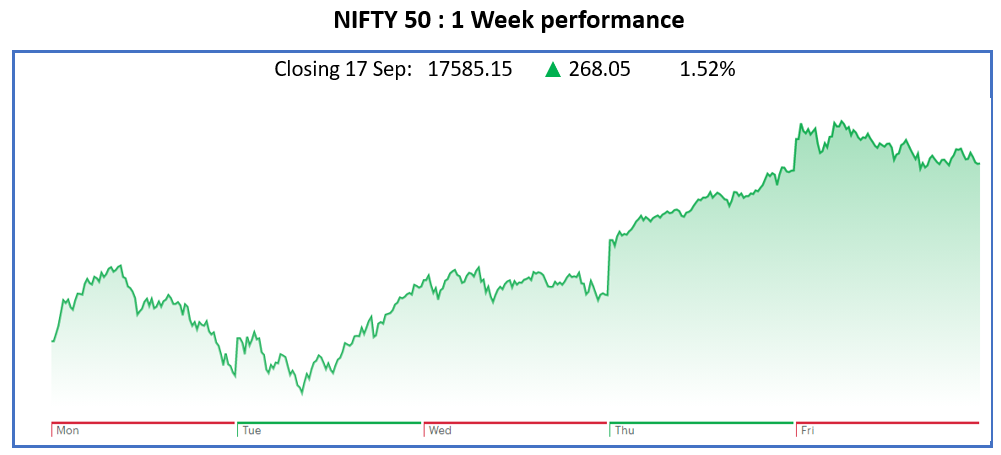

Nifty50 Last Week

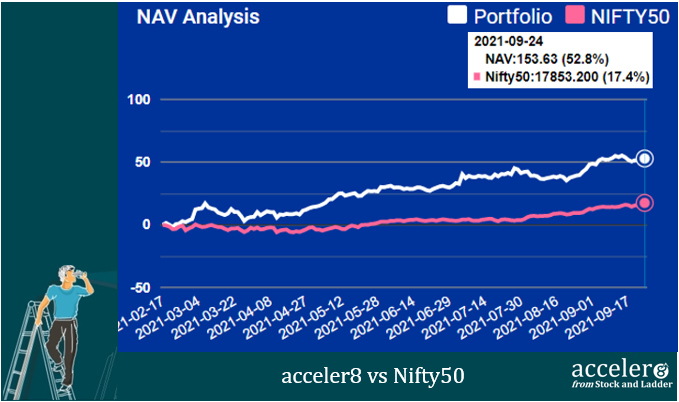

acceler8 Portfolio NAV

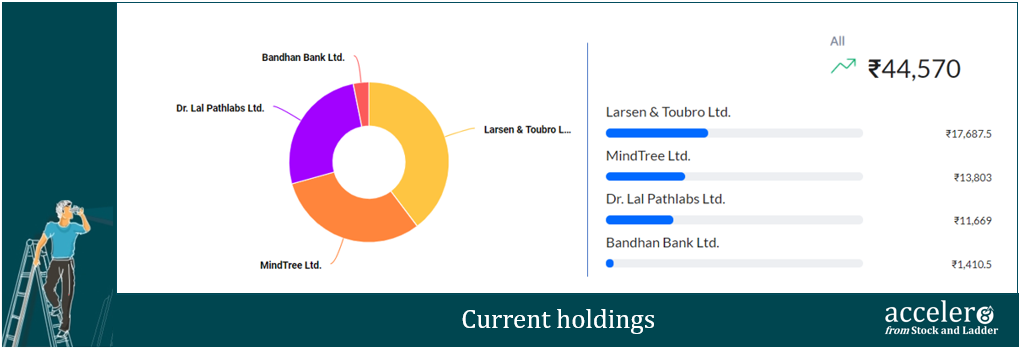

#acceler8 continues its strong performance and the portfolio has 35.4 % outperformance against NIFTY 50.

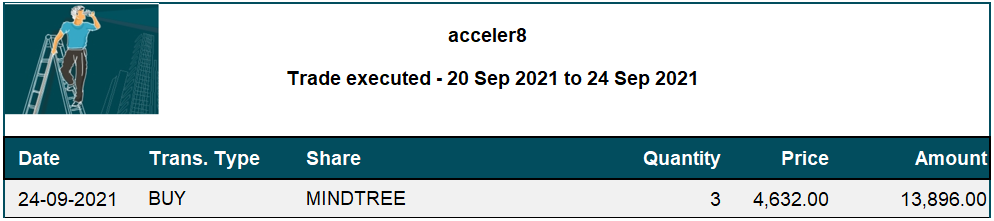

Trades this week

Position taken in Mindtree. The stock has been showing excellent momentum. Industry in sweet spot with the company enjoying rock solid fundamentals. Valuation is expensive.

Current position

We are 55 % in cash reflecting the high valuations.

Happy Investing.

Until next week, take care and stay safe.

PS : We are planning a Webinar for our existing subscribers in the ensuing week. We request you to keep next Saturday evening free between 4 pm to 6 pm. We will be sharing the invite by a separate mail.

PPS : In lieu of the above webinar, only the trade details will be published in the next issue.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr