Issue 006, 28 Mar 2021

Section A – Illumin8

Walter Schloss : Strategy, Screener & Stocks

“You never really know a stock until you own a stock”- Walter Schloss

A two member investment team of father and son , one small rented room, a single telephone, zero employees , no connections with wall street, no management meetings and no client visits. Only source of information – published statements of accounts and annual reports.

The result: An astonishing 15.7% returns net of fees against S&P’s 11% over.……………47 years (1955- 2002)

Little wonder then that Warren Buffett referred to him as a Superinvestor in his seminal article “Superinvestors of Graham and Doddsville”

Walter has diversified enormously, owning well over 100 stocks currently. He knows how to identify security’s that’s a let considerably less than their value to private owner. And that’s all he does. He does not worry about whether it’s January, he doesn’t worry about whether it’s Monday, he doesn’t worry about whether it’s an election year. He simply says, if a business is worth a dollar and I can buy it for 40 cents, something good may happen to me. And he does it over and over and over again. He owns many more stock than I do – and is far less interested in the underlying nature of the business; I don’t seem to have very much influence of Walter. That’s one of his strengths; no one has much influence on him.

He never went to college and started his career as a runner in a security firm. He got interested in stocks and security analysis and approached his employer if he could join them. He was politely refused but was introduced to Benjamin Grahams investing master piece “Security Analysis”.

Another fine piece of advice he was given was that if he read and understood this book then he would not need any other apprenticeship. He read the book many times and he loved it so much that when he heard the author Benjamin Graham was taking a night course at New York Finance Institute, he jumped at the chance of learning from the master himself.

There was a brief pause due to war and on return from the war he went back to the field of security analysis and destiny would take him to his teacher’s partnership firm as a security analyst. He worked until 1955 and went on to set up his own investment firm.

Walters Schloss is a true investing legend, and his investing life has lot of lessons for those who are keen to learn. His basic philosophy is to “buy cheap” and avoid loss of money. He passionately believed that if the downside protection is taken care then the returns will take care by itself.

Schloss- Screening criteria

Even though Walter Schloss never shared his full portfolio publicly nor did he clearly specify what were his criteria for stock selection. However by analyzing multiple interviews, presentations, lectures and articles we can deduce the key criteria’s:

1. Zero debt

“Never lose money” so “buy cheap” was his cornerstone of his investing philosophy. For this he believed that little or zero debt companies had a better chance of protecting him from incurring losses. In one interview he repeated the phrase “Zero debt” 20 times in one interview. Ponder.

2. Clear Investing universe

He limited his investing universe to his circle of competence.

No Foreign stocks

No Stocks in the finance sector.

Only companies with at least 10 years of business history and financial data

Preferred companies in the manufacturing sector which produced goods.

3. Trading below book value

One valuation metric he used to identify under-valued stocks was the “book value” of the share. He believed that earnings could be volatile but actual physical assets would be difficult to manipulate. He preferred companies trading at a significant discount to its stated book value

4. 52 week low

Another favorite hunting ground was the daily 52 week low list or those hovering close to that. While a 52 week low does not automatically make it a buy , the list he believed was a good starting point.

5. Inside ownership

He preferred companies where the management had significant holdings with a belief that manager owners would keep the shareholders interest in mind in their decisions. He also kept a keen eye on insider transactions of buy and sell.

Few other key takeaways

As I went through the literature available on Schloss, there are a few interesting observations:

Do not make commit your entire planned allocation to a scrip at once. Buy in small quantity first to test the waters (10% to 50% max). Then commit the rest based on how the initial investment works out.

Do not spend too much time on economic analysis, state of the economy, political situations and other macro-economic factors. Only thing that mattered was if the stock was cheap (value vs Price)

Buy with at least 50% potential upside. Take new positions where you believe there is significant profit potential and when your target is reached be unemotional and exit.

It is not possible to sell the stocks at their peak hence it is bound to happen that the price of stock might go up after you sell hence one needs to be more one needs to keep our emotions in check with no regrets. Also sell when there is juice left to make it attractive to buyers.

When buying a stock with a value investing philosophy then

>Buy with at least 3 years in mind. It usually takes 3 to 4 years for the negative scenario in which the initial purchase was made to turn around

>Be ready to have a notional loss for a certain period.

>Be ready to buy more when the price falls.

The first few years of investment is going to be tough with mistakes bound to happen when you are managing money. No amount of study will replace the practical experience. He believed that 10 years is a milestone after which some sort of expertise will kick in.

Don’t abandon your philosophy at the first sight of danger or when returns trail below the benchmark if you are convinced of your strategy and philosophy. Don’t jump from one strategy to another and expect great results.

Know yourself: Have clarity on what you want out of your investing operations. Schloss wanted to live 100 years (managed 95) and believed continuous management meetings and client visits like Peter Lynch will wear him down. He worked between 10 a.m. to 4.30 p.m.

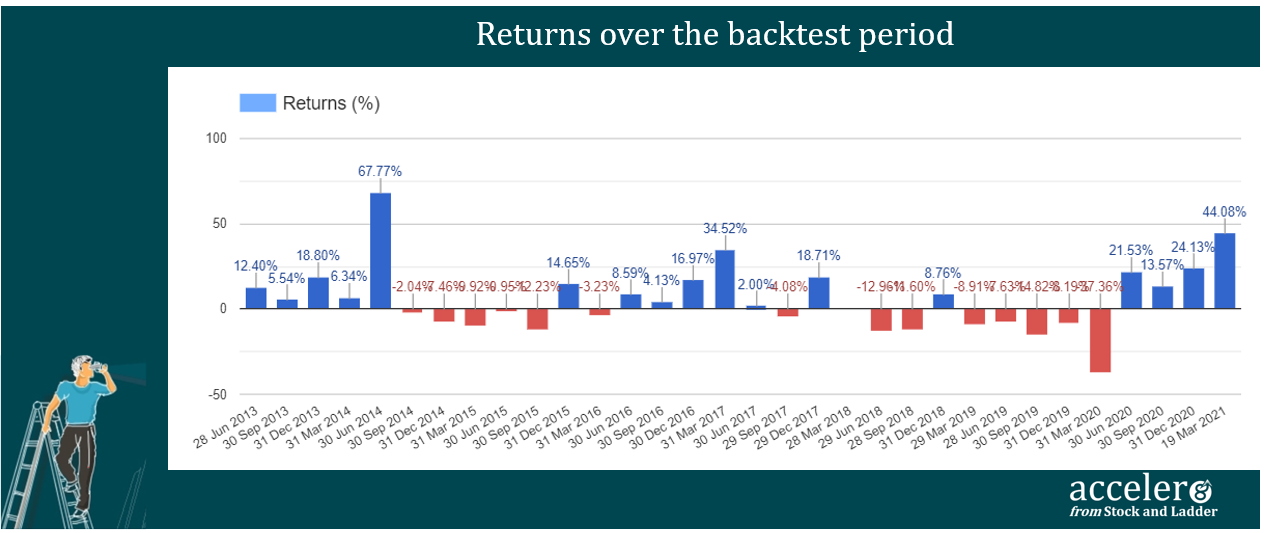

Back testing

Based on the above insights a stock screen was created. The screen was modified to include few proprietary hygiene factors which I have fine-tuned over my two decades in the market.

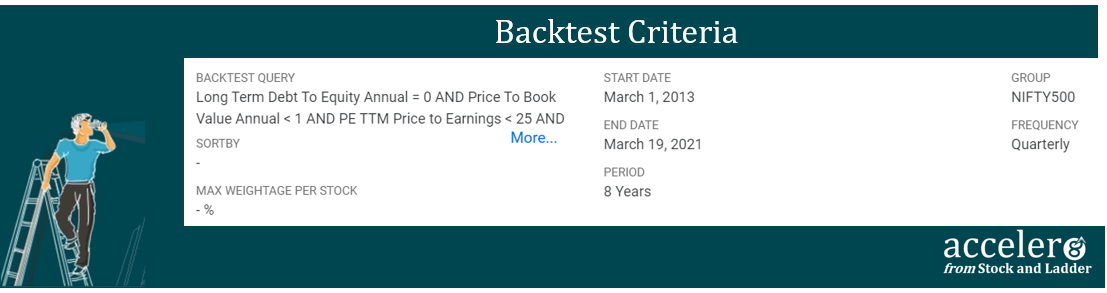

Criteria

Along with zero debt, Price to Book value less than 1, PE less than 25, a few other proprietary criteria was used to create a Walter Schloss stock screen.

The Screen was back tested for 8 years starting March 2013 till March 2021 on NIFTY500 with a quarterly frequency.

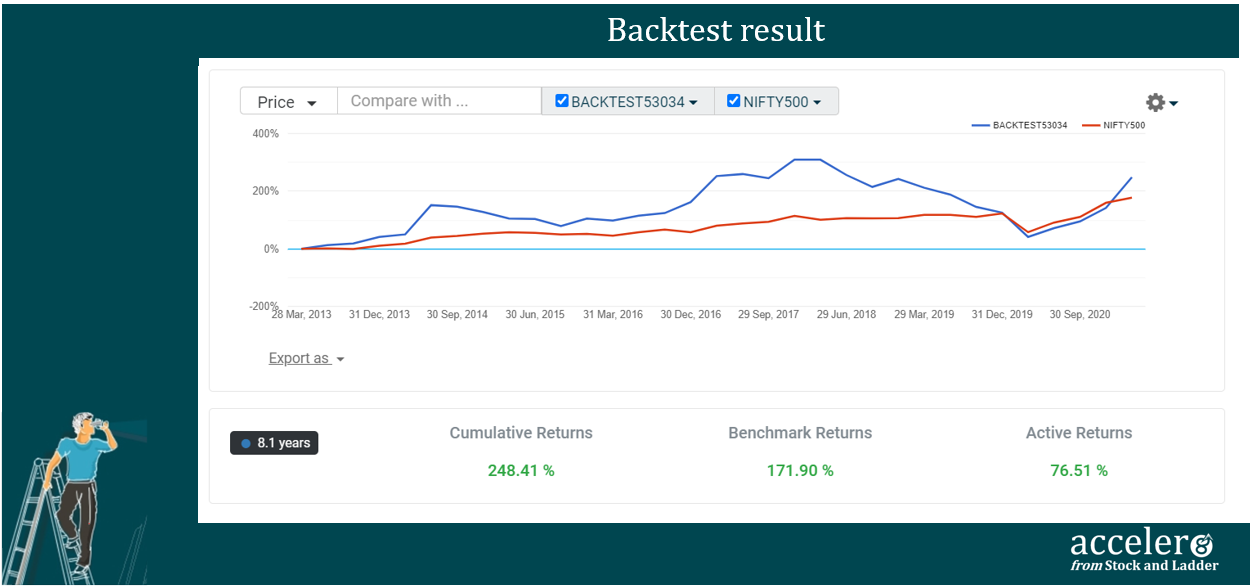

Performance

The Walter Schloss screen outperformed the benchmark. The portfolio delivered a CAGR of 16.76% with a cumulative return of 248.41% with an excess return of 76.51% over Nifty500.

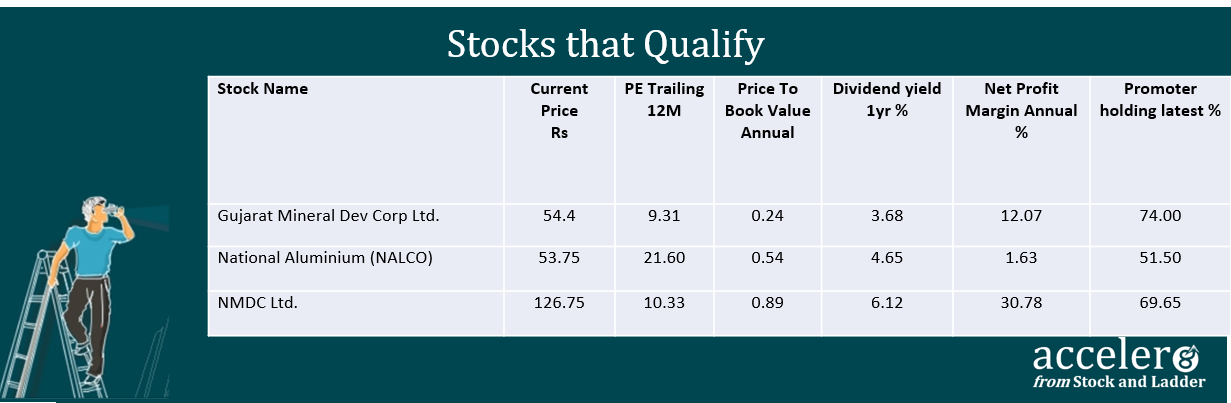

Stocks that Qualify

Currently three companies passed the modified Walter Schloss deep value investing screen.

Final Thoughts

Walter Schloss beautifully summarized his investing philosophy in one sentence- “Basically, we try to buy value expressed in the differential between its price and what we think its worth”.

He had the ability to exploit and profit from the difference between Value and Price. He did this well and just kept doing this for 47 years.

Additional reading

Walter Schloss investing track record

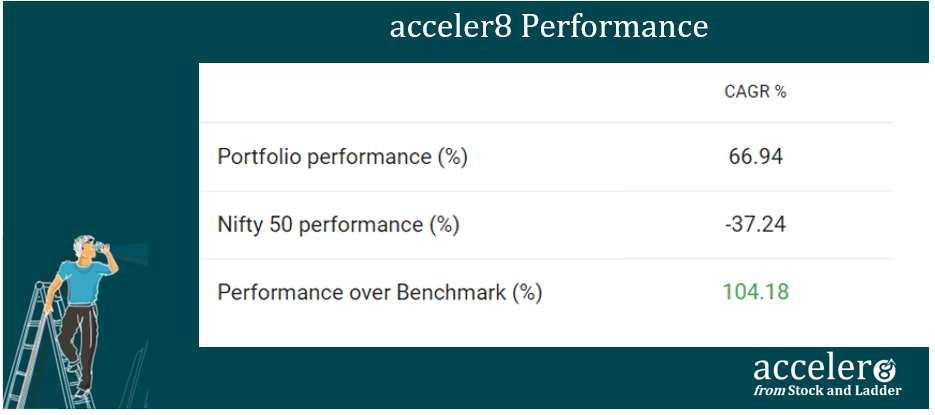

Section B – acceler8

Portfolio Updates

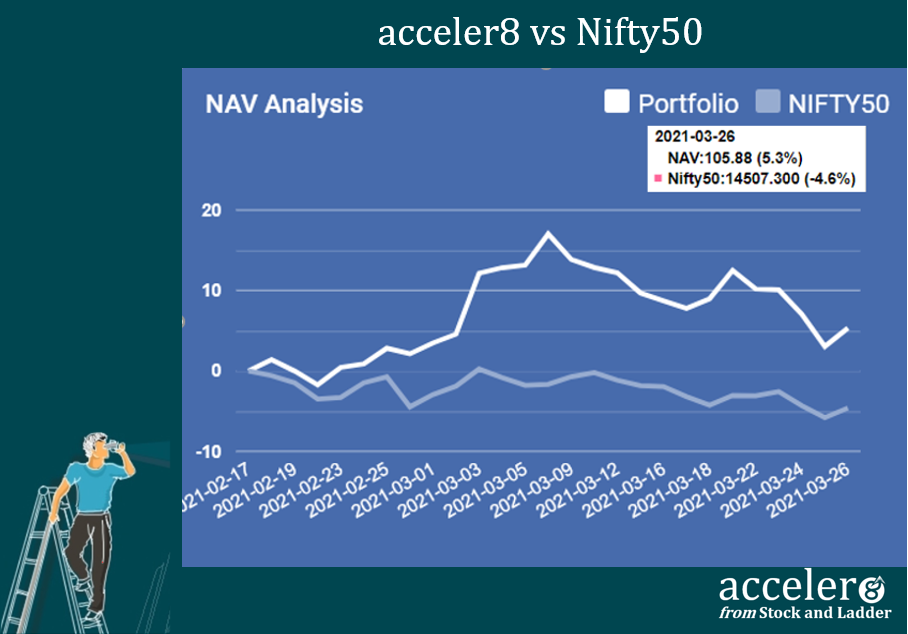

This was an interesting week for acceler8.With Nifty 50 falling 1.18% it is but natural that the effect of the overall market will be felt by acceler8 stocks too. The trick is to protect the downside risk when the market falls and have a larger upside when the market rises.

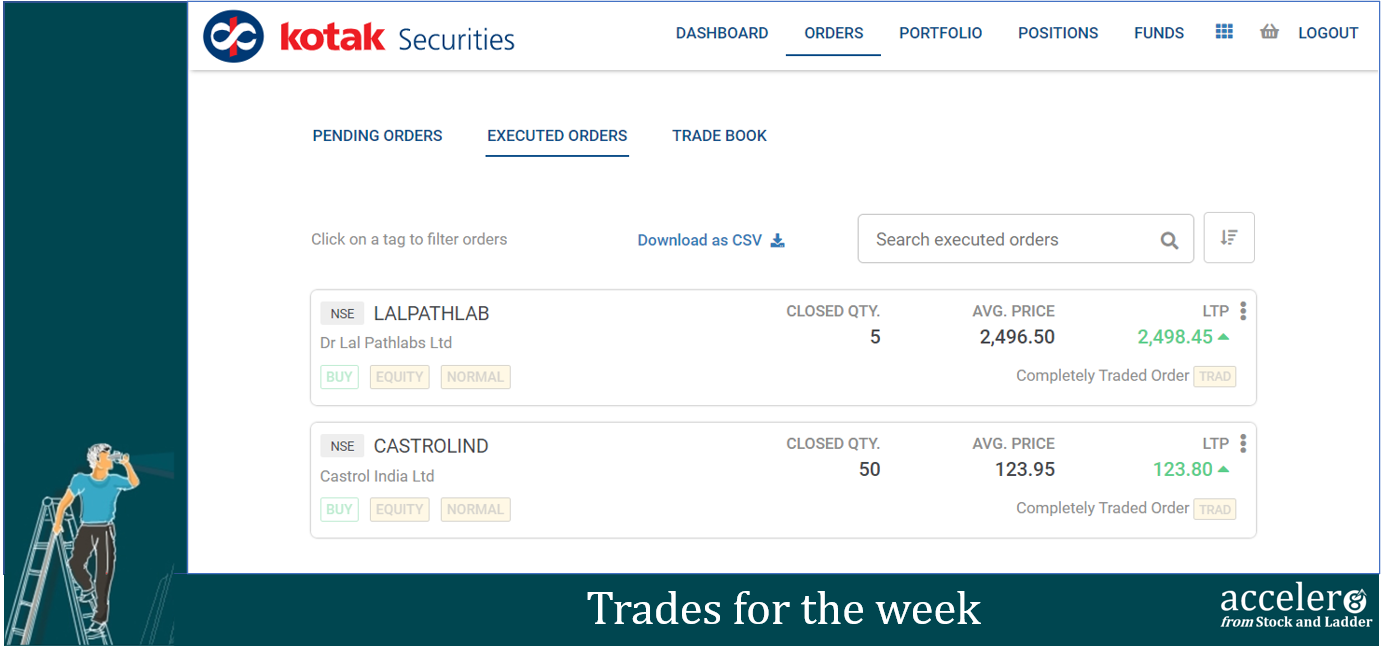

Trades done for the week

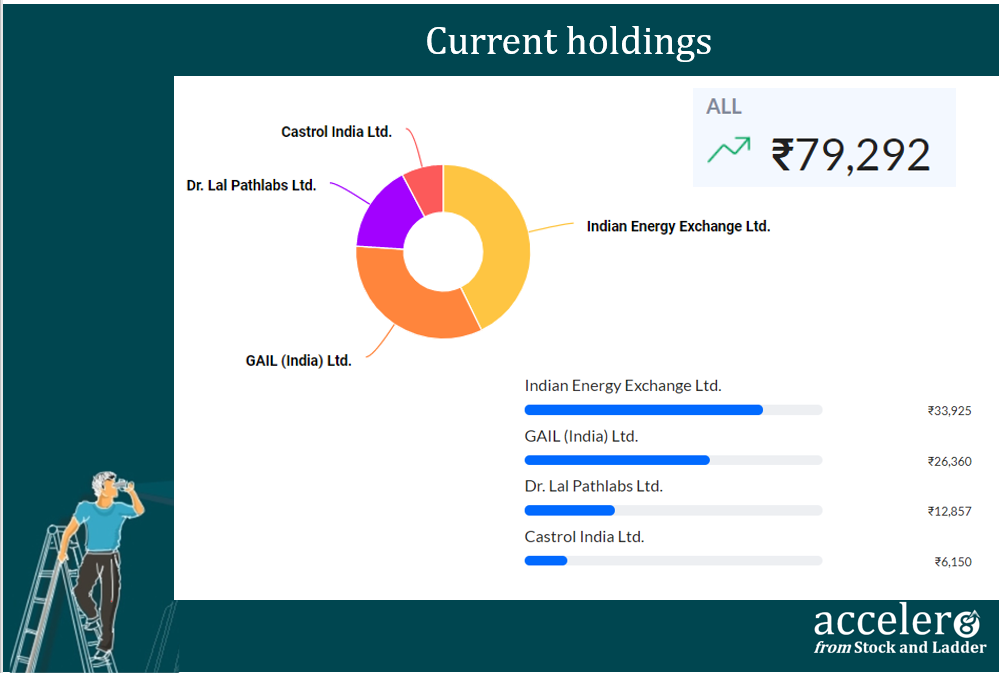

Dr Lal PathLabs – 5 shares @ ₹ 2496.50

Castrol India – 50 shares @ ₹ 23.95

(The details were shared over email during trading hours itself)

Many of you have written to me asking my logic and thinking behind the trades. As a matter of principle I do not wish to analyze an open position. Once we close a position, we’ll go back to the trade if there is a lesson to be learnt.

CASTROL is not a typical acceler8 stock. Castrol is a wonderful dividend stock having declared 43 dividends since 2000. Castrol has declared a dividend of rupees 3 per share (ex date of April 22nd ) and with a yield of close to 7% , the stock offers good dividends at a reasonable price.

Speaking of dividends, GAIL, another acceler8 stock has also declared dividend this week of 2.50 per share. This is the second dividend in 3 months from GAIL. Those of you holding GAIL, do check your bank account, your dividend should hit your account soon .

Coming to the second purchase, Dr LaL PathLab is a typical acceler8 stock with a combination of quality and momentum. With COVID 19 cases on the rise the stock should have a good run (up 3% in 1 day)

acceler8 portfolio NAV

As on 26 Mar 2021, the NAV of acceler8 portfolio is 105.88 (+5.3%) and has outperformed the benchmark Nifty50 by a significant margin (+9.9%).

Current Position

As on 26 Mar, the consolidated value of current holdings is at ₹79,292 with 21% approximately in cash.

Section C – Cura8

Handpicked #goodreads

Why Managing Your Emotions Is the Key to Building Wealth (Medium)

Sustainability in packaging: Investable themes ( Mckinsey )

SPACs: The hottest party in investment town ( Forbes India)

Hope you enjoyed reading this edition of acceler8.

Compound your learnings, Accelerate your earnings

Happy Investing !!!

PS : Please help spread the word on acceler8 socially.

PPS : acceler8 is now on Facebook. Do like the page and share with your friends.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr