Issue 014, 30 May 2021

Section A – Illumin8

Double Barrel Investing

“This double-barreled approach purchases of entire businesses through negotiation or purchases of part-interests through the stock market gives us an important advantage over capital-allocators who stick to a single course. Woody Allen once explained why eclecticism works: “The real advantage of being bisexual is that it doubles your chances for a date on Saturday night. Over the years, we’ve been Woody-like in our thinking”

– Buffett, Shareholder letter 1995

The phrase “Double barrel investing” was inspired by this paragraph written by Buffett in the 1995 annual shareholder letter. It was like that “Aha” moment when it dawned on me that one should not be a one-trick pony and we should have multiple types of weaponry in our armor.

Over many years now I have been following this approach- Multi-prong strategy: A core and satellite approach; strategic and tactical approach; Long term and short term. Portfolio construction is an art, and it needs to be done top down.

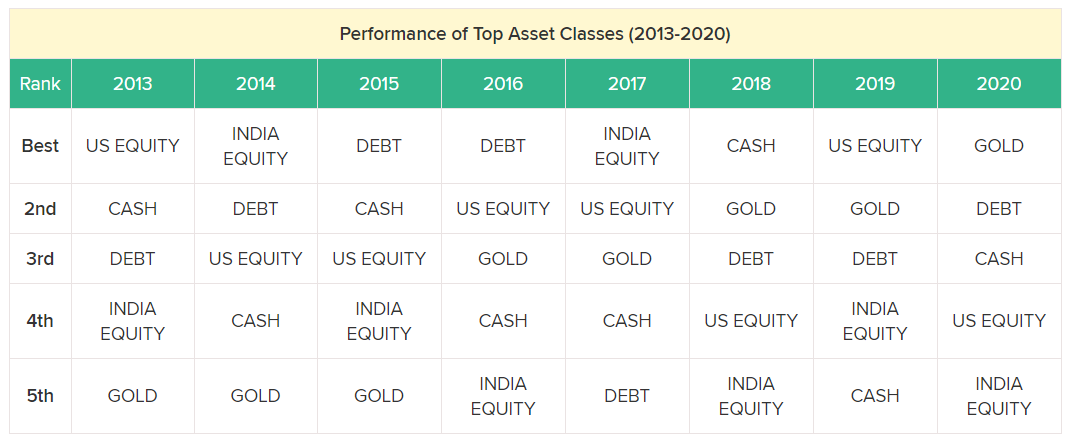

Firstly, you need to get the asset allocation right. The below table shows the performance of each asset class over the last few years:

Top Asset Classes India

(Source : Economic Times)

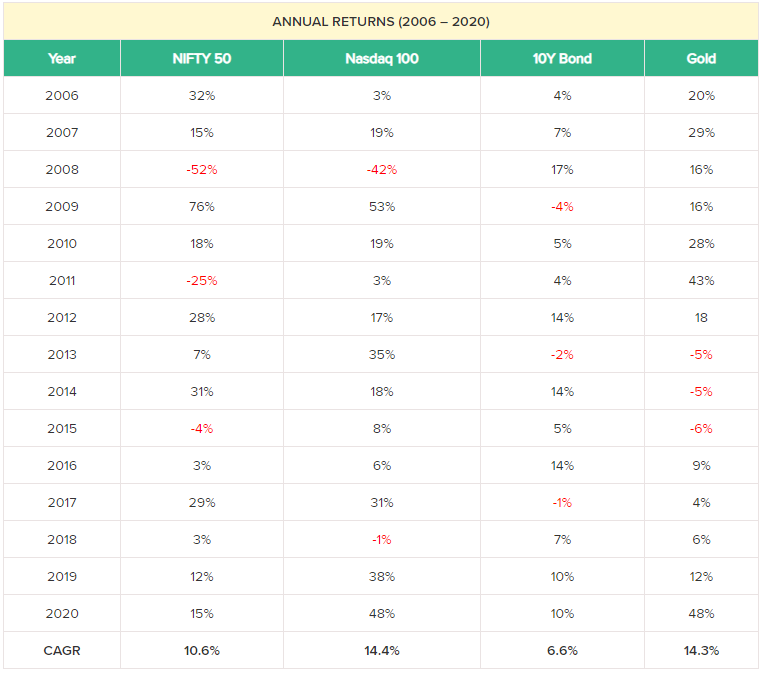

Annual Returns

(Source : Economic Times)

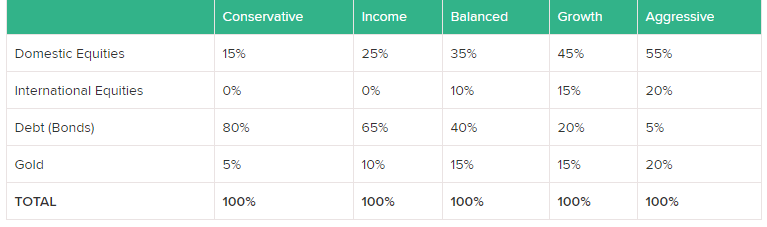

While the importance of asset allocation is a topic by itself, a investment advisor should be able to do a proper investor profiling and based on your Risk capacity and Risk appetite you can arrive at the allocation strategy.

Sample allocation strategy

(Source : Economic Times)

Equity Investing Strategies

Let us say you have decided to allocate 50 lacs for Equities as an asset class.

Then you should be asking these questions?

Investing Style

Am I going to be a passive investor, or will I be involved in actively picking stocks?

If you are time-poor, believe that you cannot spare 8 to 10 hours a week on following the markets then you should either pick a top performing equity mutual funds (Recently did an analysis of best equity funds to invest for a client,– we will leave the best mutual funds to invest post to a later date😊, those interested to know the details of the funds I selected , drop me a note) or subscribe to paid subscription services (like ours) to shortlist stocks for further research.

By Geography

Are you going to focus on Domestic stocks / International stocks .

By Market Capitalization

Are you going to invest in Large cap, Medium cap , Small cap or Multi-cap.

By Strategy

Will it be Value investing, Growth investing, Blended investing. Blended investing included Growth At Reasonable Price.

By Stock screening

Will it top down approach or a bottom up approach for picking stocks.

By technique

Will it be based on Fundamental analysis or technical analysis or a Techno-Funda approach. There are so many nuances that it may be slightly overwhelming to the average investor.

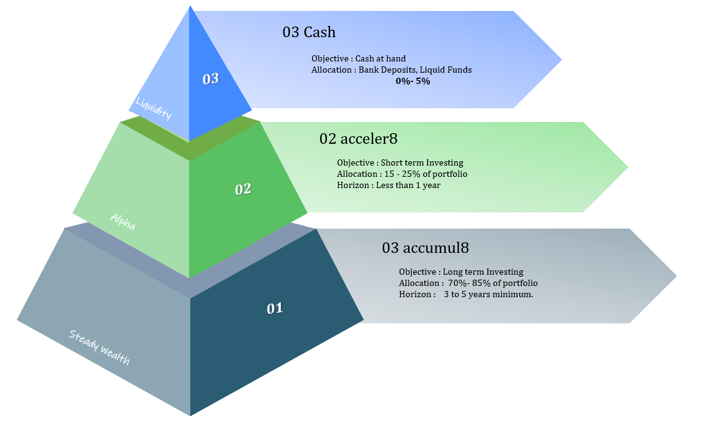

Double-barrel investing

At the heart of this concept is a key feature – Core & Satellite Portfolio and a blended investing style.

A. Core Portfolio – accumul8

The Core Portfolio is invested in blue-chips for a long-term investing horizon of minimum 3 to 5 years. This portfolio has the following characteristics:

– 8 to 12 trades a year

– Allocation of 70 to 85 % of your equity component

– Create a collection of outstanding companies to be held in “decades”.

– Harness the power of compounding.

– Low importance for market timing

B. Satellite Portfolio – acceler8

Satellite Portfolio is used for generation of alpha or active returns to bump up your returns at the portfolio level.

This portfolio has the following characteristics:

– Allocation of 15 – 25% of your equity component

– No restrictions on the no. of trades

– Time horizon of 1 week to 1 year

– Generate Alpha over the short term

– Harness the power of momentum

Why a double barrel approach works?

I personally believe every investor must follow a double barrel investing approach.

The key reasons :

1. Do not be a one – trick pony

Most of us love cricket and let me give you a cricketing analogy. Here is Steve Waugh on Anil Kumble. The best bowlers are those who are not a one- trick pony and have multiple variations up the sleeve.

Similarly in investing there are long periods of time when one factor will under-perform.

Study 1

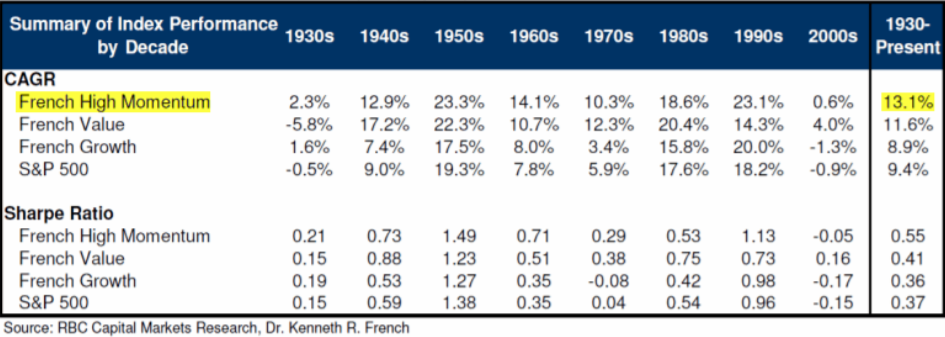

Momentum Vs Value Vs Growth since 1930

The below table shows the returns of Momentum Vs Value Vs Growth. As you can see in different 10 year period (decades), Value, Momentum and Growth have outperformed each other.

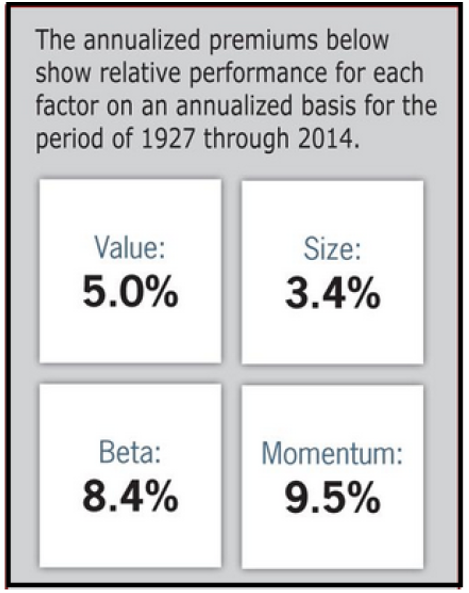

Study 2

Factor Investing – Momentum Vs Value

The below study by Larry Swedroe & Andrew Berkin shows that Momentum is a key ingredient for alpha generation over 80 yrs.

Source: Larry Swedroe & Andrew Berkin

Different strategies perform differently under different market conditions. In bull markets and bear markets different strategies perform differently with varied results.

2. Do not fight human nature

While it is quite catchy to hear phrases like “investing is like watching paint dry” or “investing is like watching grass grow”, honestly ask yourself if you can do this?

Do you have the temperament to sit all day along only reading and executing one trade a year? If yes then great- you have the mental make up to be included in the investing hall of fame

“All of humanity’s problems stem from man’s inability to sit quietly in a room alone.”

–Blaise Pascal

“Most of us have something what we call as activity bias”. We need to be seen as doing something even if we know 99% of Long-Term investing is doing nothing. If you happen to be a money manager, the problem multiplies.

Odysseus, the wandering protagonist of Homer’s Odyssey, had a fear of temptation. In Greek mythology, sailors were regularly lured to their deaths by Sirens, creatures who sang a beautiful and irresistible song. Entranced by the song, these sailors would steer the ship towards the call and get killed in the process.

In order to avoid this fate, Odysseus ordered his crew to plug their ears with beeswax and to tie him firmly to the ship’s mast. On hearing the Sirens’ song, Odysseus himself could not resist and begged to be untied, but since he had instructed his crew to ignore him, they refused his pleas.

Thus, the ship was able to sail safely past danger; but only because Odysseus was smart enough not to underestimate the power of temptation.

“In investing too, be an Odysseus”. While 80% of your long term portfolio can continue to be untouched for compounding to work its magic, the action can be focused on remaining 20 % where we can take tactical short term calls for alpha generation.

3) Enhanced Returns

Combining two strategies gives you additional returns with proportionately lower risk thereby helping you generate alpha.

E.g. Portfolio value of ₹ 25,00,000 with 80% allocation in Long-Term portfolio and 20% in Short-Term portfolio.

Assuming Long-Term portfolio earns 12% and Short-Term portfolio earns 20%.

Scenario 1

Fully invested in Long-term portfolio

Assuming ₹ 25,00,000 is invested @ 12% returns for 5 years, you will generate ₹ 44.05 lacs.

Scenario 2

Double Barrel Investing

Assuming 80% in Long-Term (accumul8) and 20% in Short-Term (acceler8).

You will generate ₹ 3524683 @ 12% in accumul8 and ₹ 1244160 @ 20% in acceler8.

The total returns will be ₹ 47.68 lacs @ 13.80 % which is ₹ 3.63 lacs (1.80%) more.

As you can see that in Scenario 2, by following Double Barrel Investing, you can generate additional returns for nominal additional risk.

Final thoughts

A double barrel investing approach increases your chances of returns with minimal additional risk. This also helps you combine the desire for action, at the same time bulk of the portfolio remains untouched.

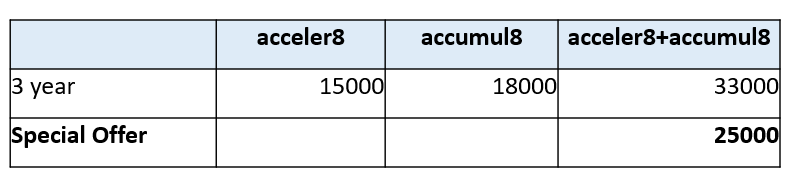

Please refer Section C for an offer combining both acceler8 and accumul8.

Section B – acceler8

Portfolio Updates

This week was good for acceler8. We exited CDSL at a handsome profit of +10% in 20 trading days. While the stock rose further 10% in the next two days, there are no sense of regret as

a) One should be rule bound when following the momentum strategy

b) Both on positive and negative side, once you decide on a acceptable percentage of returns, there shouldn’t be any looking back as stock market is a giant regret machine.

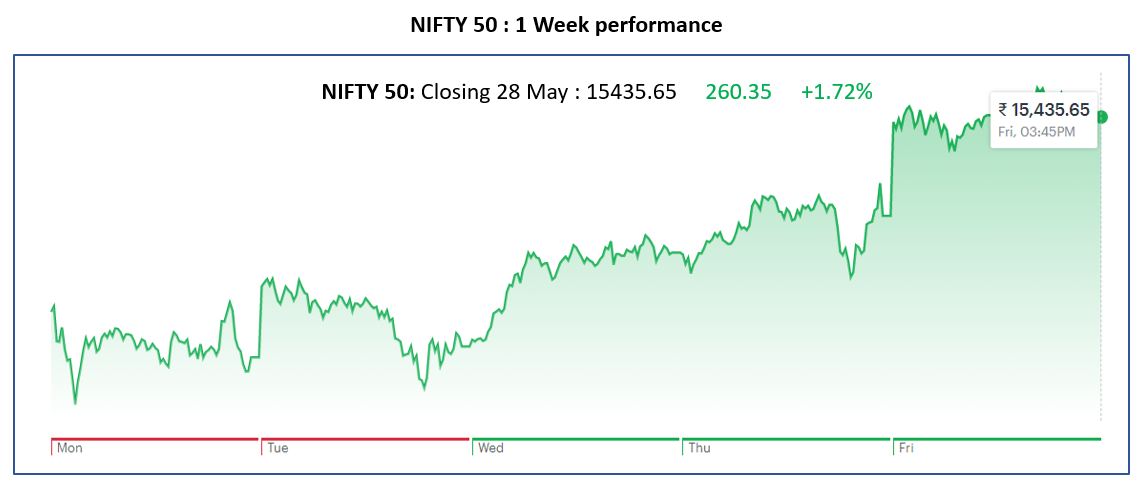

NIFTY50 Last Week

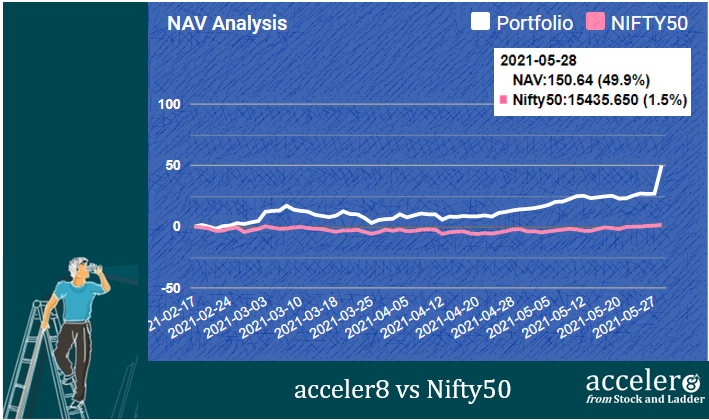

acceler8 portfolio NAV

As on 28 May 2021, the NAV of acceler8 portfolio is 150.64 (+49.9%) and has outperformed the benchmark Nifty50 by a significant margin (+48.4%).

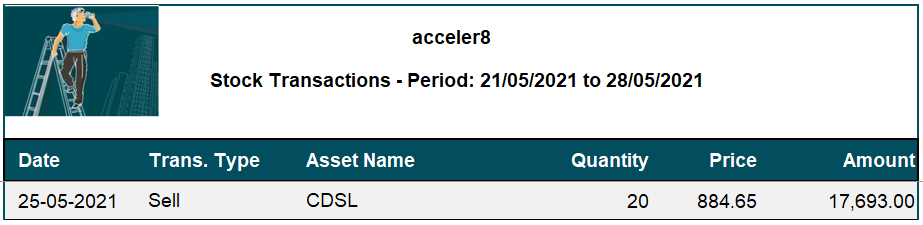

Trades done for the week

The following trades were done this week.

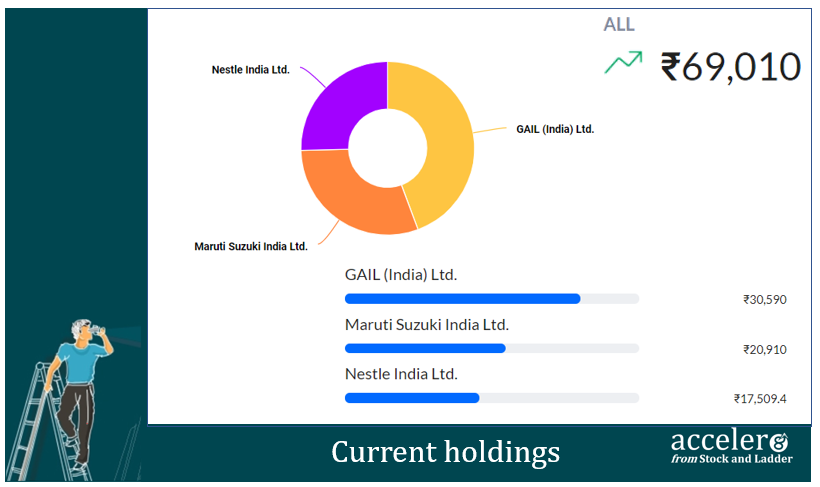

Current Position

As on 28 May, the consolidated value of current holdings is at ₹69,010 with around 33% in cash.

Section C – Stock Screeners

Momentum 20-20 Screener

Momentum 20-20 portfolio has two stocks :

1. Grindwell Norton

2. Tata Elxsi

Rebalancing for this Week

Nil

Grindwell Norton reached a new 52 week high, gaining almost 5% on a single trading day (28 Fri).

This week has been quite important at Stock and Ladder.

We launched our accumul8 Follow My Portfolio service. Based on multiple requests for long term plan ( 3 years) and also to have a single price for both the strategies, here is an offer available exclusively for existing acceler8 Premium Subscribers.

Special offer of ₹ 25000 for 3 year access to both acceler8 and accumul8

Happy Investing. Stay Safe and Take Care.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr