Issue 011, 09 May 2021

Section A – Illumin8

Lessons from Meme Stocks

“What the wise do in the beginning, fools do in the end”.

Warren Buffett

GameStop. AMC. Blackberry. Melvin Capital. Reddit forums. Wall street bets.

Does it ring a bell ?

When you hear these words, you may have realized what I am talking about – Meme stocks. We have been constantly hit by a barrage of news on these since January.

In this post, we look at Meme stocks and what we can learn from them.

What is meme stock?

A meme stock is a stock that has seen dramatic change in volume and price driven by discussions in social media and online forums. The stock prices shoot up and gets far away from the fundamentals. This is solely due to the stock going viral in social media and fueled by attention from famous personalities and influencers.

GameStop

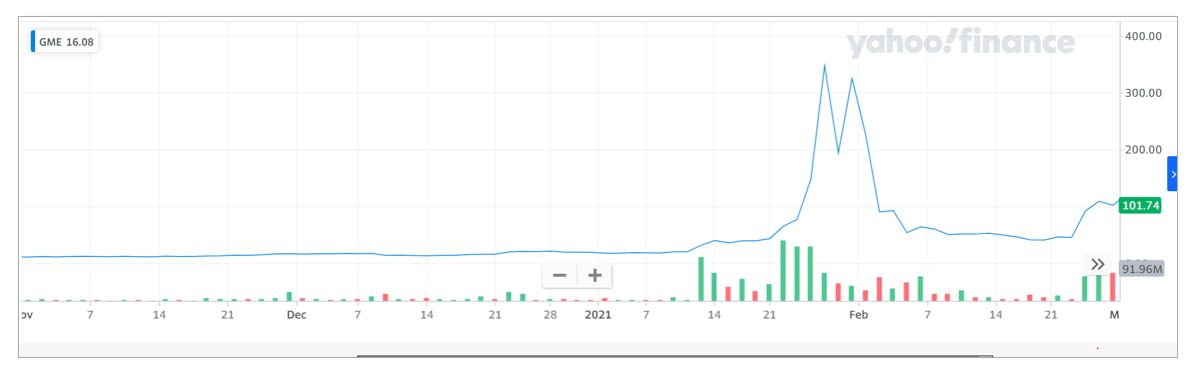

The most (in)famous of the meme stock is GME (GameStop). The stock gained 3000% in a short period. What had happened?

The stock was hovering around in the twenties for the whole of 2020. Then something happened in Jan 2021.

Reddit Forum

In the Reddit subgroup called Wallstreetbets, a user posted an interesting piece of information. The user had found that a hedge fund had shorted the stock of GME. Interestingly, when the math was done, the short selling was done for 138% of the quantity of stocks in circulation.

In simple terms – If the company had issued 100 shares, the hedge fund had done a short sell of 138 shares, much more than the actual quantity possible. This information quickly went viral and Redditters decided they will take on the hedge fund.

The post went viral and the social interest in Reddit created a mad interest in the stock pushing the price up. Then if this was not enough, Elon Musk tweeted this:

This was the tipping point – involvement of an influencer / famous personality. Elon Musk’s tweet led to the price of GameStop doubling in a day.

If you thought that the combination of online forum + Elon Musk were the only reasons for the GameStop meme episode, then you are mistaken.

Remember this?

“The Big Short” – A wonderful movie on Wallstreet based on the best selling book by Michael lewis with some wonderful acting from Christian Bale and others. Its basically the story of Michael Burry’s Scion Asset Management and its billion dollar bet against the US housing market.

Now Scion owned 1.7 million shares of GameStop as of September 2020. Burry tweeted disapproving the behavior of Reddit users and described retail investors did was “unnatural, insane and dangerous”, tagged the regulator and then quickly deleted this tweet:

Quickly, the regulators got involved. Now after the “SEC visit”, Burry went on to close his Twitter account much to the disappointment of the legions of his fans.

As a sub-plot, Robinhood the trading app brought on additional margin requirements for trading in GameStop. This further hardened the resolve of the Reddit community to take the hedge fund to the cleaners.

Life cycle of a Meme Stock

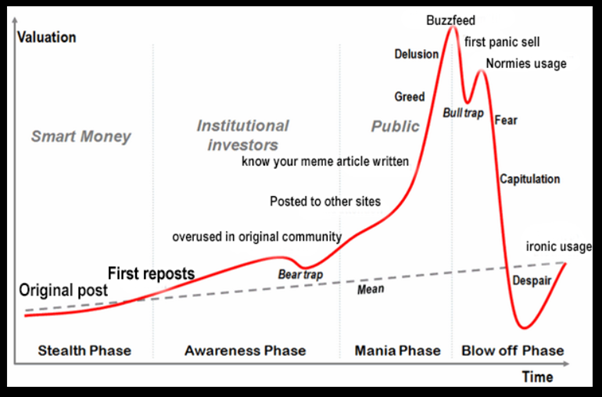

Now if we must summarize, these would be the typical life-cycle of a meme stock:

a) Stealth phase

b) Awareness phase

c) Mania phase

d) Blow off Phase

There is a stealth phase when only few are aware of the “idea” and when smart money is laid out. Then the awareness phase begins, FOMO plays out and the panic sell happens.

Lessons from Meme Stocks

“History never repeats itself, but it often rhymes.”

–Mark Twain

We may not have liked History as a subject during our college days but to succeed in the stock market, it is vital to know the financial history. Why?

On the surface, Meme stocks as a concept looks normal. A wonderful idea for making money is posted on social media. Now the post goes viral, famous personalities jump in adding further fuel to the rally and voila, the share zooms.

Now if were to take a pause and think about it. This is what happens in typical bubble right? Take south sea bubble or any other mania bubble for that matter.

Sir Isaac Newton lost 20000 pounds in 17th century or any other mania or bubble for that matter. What does it mean then?

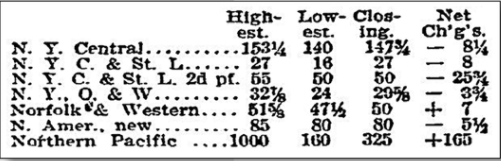

The exact thing what played out in the GameStop episode also happened a cool 100 years ago in the biggest short squeeze of the last century. Two heavy weights fought control of the a railroad business, The Union Pacific.

On the fateful day, it became obvious that more shares were sold than that could be bought from the market and the mad frenzy to acquire shares in the open market drove up the share price from $150 to $1000. And this happened in 1901.

It became obvious on Thursday that more shares were sold short than could be bought back in the market. Northern Pacific rose quickly as short sellers rushed frantically to cover their positions. Except, no shares were available. Harriman and Hill had cornered the market. The stock price was bid up — $300, $500, $800, and finally $1,000 a share.

The deadline to deliver shorted shares was 2:15 pm Thursday. Short sellers dumped everything as their Pacific Northern losses grew. It set off a market-wide panic. Margin loan rates spiked to 60%, compounding the selling.

Key Lesson

“Wall Street never changes, the pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes.”

Jesse Livermore

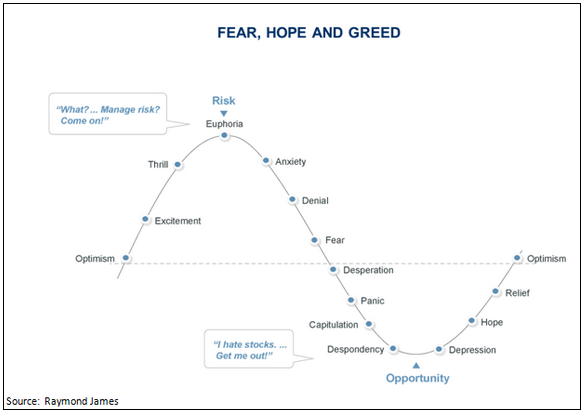

The taxonomy of emotions says that we humans have 6 root emotions: Fear, Anger, Sadness, Surprise, Joy and Love. These are the emotions we take to the stock market and our investing.

The below cycle of Fear, Hope and Greed is constant and universal.

As long as we remain “human” and not robots without emotions, the markets will remain inefficient. There will be cycles of fear and greed playing out and those who can control their emotions better will have greater chances for stock market success.

Today it might be Meme stocks, tomorrow it could be something else. But the underlying principle that stock market participants are human with emotions will cause such things to occur again.

Hence its vital that every investor should learn and understand our financial history. Remember these immortal words from George Santayana,”

Those who don’t remember their history are condemned to repeat it”.

Footnote :

1. Great books to read

A Short History of Financial Euphoria by John Kenneth Galbraith is an excellent book on this subject. Its short, crisp and interesting.

If you want to read the absolute best book on this subject then it would be “Manias, Panics & Crashes” by Charles Kindleberger– the only book you need to read on Financial crisis.

The Big Shot by Michael Lewis based on which the movie by the same name was made, also makes for an interesting reading.

2. Please bookmark this page : Stock and Ladder’s Amazon page

Please visit our Amazon page where we have maintained an excellent collection of investing books to read including the ones listed above.

Disclosure : This Amazon page is an Affiliate site where we get a small fee in case you make a purchase. Rest assured there will be no additional cost you need to pay in case you make your purchases through this page. However this will help us in a big way to make this service self sustaining. Looking forward to your support as always.

Section B – acceler8

Portfolio Updates

1) acceler8 portfolio NAV

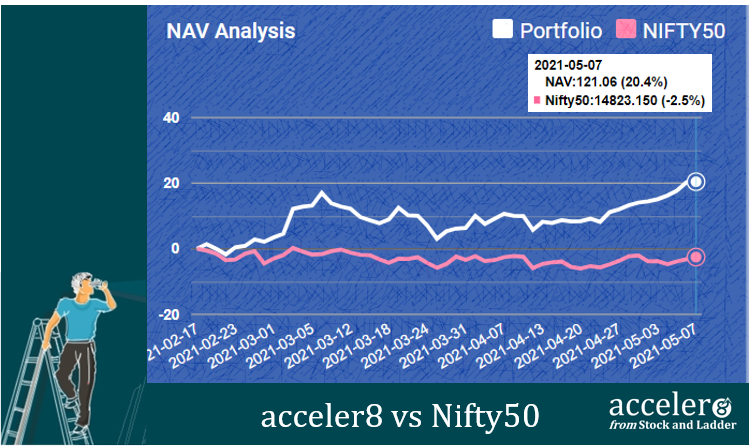

As on 07 May 2021, the NAV of acceler8 portfolio is 121.06 (+20.4%) and has outperformed the benchmark Nifty50 by a significant margin (+22.9%).

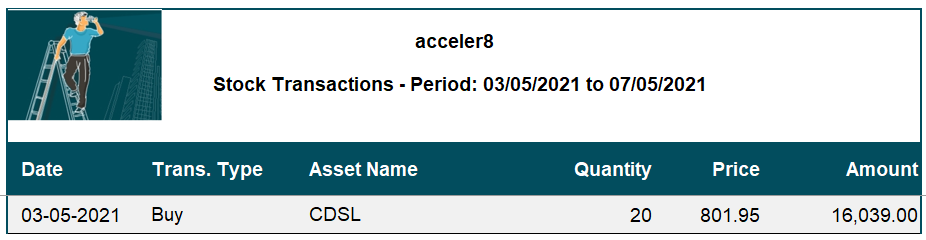

2) Trades done for the week

The following trades were done this week.

CDSL is a fundamentally strong scrip with excellent financials. We will delve deeper into it in subsequent issues.

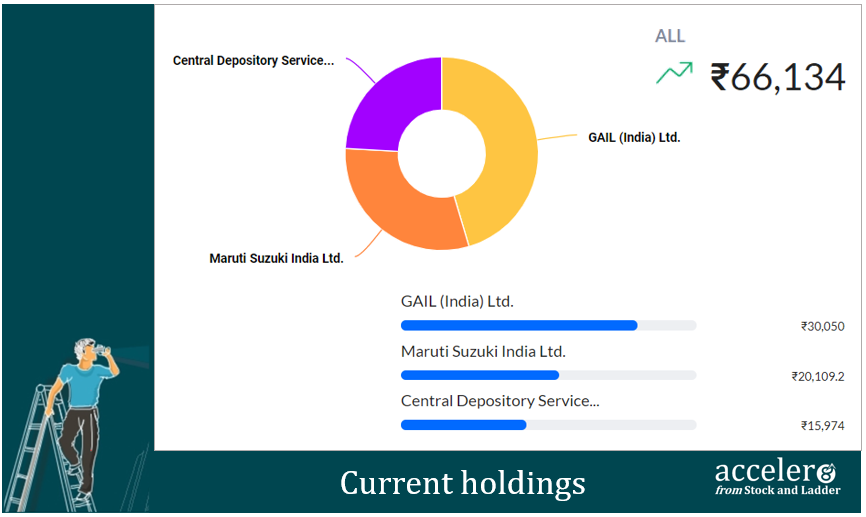

3) Current Position

As on 07 May, the consolidated value of current holdings is at ₹66,134 with around 40% in cash.

Section C – Stock Screeners

Based on subscriber feedback and also as part of our constant endeavor to provide maximum value to our subscribers, we are introducing a new feature from this issue. We will be looking at profitable stock screeners backtested in the Indian market.

How will these screeners help ?

The stocks which qualify / pass the screener can be used to create a high quality watchlist which can be taken up for further research or analysis. We will be looking at multiple screeners covering different investing strategies : value investing, growth investing, dividend investing, momentum investing etc.

A model dummy portfolio will be used to track the performance of each of these screener strategies.

First up, we will look at a momentum screener.

Momentum 20-20 screener portfolio

Acceler8 portfolio follows a proprietary version of momentum investing which I call as Bluechip momentum. The strategy tries to marry three investing strategies: Quality investing, Focus investing and momentum investing to pick up winning stocks for short term profits.

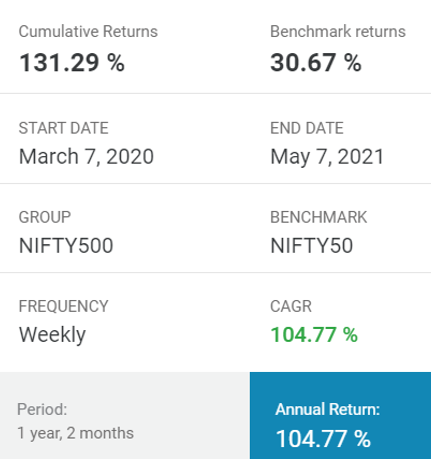

I back-tested a version of this strategy with data from the Indian market . The goal was to create a 20 stock portfolio from NSE with a weekly rebalancing for a year and it was benchmark it against the Nifty 50

Back-testing results

The result was nothing sort of startling. The strategy delivered a CAGR of 105.12% with excess returns of over 100%.

Momentum 20-20 screener

This is a mechanical strategy and does not involve any intervention from my side.

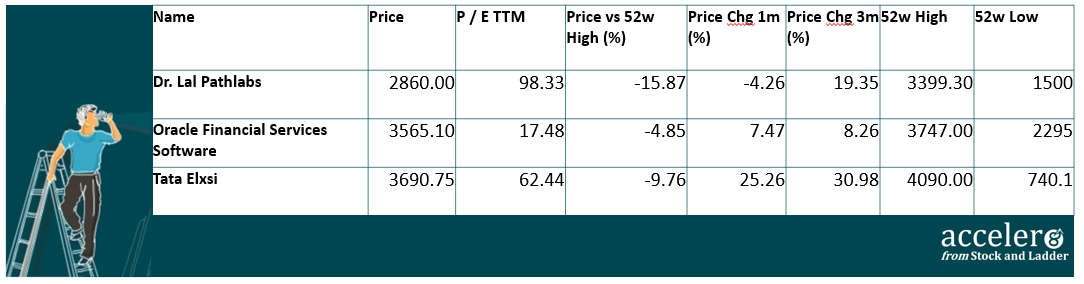

Three stocks qualified and passed the screener.

1. Dr. Lal Path Labs

2. Tata Elxsi

3. Oracle Financial

We will be sharing the updates on this portfolio on a weekly basis.

Until next week, stay safe.

Keep learning, Keep rising

Team #acceler8

PS : Please share your thoughts on the new feature of Stock Screeners we have introduced in this issue.

Dear Subscriber,

This is a gentle reminder for those of you who are yet to share the Membership Form with us. This is required to help us set up the Telegram group.

In case you have already shared your details, please ignore.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr