Issue 026, 29 Aug 2021

Section A – illumin8

Swing you Bum!

The stock market is a non-called strike game. You don’t have to swing at everything – you can wait for your pitch. The problem when you’re a money manager is that your fans keep yelling, “Swing you bum!”

– Warren Buffett

“The trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot. And if people are yelling, ‘Swing, you bum!’ ignore them.”

While Buffett can ignore, normal mortals like me cannot.

I can understand that for some of you the thought that we are not doing enough trades may have crossed your mind.

As a cricket crazy nation, I am sure many of you would have followed our Indian cricket team’s horror show in the third test against England.

A where our Indian batsmen were poking at balls outside the OFF stump and giving catching practice to the slip corridor. Why talk about the horror show of the Indian Cricket Team?

One of our acceler8 customer and my good friend gave me a call on Friday and said he has some market feedback for me “Ravi, there is a feeling that the number of trades we are doing in acceler8 has come down and the last few trades have not exactly lit up the charts”.

To be honest, I expected this question to come up.

I tried to explain my rationale to my friend that when markets are in such expensive and unchartered territory ,we must preserve our capital and only trade when we are absolutely convinced of the idea. No trades for trade sake.

By the end of that 10 min call he told me that he really understood my reasoning and agreed to my line of thinking that in expensive markets its very important to not lose your shirt.

However, he also added that it would be better if I could also write a few words in the next edition of the newsletter so that the other readers also could understand. I said to him, “Not just few words, but the whole edition”

While I had mentioned about these when I launched the service I now realize that some things are good to be repeated ,emphasized and highlighted.

Dear readers, hopefully you too can agree with my logic by the time you reach the end of this post.

A) Bhav Bhagwan che

I am not sure how many of you have interacted with investors, traders and brokers from Mumbai. I have noticed a phrase being often repeated by them- “Bhav Bhagwan Che”. It roughly translates to “Price is God” (in the stock market).

What ever be your strategy – Value / Quality / Momentum- Price is the key factor which determines your returns. Even shares of outstanding companies take a very long time to reach the highs reached during bull market frenzy.

Let me share with you all my favourite example from the Indian stock market:

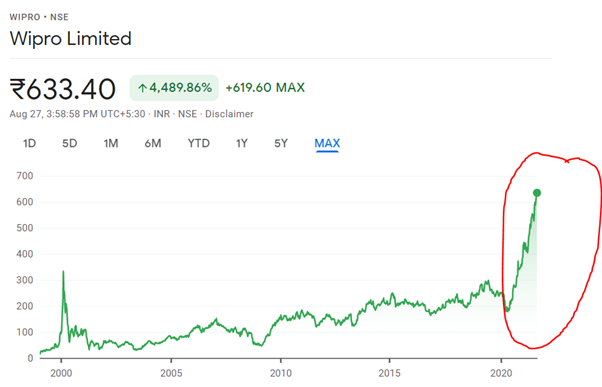

Price chart (1999- 2001)

Please have a look at the below chart and you can see a sky scrapper sticking out. can you guess this Bluechip scrip?

Clue:

This is a fundamentally sound company with an excellent and honest management. This Sensex scrip has an outstanding track record of rewarding shareholders in 2000 also just the way it is today. (For the record, the company has declared 30 dividends and 5 bonuses from 2000).

Now before I reveal the scrip name, here are three more charts of three investors who invest in this Bluechip scrip in February 2000 with a gap of one week each

Investor A- Feb 4th 2000, PRICE=200

Now let us say an investor A got into the scrip on Feb 4th, 2000, the price was 200.

The investor then would have had to wait till Feb 2013, a cool 13 years for the scrip to touch the price he paid on Feb 4, 2000. Price is God.

Investor B- Feb 10th 2000 , PRICE = 264

Now let us say another investor got into the same scrip one-week later on Feb 11. The Momentum was fantastic. What was 200 quickly became 264. All the momentum screens would have flashed this stock.

This investor would have had to wait 19 years for the scrip to touch the price he paid. And since he was one week late in 2000 (Feb 10 instead of Feb 4,) he had to wait another 6 years till 2019 for the scrip to touch the price paid.

Investor C – Feb 18th 2000- Price =334

Now we will make it even interesting. Another investor C invests in the scrip on Feb 18th (another week later). The momentum is awesome, and the peak price is 334. So you had Investor A on Feb 4 @ 200; investor B on Feb 10 @ 264 and now investor C @ 334.

The investor C would have had to wait for almost 21 years (Oct 2020) for the price to touch that price what he paid on Feb 18, 2000. Think about it, Investor A had to wait 13 years, Investor B- 19 years and investor C – 21 years; All invested in the same month – February 2000.

Still wondering which scrip is this?

The scrip is WIPRO. If you thought that the spike in early 2000 was a sky scrapper then what would you call what is happening now in 2021.

Will any of us like to wait for 15 years to just break even? Newton famously said “I can calculate the movement of the stars and the planet but not the madness of men in the stock market”. Don’t know what that genius would have had to say if saw what is happening in our markets.

Hence, one must be very careful with the price paid for a security however good the business may be. If one pays a too high price then one may have to wait sometimes for 1 or 2 decades to profit.

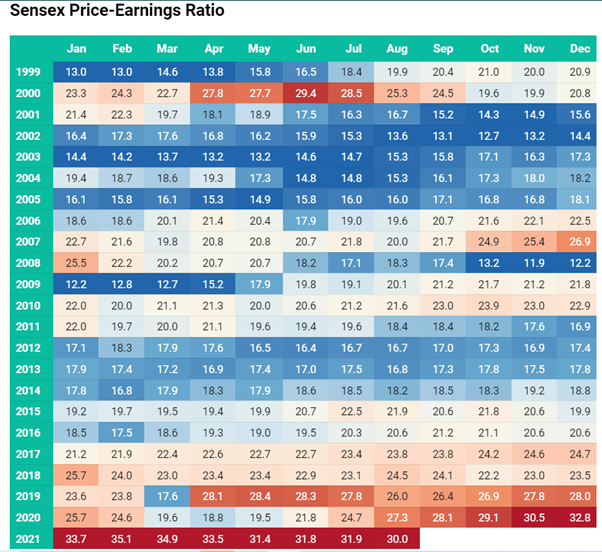

B) CAPE RATIO

The CAPE ratio – cyclically adjusted price-to-earnings ratio was popularized by Yale University professor Robert Shiller. It is also known as the Shiller P/E ratio and is generally applied to broad equity indices to assess whether the market is undervalued or overvalued

CAPE ratio is the commonly used measure to assess how expensive the indices are. The CAPE ratio is a valuation measure that uses real earnings per share (EPS) over a 10-year period to smooth out fluctuations in corporate profits that occur over different periods of a business cycle.

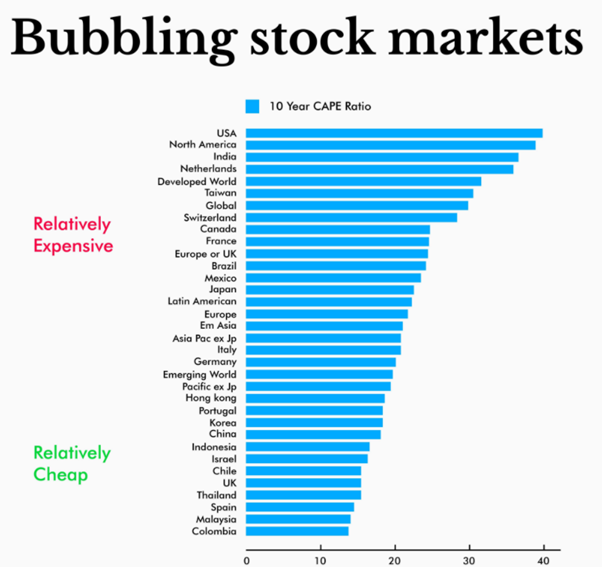

While equity markets globally have rallied, the Indian stock markets are one of the top performers across the world.

Look at the charts: India is the third most expensive market in the world. Let that sink in.

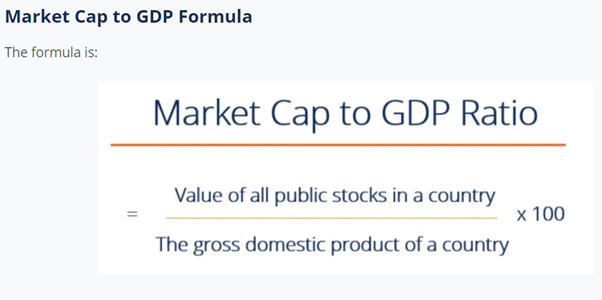

3) Buffett Indicator

In a 2001 interview with Fortune, Buffett stated that the best measure of whether the market is over, under, or fairly priced is how the total market capitalization of all U.S. equities compares with national income.

As Buffett put it, “The ratio has certain limitations in telling you what you need to know. But it’s probably the best single measure of where valuations stand at given moment.”

Recently, Mint ran a story

the measure is estimated at 104% for the current fiscal, pointed out Motilal Oswal Securities Ltd. This is well above the historical average of 79%.

We are 25% above our historical average. While some experts claim that , this indicator is not valid for India due to her unique circumstances, the market cap of all BSE Scrips have crossed 3 trillion dollars in 2021and many believe that 5 trillion dollars is next.

So as per Buffett indicator too, the market is overheated.

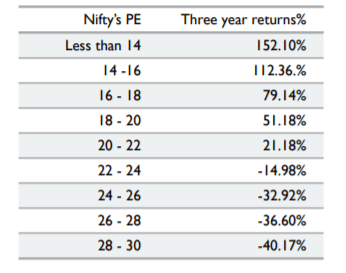

4) Prof. Bakshi’s study

Professor Sanjay Bakshi wrote this fine piece of advice in late 2008 on expensive markets

“Recent research done by my firm shows just how dangerous it is to remain invested in an expensive market. Since NSE started, every time when Nifty’s Price/Earnings ratio exceeded 22, the average return from Indian equities over the subsequent three years became negative — see accompanying table.

When the next bull market comes, you will find plenty of “experts” who will tell you to buy stocks and to remain invested, and to ignore lessons from history because “this time its different.” You must resolve today that you will ignore such advice. You will avoid investing, and remaining invested in equities when they become historically expensive.

Remember this: History tells us that when markets fall, almost every stock falls too. Sure there are cheap things to buy in a bull market. They are traps. You will avoid them because you know that cheap things will become cheaper after a major market decline.

By ignoring the table and my advice, you will not prove Benjamin Disraeli right when he wrote: “What we learn from history, is that we don’t learn from history.

If you study the table then above 22 PE the possibility of making some money over three years is very unlikely with a high possibility of negative returns.

Today we are in un-chartered territory. The Sensex PE is not only above 22 but more than even 30. It had even touched 35 this year.

There seems to be no correlation between corporate earnings, state of the economy and the state of the stock market. Mind you, the threat of COVID has not entirely receded either and the threat of the third wave looms.

While I have highlighted 4 key reasons there are many more reasons but I am pretty confident you would have got the crux of my message

Final thoughts

As a philosophy, the return of capital is of utmost importance than return on capital. While I can understand why some of you may feel that we are not doing enough trades, it is of paramount importance to understand that we will never be doing trades for the sake of investing.

The 15 consecutive 25% + returns is a testimony to the underlying power of our strategy. Rest assured no stone will be left unturned to ensure that your money never sleeps. While I can hear shouts of “Swing ya, Bum”, I hope that you are also now as convinced as my friend was when I explained to him the reason as to why we are at 60% cash .

We will wait for the big fat pitch and hopefully Mr. Market will throw us a juicy full toss soon. The antennas are up and I am again assuring you that we will burn the midnight oil to find profitable ideas.

Section B – acceler8

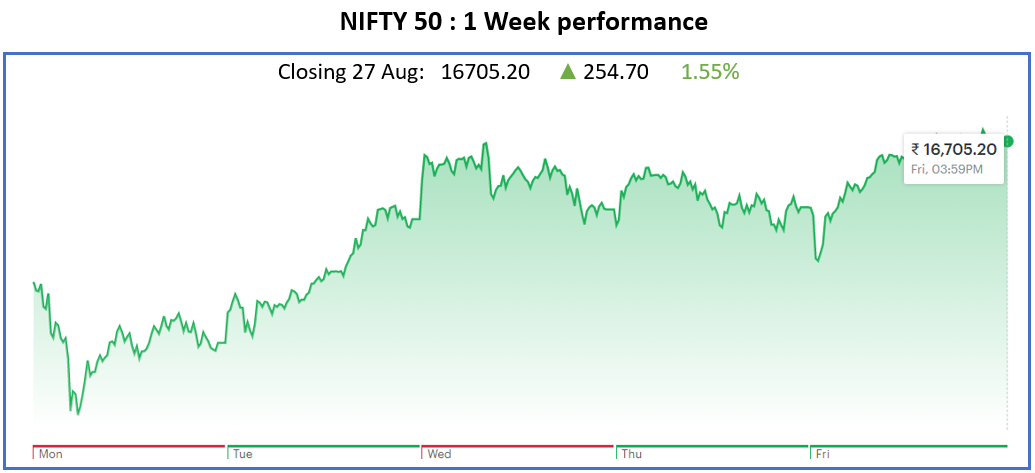

Nifty50 Last Week

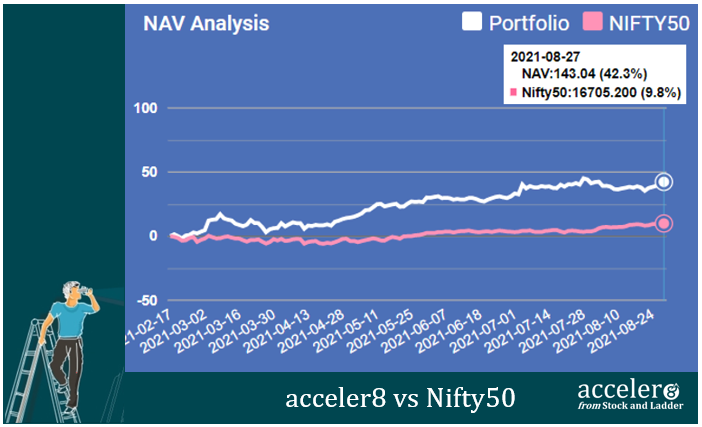

acceler8 Portfolio NAV

#acceler8 continues its strong performance and the portfolio has +32.50 % outperformance against NIFTY 50.

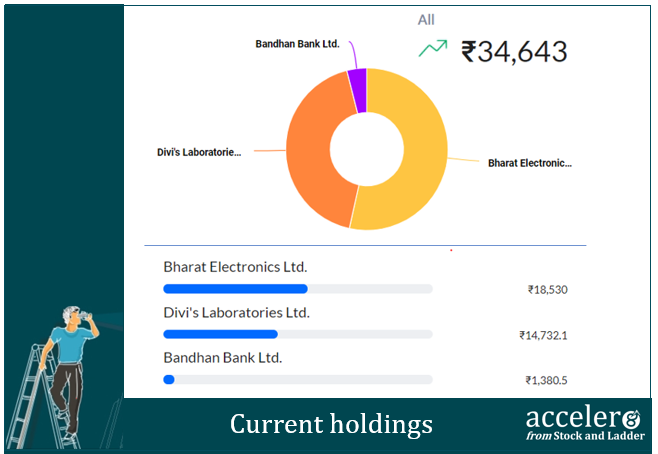

Current position

As mentioned in section A, we are close to 60% cash. With this extremely high valuations, I prefer to do a quick surgical strike of entry and exit. Also, the scrips we are holding are fundamentally sound scrips and paraphrasing Buffett “Even if the market closes for 5 years, I am happy to keep them”

Stay Calm, Stay Safe.

Happy investing.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr