Issue 005, 18 Mar, 2021

“ The greatest education in the world is watching the masters at work”

There is always something to learn because life never stops teaching. If we get to learn from the best in the business then our learning gets accelerated.

Last month we had a fine investing conversation with Alok Jain from weekend investing.

This month we have lined up another fine investor who has been kind enough to spare his time to share with us the distilled essence of his two decades of investing learning – Abhishek Basumallick

Abhishek is the founder and principal equity advisor at www.intelsense.in, a SEBI registered equity advisory. He is an investor in India equity markets for nearly two decades.

He is an electrical engineer by education with an executive management degree. He started his career in the IT industry. The equities bug bit him early on and he started investing in equites just as he started his IT career in 2000.

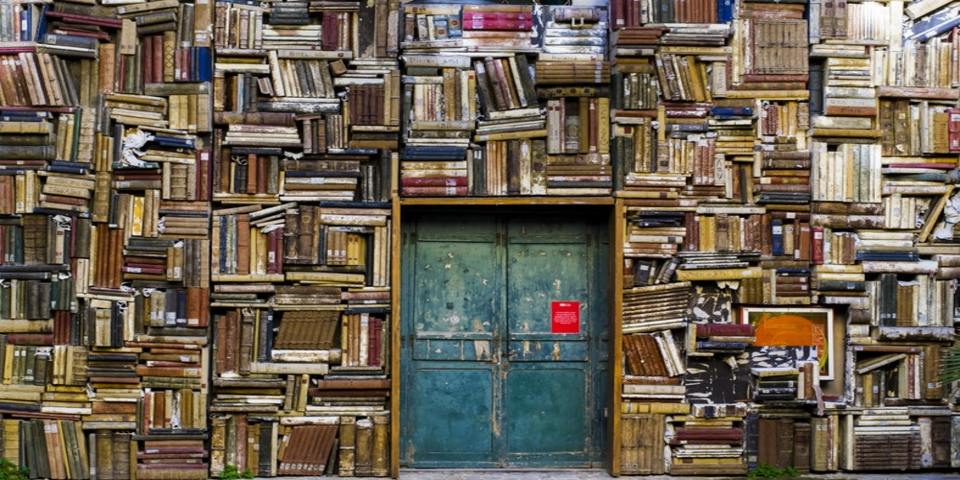

He is a keen bibliophile and loves reading across genres. He also passionately follows sports – tennis and football (stopped watching cricket after Sachin retired!)

Ravi :

Stephen King famously quipped “ The scariest moment is always just before you start”.

Please tell us something about yourself and about how our journey into the world of investing began?

ABHISHEK:

I am from Kolkata and started investing from 2000. I had absolutely no background in investing so had to learn everything from scratch. Made a lot of mistakes in the initial years. I tried a lot of things in the initial years. I read a lot, something like 4-5 magazines, online articles in Investopedia.com and fool.com and brokerage reports that I could find.

I chanced upon The Warren Buffett Way and immediately connected with the logic of buying businesses. That book opened up a whole new world of investing for me.

Ravi: That’s quiet interesting. Incidentally you are the third interviewee mentioning about the book “The Warren Buffett Way”. It is one inspirational book I think I am going to include in my book recommendation list.

Next up, What accurately describes your current line of investment thinking / investing strategy? How has your investing philosophy / process evolved over the years?

ABHISHEK:

I have always believed in thoughtful investing. I am a skeptic by nature and also fairly disciplined. I love to understand the big picture of an investment and am a proponent of behavioral psychology and strongly believe that it is perhaps the biggest factor in investing success or failure.

Investing is like life and it is critical to continuously keep learning. I am also keenly studying factor investing (quantitative investing) using algorithms for building a portfolio as well as technical analysis. It is important to integrate all information into our analysis, whether it fundamental, technical or statistical data.

I strongly believe in error reduction in investing. For that I personally use checklists. This checklist should be a living document and should incorporate all learnings into it.

Ravi : Cannot agree more on every single point especially on continuously learning. I am reminded of the famous sculptor & painter Michelangelo said at the age of 87 “I am still learning”.

Phew, get goosebumps when I think about this. This need for constantly learning and trying to get continuously better at investing is a reason behind my acceler8 newsletter.

Based on your current thought process you have mentioned, what are the criteria’s or characteristics you look for in a business for it to be considered investment worthy?

ABHISHEK:

I look for strong businesses with reasonably good management. I prefer to buy them at cheap prices but am not averse to paying up. I really like the QGLP framework espoused by Raamdeo Agarwal. I think it is a great mental model to think about businesses. Opportunity size and quality and sustainability of growth is very important.

The most important aspect is to work on one’s own investment psychology. The ability to hold on during strong market corrections or ability to realize one’s mistake and sell at a loss is not easy.

Another aspect is to understand that it is not possible to have perfect knowledge about a situation. So, no matter how well I think I know a business, I am still always looking for signs that I may be wrong. Being confident of one’s picks is important, and conversely, being able to change one’s mind fast is also equally important.

For example, Bajaj Finance, is a stock I hold (not a recommendation for readers) for a while. I think it has the hallmark of being a excellent long term compounder. It is up a lot from when I bought it, so the psychological feedback is positive. Yet, lot of things can go wrong.

So, as an investor I need to be open about understanding them and monitoring them. High valuations is just one of the problems with the company, which everyone seems to be fixated on.

Ravi : QGLP is indeed a great mental model to have in your arsenal. Corollary to the above question, if there were to be “ABHISHEK’s 5 rules for successful investing” then what would that be?

ABHISHEK:

I actually have a “10 commandments for myself”.

1. Discipline is the most important aspect of investing

2. Understand the business you are investing in – what products or services it makes, who are its main customers, what are the key raw materials etc.

3. Look for companies with competitive advantage – how does the company keep competition away and maintain its margins

4. Margin of safety – could be from depressed price, sustainability & duration of growth etc.

5. Have patience – compounding works wonders

6. Overcome emotions when selling

7. Don’t make large losses – use a stop loss even in investing

8. Think if you would buy the whole company if you had the money and the option

9. Try to consciously avoid following the directions given out by the market; avoid being fearful when the market falls and greedy when it rallies

10. Volatility is a feature of the markets, not a bug. Expect volatility. Timing the market accurately and consistently is not possible.

Ravi : If it was a gymnastics event, I would have given you a perfect 10 just like what Nadia Comaneci got in 1976 Olympics.

Moving on, What has been your best investment idea (need not be the most profitable) till date? Can you also elaborate on the thinking that went behind the investment idea?

ABHISHEK:

Difficult to name a single “best idea”.

I think I was lucky to have invested in a lot of good ideas. I am not the kind of person who would be the first person to invest in an unknown idea. I usually like to see a company deliver on its numbers before buying.

So, I am usually a late entrant, but probably because of my temperament, I am able to hold on for a long period. I have been lucky in investing in good performing stocks like Supreme Industries, Mayur Uniquoters, Astral Poly, Cera, Symphony, Century Ply, Bajaj Finance, Divi’s labs, Ajanta Pharma and so on.

Ravi : Wow, that’s an enviable collection of compounders. From master stroke let’s move on to mistakes. Mistakes are sometimes referred to as “unexpected learning experiences”.

Can you share any investing mistake(s) you have made and the lessons we can learn from them?

ABHISHEK:

Too many mistakes to count. Specially in the initial years. Lately, mistakes are more in getting carried away in bull phases.

But mistakes which really rankle are those of omission, where I had studied the company and then passed. Stocks like Eicher Motors, Page Industries and HDFC Bank still come back to haunt me. 😊

Ravi : Whenever I get this feeling of regret about something in the stock market, I just remember this tweet

Next up is one of my favorite question. Let us say a bunch of beginners approached you for advice on how to be a better investor then what would your advice for them be?

ABHISHEK:

Actually, a lot of new investors approach me for advice and one of the reasons I started the www.intelsense.in, the advisory, was to have a structured mechanism to help new investors get better.

The first thing to do is to read as much as possible, about investing, about other topics like psychology, sociology, finance, scientific developments etc. to be able to form a broad mental framework.

I also suggest reading about how other investors / traders think and operate. Interacting with good investors is another good way of building up skills.

One definite no-no is getting into too many whatsapp groups. Today, people mistake information for knowledge. Most whatsapp groups, with very few exceptions, are actually detrimental to the investing process.

They create unnecessary noise and distract us. It is better to read and have time to reflect on learnings that continuously skimming to meaningless whatsapp forwards.

Ravi: That’s a set of fine advice especially on reading. Reading is vital for every investor and reading is the process for sharpening our investing axe.

Next up is one of my favorite questions: Which are the top 5 books you feel is a must read for every investor?

ABHISHEK:

Reading will depend on where one is on the knowledge curve. So, there is no one recommended list of books for all.

For people who are starting off investing, One up on Wall Street by Peter Lynch, The Most Important Thing by Howard Marks, Margin of Safety (pdf available only) by Seth Kalrman, Common Stocks and Uncommon Profits by Phil Fischer are good.

Ravi: That’s an excellent set of books to read. I did a small exercise few years back to find the best book for investing beginners and Peter Lynch’s masterpiece did feature.

Last question, outside your passion for stock market and investing, are there any other interests / activities which are close to your heart?

ABHISHEK:

Actually lots!! Sports (both playing and watching tennis and football), reading, chatting with friends, watching movies, listening to Kishore Kumar songs…. The list goes on 😊

Thank you Abhishek, that was really insightful. Thanks once again for your time.

Dear Readers, if you liked this post you will surely like what acceler8 is about.

#acceler8 is all about accelerating your earnings by compounding your learnings.

Subscribe now. There is a 7 day free trial and a discount on the annual offer.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr