Issue 010, 02 May 2021

Section A – Illumin8

Betting on Comebacks

“Great investment opportunities come around when excellent companies are surrounded by unusual circumstances that cause the stock to be mis-appraised”

-Buffett

Momentum investing works on the premise of “buy high, sell higher” whereas at the other end of the spectrum we have value investing strategy which works on the basic premise of “buy low, sell higher”.

This week we take a closer look at one of the interesting value investing strategy put forward by Luke Wiley.

Luke Wiley is the managing director of Wealth Management at UBS. He began his career in financial services in 1997, after graduating from the University of Cincinnati with a triple major in Finance, Accounting, and Real Estate. Luke is also the lead partner of Wiley Wealth Management.

He is also the author of the book “The 52-Week Low Formula” – A contrarian strategy that lowers risk, beats the market and overcomes human emotion.

52-Week low Strategy

Luke Wiley draws inspiration from some of the brightest minds in the field of investing: Warren Buffett, Howard Marks, Michel Porter, Pat Dorsey, among others.

The 52-week Low formula is a contrarian investing strategy based on the idea that even the best companies go through a skid, a downturn in that stock value. If a company answers the above four questions well, then the 52-week formula checks if its trading at low price over the last year.

These then become candidates for further analysis. The underlying premise: Investors punish recent performances even if they are solid companies. But solid companies have a knack of making a comeback. Finding these temporarily fallen out stars and investing in them gives a good chance of profits

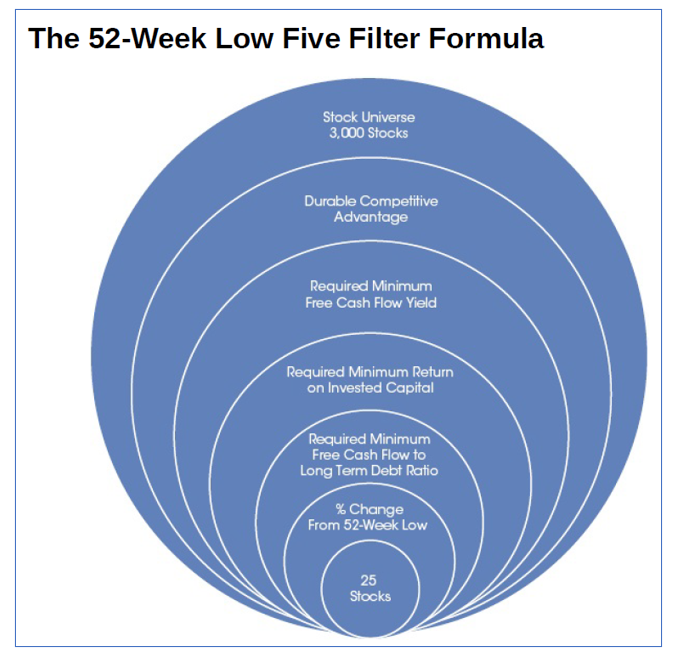

The 52-Week Formula

The below table explains the 5 filters used to screen stocks based on this criteria.

1. Do they have a durable competitive advantage?

In simple words : Does the company has any kind of economic moat ? Is it a company that is hard to compete against either because they operate in a difficult market or because competing with them would require an unreasonably high investment from competition.

2. What is the purchase value of the company?

If someone were to come in and buy everything, would they inherit debt greater than revenue? Would you make more money that you would simply investing in 10-year Treasury bonds?

3. What’s the Return on Invested Capital of the company?

Is it using its money well to create returns or is it taking on bad investments that don’t pay off?

4. Can it pay its debt off quickly?

There are a lot of companies out there that are making a lot of money, but can they, should all revenue activities cease and all debt come due, remain in the black?

5. Finally, is it trading close to its 52-week low?

After the first four filters are applied, this is the most crucial filter which seeks to identify companies trading close their 52-week low which implies they are temporarily fallen outside the investors radar.

How has this strategy performed ?

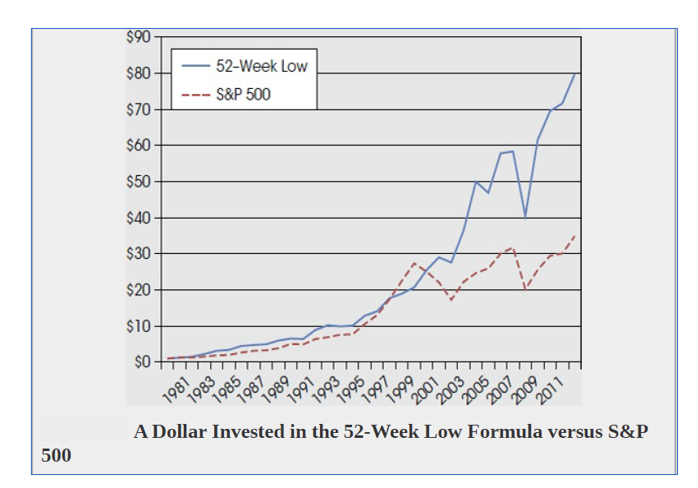

An investment research firm Empiritrage conducted back testing of how the 52-week Low formula performed against the Standard & Poor’s (S&P) 500 between 1980 and 2012.

Empiritrage’s independent testing examined the journey of a single dollar invested in both the 52-week Low formula and the S&P 500. Both investments were equally valuable in 1980: $1 (One Dollar)

52-Week formula Vs S&P 500

Backtest result

The researchers found that by 2012, that single dollar invested in the S&P 500 was now worth $34.87, while the dollar invested in the 52-week Low formula was now worth $79.69—more than twice that of the market investment.

Back-testing in Indian Market

We applied a modified 52-week formula and below are the results.

52-week low stock screen

Based on the 52-week low formula, a stock screen was developed and few additional parameters which are hygiene factors (fine tuned over many years) for my investment strategy were added to the original 52-week low formula.

Few key screener criteria (not the complete)

Within 10% of the 52-week low

ROCE > 12%

Net Profit Margin > 5%

Long term Debt to Equity < 0.5 + ……………..

Backtest results – India

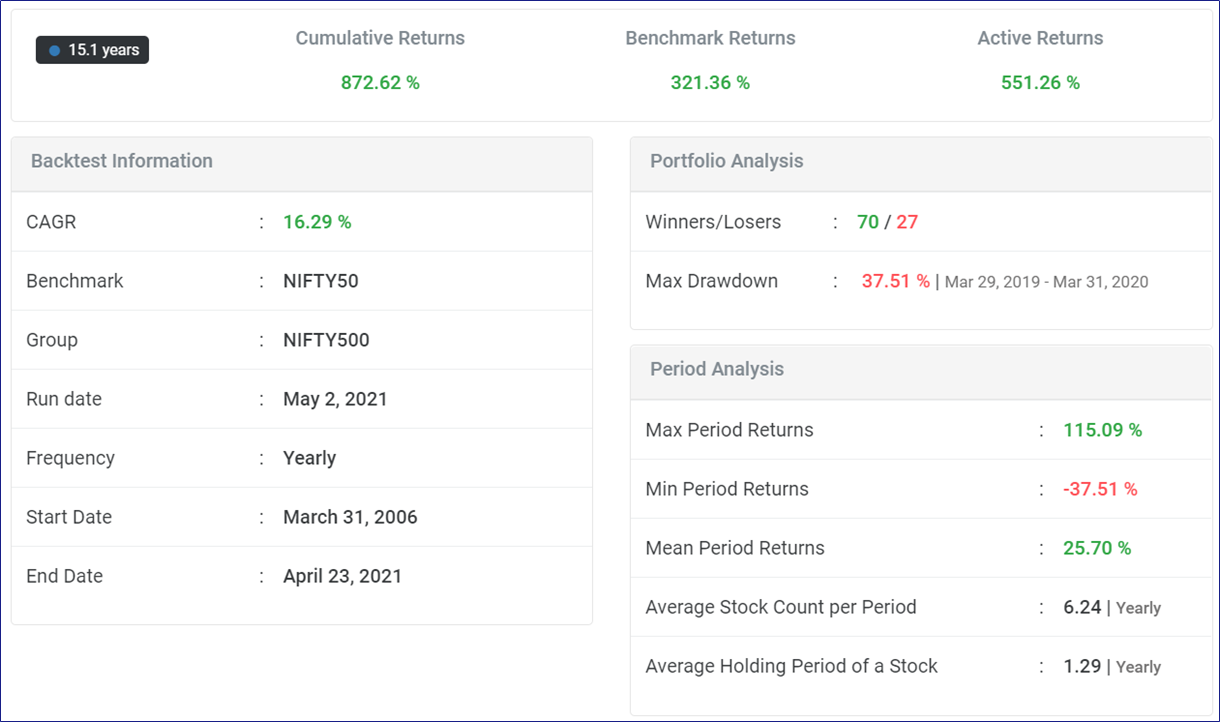

a) CAGR of 16.29%

The screener was applied on NIFTY 500 to create a 20 stock portfolio which was rebalanced annually and backtested for 15 years.

The portfolio delivered an impressive CAGR of 16.29%. The returns were benchmarked against NIFTY 50 and there was an impressive outperformance of +551.26 % over 15 years.

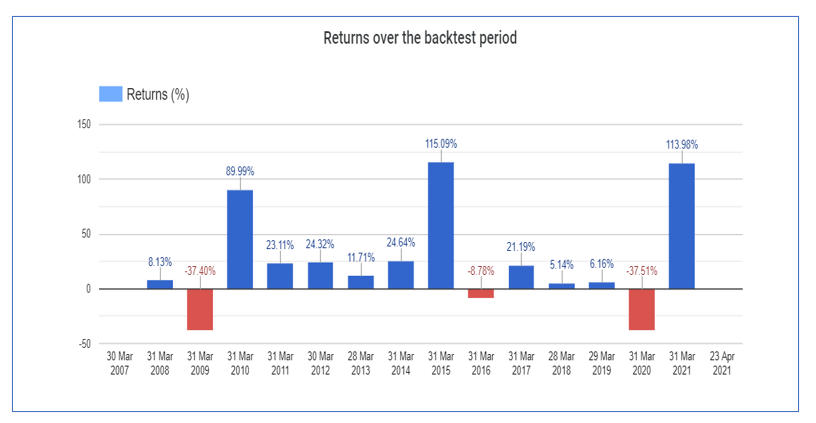

b) Consistent performance across market cycles

If we were to analyze the returns over the period of 15 years the 52-week low formula trailed to give a negative return in only 3 years. This implies that this strategy is effective across market cycles.

c) Long term strategy

In the original 30 year backtest (referred in the “52-Week formula Vs S&P 500”), it was observed that the strategy trailed the benchmark in the initial years and only after a decade the outperformance started showing up before it really exploded in the second and third decade.

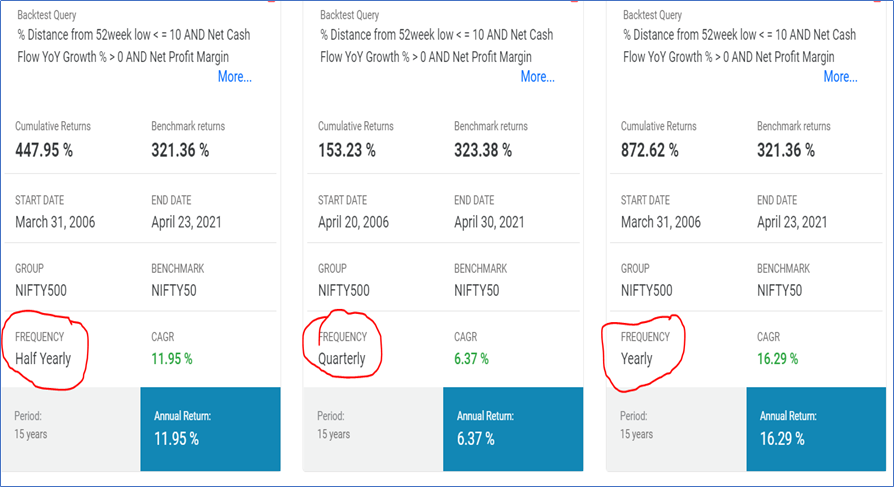

We backtested the same strategy with different rebalancing frequencies :

Quarterly

Half-yearly

Yearly

The screener when applied today (2 May 2021) returned two stocks :

a) Nestle India

b) KRBL

Final Thoughts

While no strategy is perfect, Luke Wiley’s 52-week low formula provides the investor with a screening criteria and an investing strategy which has delivered long term returns consistently.

While all the stocks which pass this screener may not be a sound investment, it does provide the investor with a quality watchlist which can act as a good starting point for further research.

Betting on a comeback is a tricky and risky investing strategy but when done intelligently can be quite rewarding.

Section B – acceler8

Portfolio Updates

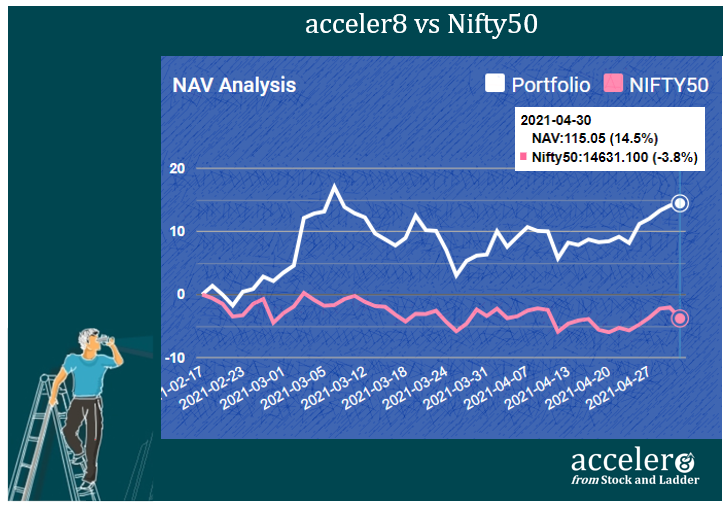

1) acceler8 portfolio NAV

As on 30 Apr 2021, the NAV of acceler8 portfolio was 115.05 (+14.05%) and has outperformed the benchmark Nifty50 by a significant margin (+18.3%).

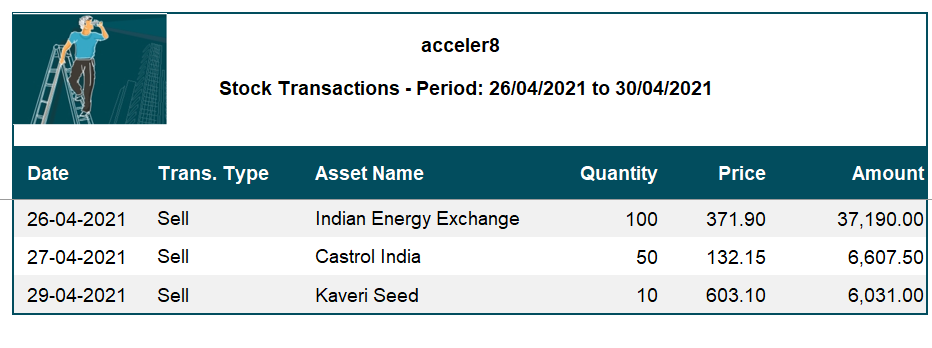

2) Trades done for the week

The following trades were done this week. I had mentioned in an earlier letter “we have cast our net and its time to wait” and the time had come this week to enjoy the fruits of our investment.

All the three trades returned decent (being modest 🙂) profits.

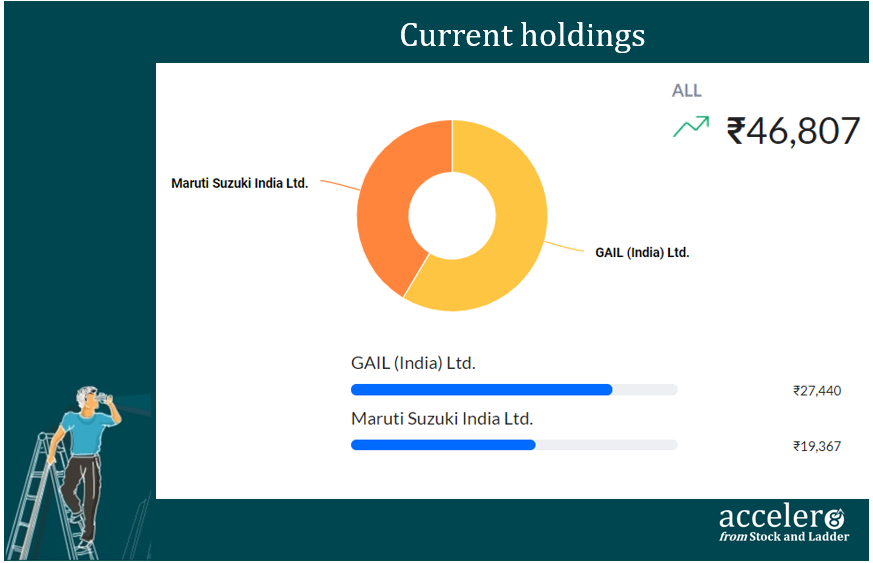

3) Current Position

As on 30 Apr, the consolidated value of current holdings is at ₹46,807 ( with 60 % approx. in cash).

Market Musings

“In order to succeed you must first survive”

The above thoughts often quoted by Warren Buffett / Nassim Taleb / Howard Marks describes the current investing climate aptly.

With the second wave of Covid pandemic hitting India hard with new record number of cases being reported, the situation is one of exasperation and desperation. India Inc continues to put up a brave face along with the Indian public.

i) In these circumstances as I have consistently maintained it is better to have quick surgical strikes in the market and take profits than leave money on the table. This is precisely what we did at acceler8. Even though the fundamentals remained intact we exited both Kaveri and IEX.

a) Kaveri Seeds was exited with a 5+% profit in less than a week and

b) IEX was exited with 8+% profit in a month.

ii) Castrol was a trade done not specifically with a momentum strategy in mind as was explained in the webinar as well my earlier newsletters. It was a short term arbitrage as the company had already declared a dividend of ₹ 3 per share. The Castrol trade panned out exactly as planned and we exited with a 9% gain in a little over a month.

iii) Since inception acceler8 portfolio has delivered an XIRR of 97.87 %. While such high XIRR is hard to sustain, acceler8 portfolio continues to enjoy “good momentum”.

With 60% in Cash, we are ready to capitalize on any good opportunity Mr. Market might throw at us.

Section C – Cura8

We have started a video series highlighting investing insights for intelligent investing.

Please do checkout our first video in the series.

Hope you enjoyed the video and Subscribed to our Channel.

Until next week, Stay Safe.

Keep Learning, Keep Rising.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr