Issue 005, 21 Mar 2021

Section A – Illumin8

Quality triumphs Junk

“Quality is never an accident; it is a result of intelligent effort”- John Ruskin.

Everyone loves Quality. So, should YOU if you are a thoughtful stock investor.

When we buy electronic appliances, gadgets, groceries, clothing or any other products for our personal use, we expect it to be of “very good quality” at a very “reasonable” price.

Why should it be different when it comes to buying stocks?

Superinvestors on Quality

“We’ve really made the money out of high-quality businesses. In some cases, we bought the whole business. And in some cases, we just bought a big block of stock. But when you analyze what happened, the big money’s been made in the high quality businesses. And most of the other people who’ve made a lot of money have done so in high quality businesses.”

-Charlie Munger

“We aim to invest in high quality businesses. This may sound blindingly obvious, but you might be surprised how many investors either don’t do this

–Nick train

“Quality counts. If you are a long term investor, it’s hard to find a more important factor as to what will power your ultimate investment returns.”

-Thomas Gayner

As is apparent that quality as a factor is highly valued by successful investors. The question then arises in our mind, what is considered as “quality” when it comes to stocks.

What is Quality ?

“We look for very high quality businesses, what we’d describe as simple, predictable, free-cashflow generative dominant businesses. A business Warren Buffett would describe as having a moat around it.”

-Bill Ackman

“Is it a great business? That’s the key question. Is it earning high returns on capital and command high margins? Does it have a good history of growing its intrinsic value and rewarding shareholders?

-Francois Rochon

We define quality as the ability of a business to sustain a high-unleveraged return on its capital. We concentrate on businesses with clear opportunities to grow indefinitely while generating high returns on the capital required for growth. We prefer businesses that would make a high return on their shareholders’ equity, even if they were debt free.”

-Andy Brown

So there you go, you have a great set of criteria to define quality stocks :

· Free cashflow

· Simple and predictable

· Economic moat

· High returns of capital

· High margins

· Debt free (unleveraged)

· High growth opportunities

What happens when you buy quality ?

Numerous studies have shown that investing in “quality” companies is highly rewarding to investors.

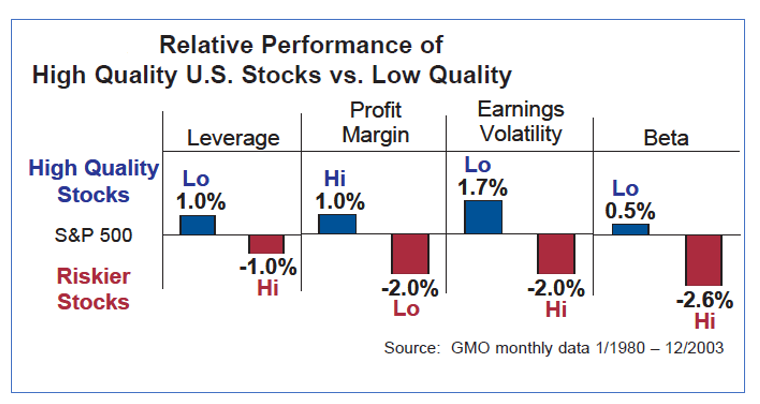

In one such excellent study by GMO “The Case for Quality- The danger of Junk” the authors compared the performance of high quality stocks versus low quality and found high quality stocks to outperform which is relatively unsurprising.

What is surprising was that investors were regularly willing to overpay for “riskier” stocks while overlooking the less riskier, more profitable, more rewarding and less volatile high quality.

In the study, Quality company meant fulfilling all the three criteria:

Low leverage

High profitability

Low earnings volatility

The authors studied data from 1980 and concluded :

“High quality stocks have always won over longer holding periods. No matter what metric is used to identify quality stocks – leverage, profitability, earnings volatility, or beta – high quality stocks have beaten out low quality stocks”

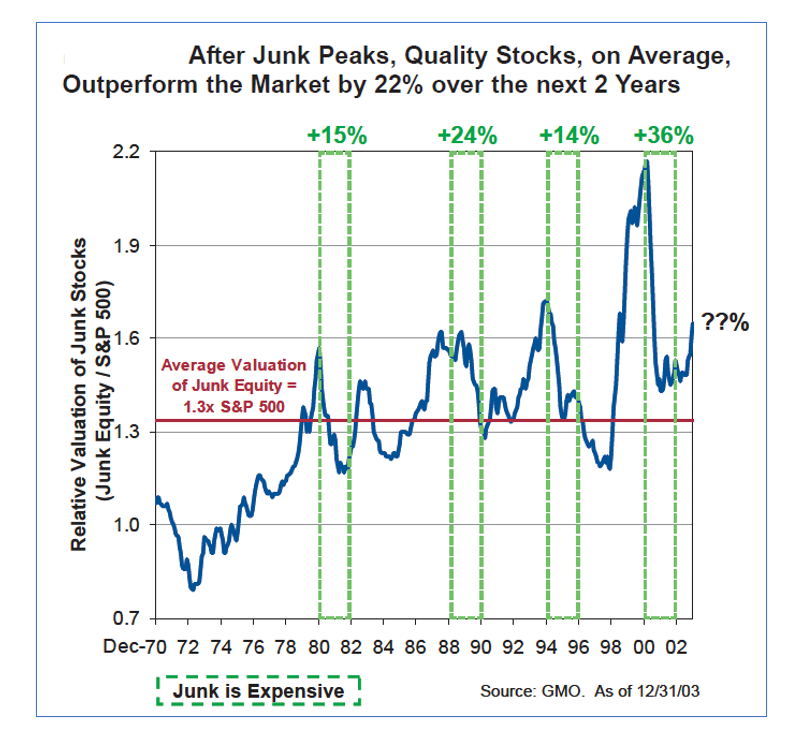

There may be an occasional year where high quality tends to underperform but “junk stocks” after their peak regress quickly and reverts to mean. This was validated in the study

“Since 1971, as low quality regresses, high quality stocks have, on average, outperformed the market by an average of an amazing 22% over the next 2 years”

As is clear, quality investing as a strategy is highly rewarding to investors.

Then the million dollar question which comes to our mind: “Does the strategy work in India?”

Back testing

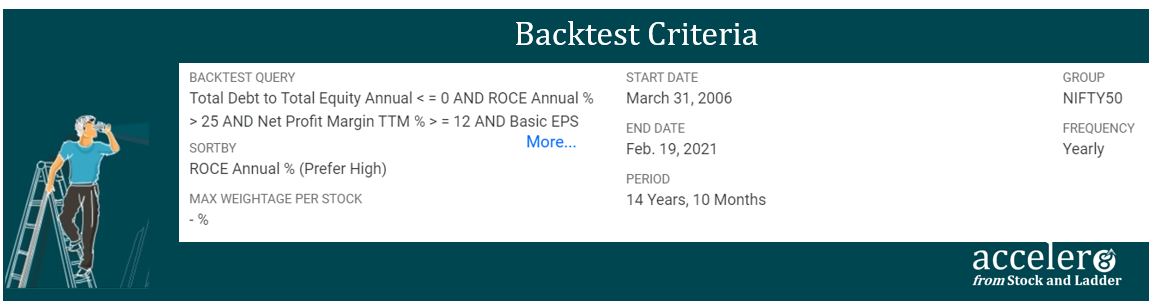

We ran a modified screen on the data from Indian market.

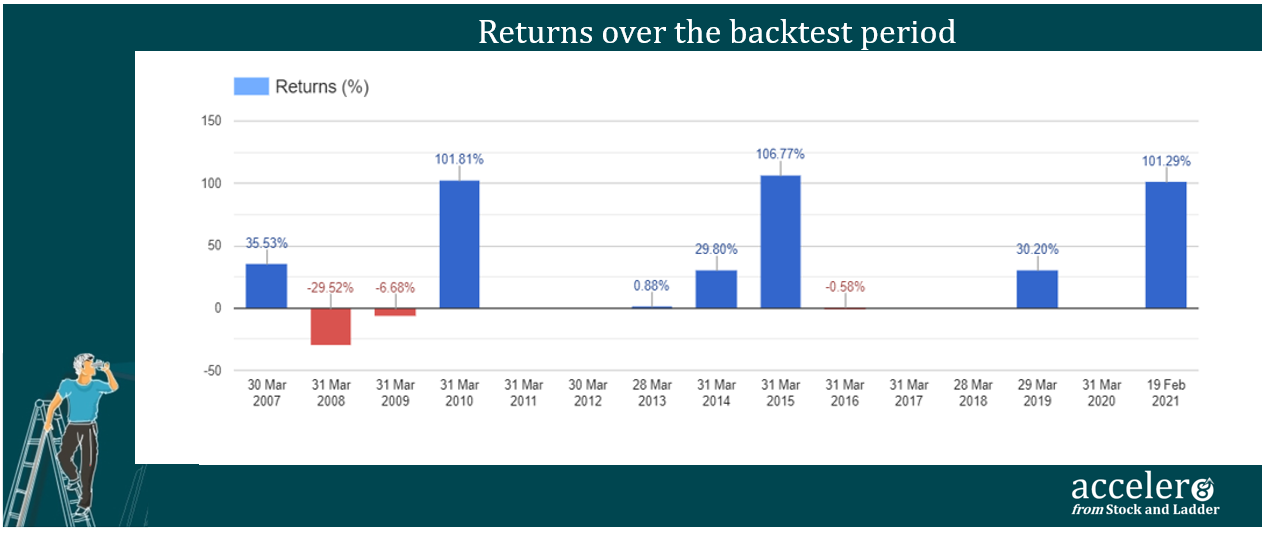

Along with the basic criteria of low leverage, high profitability and high return on capital, added a couple of proprietary criteria’s and back tested the data for 15 years.

Criteria

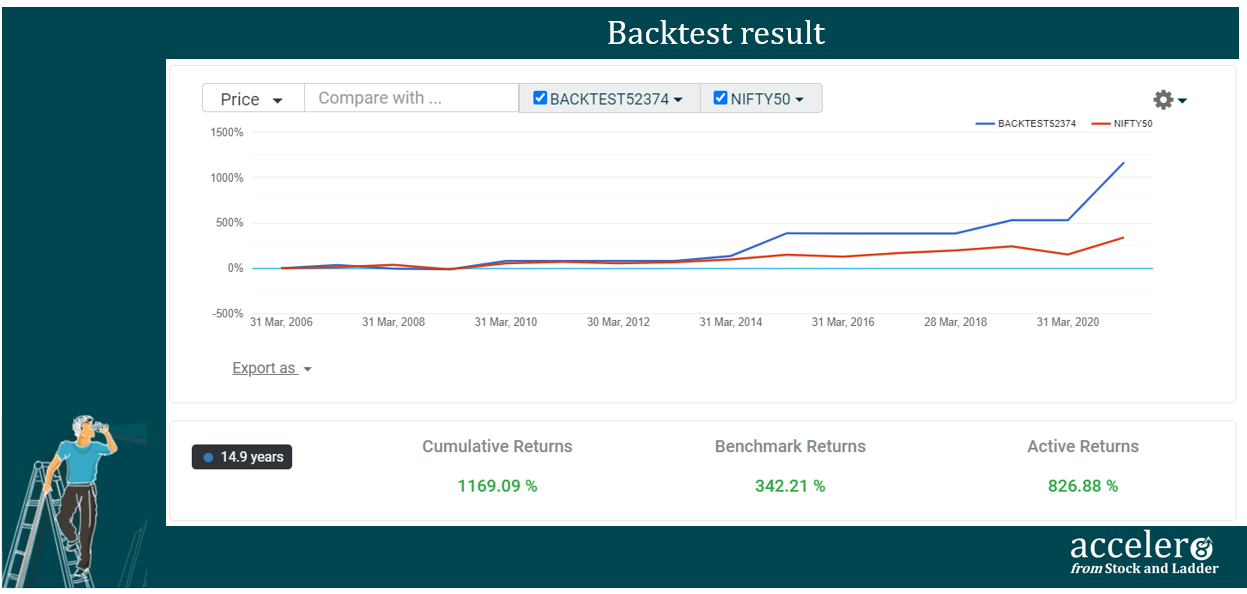

The result was nothing short of amazing –

A CAGR of 18.59% and a overall return of 1169 %.

Its clear that quality investing is an excellent investing strategy for investors to pursue.

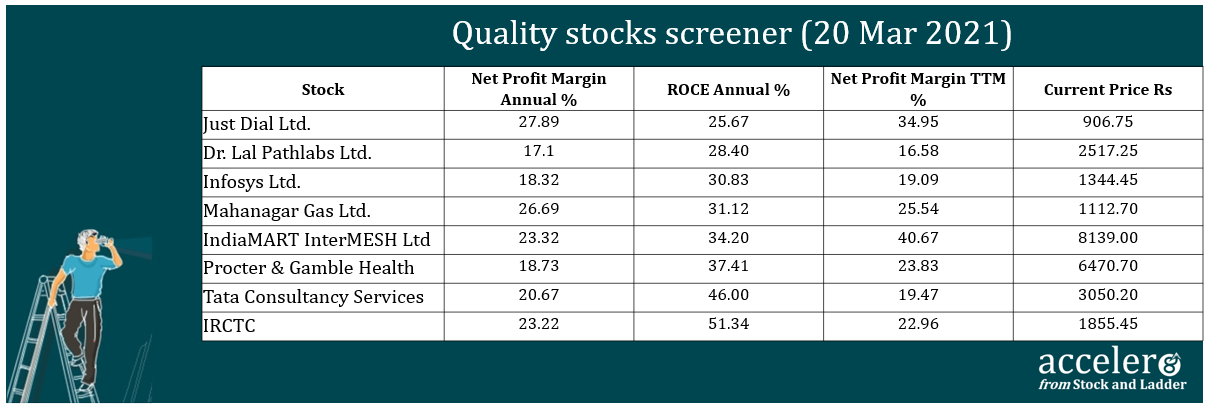

Then the next question that comes to mind is applying this criteria to Indian market. The following scrips passed the screener when I ran it today.

If you are keen to know what the screener will throw up then here are the results:

Stocks that qualify

As the GMO study and numerous other studies have confirmed that sticking to quality companies is profitable investing strategy. The acceler8 portfolio follows a strategy which I call as Bluechip momentum investing where quality is one of the key factors for stock selection.

As Philip Fisher said

“I believe that the greatest long-range investment profits are never obtained by investing in marginal companies”

Section B – acceler8

Portfolio Updates

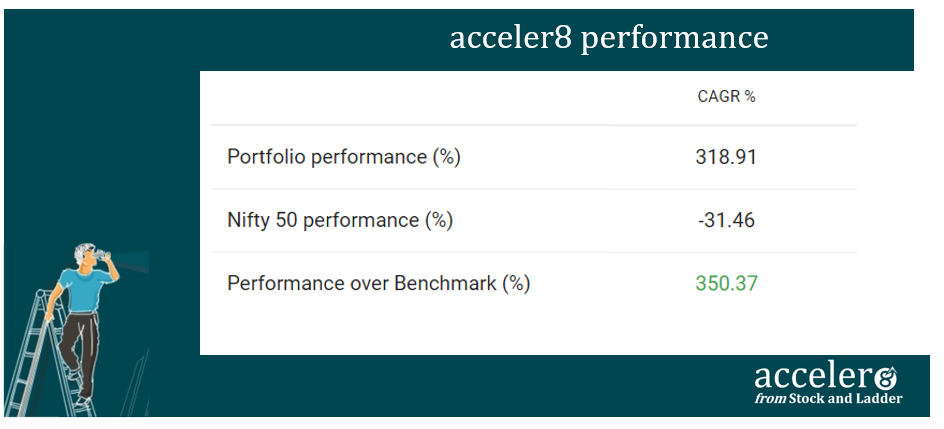

The strong run of acceler8 portfolio continues and we continue to exercise cautious optimism and undertake only high conviction trade.

acceler8 portfolio NAV

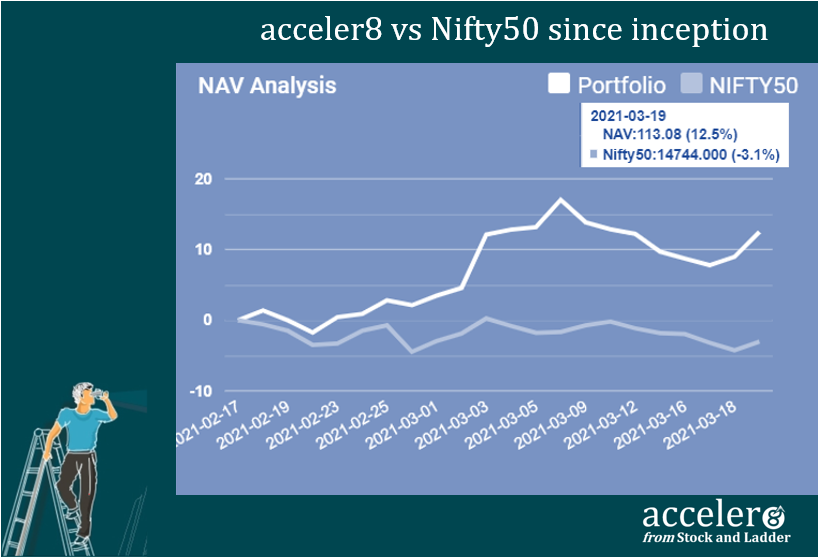

As on 19 Mar 2021, the NAV of acceler8 portfolio is 113.08 (+12.5%) and has outperformed the benchmark Nifty50 by a significant margin (+15.6%).

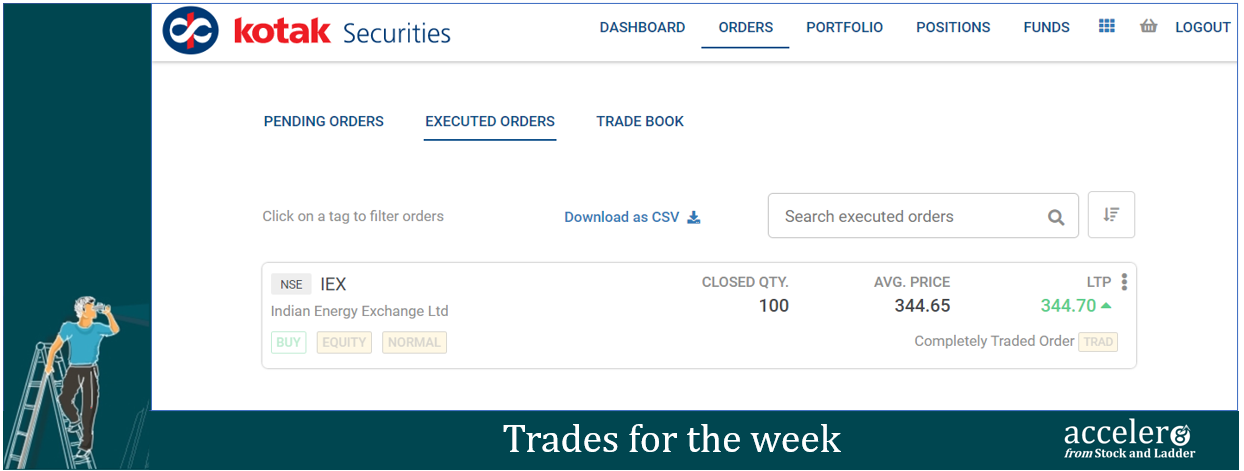

Trades done for the week

New position – Bought IEX @ ₹ 344.65

(The details were shared over email during trading hours itself.)

The icing on the cake : The position is up 7.2% in three trading days.

Current Position

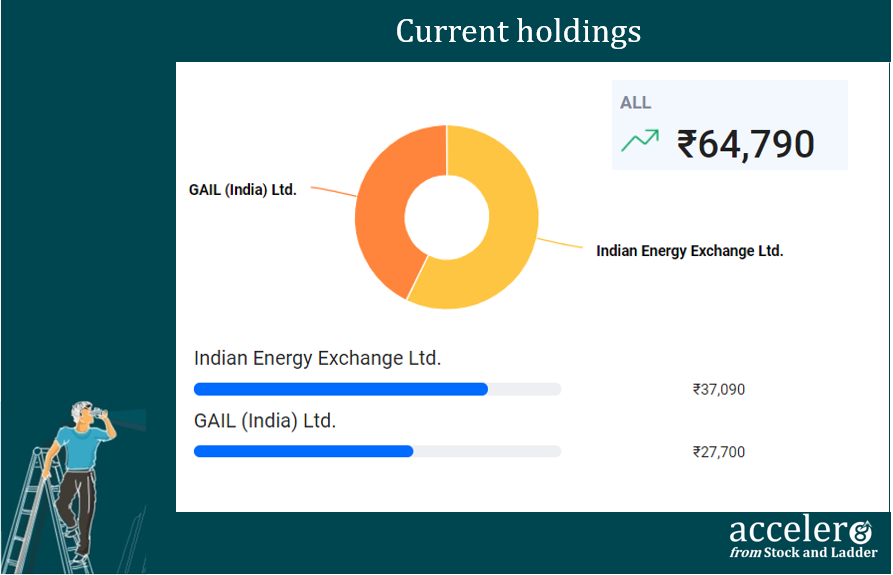

As on 18 Mar, the consolidated value of current holdings is at ₹64,790 with 35% approximately in cash.

The powder is dry and is ready for any opportunity the market may throw at us.

Section C – Cura8

Handpicked #goodreads

From Crypto Art to Trading Cards, Investment Manias Abound

A series of investment manias have gripped the financial world. For months, professional and everyday investors have pushed up the prices of stocks and real estate. Now the frenzy has spilled over into the riskiest — and in some cases, wackiest — assets, including digital ephemera and media, cryptocurrencies, collectibles like trading cards and even sneakers. [The New York Times]

3 Ways the Pandemic Has Made the World Better

The year 2020 has been an year of pandemic. And yet this year has taught us much. Strange as it may sound, the coronavirus pandemic has delivered blessings, and it does not diminish our ongoing suffering to acknowledge them. In fact, recognizing them increases the chance that our society may emerge from this ordeal more capable, more agile, and more prepared for the future. Here are three ways the world has changed for the better during this awful year. [The Atlantic]

10 Breakthrough Technologies 2021

The annual compilation of important technologies of the year from MIT. This gives the user a sneak peek of what to expect in future. [MIT]

Hope you enjoyed reading this edition of acceler8.

Happy Investing !!!

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr