Issue 008, 18 Apr 2021

Section A – Illumin8

Punchcard

“There is nothing so terrible as activity without insight.”

Johann Wolfgang von Goethe

Think you are walking through the desert like this scene from Good, Bad, Ugly, you will know how important it is to preserve water for survival or if you are climbing a mountain you would know how important it is to preserve oxygen for your survival. But when it comes to investing we seem to sometimes forget how important it is to preserve your capital for your financial wellbeing.

Money is a finite resource and that brings with it the need to judiciously use and deploy. Capital allocation assumes a whole lot of meaning in our financial survival and if we are to climb to the very summit of financial freedom.

Warren Buffet on Punchcard

One concept which can help us get a perspective on allocating capital for an idea comes from none other Warren Buffett. Across multiple university lectures and annual letters this concept has been highlighted as a key to ultimate financial welfare.

“I always tell students in business school they’d be better off when they got out of business school to have a punch card with 20 punches on it. And every time they made an investment decision, they used up one of their punches, because they aren’t going to get 20 great ideas in their lifetime. They’re going to get five or three or seven, and you can get rich off five or three or seven. But what you can’t get rich doing is trying to get one every day.”

Warren Buffett

Buffett has often said, “I could improve your ultimate financial welfare by giving you a ticket with only twenty slots in it so that you had twenty punches – representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all. Under those rules, you’d really think carefully about what you did, and you’d be forced to load up on what you’d really thought about. So you’d do so much better.”

Warren Buffet

Implications for Investing

Punchcard as a philosophy is very powerful and has deep meaning when you ponder about it. It is a concept, a philosophy and a way of thinking which needs careful consideration.

For investors, I can think of three key learnings from the philosophy behind Punchcard investing.

1) Pull the trigger only on high conviction bets

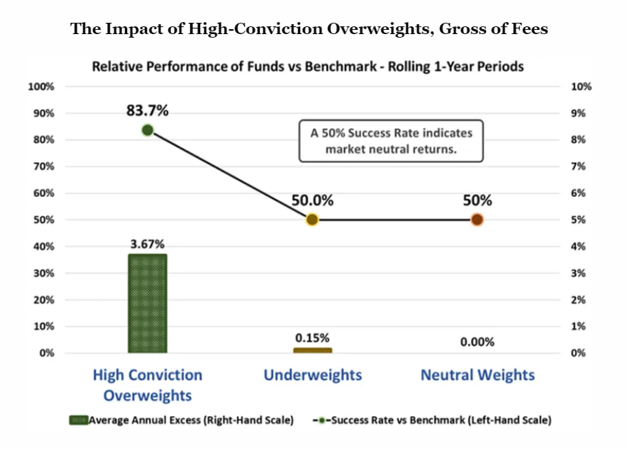

An excellent research study was conducted to find out how fund managers generated stock-selection alpha.

The multi year study covered 114 US equity mutual funds from 57 fund families and evaluated more than 400,000 individual rolling one-year performance periods. Combined, this sample represented about $2 trillion in assets under management (AUM)

The focus of the study was to understand one thing : The role of fund manager conviction (overweight positions) in alpha.

The study concluded

“The High-Conviction Overweight’s, composed of the managers’ best ideas, is the only category that delivers stock-selection alpha. High-Conviction Overweight’s achieved success rates of 84% gross of fees and 74% net of a theoretical 85 basis points (bps) fees.”

2) Don’t Need to swing at everything

There are all sorts of investing ideas from green energy, advanced enzymes to cutting edge AI backed technology companies you will come across and will be pitched by analysts, commentators and experts. There is no need to swing at the idea if its outside your “comfort zone” or what is called as “circle of competence”.

For me, this is especially true for ideas from the pharma sector where I confess to have very limited knowledge. Let me give you an example:

I have a little bit of technological background and when someone says API it would immediately mean Application Programming Interface. But for a person from the pharmaceutical industry, API would immediately mean Active Pharmaceutical Ingredient which I am totally unaware off.

Since I am cognizant of my limited knowledge about pharma industry per se, I think twice or thrice before I even consider swinging at ideas from these.

3) Beware of activity Bias

“All of humanity’s problems stem from man’s inability to sit quietly in a room alone.”

Blaise Pascal

How many of us can actually follow this? If you are a private investor it is still conceivable that you could follow this but if you are a professional money manager or run a stock advisory service it becomes extremely difficult to practice this or justify the fees.

When a customer calls inquiring on the reason for not having not received any stock trades in acceler8 portfolio, how would this response sound?

Read 2 books.

Studied 4 annual reports.

Listened to 5 conference call

Attended 1 seminar on investing

Analyzed 8 possible trades and decided against pulling the trigger

Surely, few of you would not find it palatable. This is the advantage of an individual investor has over professional money managers. The individual investor can choose to invest only at ideas that he is comfortable with and long periods of inactivity is not under scrutiny.

Having said this, I have found that even individual investors struggle to practice this philosophy as there is a bias for action. Simply sitting in a room learning and researching and improving ones knowledge are not exactly quantifiable.

Punchcard Investing Fund

It is extremely difficult for anyone to follow this rule per se. But the concept behind it is extremely powerful. One way I have conceived of implementing this philosophy is to create what I call a Punchcard Investing Fund.

Create a Punchcard fund by starting an SIP of 12 months. The amount of SIP is based on your investing profile. It can be ₹10,000 , ₹20,000 or ₹50000 .

After the end of year 1, the proceeds of the SIP / recurring deposit to be put in a liquid fund.

You have a chance to invest in one idea. The proceeds can be invested in one idea the next year.

In case you don’t get any idea, you carry forward it to the next year.

Now when you have to select your one investment idea for the Punchcard fund you would be very careful and extremely choosy. You will want to bet on the best idea which is in your comfort zone and on which you have very high conviction.

Rinse. Repeat for 20 years. You will be amazed at what you have achieved from the Punchcard fund (you can thank me later😊)

Implications for life

Punch card can be useful not just for investing but for life too. It’s a powerful concept which help bring clarity of purpose and focus. It is a tool which can be used to focus and get your priorities in life right.

Do along with me a small exercise (no cheating 😊) 20-10-5.

Take a sheet of paper now (no laptop).

Write down the top 20 most important things you want do in your life. Take at least half hour to come up with the list.

Read each one of them once and then eliminate 10 of them (50%) and you will be left with your top 10 things / goals.

Read each of the remaining 10 in one go and then eliminate another 5 (50%) of them

Reverse the paper and write down the 5 remaining ones

These are the 5 most important things you should focus you time , energy and capital for. In the punch-card called life these are the 5 punches you have just made.

Final thoughts

In life and in investing, resources are finite and limited . Successful are those who understand the need to preserve and judiciously use these finite resources and focus on what is most crucial and critical for achieving you goals , be it financial or otherwise.

PS : In accumul8, an investing strategy for long term investing we will try to incorporate shades of this philosophy.

Additional :

Warren Buffet on Punchcard Investing

Section B – acceler8

Portfolio Updates

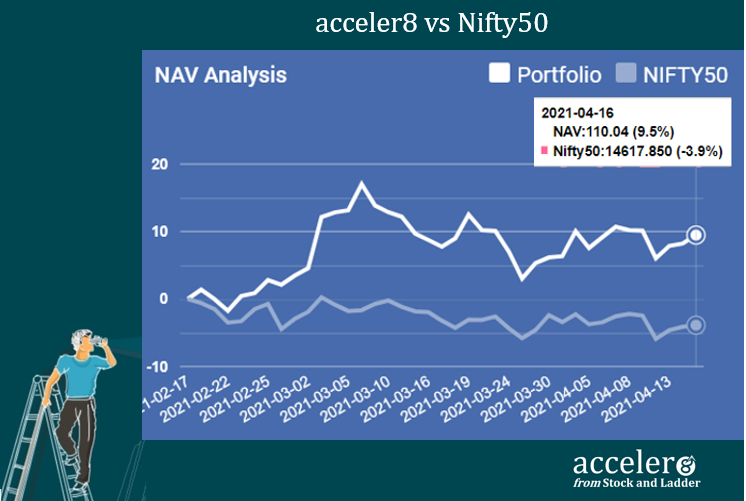

1) acceler8 portfolio NAV

As on 16 Apr 2021, the NAV of acceler8 portfolio is 110.04 (+9.5%) and has outperformed the benchmark Nifty50 by a significant margin (+13.4%).

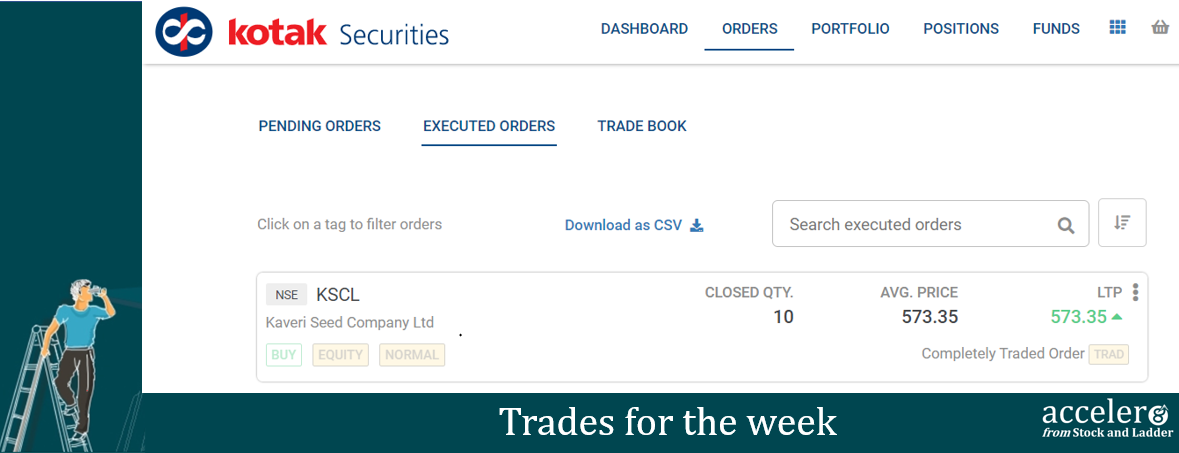

2) Trades done for the week

New position – Bought Kaveri Seed @ ₹ 573.35

(The details were shared over email during trading hours itself.)

Kaveri seeds is one of India’s largest agricultural company specializing in hybrid seeds. The company operates in the agricultural /horticultural sector and has shown a 10% growth in the last one week. A fundamentally sound stock with reasonable valuation and a positive momentum due to normal monsoon prediction, we have picked up the stock for our acceler8 portfolio.

Kaveri Seed – Last week

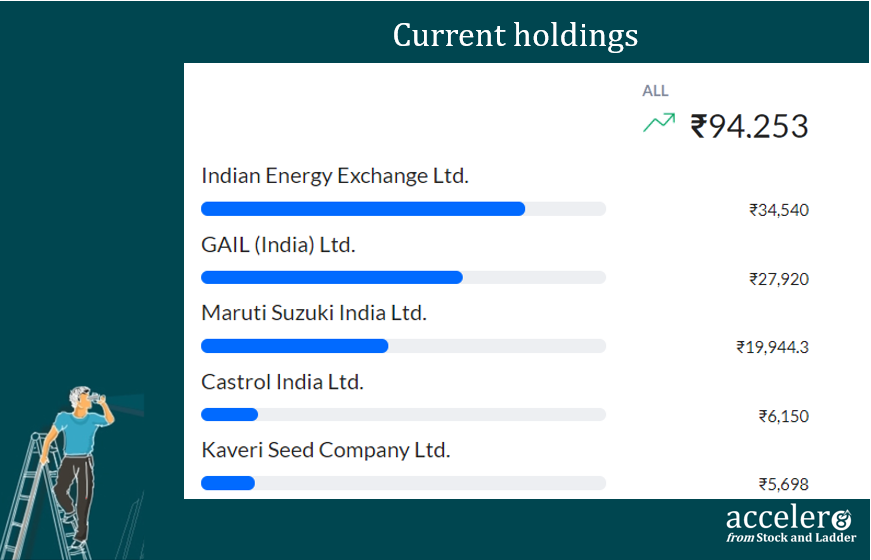

3) Current Position

As on 16 Apr, the consolidated value of current holdings is at ₹94,253 with 6% approximately in cash.

We have cast our net and its time to wait.

Section C – Cura8

Handpicked #goodreads

1) The Rise and Fall of Bitcoin Billionaire Arthur Hayes (VanityFair)

2) Chairman and CEO letter to Shareholders (JPMorganchase)

3) Global Trends 2040 (National Intelligence Council)

Hope you enjoyed reading this edition of acceler8.

Compound your learnings, Accelerate your earnings

Happy Investing !!!

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr