acceler8 Issue 002, 28 Feb 2021

Section A

acceler8 Portfolio

As mentioned in the last week’s edition, the markets are over heated and taking up long term positions is not something that I am comfortable with. In this market, I prefer a surgical strike kind of operation – precise, quick and well planned.

Trades done:

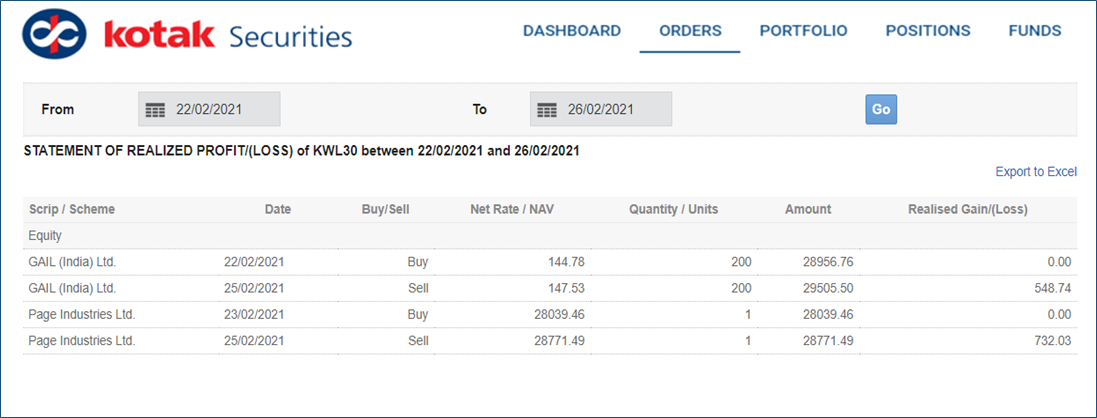

Entered and Exited GAIL and Page Industries with decent profits.

a) GAIL

Exited with ₹ 548 (1.89% ) gain net of taxes and brokerage in three days. Look out for the drastic drop from Point C to Point D. In these markets its essential to book profits regularly.

b) Page Industries

Exited with ₹ 732 (2.61% ) gain net of taxes and brokerage in two days.

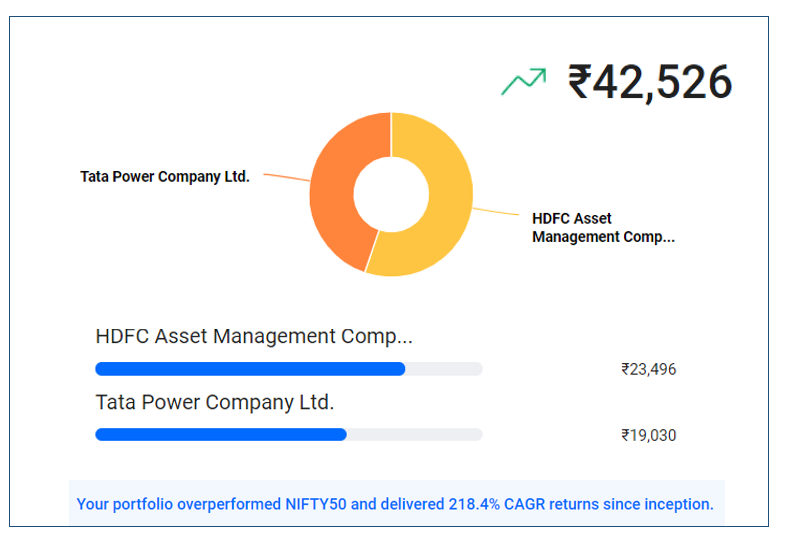

c) Current Position

We are in 60% cash and in the first two weeks managed to outperform the benchmark.

Its early days and I am not going get to XIRR and other portfolio benchmark metrics.

Section B

My lessons from 2020 Buffett’s Annual letter

“Confronted with a like challenge to distill the secret of sound investment into three words, we venture the motto, MARGIN OF SAFETY”

– Benjamin Graham

In the deep sea, there is lot of water around but its not fit for consumption. Similarly, we live in a world where we are drowning in the sea of data and getting bashed from all sides by waves of information. Unsurprisingly this abundance of information is in stark contrast to a poverty of insight.

Luckily, for over 40 years now, the Oracle of Omaha has been serving the investor community with his annual doze of distilled investing wisdom through his yearly shareholder letters.

Every year Buffett fans in particular and investing community in general look forward to the annual commentary. The wait was over when the 2020 annual letter was released yesterday.

Key takeaways

I poured through this year’s shareholder letter and as always found quiet a few investing gems.

1) Margin of safety is evergreen

The final component in our GAAP figure – that ugly $11 billion write-down – is almost entirely the quantification of a mistake I made in 2016. That year, Berkshire purchased Precision Castparts (“PCC”), and I paid too much for the company

I believe I was right in concluding that PCC would, over time, earn good returns on the net tangible assets deployed in its operations. I was wrong, however, in judging the average amount of future earnings and, consequently, wrong in my calculation of the proper price to pay for the business. PCC is far from my first error of that sort. But it’s a big one.

The success or failure of an investment at the simplest level boils down to the price you pay. And, there is no magic formula for getting the price right.

While arriving at the possible buy price, one is actually making a set of assumptions about competition, cashflow and many more business variables. The assumptions may simply go horribly wrong.

And be aware that this could happen to the best of the best in this business. The $11 billion write down mentioned by Buffett in this years letter is a clear warning to all of us and a reminder to the fundamental concept of investing-Margin of Safety.

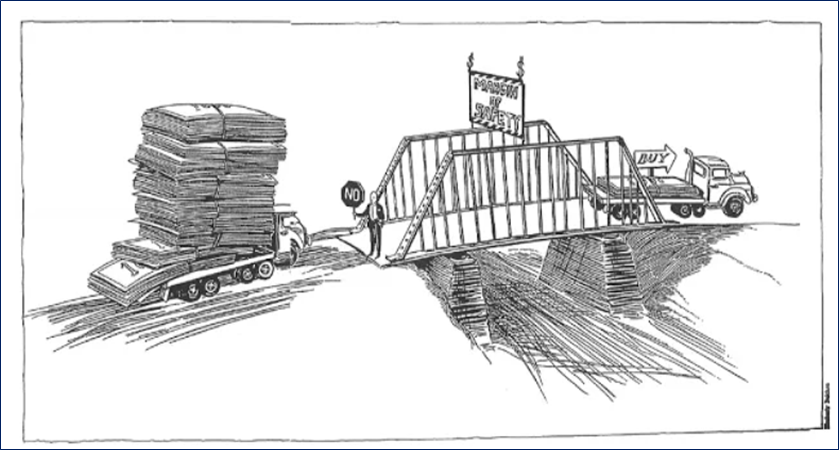

Bridge Analogy

Buffett himself has emphasized the importance of “Margin of Safety” in all our investments and his Bridge analogy is so apt that its etched in our minds.

“You have to have the knowledge to enable you to make a very general estimate about the value of the underlying business. But you do not cut it close.

That is what Ben Graham meant by having a margin of safety.

“You don’t try to buy businesses worth $83 million for $80 million. You leave yourself an enormous margin.

When you build a bridge, you insist it can carry 30,000 pounds, but you only drive 10,000 pound trucks across it. And that same principle works in investing.”

In Investing, we are dealing with a lot of unknowns- New Regulations can be introduced, pandemics can break out, companies can go bust, managements can turn out to be unscrupulous & more.

Building in a margin of safety based on your investing style, strategy and resources will ensure you are decimated by factors not in your control. No many can brush aside a $11 billion hole and walk away as if nothing happened like Warren Buffett did.

In Investing to succeed you must first survive. Margin of safety is the premium you need to pay for own investing longevity.

2) KISS works in Life and in Investing

Charlie and I will simply deploy your capital into whatever we believe makes the most sense, based on a company’s durable competitive strengths, the capabilities and character of its management, and price. If that strategy requires little or no effort on our part, so much the better.

In contrast to the scoring system utilized in diving competitions, you are awarded no points in business endeavors for “degree of difficulty.”

Furthermore, as Ronald Reagan cautioned: “It’s said that hard work never killed anyone, but I say why take the chance?”

In life in general and in investing in particular, “KISS – Keep IT Simple Stupid” is a surprisingly powerful strategy.

There are no extra rewards or brownie points for making money the hard way.

A hundred thousand made by investing in a simple, boring and easy to understand business is worth exactly the same as the hundred thousand made by investing in companies whose products are too complex, high- tech or having business models you just don’t understand.

Sometimes when we look up the financial statements of some companies one finds a

a) plethora of group companies with a complex holding structure

b) a long list of overseas entities registered in Bahamas, Netherlands, Cayman Islands;

c) complex web of related party transactions.

Studying these financial statements, decoding the numbers, looking out for accounting shenanigans is extremely challenging and there is no extra reward for the hard work.

Also, there is no correlation between complexity of your investing process and the proportion of your rewards. Using complex mathematical models, advanced data models or multi- factor analysis is no guarantee for greater rewards.

Don’t take my word for it.

“That’s been one of my mantras – focus & simplicity. Simple can be harder than complex: You have to work hard to get your thinking clean to make it simple. But it’s worth it because once you get there, you can move mountains”

– Steve Jobs

No wonder another bright mind Albert Einstein considered “Simple” to be the highest form of intellect.

In life and investing it pays to keep it simple. Work Hard, even better, Work Smart.

3) Other Gems

These are mostly self-explanatory.

a) Capital intensive businesses are “good”; what is “best” is asset- light businesses with high margins.

Asset-heavy companies, however, can be good investments. The best results occur at companies that require minimal assets to conduct high-margin businesses – and offer goods or services that will expand their sales volume with only minor needs for additional capital.

b) Investors should be wary of expenses.

Productive assets such as farms, real estate and, yes, business ownership produce wealth – lots of it. Most owners of such properties will be rewarded. All that’s required is the passage of time, an inner calm, ample diversification and a minimization of transactions and fees. Still, investors must never forget that their expenses are Wall Street’s income. And, unlike my monkey, Wall Streeters do not work for peanuts.

c) Never bet against America (India)

In its brief 232 years of existence, however, there has been no incubator for unleashing human potential like America. Despite some severe interruptions, our country’s economic progress has been breathtaking. Beyond that, we retain our constitutional aspiration of becoming “a more perfect union.” Progress on that front has been slow, uneven and often discouraging. We have, however, moved forward and will continue to do so.

Our unwavering conclusion: Never bet against America.

Not to sound jingoistic or simply patriotic, but India with 1000’s of years of civilization, and a billion strong population is really in a unique position economically and demographically.

My unwavering conclusion : Never bet against India. Invest in equities and be part of the India growth story.

I hope you found these lessons useful.

Section C

Curated investing content

1) John Mauldin on overvalued market

2) Something you should know about Clubhouse

3) Charlie Munger at this year’s Daily General Annual Meeting

Bonus content

Here is the 41st edition of Graham & Doddsville – A student-led investment publication of Columbia Business School (CBS).

Additional reading :

Keep Learning, Happy investing !!!

PS : If you liked what you read, please spread the good word. It will mean a world to me.

Relate Posts

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf Let’s stay connected, Follow me on Twitter @Stocknladdr